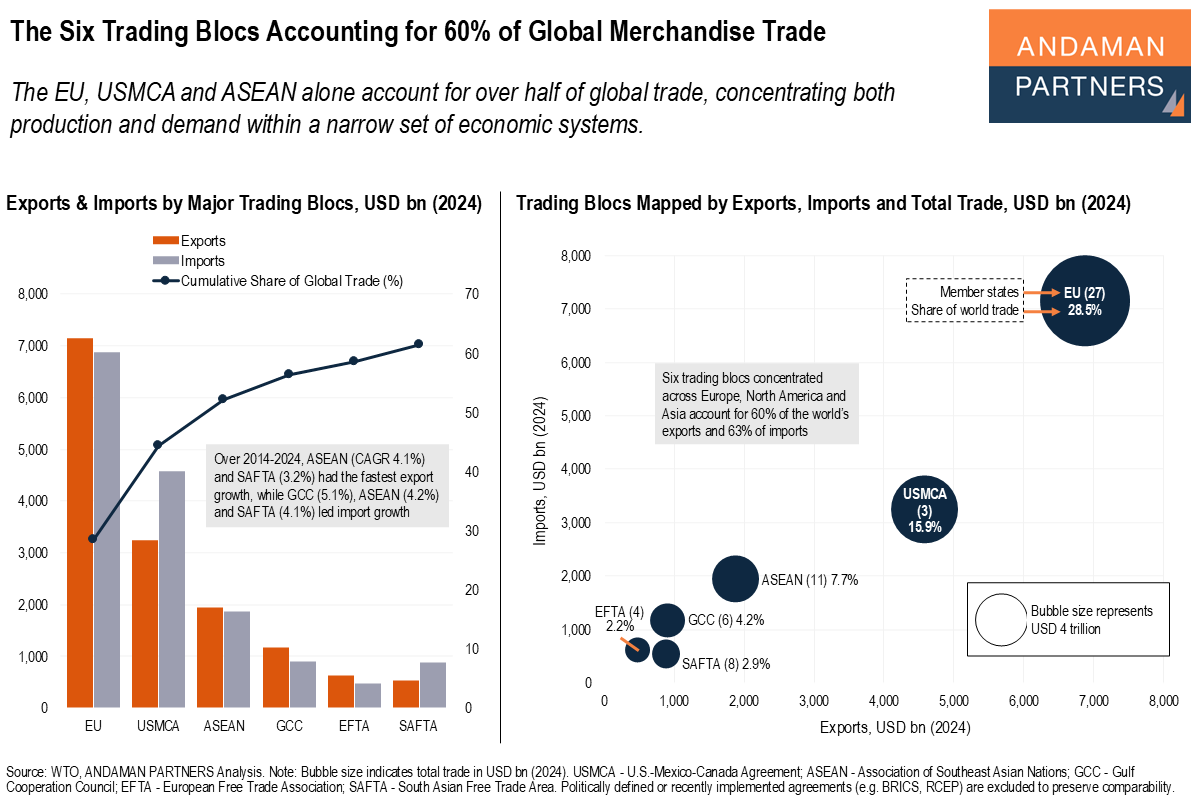

The EU, USMCA and ASEAN alone account for over half of global trade, concentrating both production and demand within a narrow set of economic systems.

Global merchandise trade is highly concentrated. Just six trading blocs, namely the European Union (EU), U.S.-Mexico-Canada Agreement (USMCA), Association of Southeast Asian Nations (ASEAN), Gulf Cooperation Council (GCC), European Free Trade Association (EFTA) and South Asian Free Trade Area (SAFTA), account for roughly 60% of global exports and imports. The EU, USMCA, and ASEAN alone account for more than 50% of the world’s trade.

This concentration reflects more than scale; it highlights how production capacity and demand power are increasingly organised within a small number of large, multi-country economic systems that dominate global trade flows.

Within this top tier, structural differences are pronounced. The EU remains the world’s most complete trade system, combining export capacity with equally significant import demand. The USMCA is more demand-heavy, reflecting the pull of the U.S. market, while ASEAN stands out as the only emerging bloc operating at a comparable scale with a relatively balanced trade profile.

