Australia’s exports have in recent years become predominantly focused on minerals and fuels. In 2023, the Minerals, Fuels & Chemicals sector accounted for almost 70% of the country’s exports. This specialization has been a significant revenue source for Australia but is also a risky prospect in a changing and volatile global trade context.

Australia’s exports have become predominantly focused on minerals and fuels:

- From 2002 to 2023, total exports increased from almost USD 65 billion to just under USD 370 billion, an increase of 468%.

- One sector accounted for the most significant growth: Minerals, Fuels & Chemicals. In 2002, this sector accounted for 34% of Australian exports; in 2023, the share increased to a staggering 69.1%.

- Minerals, Fuels & Chemicals mostly comprises coal, iron ore and petroleum gas, which are predominantly exported to China, Japan, South Korea and India.

- In 2022, Australia was the world’s largest exporter of coal, iron ore, wheat and aluminium oxide.

Australia’s highly specialized export profile can be a source of risk and opportunity in a changing global trade context. China is Australia’s largest customer of minerals and fuels, taking a share of 40% in 2023. However, China’s economic growth and appetite for minerals and fuels are gradually slowing. It is doubtful whether other countries will fully be able to make up for China’s slowing demand for Australian exports.

This is a risky scenario for Australia and its highly specialized export profile. But it also presents an opportunity: Firstly, to leverage its proximity to Asia and ‘be the best at marketing and sales of resources’ to these markets’ customers; and secondly, to develop other export sectors, such as metals, tools & machinery and agricultural goods. In addition, this also presents favorable investment opportunities for foreign investors in Australia’s other export sectors.

From an Australian point of view, it will be essential to also market its other exports in China, India, and other large foreign markets better than other competitors. This suggests that the Australian economy will be tied even more closely to Asia’s rising economies. Supportive policy, capacity and skills development, and exemplary boardroom leadership have never been more important.

ANDAMAN PARTNERS supports international business ventures and growth. We help launch global initiatives and accelerate successful expansion across borders. If your business, operations or project requires cross-border support, contact connect@andamanpartners.com.

ANDAMAN PARTNERS to Attend Investing in African Mining Indaba 2026 in Cape Town

ANDAMAN PARTNERS Co-Founders Kobus van der Wath and Rachel Wu will attend Investing in African Mining Indaba 2026 in Cape Town, South Africa.

Join ANDAMAN PARTNERS at Networking Event in Cape Town Ahead of Mining Indaba 2026

ANDAMAN PARTNERS is pleased to support and sponsor this popular Pre-Indaba event in Cape Town.

AAMEG Event in Cape Town Ahead of Mining Indaba 2026

ANDAMAN PARTNERS is pleased to sponsor and support the AAMEG pre-Mining Indaba Cocktails & Canapes event.

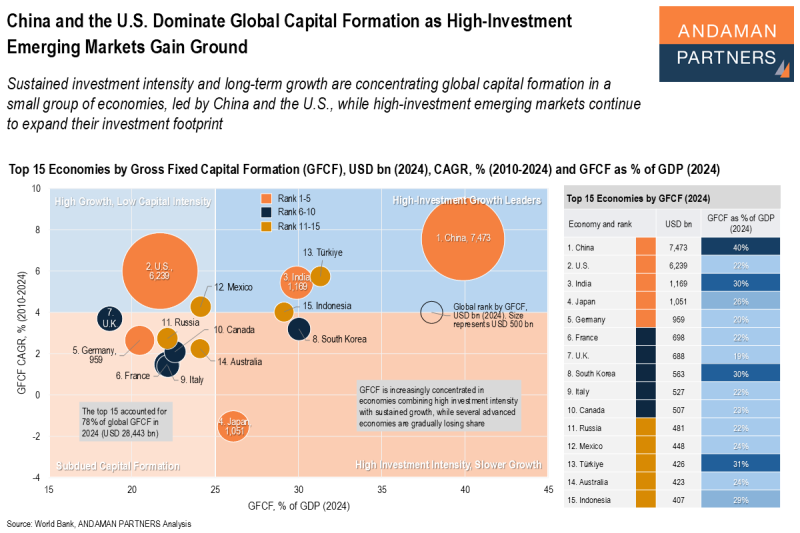

China and the U.S. Dominate Global Capital Formation as High-Investment Emerging Markets Gain Ground

Sustained investment intensity and long-term growth are concentrating global capital formation in a small group of economies, led by China and the U.S.

