Global exports are concentrated in a few major economies, led by China, the U.S. and Germany, but several large developing countries and smaller emerging economies have made great strides in recent years. This dynamic global trade setting creates opportunities for astute global supply chain managers to optimize value via effective global procurement.

Highlights:

- Global merchandise exports are estimated to have reached USD 22.5 trillion in 2024, a slight increase of 2% year-on-year and below the 2022 record high of over USD 23 trillion.

- China, the U.S., Germany, the Netherlands and Japan dominate global exports, accounting for almost 40% of the total.

- Among the major economies, several emerging markets have steadily climbed export rankings in recent years, notably Mexico, the UAE and India. Vietnam, Poland, Türkiye, Brazil and Malaysia had the fastest-growing exports.

- Outside the top 30 global exporters, smaller emerging economies in Eastern Europe, Africa and Asia reported double-digit export growth.

- Metals, Electronics & Machinery dominates global exports, accounting for almost 40% of the total.

Global merchandise export volumes dropped by over 7% in 2020 due to the COVID-19 pandemic, as widespread cross-border restrictions and logistical disruptions contributed to a decline in global demand. In 2021, exports rebounded by 20% due to recovering global demand and rising commodity prices, followed by a further increase of 6% in 2022 to a record high of USD 23.1 trillion.

In 2023, global exports receded by 4.5% (or about a trillion U.S. dollars) to USD 22.1 trillion, mainly due to lower demand in developed economies, underperforming East Asian economies and decreasing commodity prices. In 2024, global exports rose by 2% to an estimated USD 22.5 trillion, around USD 600 billion below the 2022 peak.

Political factors have been important in shaping global trade patterns in recent years. Since the latter part of 2022, there has been a noticeable rise in the political proximity of trade, indicating a shift in bilateral trade preferences towards countries with similar geopolitical stances (e.g., “friend-shoring”).

There was also an overall decrease in the diversification of trade partnerships and a concentration of trade within significant trade relationships. Global trade was severely affected by the war in Ukraine, sanctions imposed on the Russian Federation and friction in the U.S.-China trade relationship.

Moderating global inflation and improving economic growth forecasts suggest a reversal in 2024-2025 of the downward macroeconomic trends that characterized most of 2023. These trends are underpinned by positive trade dynamics for the U.S. and (predominantly Asian) developing economies.

Additionally, rising demand for products related to energy transition and artificial intelligence should contribute to trade growth through 2025. However, global trade remains vulnerable to several downside risks, including geopolitical tensions, rising shipping costs, increases in subsidies and trade-restrictive measures.

Export rankings

China, the U.S. and Germany have remained the world’s three largest exporters for nearly two decades. China became the world’s largest exporter in 2009 when it surpassed Germany.

In 2023, China’s exports amounted to USD 3.38 trillion, accounting for 15% of the global total. U.S. exports were USD 2 trillion (9%) and Germany’s were USD 1.69 trillion (8%). Rounding out the top five were the Netherlands with USD 742 billion and Japan with USD 718 billion. These five countries accounted for 39% of global exports.

Rounding out the top ten are Italy (USD 677 billion), France (USD 640 billion), South Korea (USD 632 billion), Mexico (USD 593 billion) and Hong Kong, China (USD 575 billion).

Several emerging markets have steadily climbed export rankings in recent years. From 2013 to 2023, the Netherlands, Italy, Mexico, the UAE, Taiwan (China), India and Spain increased their rankings among the top 20 exporters.

India entered the top 20 in 2013 and moved up one spot to 17th in 2023, while the most prominent climbers over this period were the UAE (16th to 11th) and Mexico (14th to 9th). Japan, France, South Korea, the U.K., Singapore, Switzerland and Belgium dropped a few places, while Saudi Arabia fell out of the top 20.

Of China’s USD 3.38 trillion exports in 2023, most went to the U.S. (USD 501 billion), Hong Kong, China (USD 275 billion) and Japan (USD 175 billion). From 2013 to 2023, Chinese exports to Russia and India increased rapidly: USD 48 billion to USD 118 billion for India and USD 50 billion to USD 111 billion for Russia. This made India and Russia China’s sixth and seventh-largest export destinations, respectively.

In 2023, China was the leading export destination for Brazilian exports, while the U.S. was the leading destination for exports from Mexico, India, Vietnam and Thailand.

Most of the UAE’s exports went to Saudi Arabia, most of Malaysia’s exports went to Singapore, and most of Poland and Türkiye’s exports went to Germany.

From 2013 to 2023, the top 20 exporters recorded a compound annual growth rate of 2%, and Rest of World, 1%. Among the top 20, Mexico (5%), China (4%), the UAE (4%), Taiwan, China (4%), India (3%), the Netherlands (3%) and Spain (3%) exceeded 2% growth.