Resource-centric blocs such as the GCC retain importance through export intensity rather than breadth, while South Asia’s trade system remains import-skewed, underscoring different development and consumption dynamics.

By contrast, Africa’s regional trading blocs remain marginal globally. Even the continent’s largest groupings, the Southern African Development Community (SADC), the Common Market for Eastern and Southern Africa (COMESA) and the Economic Community of West African States (ECOWAS), each account for well under 2% of global trade, despite periods of faster growth.

The gap is one of scale and integration rather than volatility: African trade remains fragmented across multiple small blocs with limited intra-regional depth and industrial density.

European Union (EU)

- Members: 27 countries

- Trade profile: The world’s most complete trade system, combining a large export base with a large import market.

United States-Mexico-Canada Agreement (USMCA)

- Members: U.S., Canada, Mexico

- Trade profile: A demand-heavy trade system anchored by the scale of the U.S. consumer market.

Association of Southeast Asian Nations (ASEAN)

- Members: Indonesia, Thailand, Vietnam, Malaysia, Singapore, Philippines, Cambodia, Laos, Myanmar, Brunei, Timor-Leste

- Trade profile: Combines strong export growth with a relatively balanced import profile, reflecting its dual role as a manufacturing base and a fast-growing consumption market.

Gulf Cooperation Council (GCC)

- Members: Saudi Arabia, United Arab Emirates, Qatar, Kuwait, Oman, Bahrain

- Trade profile: Export-led system dominated by energy and petrochemicals.

European Free Trade Association (EFTA)

- Members: Switzerland, Norway, Iceland, Liechtenstein

- Trade profile: Small but highly trade-intensive bloc encompassing high-value manufacturing and energy exports (Norway) and financial and pharmaceutical specialisation (Switzerland).

South Asian Free Trade Area (SAFTA)

- Members: India, Pakistan, Bangladesh, Sri Lanka, Nepal, Bhutan, Maldives, Afghanistan

- Trade profile: India dominates the bloc’s trade flows, while cross-border trade within South Asia remains low relative to economic size.

Also by ANDAMAN PARTNERS:

ANDAMAN PARTNERS supports international business ventures and growth. We help launch global initiatives and accelerate successful expansion across borders. If your business, operations or project requires cross-border support, contact connect@andamanpartners.com.

ANDAMAN PARTNERS Wishes You a Happy and Prosperous Year of the Horse!

Compliments of the Chinese Lunar New Year to all our clients, customers, suppliers and partners.

ANDAMAN PARTNERS to Attend Investing in African Mining Indaba 2026 in Cape Town

ANDAMAN PARTNERS Co-Founders Kobus van der Wath and Rachel Wu will attend Investing in African Mining Indaba 2026 in Cape Town, South Africa.

Join ANDAMAN PARTNERS at Networking Event in Cape Town Ahead of Mining Indaba 2026

ANDAMAN PARTNERS is pleased to support and sponsor this popular Pre-Indaba event in Cape Town.

