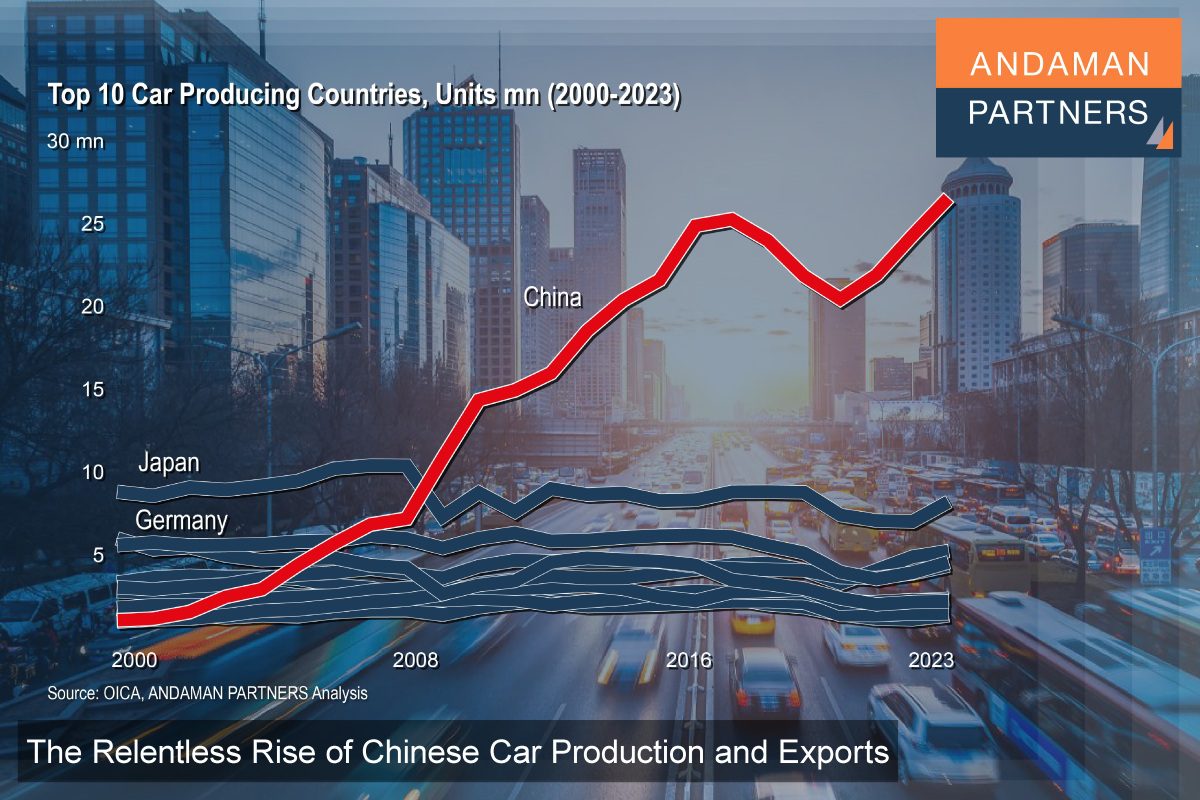

With distinct advantages in production capacity, technology and supply chains, China dominates car production and leads the global transition to electric vehicles. China is now making great strides in car exports, too. Although its electric vehicles are facing tariffs in major international markets, its conventional cars running on fossil fuels are more popular than ever in markets worldwide.

China is the nexus of global car production, and its rise has been unambiguous:

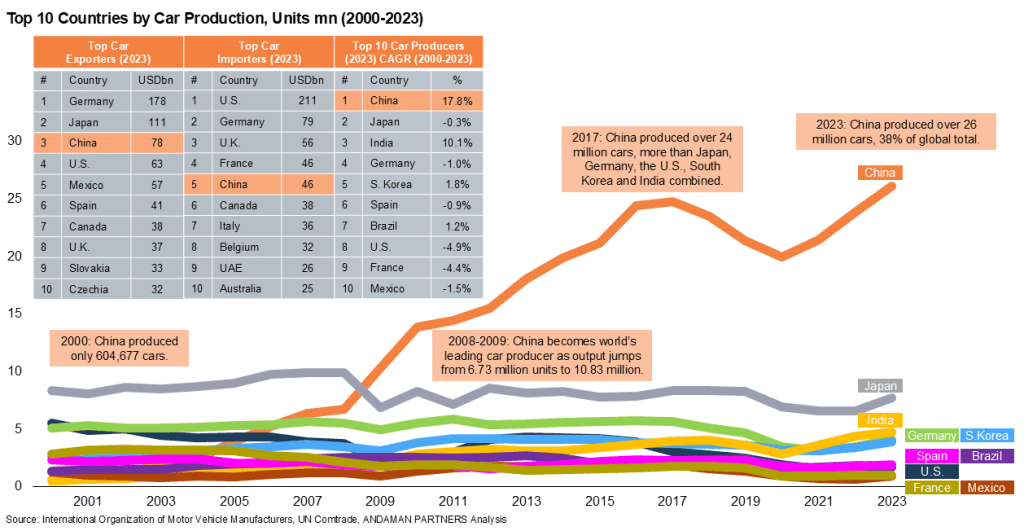

- Taking the lead: In 2008, when the Global Financial Crisis gripped the global economy, output in all the leading car-producing countries stagnated. But in China, output increased by 3.64 million to well over 10 million cars, far surpassing the 6.86 million produced by second-placed Japan.

