The global economy is undergoing a gradual but inexorable shift from developed to developing and emerging economies. Among the major developing economies, India, Indonesia and China will drive global growth over the next five years, but rapid growth in smaller emerging economies will create many new business opportunities. These economic shifts are broad, far-reaching and consequential, and must be carefully considered in boardrooms across industries and regions. Businesses must develop relevant ‘Strategic Markers’ as they frame their future plans.

Highlights:

- The global economy is projected to grow at an average of 3.2% from 2023 to 2029 in real GDP terms. Several of the largest economies, led by India, Indonesia, China, Turkey, Brazil and Poland, could outperform the global average.

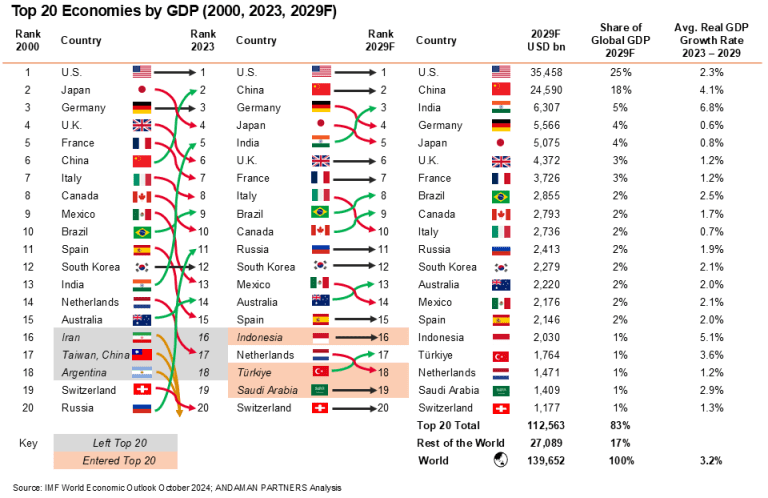

- By 2029, the U.S. and China will be the world’s largest economies, and India could be the third-largest, surpassing Germany and Japan.

- India will be the fastest-growing major economy from 2023 to 2029, with average real GDP growth of 6.8%. Several smaller developing economies in Africa and Asia are projected to exceed India’s growth rate.

- Between 2000 and 2023, Indonesia, Turkey and Saudi Arabia entered the top 20, but Iran, Taiwan (China) and Argentina fell out of the top 20.

- Developing ‘Strategic Markers’ will be crucial to aid businesses in developing future-proof strategies.

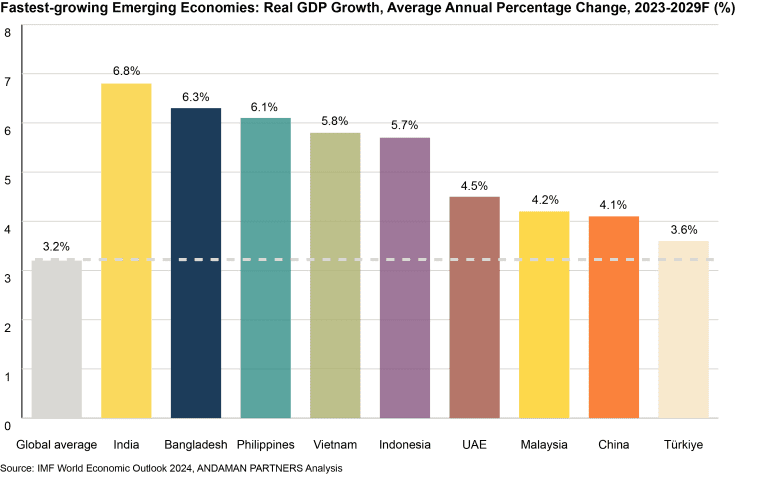

According to IMF projections, the global economy will grow by 3.2% between 2023 and 2029 in terms of average real GDP, from around USD 110 trillion to just under USD 140 trillion. Among the largest developing economies, India (6.8%), Indonesia (5.1%), China (4.1%) and Türkiye (3.6%) could outperform the global average, while many developed economies, such as Germany (0.6%) and France (1.2%), could fail to reach this level.

The U.S. and China will remain the world’s largest economies in 2029. The U.S. economy is projected to exceed USD 35 trillion, with projected average real GDP growth of 2.3% from 2023 to 2029. With a projected growth rate of over 4.1% over the same period, China could consolidate its position as the world’s second-largest economy, with GDP reaching USD 24.6 trillion. These two economies would then respectively constitute 25% and 18% of the global economy, or 43% between the two of them.

India is projected to grow at 6.8% from 2023 to 2029, more than twice the global average, and is projected to increase its economy from USD 3.6 trillion in 2023 to USD 6.3 trillion in 2029. This would mean that India could surpass Germany and Japan as the world’s third-largest economy by 2029.

The U.K., France, Brazil, Canada and Italy are projected to make up the rest of the top ten in 2029. Indonesia is projected to grow by 5.1% from 2023 to 2029 to exceed USD 2 trillion, making it the world’s sixteenth-largest economy, with Russia, South Korea, Australia, Mexico, and Spain ahead of it outside the top ten.