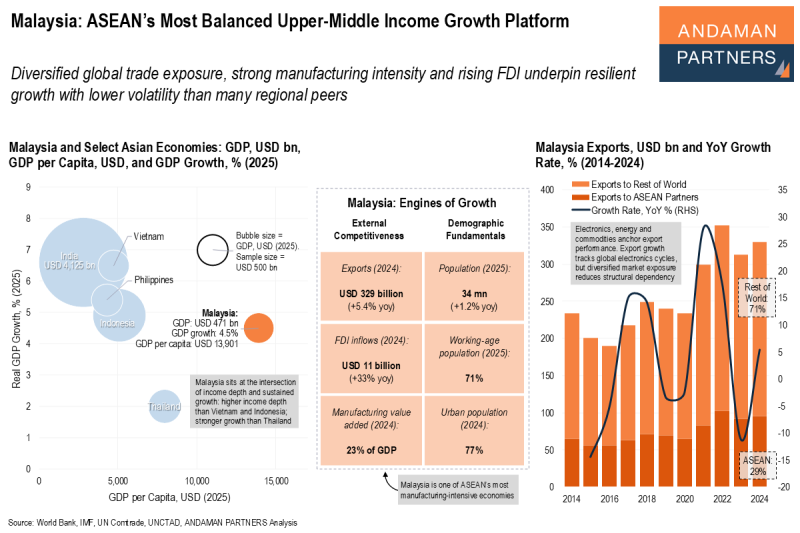

Malaysia: ASEAN’s Most Balanced Upper-Middle Income Growth Platform

Diversified global trade exposure, strong manufacturing intensity and rising FDI underpin resilient growth with lower volatility than many regional peers.

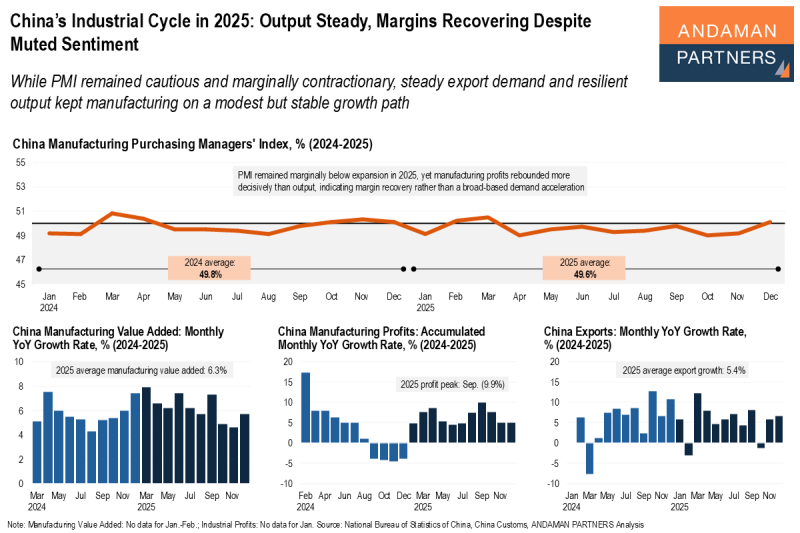

China’s Industrial Cycle in 2025: Output Steady, Margins Recovering Despite Muted Sentiment

While PMI remained cautious and marginally contractionary, steady export demand and resilient output kept manufacturing on a modest but stable growth path.

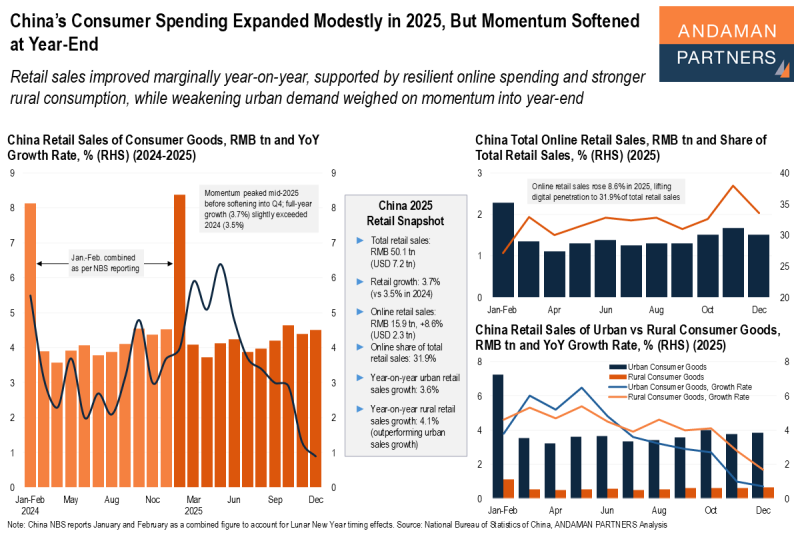

China’s Consumer Spending Expanded Modestly in 2025, But Momentum Softened at Year-End

Retail sales improved marginally year-on-year, supported by resilient online spending and stronger rural consumption.