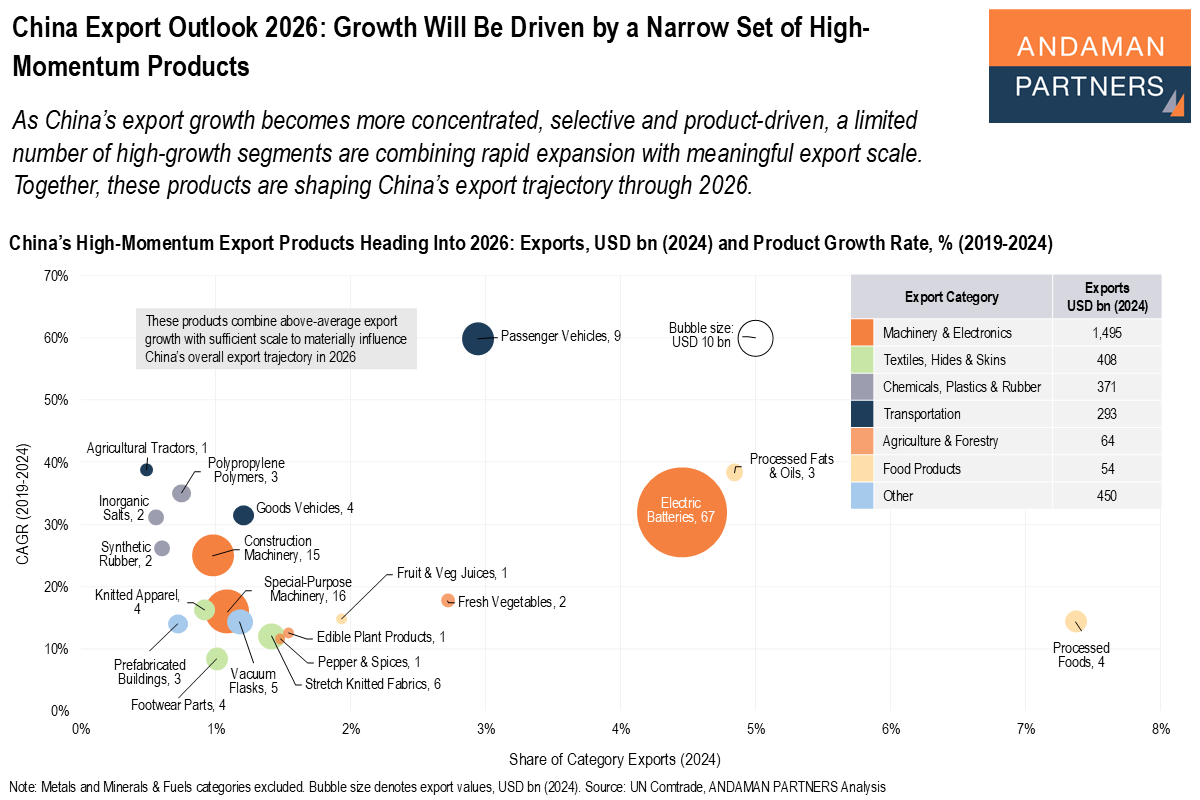

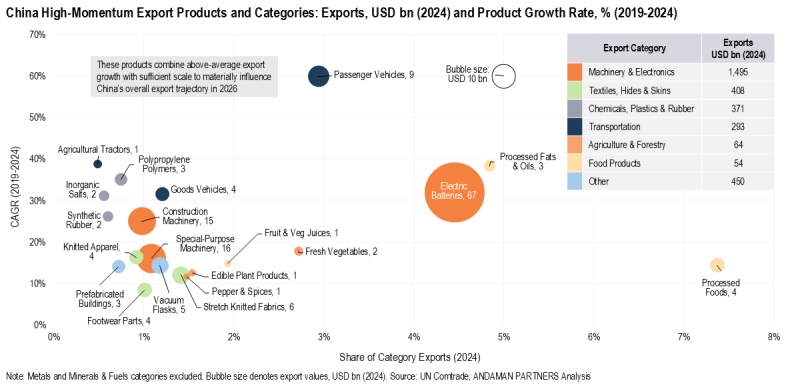

As China’s export growth becomes more concentrated, selective and product-driven, a limited number of high-growth segments, most notably electric batteries, vehicles and advanced machinery, are combining rapid expansion with meaningful export scale. Together, these products are shaping China’s export trajectory through 2026.

