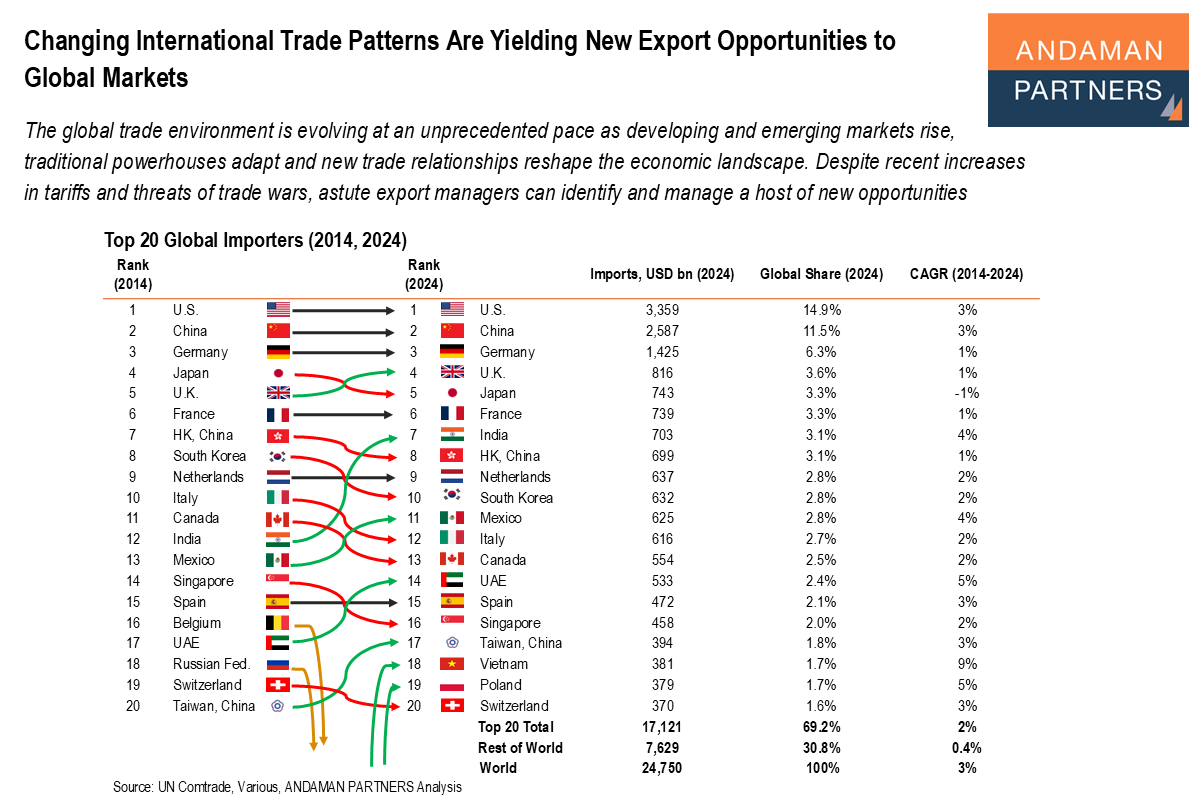

The global trade environment is evolving at an unprecedented pace as developing and emerging markets rise, traditional powerhouses adapt and new trade relationships reshape the economic landscape. Despite recent increases in tariffs and threats of trade wars, astute export managers can identify and manage a host of new opportunities.

Highlights:

- The world’s imported goods were worth USD 24.8 trillion in 2024, an increase of 2% on the previous year and a record high level.

- The top 20 importers in 2023 accounted for almost 70% of global imports, indicating the concentration of international trade in a few major economies.

- Three trade categories dominated world imports in 2023, accounting for 70%: Machinery, Electronics & Metals, Minerals, Fuels & Chemicals and Transport Vehicles.

- Vietnam’s imports grew by 9% from 2014 to 2024, and the country climbed 14 places in global import rankings to 18th. Other prominent climbers were India, Mexico, the UAE, Poland and the Philippines.

- From 2014 to 2024, South Africa dropped six places in global import rankings (34th to 40th). Russia dropped thirteen places to 31, and Brazil dropped four places to 26th.

- The China +1 strategy and regional agreements like RCEP and USMCA are driving trade diversification, benefiting emerging economies while reducing China dependence.

The world imported goods worth USD 24.8 trillion in 2024, an increase of 2% year-on-year, a rebound from 2023 when world imports contracted slightly year-on-year.

The record high level of imports in 2024 is partly attributable to declining inflation and interest rates worldwide and the likely front-loading of imports ahead of anticipated increased tariffs in 2025. From 2014 to 2024, world imports grew by a compound annual growth rate (CAGR) of 3%.

Import Rankings

The top 20 importing countries accounted for 69.2% of total imports in 2024. This underscores the challenges developing markets face in competing with established economies.

In 2024, the U.S., China and Germany maintained their positions as the top three importers, collectively accounting for 32.7% of world imports. This dominance is based on these countries’ large industrial bases, robust technology sectors and consumption-driven economies. Japan and the U.K. remained the fourth and fifth-largest importers, although they traded places between 2014 and 2024, while France remained sixth.

