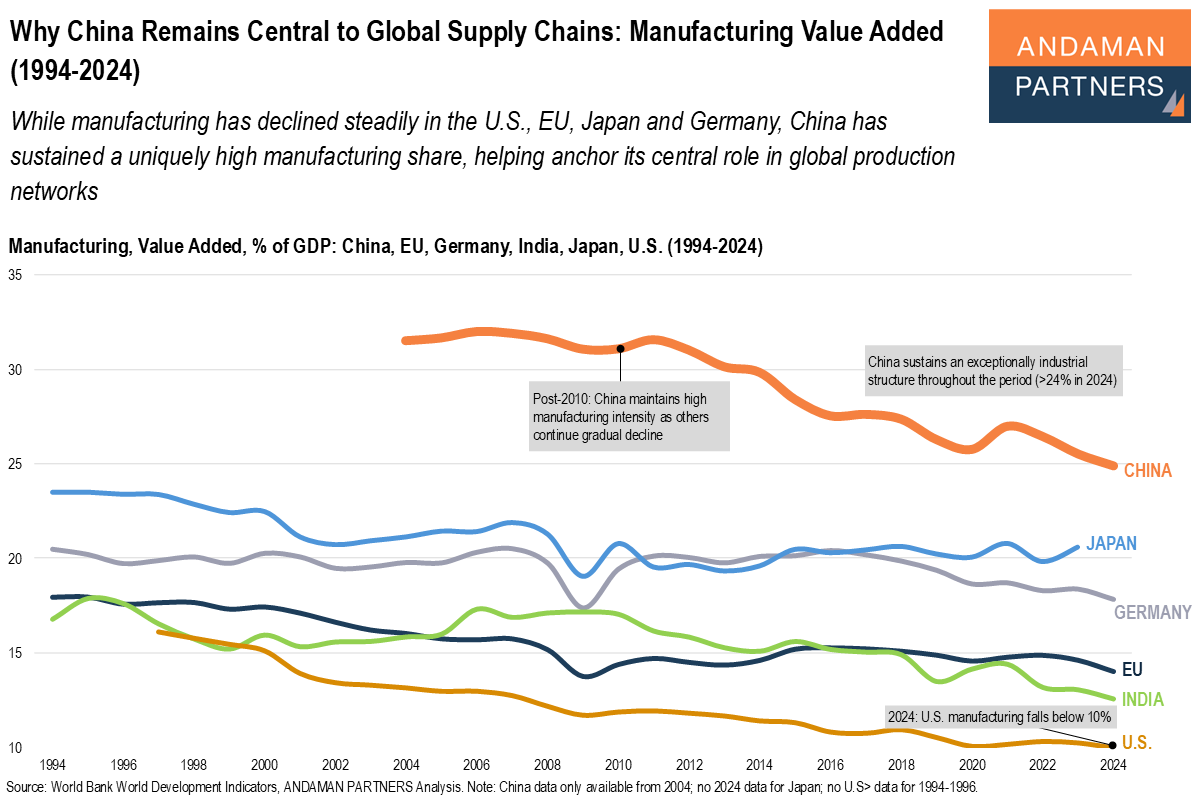

While manufacturing has declined steadily in the U.S., EU, Japan and Germany, China has sustained a uniquely high manufacturing share, helping anchor its central role in global production networks.

Global manufacturing structures have diverged sharply over the past three decades. While the manufacturing share of GDP has declined steadily in the U.S., EU, Japan and Germany—reflecting the long-term shift toward services—China has sustained an unusually high manufacturing intensity throughout the period.

This structural divergence is the foundation of the modern global production system. Most advanced economies normalised toward 12-18% manufacturing shares; China remained above 25% even as its economy grew tenfold.

This sustained industrial structure helps explain China’s centrality in global supply chains. After 2010 in particular, China maintained an elevated manufacturing share at a time when other major economies were continuing gradual de-industrialisation. This divergence made China uniquely capable of absorbing global production at scale, extending deep supplier networks across electronics, machinery, metals, chemicals and consumer goods.

The fact that China in 2024 is still at 24.9% of manufacturing value added as % of GDP, contrasted with the downward trajectories of the U.S., EU, Japan, and Germany, illustrates why China became the world’s dominant manufacturing hub during the hyper-globalisation era and why it is still central to manufacturing and supply chains.

Also by ANDAMAN PARTNERS:

ANDAMAN PARTNERS supports international business ventures and growth. We help launch global initiatives and accelerate successful expansion across borders. If your business, operations or project requires cross-border support, contact connect@andamanpartners.com.

ANDAMAN PARTNERS Wishes You a Happy and Prosperous Year of the Horse!

Compliments of the Chinese Lunar New Year to all our clients, customers, suppliers and partners.

ANDAMAN PARTNERS to Attend Investing in African Mining Indaba 2026 in Cape Town

ANDAMAN PARTNERS Co-Founders Kobus van der Wath and Rachel Wu will attend Investing in African Mining Indaba 2026 in Cape Town, South Africa.

