Energy, mobility and industrial equipment—led by imports from China and strong U.S. supply—underpin Chile’s industrial and consumer economy.

In 2024, Chile’s total imports amounted to USD 84 billion, a slight decrease of 1.2% from 2023. With exports of USD 99 billion, the country recorded a trade surplus of about USD 15 billion. From 2004 to 2024, Chile’s imports increased at a CAGR of 6%.

Chile’s largest import categories in 2024 were Machinery & Electronics at USD 18.7 billion (22% of total imports) and Minerals & Fuels at USD 17.3 billion (21%). Other notable categories were Chemicals, Plastics or Rubber (15%), Transportation (10%) and Textiles, Hides & Skins (7%).

Chile’s largest import products in 2024 were refined petroleum oils (USD 7 billion) and crude petroleum oils (USD 5 billion). Other Minerals & Fuels products among the top 20 imports were petroleum gases, molybdenum ores and coal.

Chile’s third- and fifth-largest imports were transport-related, namely passenger vehicles (USD 3.3 billion) and goods vehicles (USD 2.6 billion). Many of the imported passenger vehicles were electric vehicles (EVs), as sales of EVs in Chile increased by 183% in 2024 compared to 2023, reaching 4,500 units, according to the National Automotive Association of Chile (ANAC).

The various products in the Machinery & Electronics category among Chile’s top 20 imports included telephones (USD 2.8 billion), data-processing machines, self-propelled machines, electric accumulators, centrifuges, machinery parts and electric motors.

Chemicals, Plastics or Rubber products among the top 20 imports included medicaments, pneumatic tyres and vaccines.

China is Chile’s leading source of imports, accounting for 24% in 2024, followed closely by U.S. imports at 19%. Other notable import partners are Brazil (9%), Argentina (9%) and Germany (3%).

Also by ANDAMAN PARTNERS:

ANDAMAN PARTNERS supports international business ventures and growth. We help launch global initiatives and accelerate successful expansion across borders. If your business, operations or project requires cross-border support, contact connect@andamanpartners.com.

ANDAMAN PARTNERS to Attend Investing in African Mining Indaba 2026 in Cape Town

ANDAMAN PARTNERS Co-Founders Kobus van der Wath and Rachel Wu will attend Investing in African Mining Indaba 2026 in Cape Town, South Africa.

Join ANDAMAN PARTNERS at Networking Event in Cape Town Ahead of Mining Indaba 2026

ANDAMAN PARTNERS is pleased to support and sponsor this popular Pre-Indaba event in Cape Town.

AAMEG Event in Cape Town Ahead of Mining Indaba 2026

ANDAMAN PARTNERS is pleased to sponsor and support the AAMEG pre-Mining Indaba Cocktails & Canapes event.

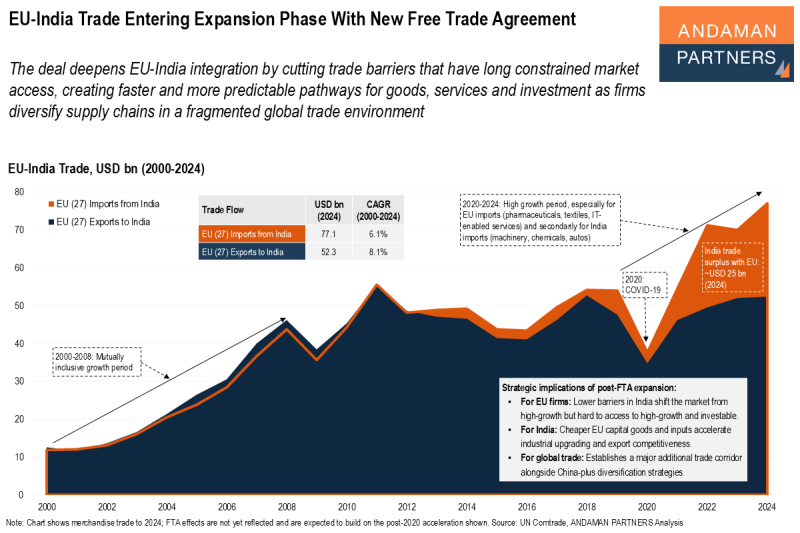

EU-India Trade Entering Expansion Phase With New Free Trade Agreement

The deal deepens EU-India integration by cutting trade barriers that have long constrained market access.

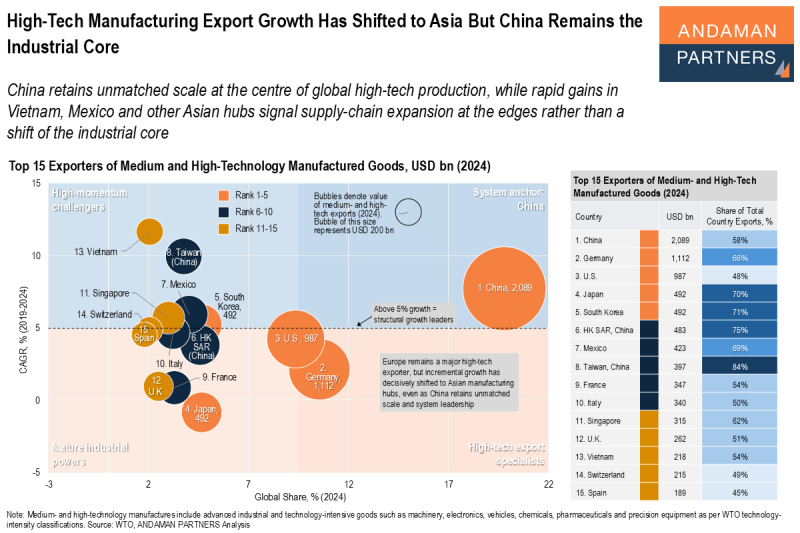

High-Tech Manufacturing Export Growth Has Shifted to Asia, But China Remains the Industrial Core

China retains unmatched scale at the centre of global high-tech production, while rapid gains in Vietnam, Mexico and other Asian hubs.

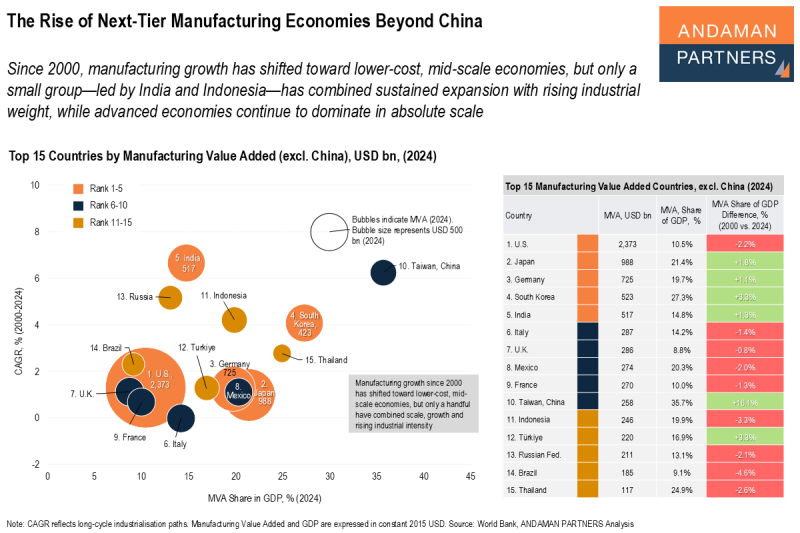

The Rise of Next-Tier Manufacturing Economies Beyond China

Manufacturing growth shifted toward lower-cost, mid-scale economies, but only a small group has combined sustained expansion with rising industrial weight.