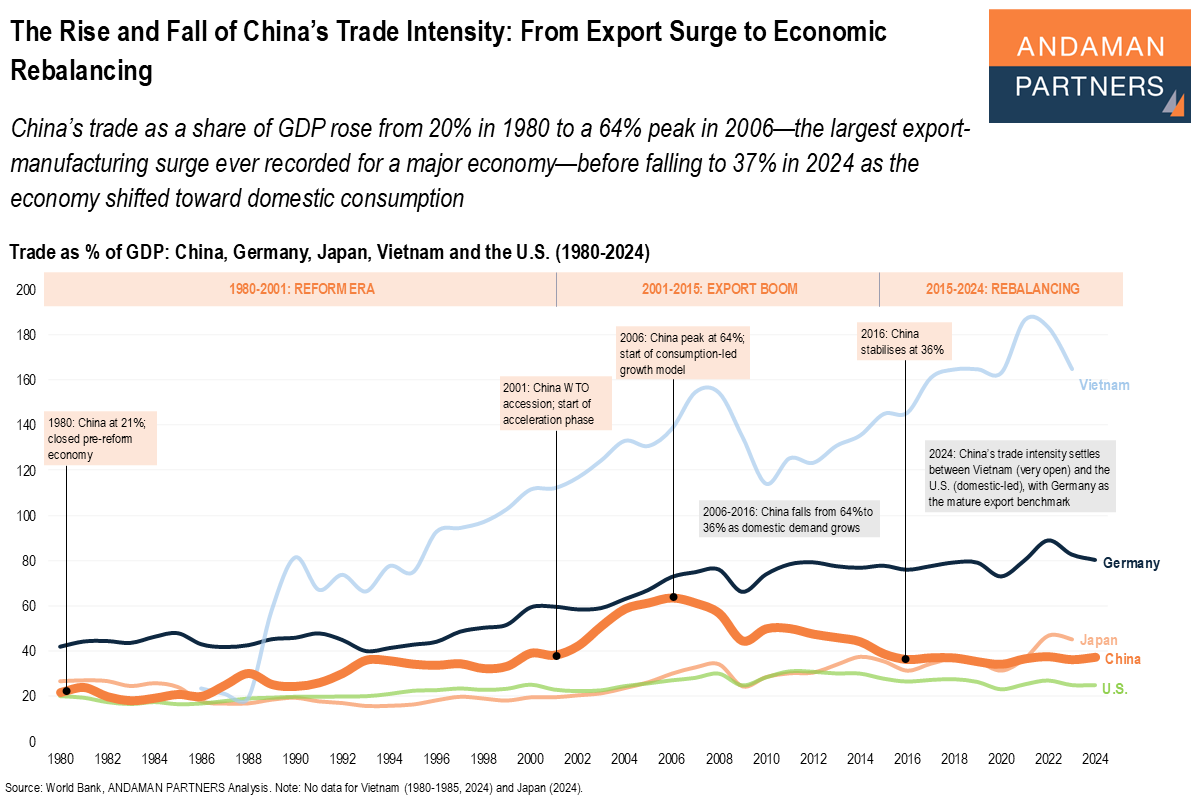

China’s trade as a share of GDP rose from 20% in 1980 to a 64% peak in 2006—the largest export-manufacturing surge ever recorded for a major economy—before falling to 37% in 2024 as the economy shifted toward domestic consumption.

China’s trade intensity (trade as a % of GDP) over the past four decades reveals one of the most consequential economic transformations of the modern era. In 1980, China was still a largely closed, pre-reform economy, with trade accounting for just 20% of GDP. This placed it closer to large, domestic-market economies like the U.S. and Japan, which rely primarily on internal demand rather than external markets.

What followed over the next quarter-century, however, was a manufacturing and export expansion unmatched by any major economy. China’s trade share rose more than threefold to a peak of 64% in 2006, as the country became the central production base for global supply chains. This ascent was accelerated by World Trade Organisation (WTO) accession in 2001, which triggered unprecedented inflows of foreign investment, technology and production capacity. China moved from the bottom of the global integration spectrum toward levels associated with traditional export economies such as Germany, while simultaneously building manufacturing scale far larger than any historical precedent.

Yet in the mid-2000s, China’s economy began a monumental pivot. China’s trade intensity fell from 64% in 2009 to 36% by 2016, and has since roughly stabilised. This shift reflects a deliberate economic transition. Rising wages, an expanding middle class and a strategic policy shift toward domestic demand have gradually reduced China’s dependence on external markets.

At the same time, China has been steadily climbing the value chain, exporting more sophisticated, higher-margin goods, meaning export value can grow even as trade intensity falls. The decline is therefore not a sign of retreat from the world economy, but rather a structural shift towards a more balanced, internally driven development model.

Vietnam, now above 180% trade as a % of GDP, represents the archetype of a hyper-open manufacturing hub tightly integrated into foreign-owned supply chains. Germany exemplifies the mature, export-engineered industrial economy, and the U.S. and Japan show what large, domestic-led economies look like.

China now sits squarely in the middle, less externally dependent than Vietnam or Germany, but still far more trade-integrated than the U.S. or Japan. This middle position has profound implications: China retains scale, export competitiveness and supply-chain centrality, but it is no longer singularly reliant on global demand to generate growth.

For CEOs, the strategic takeaway is clear: China’s role in global trade is becoming more selective, more value-added and more domestically anchored. The era of exponential export-led expansion is over, but China’s relevance to global manufacturing, supply chains and consumer demand has only deepened. Understanding this transition is critical for positioning supply chains, investment strategies and market portfolios over the next decade.