However, emerging economies are rapidly gaining ground. Vietnam, for example, climbed an impressive 14 places to 18th in global import rankings from 2014 to 2024, with a CAGR of 9%. This is based on the country’s role as a manufacturing hub, the growth of export-focused industries such as electronics and textiles and strategic shifts like the China +1 strategy, which encourages firms to diversify supply chains away from China.

India climbed from 12th to seventh place over the same period, supported by strategic trade networks, industrial growth and high demand for consumer and capital goods.

Other emerging economies with rapidly increasing imports include Mexico, the UAE, Poland and the Philippines. With strengthened trade ties with the U.S., particularly in transport equipment, Mexico rose from 13th place to 11th. The UAE climbed three places to 14th, and Poland rose seven places to 19th. The Philippines climbed eight places (44th to 36th), driven by the country’s growing consumer goods and agricultural imports.

South Africa’s six-place decline in global import rankings to 40th highlights economic challenges. Geopolitical tensions pushed Russia down thirteen places to 31, and Brazil’s sluggish industrial performance contributed to its four-place drop to 26th.

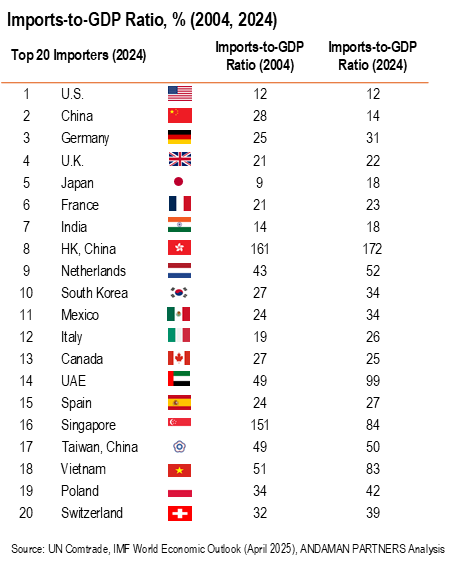

Import Dependency

The imports-to-GDP ratio illustrates an economy’s dependence on imports of foreign goods and services. Of the 20 largest importing countries, Hong Kong (China) consistently had the highest ratio from 2004 to 2024, increasing from 161% to 172%. Singapore had a ratio of 151% in 2004, but it fell back to 84% in 2024.

Other countries with high imports-to-GDP ratios in 2024 were the UAE (99%), Vietnam (83%), the Netherlands (52%), Taiwan, China (50%) and Poland (42%).

Aside from Hong Kong (China), countries with notable increases in imports-to-GDP ratios over this period were Germany, Japan, India, the Netherlands, South Korea, Mexico, Italy, the UAE, Vietnam, Poland and Switzerland.

Countries with the lowest imports-to-GDP ratios in 2024 were the U.S. (12%), China (14%), Japan (18%) and India (18%).

The U.S. ratio remained unchanged from 2004 to 2024, while China’s decreased from 28% to 14%. Canada and Singapore also had decreasing ratios over this period.

Import Sectors

Global imports in 2023, the most recent year for which sectoral data is available, were dominated by three sectors: Metals, Electronics & Machinery (38%); Minerals, Fuels & Chemicals (24%); and Transport Vehicles & Equipment (9%). These three sectors accounted for USD 16.1 trillion or 70% of the total, reflecting strong demand for infrastructure development, technology and consumer goods.

Consumer goods and intermediate products also saw rapid import growth, particularly in emerging economies across Asia and Africa, driven by rising per capita income and demand for integrated supply chains.

Metals, Electronics & Machinery grew at a CAGR of over 2% from 2013 to 2023, reaching USD 8.6 trillion. Minerals, Fuels & Chemicals grew at a slower CAGR of 1.2%, reaching USD 5.3 trillion. Transport Vehicles & Equipment imports amounted to USD 2.1 trillion in 2023, with a CAGR of 2.6% from 2013 to 2023, driven by demand for automobiles and heavy machinery.

Plastics, Rubber & Related Goods grew by a CAGR of 1%, reflecting lower demand for packaging and industrial plastics, while Textiles, Apparel & Accessories grew by less than 1%. Industrial & Specialty Chemicals grew at a CAGR of above 3%, driven by applications in manufacturing and high-tech industries.

Regarding country-specific import sectors for the top 30 importing economies in 2023, Metals, Electronics & Machinery was the leading category for China (40%), the U.S. (38%), Germany (38%) and most other economies. This category is especially prominent for Hong Kong, China (81%), Singapore (55%), Taiwan, China (54%) and the UAE (51%).

Minerals, Fuels & Chemicals was also prominent in China’s imports (35%) as well as those of India (42%), Belgium (38%), Japan (37%), South Korea (37%) and Brazil (34%).

Canada (19%), Australia (17%) and the U.K. (14%) had the highest shares of Transport Vehicles & Equipment imports.

Poland (7%), Spain (7%) and Italy (6%) had the highest shares of Textiles, Apparel & Accessories imports. Indonesia (7%) was the only country with a greater than 5% share of Agricultural & Plant-based Goods imports. Poland (7%), Mexico (7%), Czechia (6%) and Brazil (6%) had the highest shares of Plastics, Rubber & Related Goods imports.

