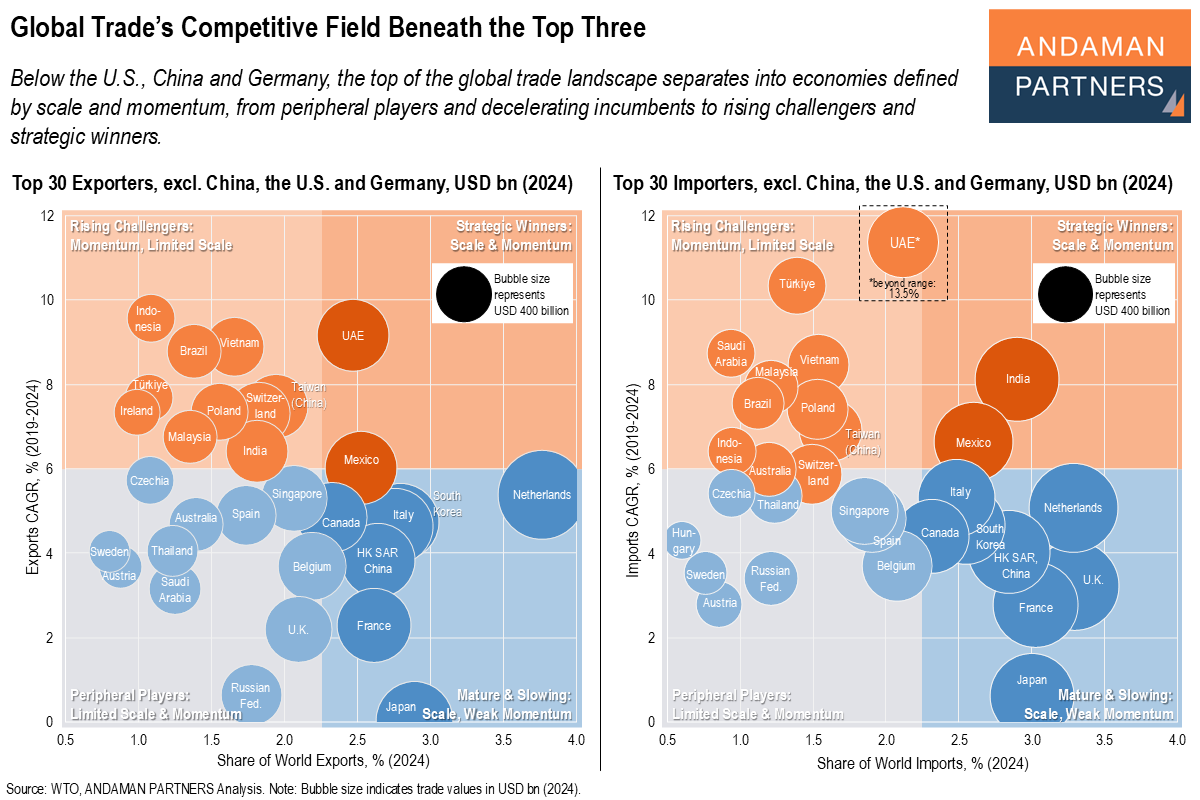

Below the U.S., China and Germany, the top of the global trade landscape separates into economies defined by scale and momentum, from peripheral players and decelerating incumbents to rising challengers and strategic winners.

At first glance, global trade is dominated by the familiar heavyweights. But once the U.S., China and Germany are set aside, the competitive field beneath the system anchors comes into view. The top 30 economies below the top three define where trade momentum is receding and emerging, and where scale is eroding and building.

The world’s next tier of trading economies can be organised along two decisive dimensions: scale, measured by share of global trade, and momentum, captured through multi-year trade growth. Together, these two dimensions separate economies into four distinct strategic positions, each with very different implications for corporates, investors and policymakers.

Strategic Winners: India, Mexico, UAE

At the top are the Strategic Winners. These economies combine meaningful scale with sustained trade momentum. They are not merely growing; they are compounding relevance. They increasingly act as hubs in global supply chains and demand networks, making them disproportionately important relative to their size. For companies, these are markets and sourcing locations that warrant long-term commitment rather than tactical engagement.

Rising Challengers: Brazil, Indonesia, Ireland, Malaysia, Poland, Switzerland, Taiwan (China), Türkiye, Vietnam

The Rising Challengers economies lack scale today, but their momentum is unmistakable. Over time, this group often supplies the next generation of trade hubs, manufacturing platforms or regional gateways. Ignoring them because they are still relatively small is a common strategic error, particularly when trade growth, not current share, determines future positioning.

Mature & Slowing: Canada, France, Hong Kong SAR (China), Italy, Japan, Netherlands, South Korea

Economies in the Mature & Slowing category retain substantial trade weight, yet their growth lags that of their peers. This does not imply decline, but it does signal diminishing marginal relevance. For CEOs, this quadrant raises questions around exposure, optimisation and resilience rather than expansion.

Peripheral Players: Australia, Austria, Belgium, Czechia, Hungary, Russian Federation, Saudi Arabia, Singapore, Spain, Sweden, Thailand, U.K.

The Peripheral Players economies combine limited scale with weak momentum. From a strategic perspective, these markets matter less for global trade decisions and can potentially be deprioritised.

Beyond the top three economies, global trade is not flat or uniform; it is sorting itself into winners, challengers and laggards, and the dividing line is no longer geography or income level, but the interaction of scale and sustained momentum.

Also by ANDAMAN PARTNERS:

ANDAMAN PARTNERS supports international business ventures and growth. We help launch global initiatives and accelerate successful expansion across borders. If your business, operations or project requires cross-border support, contact connect@andamanpartners.com.

