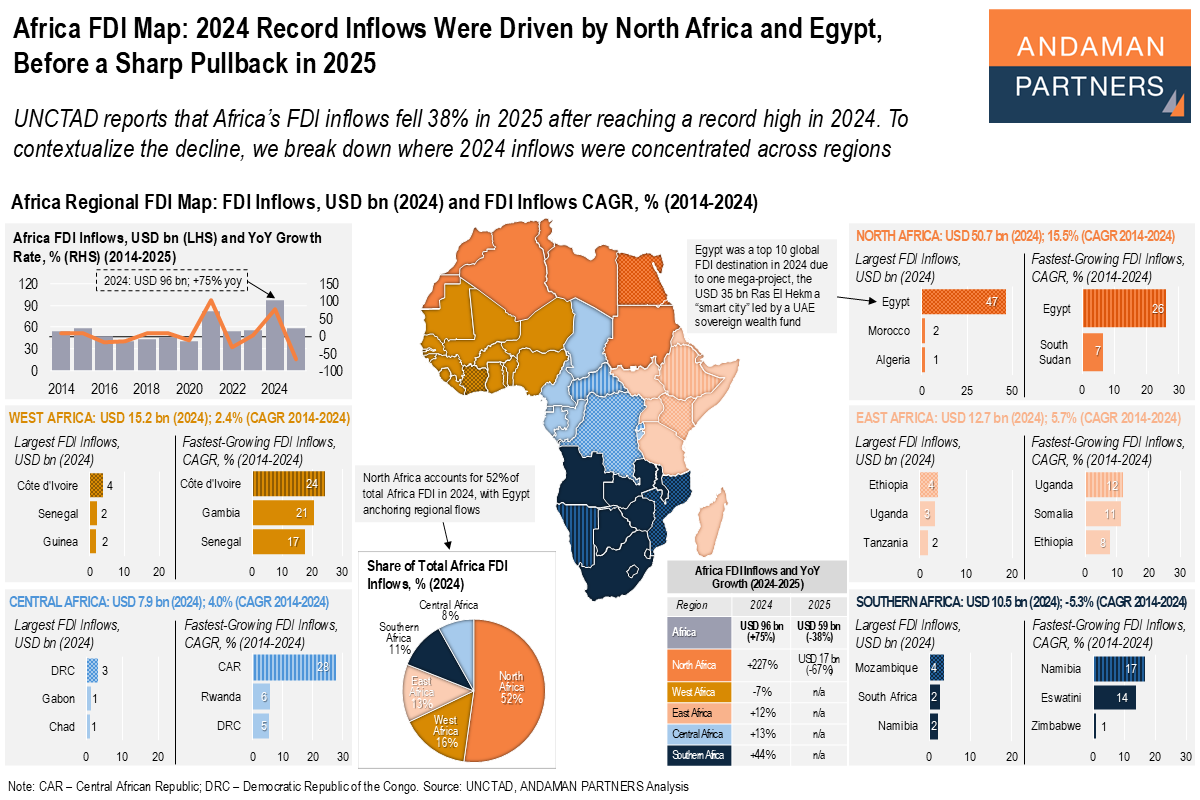

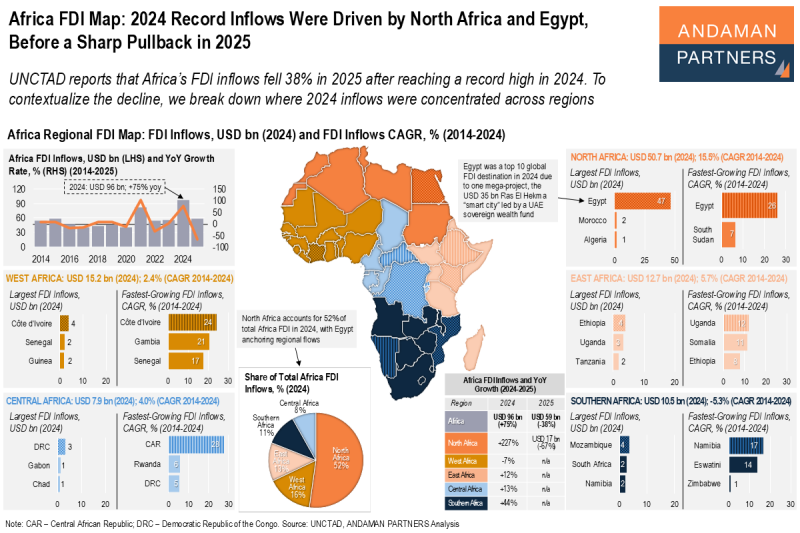

UNCTAD reports that Africa’s FDI inflows fell 38% in 2025 after reaching a record high in 2024. To contextualise the decline, we break down where 2024 inflows were concentrated across regions.

Africa’s FDI story has recently been defined by extreme volatility. UNCTAD indicates that FDI inflows into Africa surged to a record USD 96 billion in 2024 (+75% yoy), before falling sharply to USD 59 billion in 2025 (-38%). This swing reflects Africa’s continued dependence on a small number of large-scale transactions, with North Africa accounting for 52% of total inflows in 2024, anchored overwhelmingly by Egypt. In effect, 2024’s record high was not a broad-based continental boom but a highly concentrated spike, which helps explain why 2025 saw such a rapid pullback.

In North Africa, inflows reached USD 50.7 billion in 2024 (+227% yoy), supported by a strong 15.6% CAGR (2014-2024). Egypt dominated with USD 47 billion, while Morocco (USD 2 billion) and Algeria (USD 1 billion) received much smaller inflows. Egypt was also the fastest-growing market, with a 26% CAGR (2014-2024), driven by a landmark UAE-backed “smart city” development in 2024, one of Africa’s largest recent greenfield-style investment commitments.

The scale of this single project, valued at USD 35 billion, helped propel Egypt into the world’s top 10 FDI destinations in 2024 and explains much of North Africa’s outsized share of continental inflows. This highlights how Africa’s headline FDI totals can be heavily influenced by a small number of mega-deals, leading to large year-to-year volatility.