New Opportunities and Partnerships in a Changing Trade Landscape

The global trade environment is in flux, with new players emerging and traditional leaders adapting to evolving economic realities. Key sectors like machinery, electronics and transport equipment will continue to dominate imports, driven by industrial and consumer demand. At the same time, the rise of emerging markets and regional partnerships presents businesses with opportunities to adapt to more diverse and interconnected global trade networks.

Regional trade patterns highlight interconnectedness and diversification in global imports. The U.S. relies heavily on imports of machinery and electronics from Mexico, while Germany and Poland dominate the EU’s industrial trade.

In Asia, China’s demand for agricultural goods and metal imports supports its manufacturing and consumer-driven economy. The UAE has emerged as a destination for mineral and fuel imports, underlining its importance as a geographic and logistical hub.

The China +1 strategy has spurred companies to diversify their sourcing and production bases, benefiting emerging markets such as Vietnam, India and Southeast Asia. Regional partnerships like the Regional Comprehensive Economic Partnership (RCEP) in Asia and the U.S.-Mexico-Canada Agreement (USMCA) in North America are reshaping trade flows and reducing supply chain vulnerabilities.

Investing in resilience, emerging markets and strategic partnerships will be crucial for companies to thrive in this dynamic landscape. The following are some of the current priorities for international export managers:

Leverage data, analytics and strategic intelligence for success: Invest to ensure high-quality internal organisational and external market data for better decision support.

Anticipate general changes and trends in global markets as early as possible, such as the decline in traditional markets and the emergence of demand growth in new markets. Act early and diversify export portfolios to adapt to changing conditions.

Develop team skills and human capital to flourish in a changing world marked by increased risk, uncertainty, ambiguity and more open international supply chains. Adapt hiring and professional development to align with the new realities in global markets with multiple languages, cultures and time zones.

Develop organisational capabilities across the company that better support international business, e.g., global risk management, international logistics management, a collaborative mindset, partnerships and flexible business models.

ANDAMAN PARTNERS supports international business ventures and growth. We help launch global initiatives and accelerate successful expansion across borders. If your business, operations or project requires cross-border support, contact connect@andamanpartners.com.

ANDAMAN PARTNERS Was a Co-Sponsor of the South African National Day Reception in Shanghai on 30 May 2025

ANDAMAN PARTNERS was a cosponsor of the South African National Day Reception in Shanghai on 30 May 2025.

Asia’s Shifting Role in Global Supply Chains — Perspectives by ANDAMAN PARTNERS Co-Founder Rachel Wu

Analysis by ANDAMAN PARTNERS Co-Founder Rachel Wu on changing patterns in global supply chains.

ANDAMAN PARTNERS Co-sponsored the West Australian Mining Club Luncheon in Perth on 27 February 2025

WA Mining Club luncheons are valuable ways to network with colleagues and clients and learn about the latest industry insights.

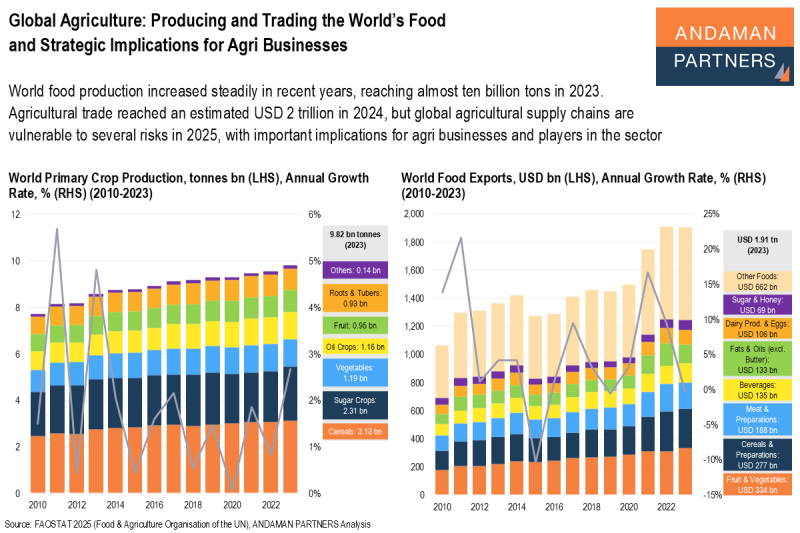

Global Agriculture: Producing and Trading the World’s Food and Strategic Implications for Agri Businesses

Global agricultural supply chains are vulnerable to several risks in 2025, with important implications for agri businesses and players in the sector.

Southeast Asia: The USD 4-trillion Economy

With rapid GDP growth, expanding trade networks and investment inflows, Southeast Asia retains its enduring appeal as a vital destination for multinational corporations seeking to diversify their supply chains and tap into Asia’s growing consumer markets.

Indonesia’s Dynamic Economic Growth Story Offering Opportunities for Global Businesses

Indonesia’s dynamic, services-led and consumption-driven economy is poised to become one of the world’s largest by mid-century, presenting many opportunities for businesses and investors.