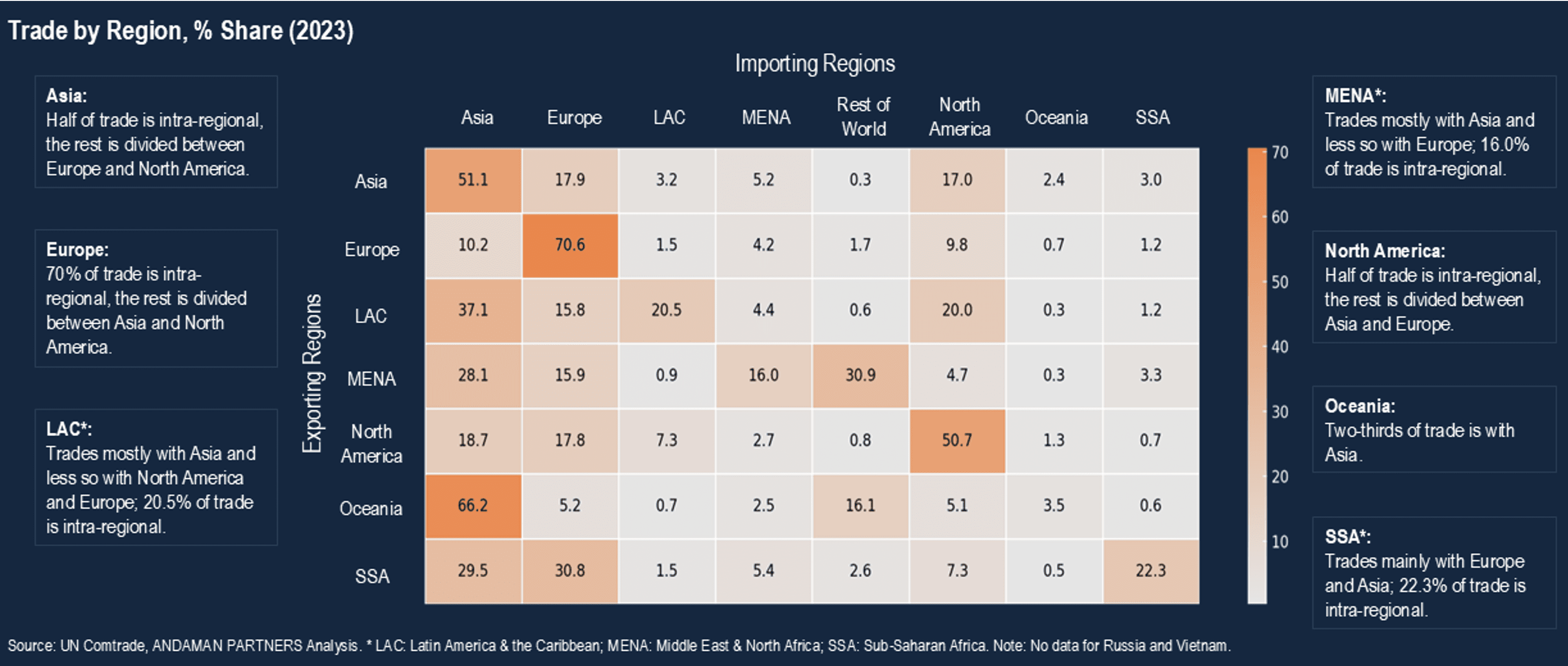

In Europe, most trade is intra-regional, while Asia and North America have a balanced distribution of internal and external trade. Certain regions, such as Oceania and Asia, have deep trade relations, while others, such as Latin America and Sub-Saharan Africa, have comparatively minor trade flows.

Asia and North America had a balanced distribution of intra-regional and extra-regional trade in 2023, while Europe’s exports were predominantly intra-regional:

- Asia exported goods worth USD 7.14 trillion, over half of which (51%) were exported to countries within the region, reflecting strong trade links between Asian economies. Europe (17.9%) and North America (17%) were the largest external trade partners.

- The three countries of North America (the U.S., Canada and Mexico) exported goods worth USD 3.18 trillion, of which 50.7% were traded within the region. The rest of the region’s trade was distributed between Asia (18.7%), Europe (17.8%) and Latin America & the Caribbean (LAC) (7.3%).