West Africa recorded USD 15.2 billion in inflows in 2024 (-7% yoy), with modest long-term growth (2.4% CAGR). Côte d’Ivoire led inflows (USD 4 billion), while Senegal and Guinea each attracted around USD 2 billion. Côte d’Ivoire also posted the strongest growth (24% CAGR), alongside Gambia (21%) and Senegal (17%).

East Africa saw USD 12.7 billion in inflows (+12 yoy), supported by a stronger 5.7% CAGR. Ethiopia led at USD 4 billion, followed by Uganda (USD 3 billion) and Tanzania (USD 2 billion). Uganda was the region’s fastest-growing market (12% CAGR), alongside Somalia (11%) and Ethiopia (9%).

In Central Africa, inflows reached USD 7.9 billion (4.0% CAGR and 13% yoy), led by the DRC (USD 3 billion), Gabon (USD 1 billion) and Chad (USD 1 billion). The Central African Republic stood out with a 28% CAGR, ahead of Rwanda (6%) and the DRC (5%).

Finally, Southern Africa attracted USD 10.5 billion (+44% yoy), but remains structurally weaker, with a -5.3% CAGR. Mozambique led inflows (USD 4 billion), while South Africa and Namibia each drew USD 2 billion. Namibia showed the fastest growth (17% CAGR), followed by Eswatini (14%).

Also by ANDAMAN PARTNERS:

ANDAMAN PARTNERS supports international business ventures and growth. We help launch global initiatives and accelerate successful expansion across borders. If your business, operations or project requires cross-border support, contact connect@andamanpartners.com.

ANDAMAN PARTNERS Wishes You a Happy and Prosperous Year of the Horse!

Compliments of the Chinese Lunar New Year to all our clients, customers, suppliers and partners.