Highlights:

- China’s next phase of export growth will be led by a limited set of high-momentum industrial, transportation, chemical, textile and agri-processing products occupying the intersection of high growth and meaningful scale.

- Transportation, especially batteries, passenger vehicles and agricultural tractors, stands out within the high-momentum cohort, alongside several machinery sub-categories including construction, special-purpose and industrial equipment.

- Chemicals, particularly polypropylene polymers, inorganic salts and synthetic rubber, will support China’s overall export performance in 2026.

- Textiles will contribute to export momentum at the margin, with selective strength in knitted apparel, stretch knitted fabrics and footwear parts.

- Agricultural and food-related exports will remain smaller in scale, but several products, especially fresh vegetables, fruit and vegetable juices, edible plant products and processed fats and oils, will support aggregate growth.

- Asia remains China’s anchor market, still absorbing nearly half of exports, though its share has edged down as Europe’s demand strengthened and North America’s relative weight declined. Africa and Latin America will provide much of the incremental demand sustaining China’s export momentum in 2026.

Growth, Concentration and the Logic of Product Momentum

China’s export performance is often assessed in aggregate terms: headline growth rates, total volumes or shifts in global market share. These metrics, however, increasingly obscure more than they reveal. Heading into 2026, what matters is not how much China exports, but which products are driving incremental growth—and why.

China’s export growth is becoming more concentrated, more selective and more product-driven. A narrow group of product categories now combines rapid growth with sufficient scale to materially shape overall export performance. These products are neither speculative bets nor marginal niches. They are established export lines with structural momentum.

This article sets out a product-level outlook for China’s exports in 2026, grounded in recent trade data, long-term structural trends and a focused assessment of logistics and market conditions. The conclusion is straightforward: China’s next phase of export growth will be led by a limited set of high-momentum industrial, transportation, chemical, textile and agri-processing products, not by broad-based expansion across the export base.

The Product Lens: Where China’s Export Momentum Is Concentrating

A comparison of export growth rates and scale over recent years reveals a decisive pattern. Only a small group of products occupies the zone where high growth and meaningful scale intersect. These are the products that matter for 2026, not because they post the highest percentage growth, but because they are large enough for that growth to move national export totals.

Transportation Equipment: Vehicles and Tractors

Transportation products stand out clearly within the high-momentum cohort. Passenger vehicles are among the most prominent, with export growth reaching a CAGR of roughly 60% between 2019 and 2024. This expansion has been driven by competitive pricing, improving quality and rising demand across emerging markets.

While much attention focuses on electric vehicles, the broader passenger vehicle category, including internal combustion and hybrid models, remains a powerful export driver, particularly in markets prioritising affordability, rapid motorisation and fleet expansion.

Agricultural tractors, with a 39% CAGR, represent a smaller but strategically important segment. Their growth reflects rising mechanisation across agriculture in Asia, Africa and Latin America. Although export volumes remain modest relative to passenger vehicles, demand is structurally supported by food security imperatives and productivity gains.

Together, these transportation exports illustrate a broader shift: China’s competitiveness increasingly extends beyond consumer goods into complex, capital-intensive equipment with long replacement cycles.

Machinery & Electronics: Batteries and Equipment (Construction, Special-Purpose, Industrial)

Machinery exports remain one of the most durable pillars of China’s export base, and several sub-categories exhibit powerful momentum.

Electric batteries, with a 32% CAGR, stand out as the most strategically significant product in this group. In 2024, batteries were China’s seventh-largest export product overall, with an export value of approximately USD 67 billion. These batteries are best understood not as consumer goods, but as manufactured industrial inputs at the core of electrification supply chains.