Several emerging markets among the top 30 global exporters recorded higher growth rates over this period, led by Vietnam (10%), Poland (6%), Türkiye (5%), Brazil (4%) and Malaysia (4%).

Outside the top 30 global exporters, several smaller emerging economies reported the fastest-growing exports from 2013 to 2023. These included Guyana (23%), driven mainly by oil exports, as well as:

- Eastern European economies whose exports all grew by around 8%, notably Armenia (mainly gems and precious metals, electrical machinery and equipment, and ores, slag and ash), Serbia (electrical machinery and other equipment), Georgia (copper ore and cars), North Macedonia (chemical goods and electrical machinery) and Slovenia (pharmaceuticals).

- Economies in Asia, notably Cambodia (14%), driven by exports of garments, footwear and agricultural products; and Kyrgyzstan (6%), mainly precious metals and stones.

- Economies in Africa, notably Cabo Verde (15%, mainly processed fish), Uganda (10%, mainly gold), Sao Tome and Principe (9%, mainly cocoa beans and palm oil), Central African Republic (9%, mainly gold and diamonds), Lesotho (9%, mainly garments and diamonds), Mozambique (7%, mainly coal briquettes and raw aluminium), Madagascar (7%, mainly raw nickel and vanilla), Senegal (7%, mainly gold and phosphoric acid), Morocco (7%, mainly chemical fertilizers, vehicles, and electrical machinery), Burkina Faso (6%, mainly gold), Zimbabwe (6%, mainly gold and tobacco) and Benin (6%, mainly raw cotton and gold).

Export dependency

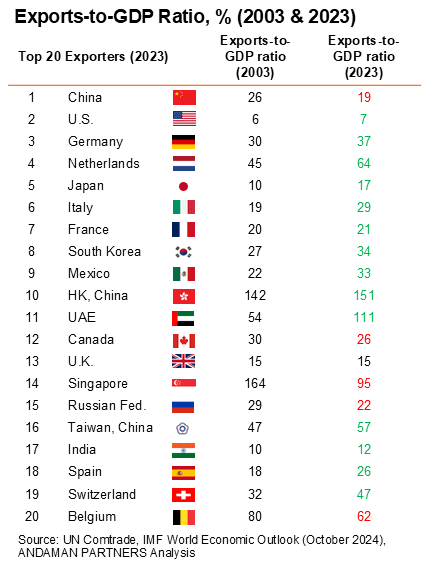

The exports-to-GDP ratio illustrates how much an economy depends on international trade and exports. Comparing the ratios in 2003 and 2023 of the 20 largest exporting countries, Hong Kong (China) and Singapore consistently had the highest ratios. However, the former increased its ratio from 142% to 151%, while the latter’s ratio fell back from 164% to 95%.

Other countries with high exports-to-GDP ratios in 2023 were the UAE (111%), Netherlands (64%), Belgium (62%), Taiwan, China (57%), Switzerland (47%), South Korea (34%) and Mexico (33%).

Other countries with high exports-to-GDP ratios in 2023 were the UAE (111%), Netherlands (64%), Belgium (62%), Taiwan, China (57%), Switzerland (47%), South Korea (34%) and Mexico (33%).

Countries with low ratios were the U.S. (7%), the U.K. (15%) and India (12%).

China’s ratio decreased from 26% in 2003 to 19% in 2023. Canada, Singapore, the Russian Federation and Belgium also had decreasing ratios over this period.

The country with the most significant increase over this period was the UAE, whose ratio more than doubled from 54% to 111%.

Export sectors

Metals, Electronics & Machinery dominates global exports, amounting to USD 8.3 trillion in 2023, or 38% of the global total, up from 36% in 2013. Minerals, Fuels & Chemicals accounted for 20% of the global total in 2023, followed by Miscellaneous Goods & Articles and Transport Vehicles & Equipment, each accounting for 11%.

The shares of Miscellaneous Goods & Articles and Transport Vehicles & Equipment remained relatively constant from 2013 to 2023, but the share of Minerals, Fuels & Chemicals declined from 24% to 20%.

Several smaller export categories increased in value from 2013 to 2023, notably Agricultural & Plant-based Goods; Food, Beverages & Tobacco; Industrial & Specialty Chemicals; and Miscellaneous Goods & Articles.

Regarding country-specific export sectors for the top 30 exporting economies, Metals, Electronics & Machinery is China’s largest export category. The same applies to several emerging market exporters, including Mexico, Vietnam, Poland, Malaysia, Thailand and Türkiye. This category is also prominent among several developed market exporters, including Italy, France, South Korea, the U.K., Singapore, and Taiwan (China).

