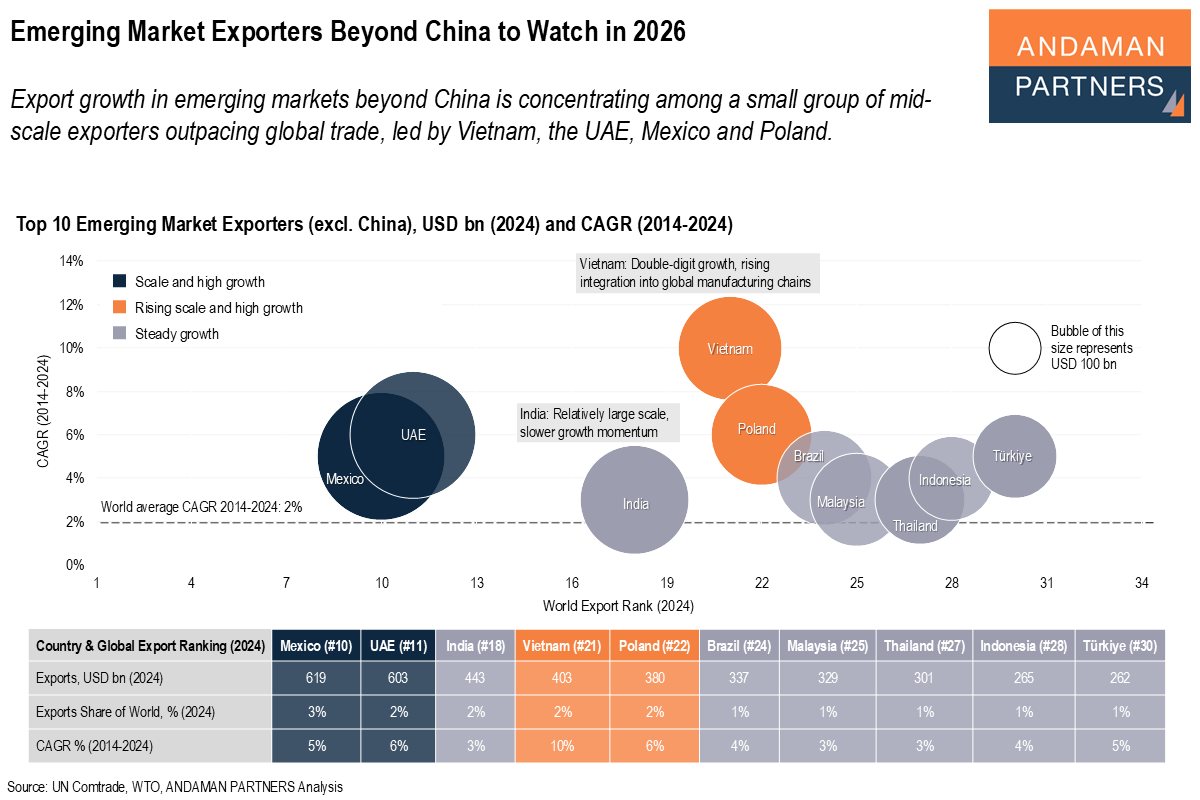

Export growth in emerging markets beyond China is concentrating among a small group of mid-scale exporters outpacing global trade, led by Vietnam, the UAE, Mexico and Poland.

Excluding China, the world’s dominant exporter by a wide margin, a small group of emerging market economies is pulling ahead, combining scale, sustained growth and deeper integration into global supply chains. These exporters merit close attention in 2026, not because they are replacing China, but because they are absorbing incremental manufacturing, trade and sourcing momentum in a world seeking diversification.

Scale and High Growth: Mexico and the UAE

Mexico and the UAE stand out as large exporters that continue to grow significantly faster than global trade. With exports of USD 619 billion in 2024, Mexico’s export strength remains anchored in deep integration with the U.S. economy, particularly in machinery, electronics and transportation equipment. Nearshoring dynamics, supply chain resilience strategies and sustained U.S. demand position Mexico as a critical beneficiary of shifting production footprints in 2026.