- Widening the gap: From 2000 to 2023, China produced 328.19 million cars, 24% of the global tally of 1.36 billion, followed by Japan with 196.94 million (14%). In 2023, China produced almost as many cars (26.12 million units) as the other top ten producing countries combined (27.93 million units).

- Vast capacity: Production costs are considerably lower in China, and the country has enough capacity to produce nearly twice as many cars as its local market requires. This would be a considerable number of units: In 2023, according to the China Association of Automobile Manufacturers (CAAM), car sales in China exceeded 30 million, an increase of 12% year-on-year.

Chinese cars are now becoming highly competitive in markets worldwide:

- Exports by value: In 2023, China was the third-largest exporter of cars behind Germany and Japan in terms of value (as opposed to units) at USD 78 billion, a significant increase from USD 45 billion in 2022 when China was the sixth-largest exporter. This is a stark turnaround from 2020 when the country was a net importer of cars.

- Exports by units: According to CAAM data, China’s car exports in 2023 expanded by 57.9% year-on-year to a record high of 4.91 million units; exports of electric vehicles (EVs) grew by 80.9% and hybrids by 47.8%.

China is at the forefront of the global EV transition:

- Largest market: China’s EV market is by far the largest in the world, accounting for 60% of global EV sales in 2023 with 5.4 million units sold (excluding hybrids), compared to 1.10 million in the second-placed U.S.

- Competitive pricing: Crucially, EVs are becoming highly competitive in China. According to an International Energy Agency (IEA) estimate, more than 60% of EVs sold in China in 2023 were cheaper than their average conventional internal combustion engine (ICE) equivalents (compared to only 5% in the U.S. in 2022).

- Rising exports: In 2023, China was the second-largest EV exporter (in terms of value) at USD 34 billion, behind only Germany with USD 40 billion.

The U.S., Canada, India, the EU and other markets have levied increased tariffs on Chinese EVs. However, most of the cars China sold abroad in 2023 were of the conventional internal combustion engine (ICE) type, which was especially popular in regions like the Middle East, Latin America, Southeast Asia and Russia.

ANDAMAN PARTNERS supports international business ventures and growth. We help launch global initiatives and accelerate successful expansion across borders. If your business, operations or project requires cross-border support, contact connect@andamanpartners.com.

ANDAMAN PARTNERS Was a Co-Sponsor of the South African National Day Reception in Shanghai on 30 May 2025

ANDAMAN PARTNERS was a cosponsor of the South African National Day Reception in Shanghai on 30 May 2025.

Asia’s Shifting Role in Global Supply Chains — Perspectives by ANDAMAN PARTNERS Co-Founder Rachel Wu

Analysis by ANDAMAN PARTNERS Co-Founder Rachel Wu on changing patterns in global supply chains.

ANDAMAN PARTNERS Co-sponsored the West Australian Mining Club Luncheon in Perth on 27 February 2025

WA Mining Club luncheons are valuable ways to network with colleagues and clients and learn about the latest industry insights.

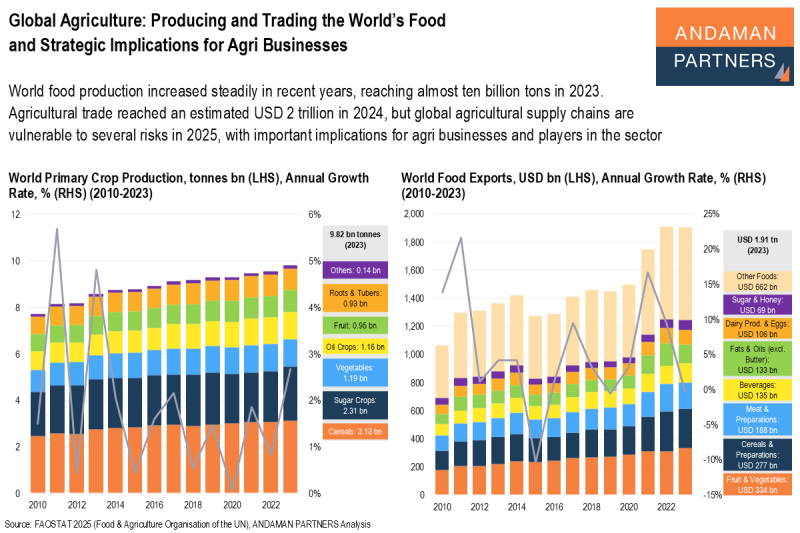

Global Agriculture: Producing and Trading the World’s Food and Strategic Implications for Agri Businesses

Global agricultural supply chains are vulnerable to several risks in 2025, with important implications for agri businesses and players in the sector.

Southeast Asia: The USD 4-trillion Economy

With rapid GDP growth, expanding trade networks and investment inflows, Southeast Asia retains its enduring appeal as a vital destination for multinational corporations seeking to diversify their supply chains and tap into Asia’s growing consumer markets.

Indonesia’s Dynamic Economic Growth Story Offering Opportunities for Global Businesses

Indonesia’s dynamic, services-led and consumption-driven economy is poised to become one of the world’s largest by mid-century, presenting many opportunities for businesses and investors.