Metals, Electronics & Machinery is likewise the most significant category for U.S., German and Japanese exports, while Transport Vehicles & Equipment is also prominent for Germany and Japan. Mexico, Spain and Czechia are other economies with prominent shares of Transport Vehicles & Equipment exports.

The leading category for the UAE, Canada, India, Belgium, Australia and Brazil is Minerals, Fuels & Chemicals. Brazil is the economy among the top 30 exporters with the highest share of Agricultural & Plant-based Goods.

Metals, Electronics & Machinery and Minerals, Fuels & Chemicals are both prominent export categories in the Netherlands and Indonesia.

Action list for global supply chain managers

Amid a dynamic global trade picture and shifting trade patterns, supply chain managers must take careful note of the following key actions to remain competitive:

- Build resilient and agile supply chains: Given the real possibility of global disruptions in 2025, companies must build supply chains that will be resilient and able to adapt quickly. Supply chain managers must diversify supplier bases and review options like dual sourcing and nearshoring.

- Seek out new trade opportunities in developing markets: Some of the best trade opportunities are in developing countries and emerging markets, and strategic intelligence is essential to identifying and utilizing such opportunities.

- Anticipate geopolitical risks: Geopolitical tension will likely be a crucial factor affecting trade and supply chains for years to come, so it is imperative to plan ahead and implement alternative supply chain options.

- Put the right teams and capabilities in place: Develop capabilities for teams to manage long and open international supply chains, paying careful attention to risk management.

- Digitalize supply chains: Implement technology to use data in digital formats to enable technologies like artificial intelligence, blockchain, and cloud-based solutions, identify inefficiencies and reduce costs.

ANDAMAN PARTNERS supports international business ventures and growth. We help launch global initiatives and accelerate successful expansion across borders. If your business, operations or project requires cross-border support, contact connect@andamanpartners.com.

ANDAMAN PARTNERS Was a Co-Sponsor of the South African National Day Reception in Shanghai on 30 May 2025

ANDAMAN PARTNERS was a cosponsor of the South African National Day Reception in Shanghai on 30 May 2025.

Asia’s Shifting Role in Global Supply Chains — Perspectives by ANDAMAN PARTNERS Co-Founder Rachel Wu

Analysis by ANDAMAN PARTNERS Co-Founder Rachel Wu on changing patterns in global supply chains.

ANDAMAN PARTNERS Co-sponsored the West Australian Mining Club Luncheon in Perth on 27 February 2025

WA Mining Club luncheons are valuable ways to network with colleagues and clients and learn about the latest industry insights.

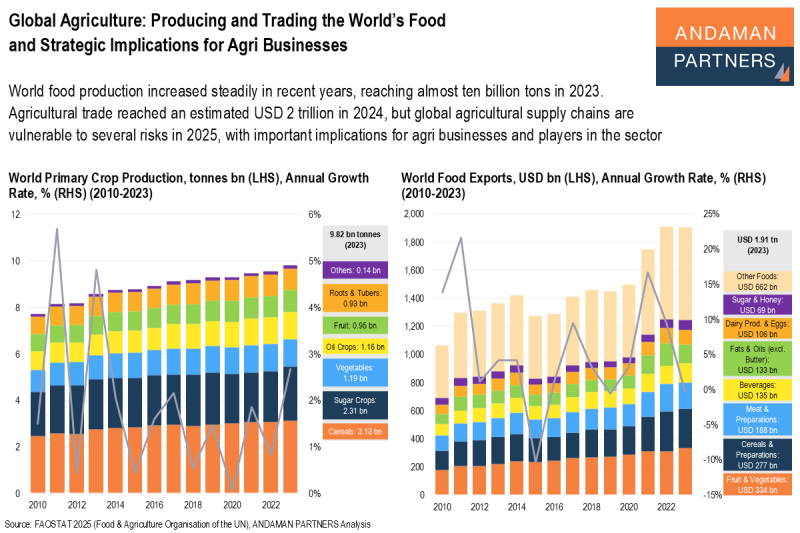

Global Agriculture: Producing and Trading the World’s Food and Strategic Implications for Agri Businesses

Global agricultural supply chains are vulnerable to several risks in 2025, with important implications for agri businesses and players in the sector.

Southeast Asia: The USD 4-trillion Economy

With rapid GDP growth, expanding trade networks and investment inflows, Southeast Asia retains its enduring appeal as a vital destination for multinational corporations seeking to diversify their supply chains and tap into Asia’s growing consumer markets.

Indonesia’s Dynamic Economic Growth Story Offering Opportunities for Global Businesses

Indonesia’s dynamic, services-led and consumption-driven economy is poised to become one of the world’s largest by mid-century, presenting many opportunities for businesses and investors.