Battery export momentum reflects a rare combination of drivers: accelerating global deployment of electric vehicles and energy storage systems, expanding downstream manufacturing capacity across multiple regions, and a structural shift toward higher-value-added components, where Chinese producers hold scale advantages. Unlike many fast-growing export lines that remain too small to matter, batteries already carry sufficient export weight to make incremental growth economically material and strategically visible.

Heading into 2026, batteries should be viewed as one of China’s most scalable export engines. They are closely linked to industrial capex cycles, increasingly embedded in global manufacturing ecosystems and relatively resilient to short-term demand fluctuations because they serve both transport and grid applications.

Construction machinery, with a CAGR of 15%, will also feature prominently in 2026, supported by infrastructure investment across emerging economies and ongoing capital expenditure cycles. Excavators, loaders and related equipment benefit from China’s scale advantages, integrated supply chains and financing capabilities.

Special-purpose machinery (CAGR 16%) spans a wide range of industrial applications and combines steady growth with high export value. These products are embedded in production processes rather than final consumption, making demand less sensitive to short-term consumer cycles. Vacuum flasks (CAGR 14%) and related equipment, while less industrial in nature, illustrate how niche manufacturing segments with brand recognition and scale can continue to deliver sustained growth.

The common thread across these machinery categories is capex-linked demand. As global investment cycles normalise and infrastructure needs persist, machinery exports offer China a relatively stable growth channel in 2026.

Chemicals & Materials: Plastics, Polymers and Industrial Inputs

Chemical exports rarely attract headlines, but they play a critical role in sustaining China’s export momentum. Polypropylene polymers (CAGR 35%), inorganic salts (CAGR 31%), synthetic rubber (CAGR 26%) and other processed chemical inputs all feature among the higher-growth export categories.

While none individually rival vehicles or machinery in absolute export value, collectively these products form a broad and resilient layer of industrial exports, benefiting from scale production, integrated upstream supply and close linkage to manufacturing and construction demand. Growth in chemicals is typically cyclical rather than explosive, but also less volatile and less exposed to trade policy shocks.

For 2026, chemicals and processed materials are likely to remain quiet contributors; not driving headlines, but underpinning overall export performance.

Textiles & Apparel: Selective Strength, not a Comeback

Textiles no longer define China’s export identity, but selected segments continue to show momentum. Knitted apparel (CAGR 16%), stretch knitted fabrics (CAGR 12%) and footwear parts (CAGR 8%) are among the fastest-growing textile-related exports.

Growth in textiles is selective rather than systemic. These segments benefit from specialised manufacturing, design capabilities and supply-chain integration that are not easily replicated elsewhere. They contribute to export momentum at the margin but do not signal a return to labour-intensive export dominance.

Agriculture and Food Processing: Incremental but Strategic

Agricultural and food-related exports feature less prominently in terms of scale, but several products show notable growth. Fresh vegetables (CAGR 18%), fruit and vegetable juices (CAGR 15%) and edible plant products (CAGR 13%) all exhibit steady expansion, while processed fats and oils recorded an exceptionally high CAGR of 38%.

Export demand in these categories is driven by urbanisation, growth in food processing capacity and rising incomes across developing markets. While unlikely to drive aggregate export growth, these products play a strategic role by diversifying export exposure, strengthening trade relationships and complementing machinery and transport exports along infrastructure-led development corridors.

Recent Export Performance: Scale, Volatility and Resilience

At the aggregate level, China’s exports remain exceptionally large. Monthly export values have fluctuated in recent years due to seasonality and shifts in global demand, but the underlying level remains structurally high. This volatility is not a weakness; it reflects the flexibility of China’s export system, which absorbs shocks while maintaining output.

By November 2025, China’s exports had already exceeded USD 3.42 trillion, and the annual total is set to surpass the USD 3.57 trillion recorded in 2024.