Also by ANDAMAN PARTNERS:

ANDAMAN PARTNERS supports international business ventures and growth. We help launch global initiatives and accelerate successful expansion across borders. If your business, operations or project requires cross-border support, contact connect@andamanpartners.com.

ANDAMAN PARTNERS Wishes You a Happy and Prosperous Year of the Horse!

Compliments of the Chinese Lunar New Year to all our clients, customers, suppliers and partners.

ANDAMAN PARTNERS to Attend Investing in African Mining Indaba 2026 in Cape Town

ANDAMAN PARTNERS Co-Founders Kobus van der Wath and Rachel Wu will attend Investing in African Mining Indaba 2026 in Cape Town, South Africa.

Join ANDAMAN PARTNERS at Networking Event in Cape Town Ahead of Mining Indaba 2026

ANDAMAN PARTNERS is pleased to support and sponsor this popular Pre-Indaba event in Cape Town.

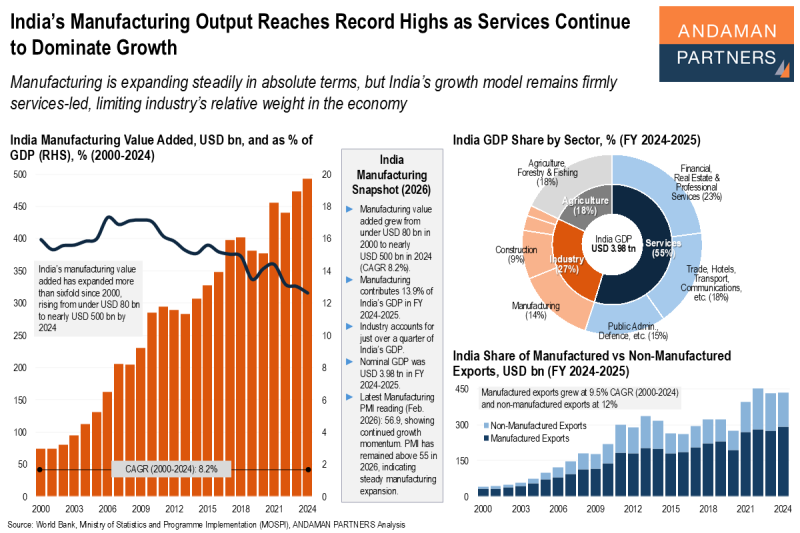

India’s Manufacturing Output Reaches Record Highs as Services Continue to Dominate Growth

Manufacturing is expanding steadily in absolute terms, but India’s growth model remains firmly services-led.

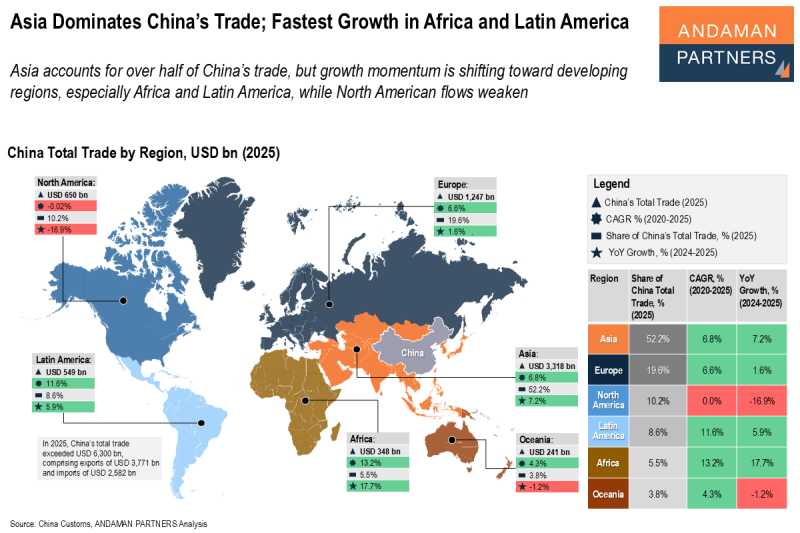

Asia Dominates China’s Trade; Fastest Growth in Africa and Latin America

Asia accounts for over half of China’s trade, but growth momentum is shifting toward developing regions, especially Africa and Latin America.

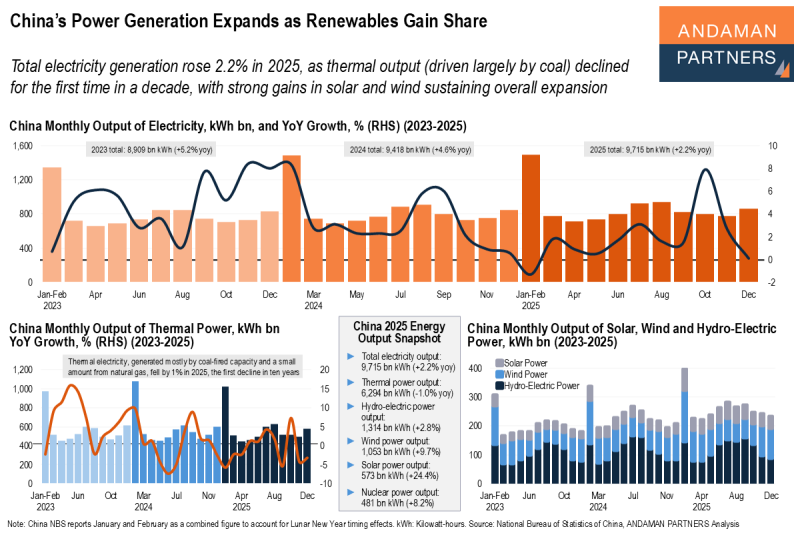

China’s Power Generation Expands as Renewables Gain Share

Electricity generation rose 2.2% in 2025, as thermal output declined for the first time in a decade, with strong gains in solar and wind.