- Europe’s exports of USD 8.30 trillion were 70.3% accounted for by intra-regional trade, with the most significant external partners being Asia (10.2%) and North America (9.8%).

Developing and emerging regions had generally low intra-regional trade and relatively high trade with Asia:

- Exports from the Middle East & North Africa (MENA) of just over USD 1.3 trillion were distributed between Asia (28.1%), Europe (15.9%) and Rest of World (31%), with 16.0% in intra-regional trade.

- LAC exports of USD 764 billion went to Asia (37.1%), North America (20%) and Europe (15.8%), with 20.5% in intra-regional trade.

- Sub-Saharan African (SSA) exports of USD 356 billion went mainly to Europe (30.8%) and Asia (29.5%), with 22.3% in intra-regional trade.

The data reveals distinct global trade patterns:

- Asia and North America trade mostly within their regions and with each other, as well as with Europe.

- Europe trades predominantly within Europe and, to a lesser extent, Asia and North America. Europe is also a significant trade partner of SSA.

- LAC, MENA, SSA and especially Oceania have strong trade links with Asia. Of Oceania’s USD 411 billion in exports, 66.2% went to Asia, reflecting Australia’s expansive trade in minerals with China.

- Developing and emerging regions LAC, MENA and SSA have comparatively minor trade flows with each other.

ANDAMAN PARTNERS supports international business ventures and growth. We help launch global initiatives and accelerate successful expansion across borders. If your business, operations or project requires cross-border support, contact connect@andamanpartners.com.

ANDAMAN PARTNERS Was a Co-Sponsor of the South African National Day Reception in Shanghai on 30 May 2025

ANDAMAN PARTNERS was a cosponsor of the South African National Day Reception in Shanghai on 30 May 2025.

Asia’s Shifting Role in Global Supply Chains — Perspectives by ANDAMAN PARTNERS Co-Founder Rachel Wu

Analysis by ANDAMAN PARTNERS Co-Founder Rachel Wu on changing patterns in global supply chains.

ANDAMAN PARTNERS Co-sponsored the West Australian Mining Club Luncheon in Perth on 27 February 2025

WA Mining Club luncheons are valuable ways to network with colleagues and clients and learn about the latest industry insights.

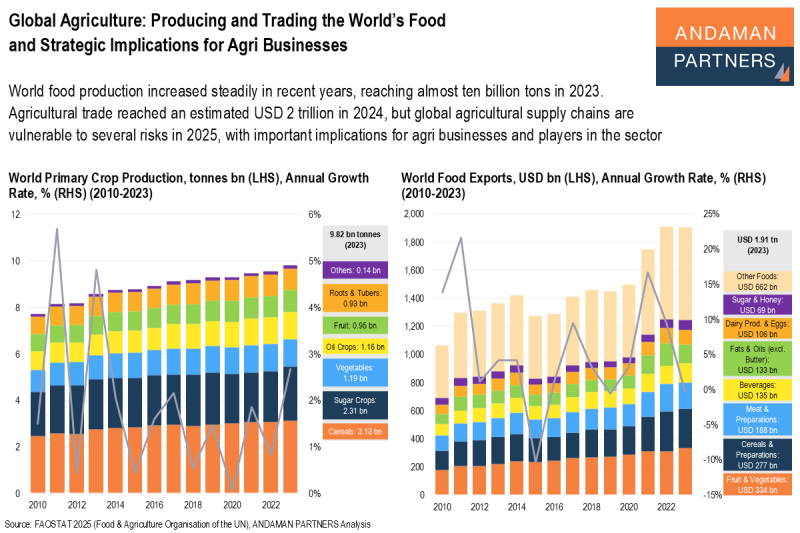

Global Agriculture: Producing and Trading the World’s Food and Strategic Implications for Agri Businesses

Global agricultural supply chains are vulnerable to several risks in 2025, with important implications for agri businesses and players in the sector.

Southeast Asia: The USD 4-trillion Economy

With rapid GDP growth, expanding trade networks and investment inflows, Southeast Asia retains its enduring appeal as a vital destination for multinational corporations seeking to diversify their supply chains and tap into Asia’s growing consumer markets.

Indonesia’s Dynamic Economic Growth Story Offering Opportunities for Global Businesses

Indonesia’s dynamic, services-led and consumption-driven economy is poised to become one of the world’s largest by mid-century, presenting many opportunities for businesses and investors.