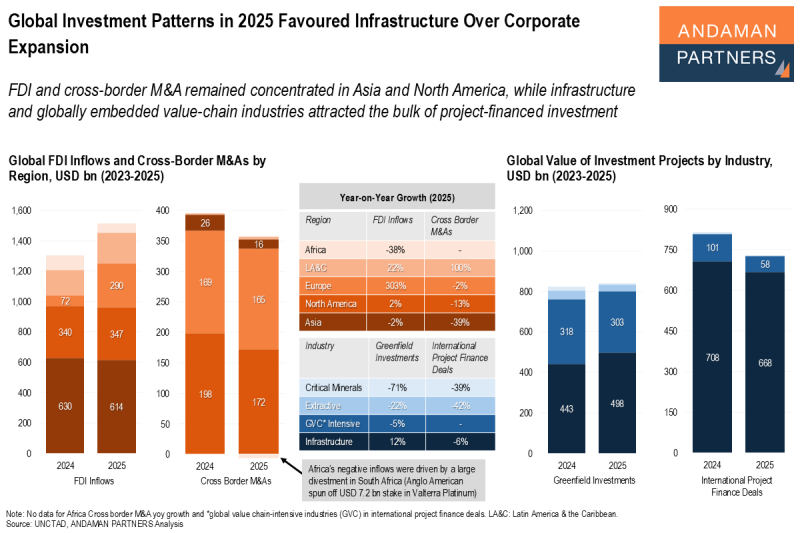

Global Investment Patterns in 2025 Favoured Infrastructure Over Corporate Expansion

FDI and M&A remained concentrated in Asia and North America, while infrastructure attracted the bulk of project-financed investment.

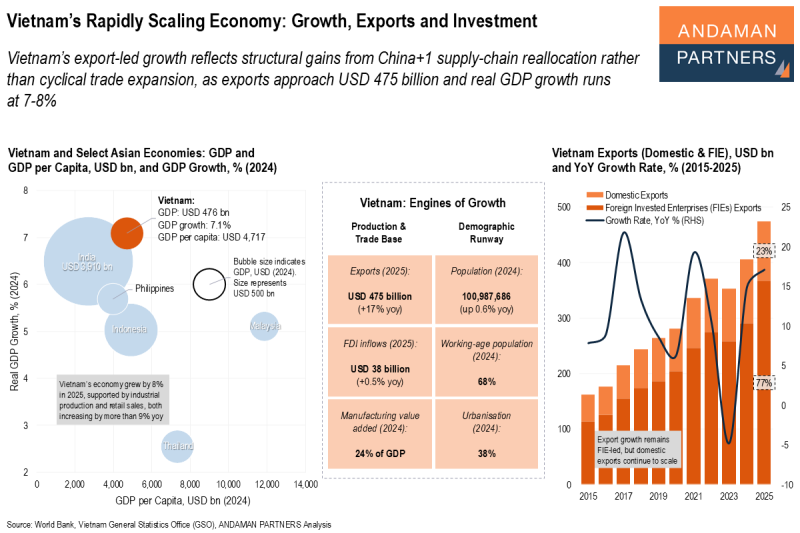

Vietnam’s Rapidly Scaling Economy: Growth, Exports and Investment

Vietnam’s export-led growth reflects structural gains from China+1 supply-chain reallocation rather than cyclical trade expansion.