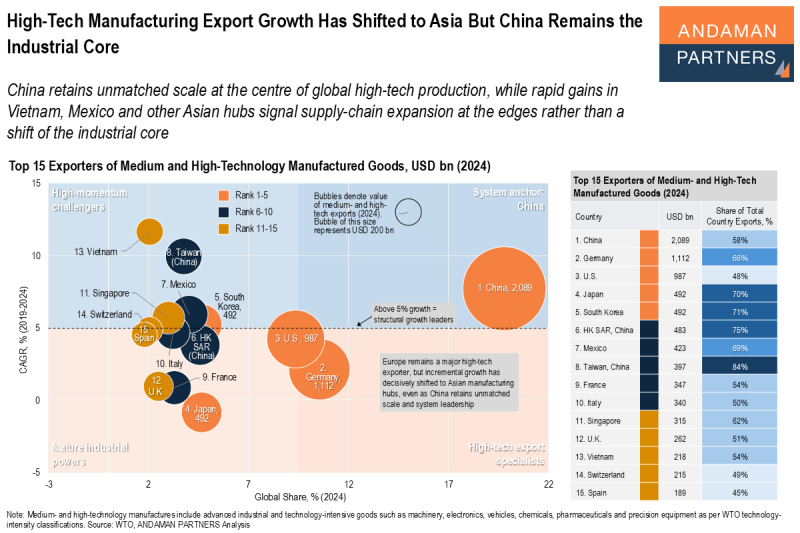

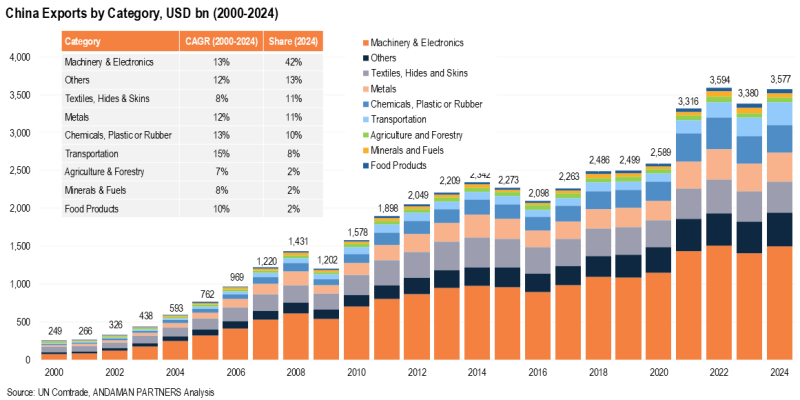

Over the past two decades, China’s exports have steadily migrated toward machinery, electronics, transportation and industrial inputs. Low-value consumer goods have lost relative share even as absolute volumes rose. This long-term trend reinforces a key point: today’s high-momentum products are the logical outcome of sustained industrial upgrading, not a short-term aberration.