Prominent developing and emerging economies outside of the top 20 largest economies but within the top 50 that are projected to exceed global average GDP growth from 2023 to 2029 include Bangladesh (6.3%), the Philippines (6.1%), Vietnam (5.8%), the UAE (4.5%) and Malaysia (4.2%).

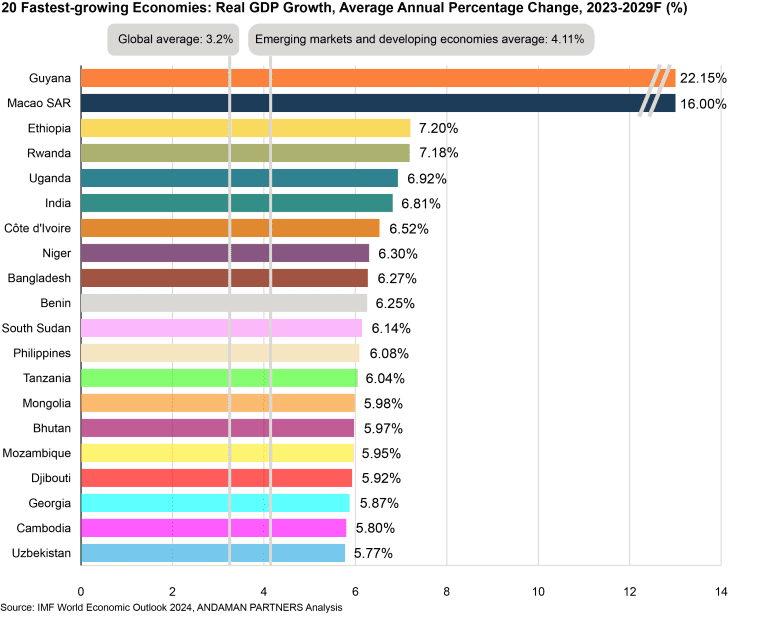

When considering all countries irrespective of size or stage of development, the fastest-growing economies from 2023 to 2029 will be relatively small developing economies in Africa and Asia. Eleven economies (Guyana, Ethiopia, Rwanda, Uganda, Côte d’Ivoire, Niger, Bangladesh, Benin, South Sudan, Philippines and Tanzania) are projected to exceed 6% average real GDP growth. Among the major economies, only India is projected to reach the same growth level.

In Africa, Ethiopia is projected to grow by 7.2% from 2023 to 2029, with its economy exceeding USD 200 billion in 2029. Driven by infrastructure investments expanding access to infrastructure and services for the country’s population, Ethiopia is projected to be Africa’s fastest-growing economy over the next five years.

Other African economies projected to grow at over 6% include Rwanda, Uganda, Côte d’Ivoire, Niger, Benin, South Sudan and Tanzania. All these economies are generally still primarily based on agriculture and are growing from a low base, with projected real GDP in 2029 ranging from USD 133 billion in the case of Côte d’Ivoire to less than USD 10 billion in South Sudan. In 2029, Uganda’s economy is projected to exceed USD 93 billion, with growth driven by mining, construction and services.

Growth in agricultural productivity in these countries is being supplemented by investments in other sectors, such as transport and digital infrastructure (Côte d’Ivoire), oil and mining (Niger), beverages and telecommunications (Benin) and manufacturing, construction, tourism, trade and financial services (Tanzania). South Sudan’s economy is primarily based on the oil sector, accounting for about 60% of the country’s GDP.

In Asia, nine economies (Bangladesh, Philippines, Mongolia, Bhutan, Cambodia, Uzbekistan, Vietnam, Tajikistan and Kyrgyz Republic) are projected to exceed 5% average real GDP growth from 2023 to 2029. By 2029, Bangladesh (USD 719 billion), the Philippines (USD 707 billion) and Vietnam (USD 672 billion) will be just outside the top 30 largest economies.

Uzbekistan’s economy is projected to reach nearly USD 190 billion in 2029, with growth driven by investment in mining and minerals. Cambodia’s economy is projected to exceed USD 71 billion in 2029, driven by tourism, and agriculture and textile exports. Mongolia’s economy is projected to exceed USD 36 billion in 2029, driven by mining and transport services. The economy of the Kyrgyz Republic is based on mineral and energy exports, and that of Tajikistan on aluminium and cotton exports. Based on hydropower, agriculture and forestry, Bhutan’s economy is projected to barely exceed USD 5 billion in 2029.

The small South American country of Guyana is projected to grow the fastest of all countries between 2023 and 2029 at over 22%, followed by the Macao Special Administrative Region of China at 16%. Guyana’s rapid growth is based on oil production, which commenced in 2019, while Macao’s economy is based on tourism and gaming.

In Europe, Georgia is projected to be the fastest-growing economy at just below 6%, followed by Armenia at 5.3%.

The shifting composition of the global economy reflects a gradual rebalancing of economic power. From 2023 to 2029, North America’s share of global GDP is projected to decline from 30.06% to 29.05%, while Europe’s share could decrease from 24.41% to 23.30%. The Asia Pacific region is projected to increase its share from 35.04% to 37.22%.