Join ANDAMAN PARTNERS at Networking Event in Cape Town Ahead of Mining Indaba 2026

ANDAMAN PARTNERS is pleased to support and sponsor this popular Pre-Indaba event in Cape Town.

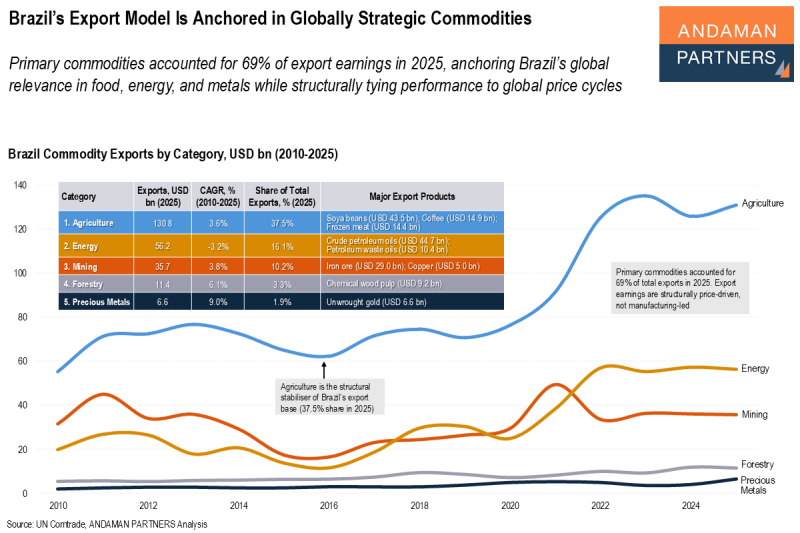

Brazil’s Export Model Is Anchored in Globally Strategic Commodities

Primary commodities accounted for 69% of export earnings in 2025, anchoring Brazil’s global relevance in food, energy, and metals.

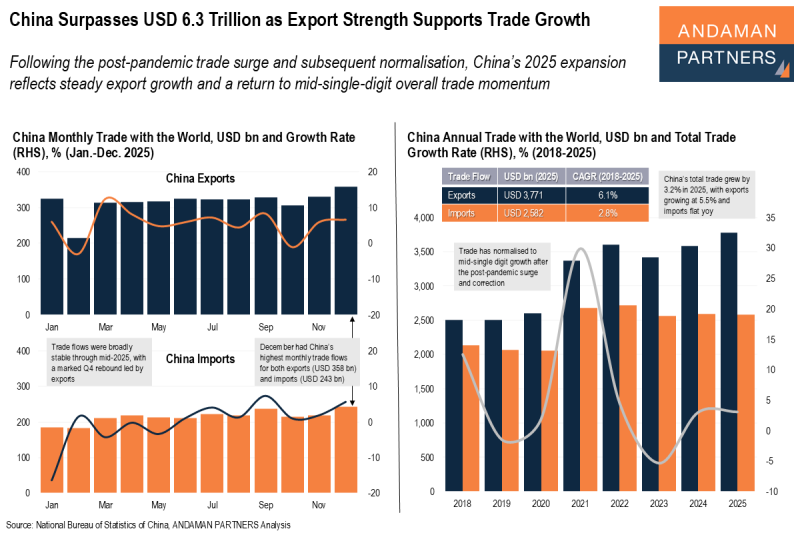

China Surpasses USD 6.3 Trillion as Export Strength Supports Trade Growth

China’s 2025 expansion reflects steady export growth and a return to mid-single-digit overall trade momentum.

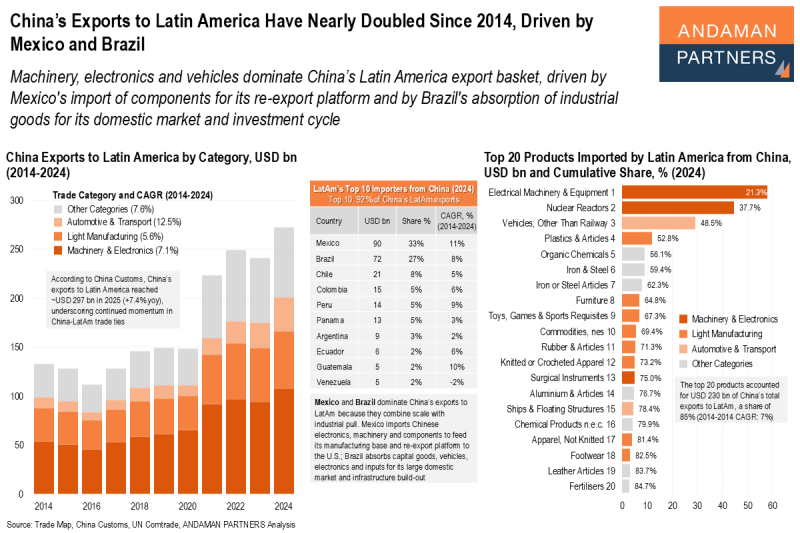

China’s Exports to Latin America Have Nearly Doubled Since 2014, Driven by Mexico and Brazil

Machinery, electronics and vehicles dominate China’s Latin America export basket, driven by Mexico and Brazil.