The UAE (USD 603 billion) reflects a different model: a diversified trading hub linking Asia, Europe and Africa. Its export profile spans energy, metals, machinery, as well as re-exports, with China, India and the U.S. among its top partners. The UAE’s continued export growth underscores its role as a logistics, energy and commercial gateway rather than a pure manufacturing base.

Rising Scale and High Growth: Vietnam and Poland

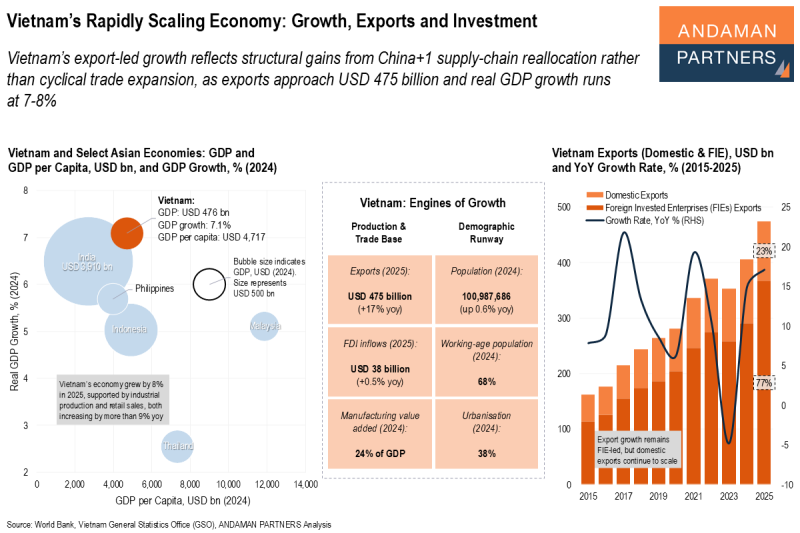

Vietnam (USD 403 billion) is the clearest breakout story among emerging exporters beyond China. With double-digit export growth over the past decade, Vietnam has steadily climbed the export rankings while deepening its role in global manufacturing chains. Machinery, electronics, textiles and agricultural products dominate its export mix, with the U.S., China and South Korea as key destinations. In 2026, Vietnam remains a focal point for companies seeking scalable manufacturing capacity outside China.

Poland (USD 380 billion) represents a parallel story within Europe. Its exports have grown solidly on the back of integration into EU industrial supply chains, particularly in machinery, automotive and chemicals. Germany and neighbouring European markets remain core destinations, but Poland’s continued expansion reflects its role as a competitive manufacturing and logistics platform within Europe’s eastern flank.

Steady Growth Exporters: India, Brazil, Malaysia, Thailand, Türkiye and Indonesia

The third group comprises exporters with meaningful scale but more moderate growth trajectories. India (USD 443 billion) stands out for size rather than momentum. Its exports span fuels, minerals, chemicals and machinery, with the U.S. as its largest destination. While growth has been slower than peers, India’s scale and policy focus on manufacturing suggest upside potential over the medium term.

With exports of USD 337 billion in 2024, Brazil’s export base remains resource-heavy, led by agriculture, forestry and minerals, with China and the U.S. as key partners. Malaysia

(USD 329 billion) and Thailand (USD 301 billion) continue to play essential roles in Asian supply chains for electronics, machinery and chemicals, though growth has been more incremental.

Türkiye (USD 262 billion) combines diversified industrial exports with proximity to European markets, while Indonesia’s exports (USD 265 billion) remain anchored in commodities and intermediate goods.

Why This Matters in 2026

These 10 emerging-market exporters illustrate where incremental global trade growth is likely to come from outside China. Export growth is no longer broadly distributed across emerging markets. It is concentrating among a smaller set of economies that combine scale, connectivity and sectoral relevance. In 2026, these countries will increasingly shape sourcing decisions, investment flows and trade exposure, making them essential markets to watch.

Also by ANDAMAN PARTNERS:

ANDAMAN PARTNERS supports international business ventures and growth. We help launch global initiatives and accelerate successful expansion across borders. If your business, operations or project requires cross-border support, contact connect@andamanpartners.com.

