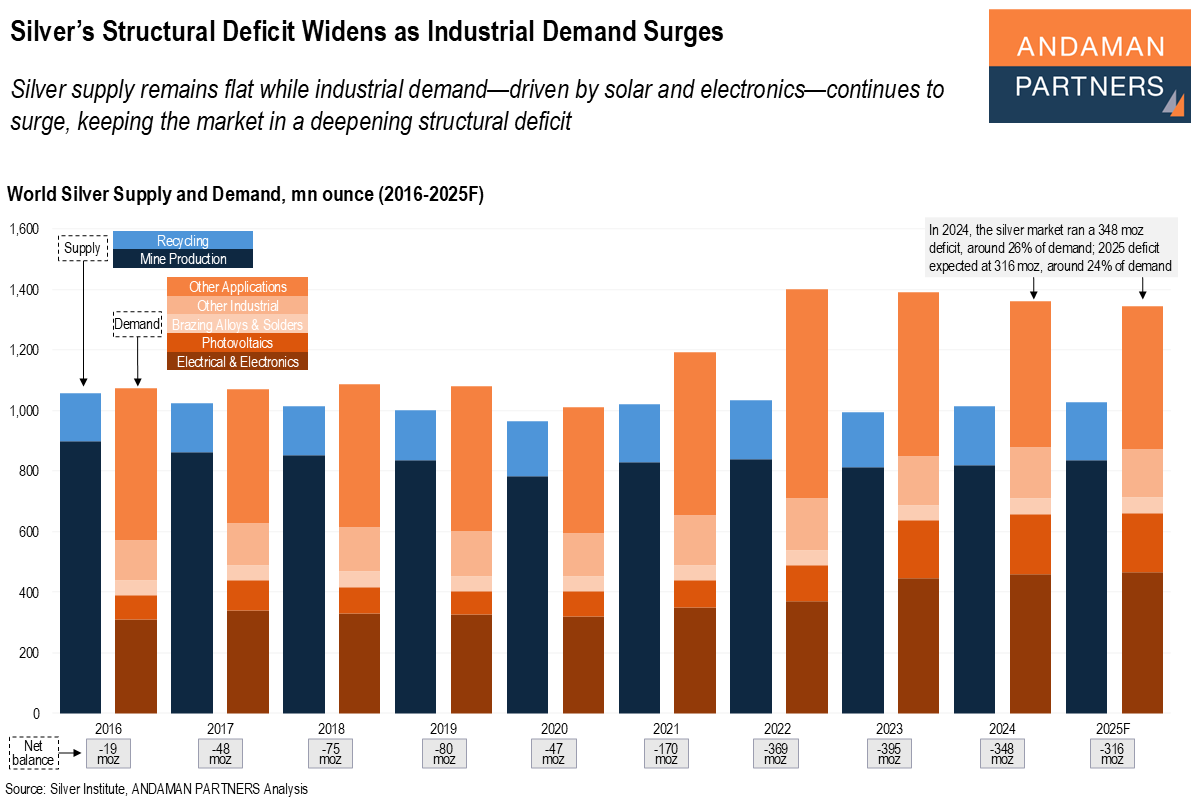

Silver supply remains flat while industrial demand—driven by solar and electronics—continues to surge, keeping the market in a deepening structural deficit.

The silver market is in a structurally tight phase: supply has been essentially flat for a decade while industrial demand — driven by solar photovoltaics, electronics, electric vehicles and other electrification technologies — has surged, pushing the market into large and persistent deficits of more than 300 million ounces in 2022-2024, with a deficit of 316 million ounces forecast for 2025.

With over 80% of silver output tied to base-metal by-product mining, supply cannot easily respond to higher prices, meaning deficits are structural rather than cyclical. This positions silver as an increasingly strategic bottleneck metal for the global energy transition, with rising industrial consumption tightening an already constrained market.

Also by ANDAMAN PARTNERS:

ANDAMAN PARTNERS supports international business ventures and growth. We help launch global initiatives and accelerate successful expansion across borders. If your business, operations or project requires cross-border support, contact connect@andamanpartners.com.

ANDAMAN PARTNERS Wishes You a Happy and Prosperous Year of the Horse!

Compliments of the Chinese Lunar New Year to all our clients, customers, suppliers and partners.

ANDAMAN PARTNERS to Attend Investing in African Mining Indaba 2026 in Cape Town

ANDAMAN PARTNERS Co-Founders Kobus van der Wath and Rachel Wu will attend Investing in African Mining Indaba 2026 in Cape Town, South Africa.

Join ANDAMAN PARTNERS at Networking Event in Cape Town Ahead of Mining Indaba 2026

ANDAMAN PARTNERS is pleased to support and sponsor this popular Pre-Indaba event in Cape Town.

