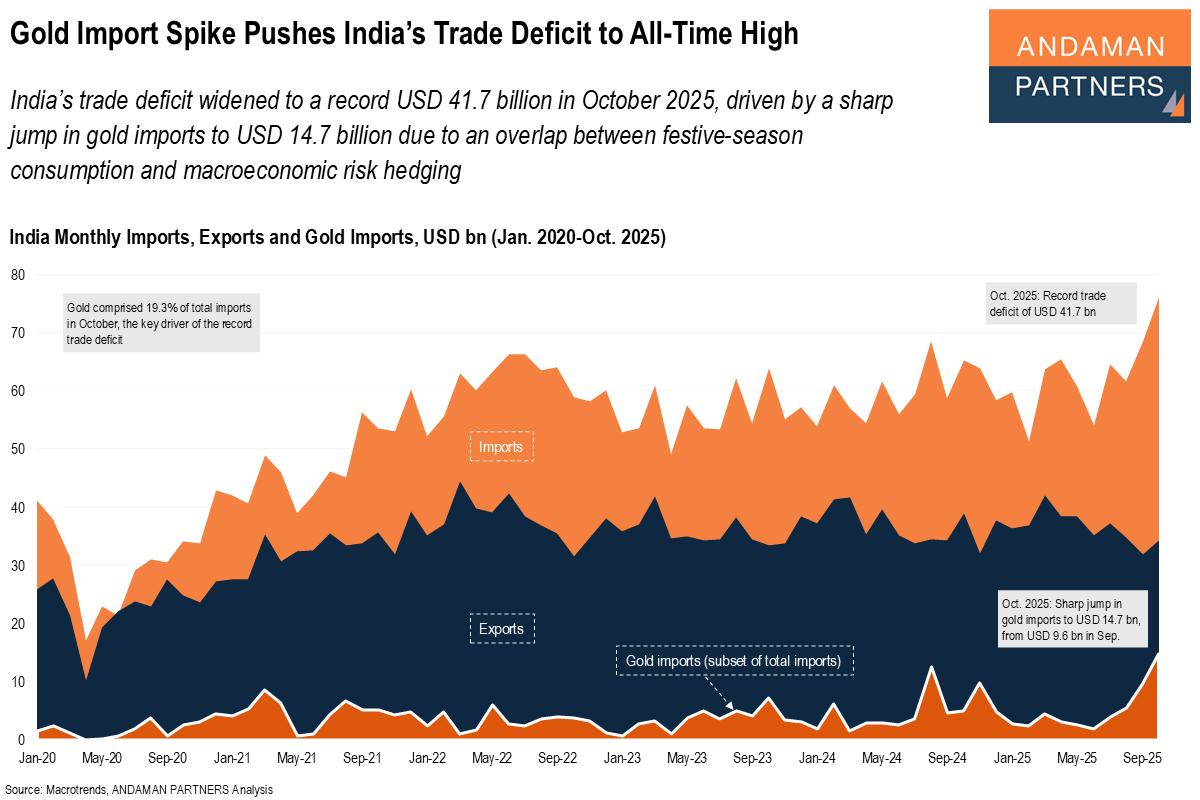

India’s trade deficit widened to a record USD 41.7 billion in October 2025, driven by a sharp jump in gold imports to USD 14.7 billion due to an overlap between festive-season consumption and macroeconomic risk hedging.

India’s merchandise trade deficit reached a record high of USD 41.7 billion in October, mainly due to surging gold imports of USD 14.7 billion.

During the five-day Diwali festive period of October 18-23, as much as USD 11 billion worth of gold was sold in India, according to the India Bullion and Jewellers Association (IBJA) and the All India Gem and Jewellery Domestic Council (GJC).

Much of this demand came from purchases of gold bars and coins rather than jewellery, indicating that consumers were treating gold primarily as an investment asset rather than a consumption good. Since 2022, the escalation of war, inflation and fiscal strain has lifted the international gold price beyond USD 4,000 per fine ounce, marking one of the steepest and most prolonged surges in gold.

India’s gold imports in October (USD 14.7 billion) were nearly 200% higher than a year earlier (USD 4.9 billion). Gold imports surged particularly in 2025 due to a combination of exceptionally high global gold prices, investment-driven demand during Diwali and a weakening rupee that encouraged early purchases. The overlap between festive-season consumption and macroeconomic risk hedging led to an unusually large spike in demand.

More broadly, India’s imports expanded almost thirteenfold between 2000 and 2024, rising from around

USD 50 billion at the start of the century to nearly USD 700 billion in 2024. This long-term surge reflects the structural transformation of India’s economy, with rapid GDP growth, rising household consumption, a deepening industrial base and tighter integration with global value chains.

India has recorded an annual trade deficit every year since 2010, except for four years, with the deficit peaking at USD 280 billion in 2022.

Also by ANDAMAN PARTNERS:

ANDAMAN PARTNERS supports international business ventures and growth. We help launch global initiatives and accelerate successful expansion across borders. If your business, operations or project requires cross-border support, contact connect@andamanpartners.com.

ANDAMAN PARTNERS Wishes You a Happy and Prosperous Year of the Horse!

Compliments of the Chinese Lunar New Year to all our clients, customers, suppliers and partners.