ANDAMAN PARTNERS Wishes You a Happy and Prosperous Year of the Horse!

Compliments of the Chinese Lunar New Year to all our clients, customers, suppliers and partners.

ANDAMAN PARTNERS to Attend Investing in African Mining Indaba 2026 in Cape Town

ANDAMAN PARTNERS Co-Founders Kobus van der Wath and Rachel Wu will attend Investing in African Mining Indaba 2026 in Cape Town, South Africa.

Join ANDAMAN PARTNERS at Networking Event in Cape Town Ahead of Mining Indaba 2026

ANDAMAN PARTNERS is pleased to support and sponsor this popular Pre-Indaba event in Cape Town.

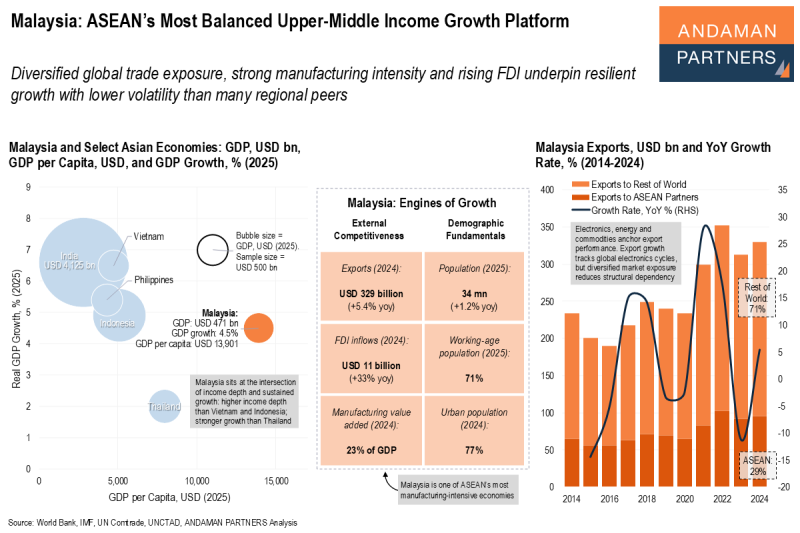

Malaysia: ASEAN’s Most Balanced Upper-Middle Income Growth Platform

Diversified global trade exposure, strong manufacturing intensity and rising FDI underpin resilient growth with lower volatility than many regional peers.

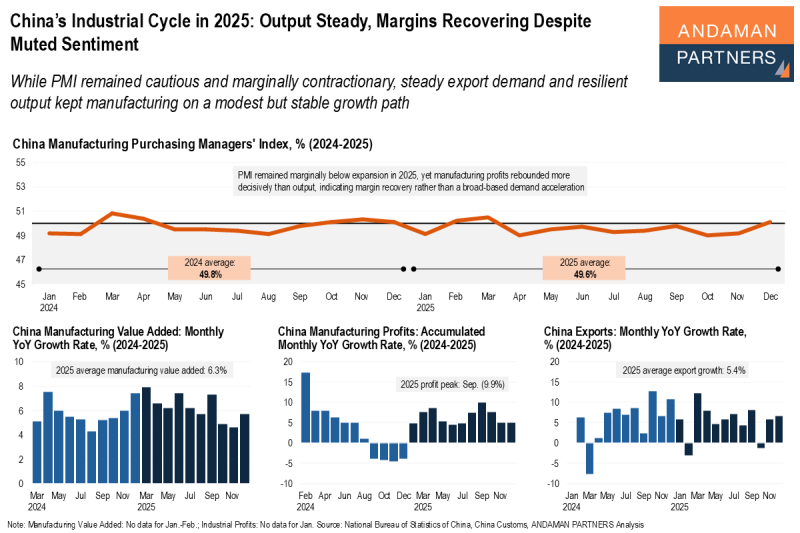

China’s Industrial Cycle in 2025: Output Steady, Margins Recovering Despite Muted Sentiment

While PMI remained cautious and marginally contractionary, steady export demand and resilient output kept manufacturing on a modest but stable growth path.

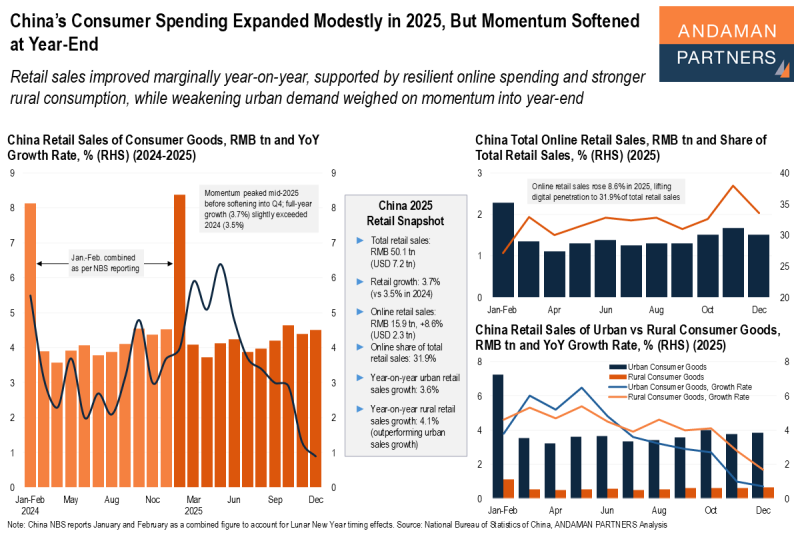

China’s Consumer Spending Expanded Modestly in 2025, But Momentum Softened at Year-End

Retail sales improved marginally year-on-year, supported by resilient online spending and stronger rural consumption.