ANDAMAN PARTNERS to Attend Investing in African Mining Indaba 2026 in Cape Town

ANDAMAN PARTNERS Co-Founders Kobus van der Wath and Rachel Wu will attend Investing in African Mining Indaba 2026 in Cape Town, South Africa.

Join ANDAMAN PARTNERS at Networking Event in Cape Town Ahead of Mining Indaba 2026

ANDAMAN PARTNERS is pleased to support and sponsor this popular Pre-Indaba event in Cape Town.

Africa FDI Map: 2024 Record Inflows Were Driven by North Africa and Egypt, Before a Sharp Pullback in 2025

Africa’s FDI inflows fell 38% in 2025 after reaching a record high in 2024. We break down where 2024 inflows were concentrated across regions.

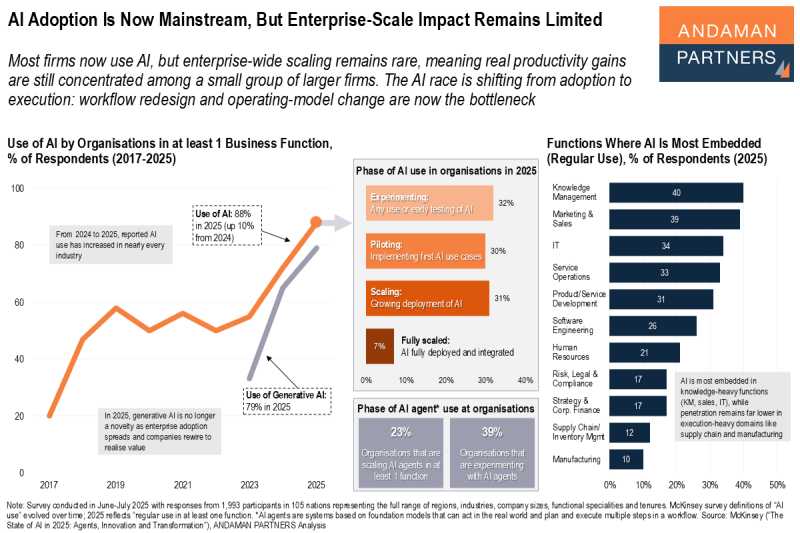

AI Adoption Is Now Mainstream, But Enterprise-Scale Impact Remains Limited

Most firms now use AI, but enterprise-wide scaling remains rare, meaning productivity gains are concentrated in a small group of larger firms.

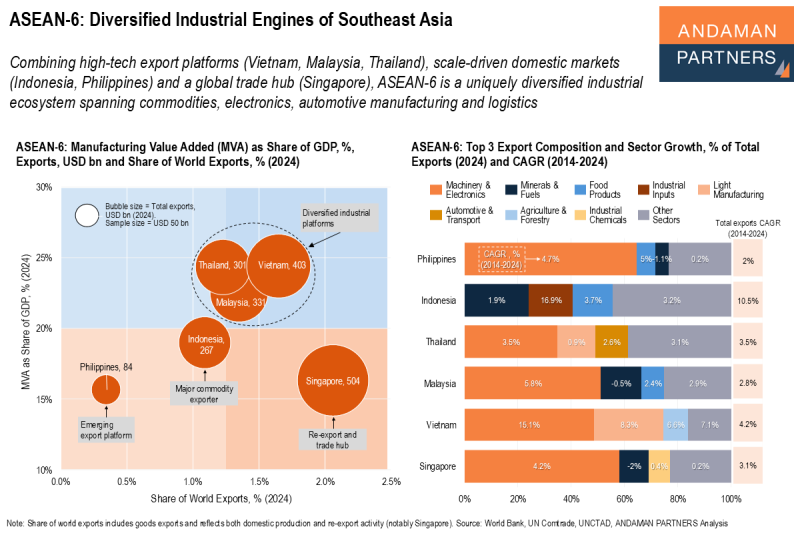

ASEAN-6: Diversified Industrial Engines of Southeast Asia

Combining high-tech export platforms, scale-driven domestic markets and a global trade hub, ASEAN-6 is a uniquely diversified industrial ecosystem.