ANDAMAN PARTNERS to Attend Investing in African Mining Indaba 2026 in Cape Town

ANDAMAN PARTNERS Co-Founders Kobus van der Wath and Rachel Wu will attend Investing in African Mining Indaba 2026 in Cape Town, South Africa.

Join ANDAMAN PARTNERS at Networking Event in Cape Town Ahead of Mining Indaba 2026

ANDAMAN PARTNERS is pleased to support and sponsor this popular Pre-Indaba event in Cape Town.

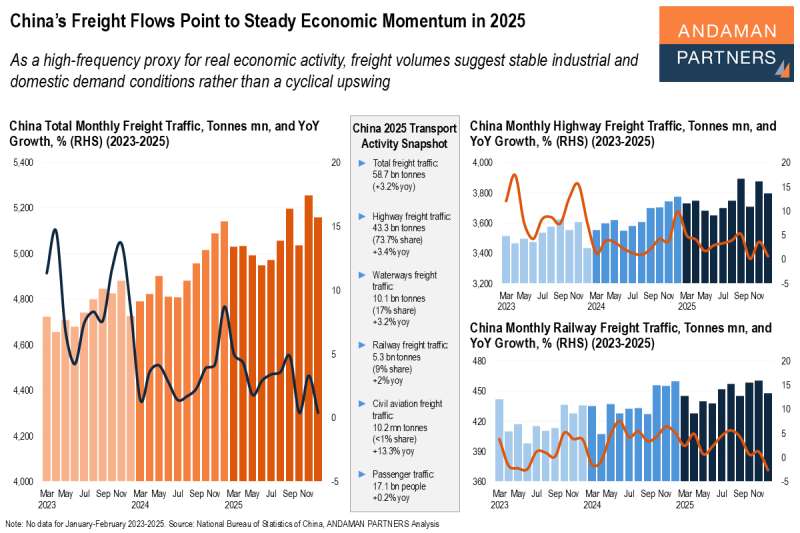

China’s Freight Flows Point to Steady Economic Momentum in 2025

Freight volumes suggest stable conditions in industrial and domestic demand rather than a cyclical upswing.

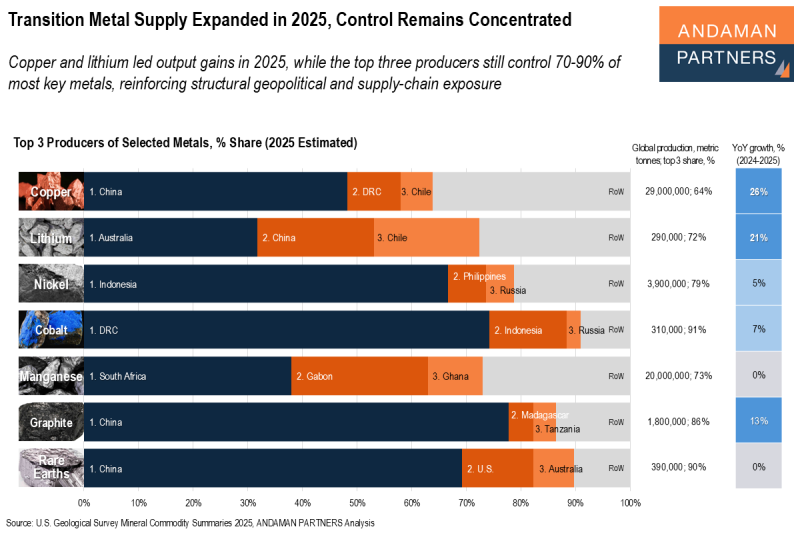

Transition Metal Supply Expanded in 2025, Control Remains Concentrated

Copper and lithium led output gains in 2025, while the top three producers still control 70-90% of most key metals.

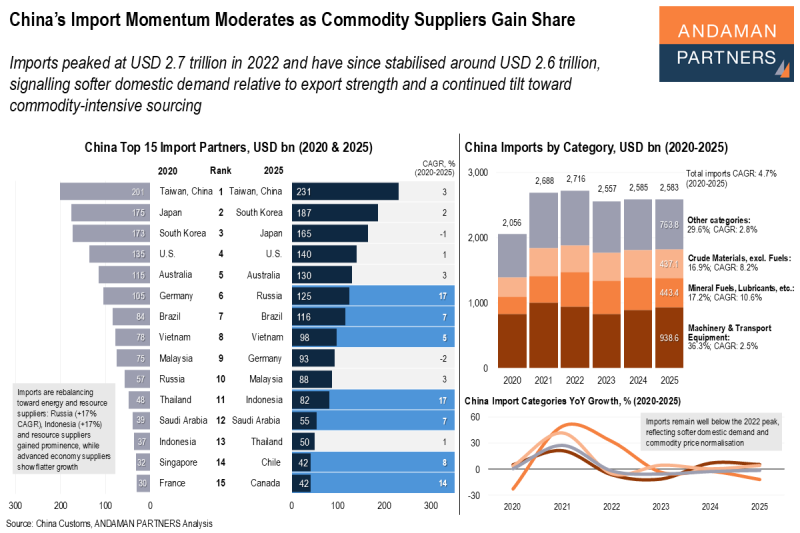

China’s Import Momentum Moderates as Commodity Suppliers Gain Share

Imports have stabilised around USD 2.6 trillion, signalling softer domestic demand and a continued tilt toward commodity-intensive sourcing.