ANDAMAN PARTNERS to Attend Investing in African Mining Indaba 2026 in Cape Town

ANDAMAN PARTNERS Co-Founders Kobus van der Wath and Rachel Wu will attend Investing in African Mining Indaba 2026 in Cape Town, South Africa.

Join ANDAMAN PARTNERS at Networking Event in Cape Town Ahead of Mining Indaba 2026

ANDAMAN PARTNERS is pleased to support and sponsor this popular Pre-Indaba event in Cape Town.

AAMEG Event in Cape Town Ahead of Mining Indaba 2026

ANDAMAN PARTNERS is pleased to sponsor and support the AAMEG pre-Mining Indaba Cocktails & Canapes event.

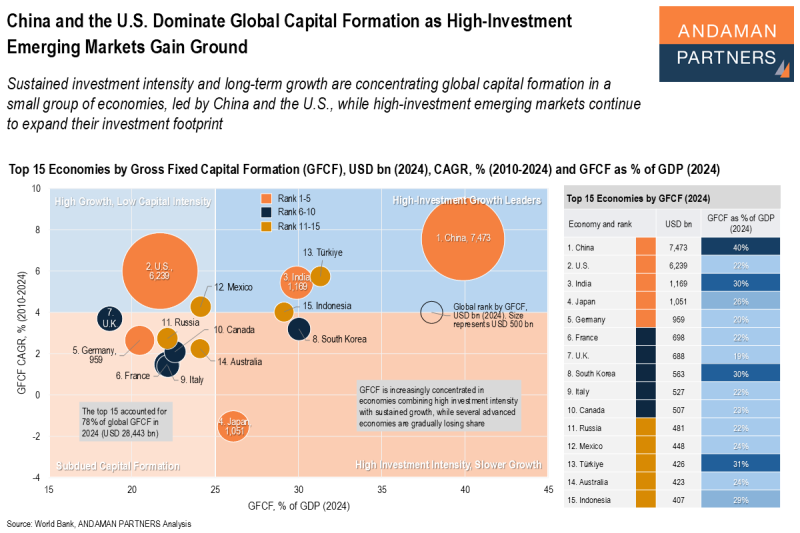

China and the U.S. Dominate Global Capital Formation as High-Investment Emerging Markets Gain Ground

Sustained investment intensity and long-term growth are concentrating global capital formation in a small group of economies, led by China and the U.S.

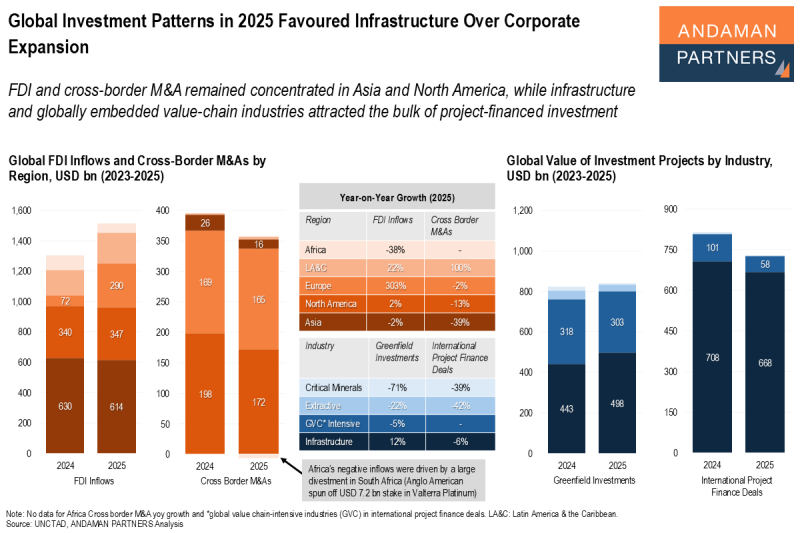

Global Investment Patterns in 2025 Favoured Infrastructure Over Corporate Expansion

FDI and M&A remained concentrated in Asia and North America, while infrastructure attracted the bulk of project-financed investment.

Vietnam’s Rapidly Scaling Economy: Growth, Exports and Investment

Vietnam’s export-led growth reflects structural gains from China+1 supply-chain reallocation rather than cyclical trade expansion.