Regional Dynamics of China’s Export Growth in 2026

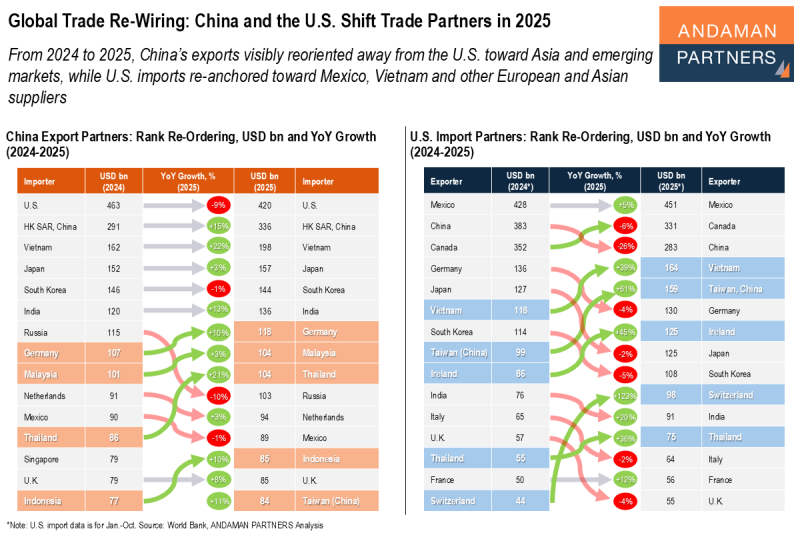

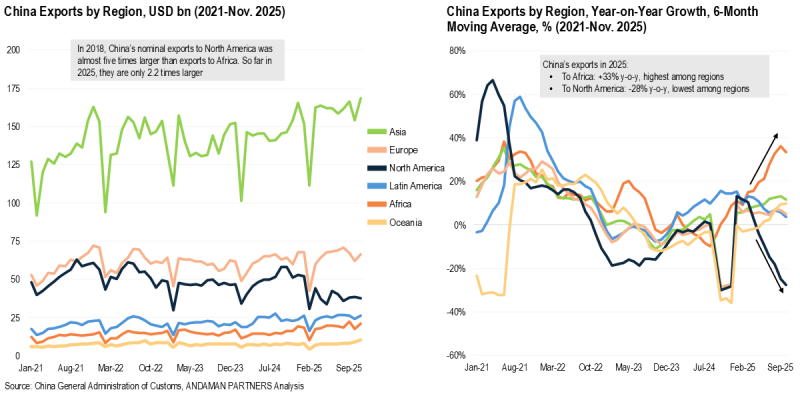

Geographically, export growth has become more differentiated. Asia remains China’s anchor market, still absorbing nearly half of exports, though its share has edged down as Europe’s demand strengthened and North America’s relative weight declined.

Africa and Latin America, while smaller in absolute terms, are delivering the fastest growth, particularly for vehicles, machinery and industrial goods. These regions will provide much of the incremental demand sustaining China’s export momentum in 2026.

Since early 2024, Africa has emerged as China’s fastest-growing export region, with a six-month moving-average growth rate accelerating to 33% year-on-year by August 2025. By contrast, North America has recorded persistent contraction, reaching -18% year-on-year over the same period.

In value terms, North America remains the larger market, but the gap has narrowed sharply. In 2018, Chinese exports to North America were nearly five times those to Africa. By January-August 2025, that multiple had fallen to just over 2.2 times.

If current trends persist, China’s exports to Africa could overtake those to North America within three to five years, a symbolic yet strategically significant shift.

Conclusion: China’s Narrower, More Powerful Export Engine

China’s export outlook for 2026 is defined by focus, not sprawl. Growth will be driven by a limited number of products that combine competitiveness, scale and global relevance. This concentration reflects maturity rather than fragility.

To understand China’s exports in 2026, decision-makers must focus on high-momentum products, not just aggregate totals.

Also by ANDAMAN PARTNERS:

ANDAMAN PARTNERS supports international business ventures and growth. We help launch global initiatives and accelerate successful expansion across borders. If your business, operations or project requires cross-border support, contact connect@andamanpartners.com.

ANDAMAN PARTNERS Wishes You a Happy and Prosperous Year of the Horse!

Compliments of the Chinese Lunar New Year to all our clients, customers, suppliers and partners.

ANDAMAN PARTNERS to Attend Investing in African Mining Indaba 2026 in Cape Town

ANDAMAN PARTNERS Co-Founders Kobus van der Wath and Rachel Wu will attend Investing in African Mining Indaba 2026 in Cape Town, South Africa.

Join ANDAMAN PARTNERS at Networking Event in Cape Town Ahead of Mining Indaba 2026

ANDAMAN PARTNERS is pleased to support and sponsor this popular Pre-Indaba event in Cape Town.