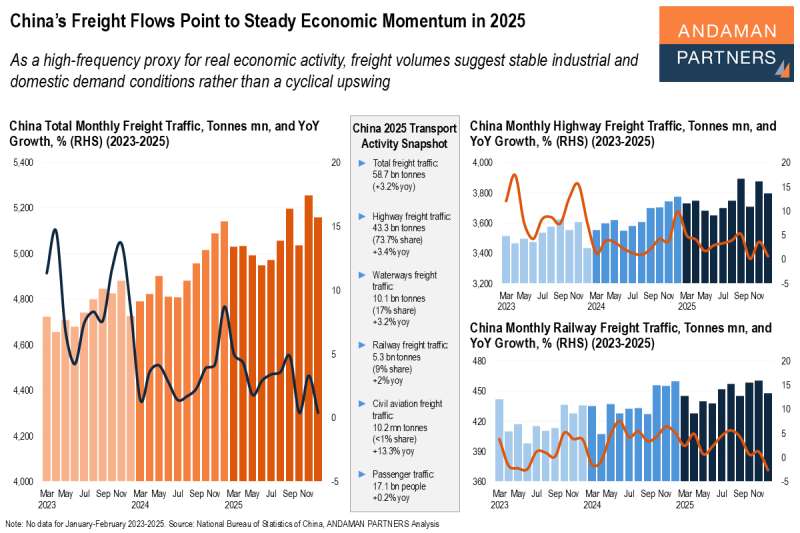

China’s Freight Flows Point to Steady Economic Momentum in 2025

Freight volumes suggest stable conditions in industrial and domestic demand rather than a cyclical upswing.

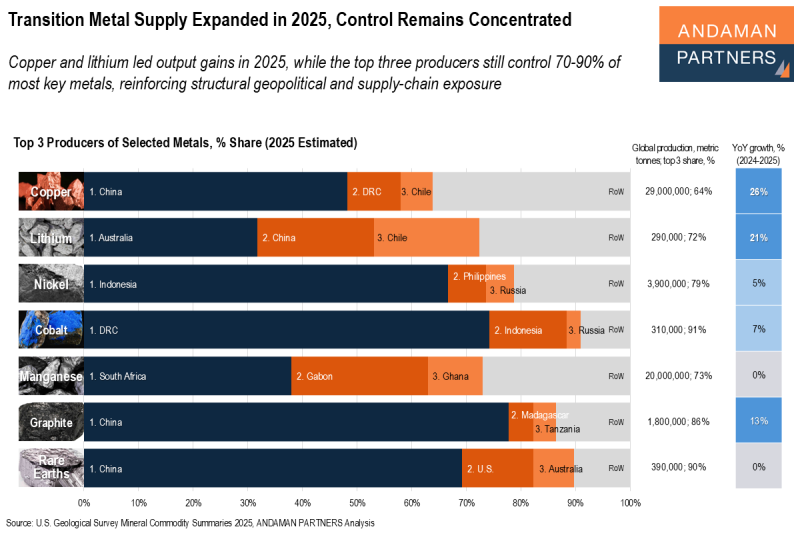

Transition Metal Supply Expanded in 2025, Control Remains Concentrated

Copper and lithium led output gains in 2025, while the top three producers still control 70-90% of most key metals.

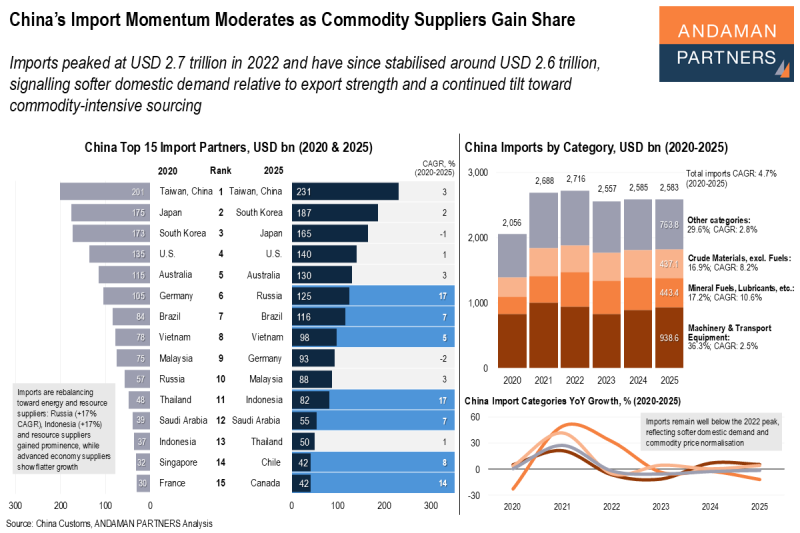

China’s Import Momentum Moderates as Commodity Suppliers Gain Share

Imports have stabilised around USD 2.6 trillion, signalling softer domestic demand and a continued tilt toward commodity-intensive sourcing.