The share of emerging market and developing economies in global GDP could increase from 41.21% to 43.71%, while the share of advanced economies could decrease from 58.79% to 56.29%.

Are you selling to, buying from or entering the right markets?

With Asia’s increasing dominance, the enduring importance of the U.S. and China, and shifting dynamics in Europe and Africa, it is crucial for businesses to ensure they are targeting the right markets with the right strategies.

To successfully navigate these changes, consider the following ‘Strategic Markers’:

- Adapt strategies for the U.S. and China: Develop flexible strategies that respond to the specific economic conditions and consumer behavior in these crucial markets. Both of these two ‘largest’ global markets are about to go through an intense period of cyclical, structural and policy adjustment (regulation, de-regulation and re-regulation). Many opportunities and risks are going to be revealed.

- Capitalize on Asia’s growth: Prioritize expansion into key Asian markets, particularly technology, consumer markets, services and industrial goods. Recognize the differences between developed, developing and emerging Asia.

- Explore new opportunities in developing and emerging markets more broadly: Beyond traditional markets, consider new opportunities in regions like Africa, Latam, Eastern Europe and the Middle East that are increasingly contributing to global trade. The past 10 years have heralded a different phase in these markets, but the next 10 years will see even more rapid transformation.

- Strengthen supply chain resilience in tapping new global regions: Ensure your supply chains are robust. Entering new markets is risky and complex. Do not overreach — and expand at a measured pace with all risks managed carefully to handle disruptions, particularly in sectors such as energy and chemicals, which remain vital to global trade.

- Develop capacity and talent: Build teams that can operate in new environments where the business needs to go. Develop and retrain existing teams to adapt quickly to new conditions and working methods. Appreciate that having the right people and skills will represent a key advantage.

- Invest in R&D for technology-driven sectors: Given the dominance of machinery and electronics in global trade, investing in innovation and staying ahead of technological trends is critical. Do not believe ‘our business will not be affected.’ Almost all businesses must innovate and leverage technology; all international businesses must do so to gain or maintain an advantage.

ANDAMAN PARTNERS supports international business ventures and growth. We help launch global initiatives and accelerate successful expansion across borders. If your business, operations or project requires cross-border support, contact connect@andamanpartners.com.

ANDAMAN PARTNERS Was a Co-Sponsor of the South African National Day Reception in Shanghai on 30 May 2025

ANDAMAN PARTNERS was a cosponsor of the South African National Day Reception in Shanghai on 30 May 2025.

Asia’s Shifting Role in Global Supply Chains — Perspectives by ANDAMAN PARTNERS Co-Founder Rachel Wu

Analysis by ANDAMAN PARTNERS Co-Founder Rachel Wu on changing patterns in global supply chains.

ANDAMAN PARTNERS Co-sponsored the West Australian Mining Club Luncheon in Perth on 27 February 2025

WA Mining Club luncheons are valuable ways to network with colleagues and clients and learn about the latest industry insights.

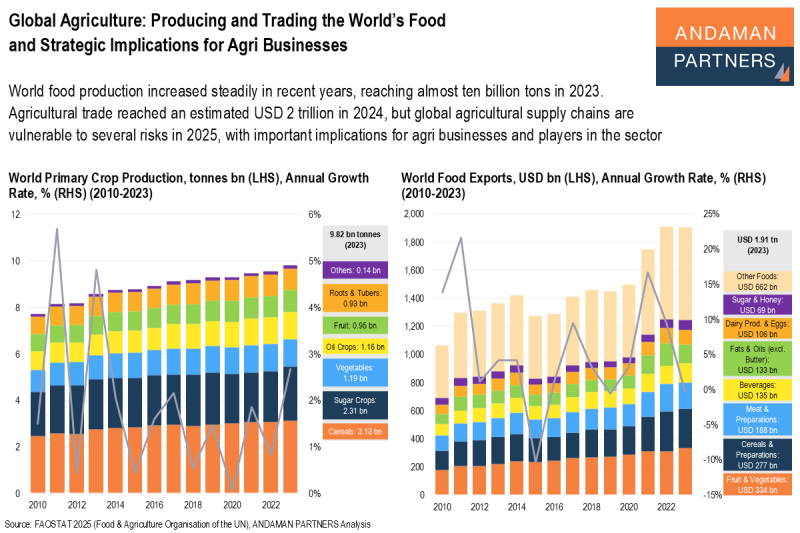

Global Agriculture: Producing and Trading the World’s Food and Strategic Implications for Agri Businesses

Global agricultural supply chains are vulnerable to several risks in 2025, with important implications for agri businesses and players in the sector.

Southeast Asia: The USD 4-trillion Economy

With rapid GDP growth, expanding trade networks and investment inflows, Southeast Asia retains its enduring appeal as a vital destination for multinational corporations seeking to diversify their supply chains and tap into Asia’s growing consumer markets.

Indonesia’s Dynamic Economic Growth Story Offering Opportunities for Global Businesses

Indonesia’s dynamic, services-led and consumption-driven economy is poised to become one of the world’s largest by mid-century, presenting many opportunities for businesses and investors.