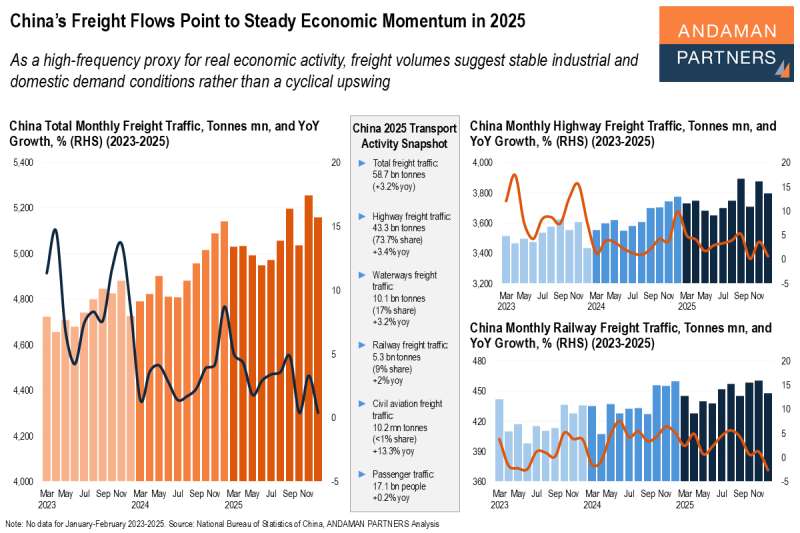

China’s Freight Flows Point to Steady Economic Momentum in 2025

Freight volumes suggest stable conditions in industrial and domestic demand rather than a cyclical upswing.

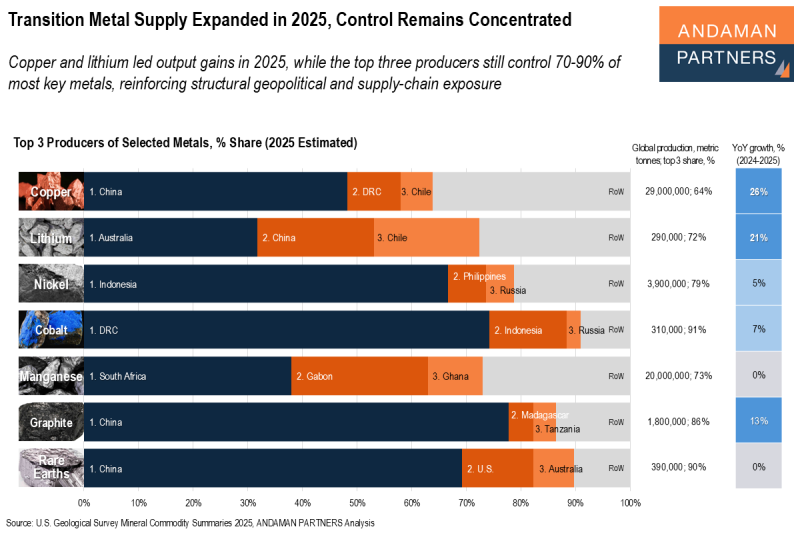

Transition Metal Supply Expanded in 2025, Control Remains Concentrated

Copper and lithium led output gains in 2025, while the top three producers still control 70-90% of most key metals.

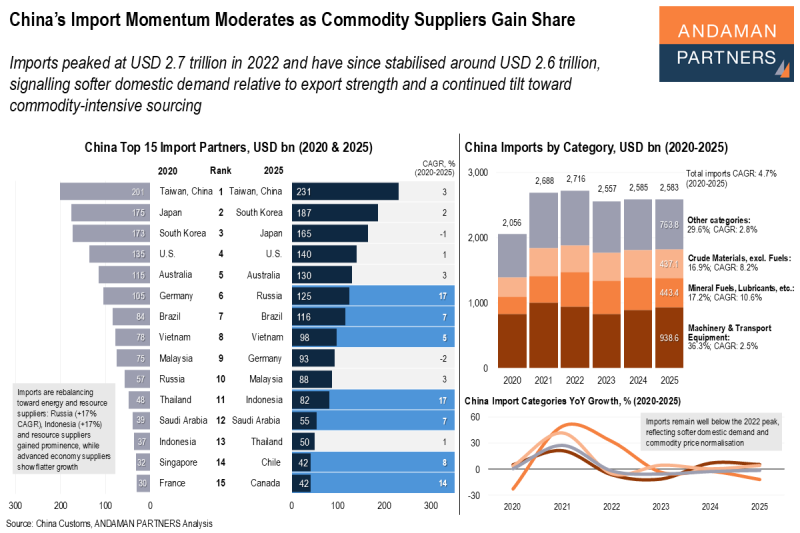

China’s Import Momentum Moderates as Commodity Suppliers Gain Share

Imports have stabilised around USD 2.6 trillion, signalling softer domestic demand and a continued tilt toward commodity-intensive sourcing.