Australia’s exports have in recent years become predominantly focused on minerals and fuels. In 2023, the Minerals, Fuels & Chemicals sector accounted for almost 70% of the country’s exports. This specialization has been a significant revenue source for Australia but is also a risky prospect in a changing and volatile global trade context.

Australia’s exports have become predominantly focused on minerals and fuels:

- From 2002 to 2023, total exports increased from almost USD 65 billion to just under USD 370 billion, an increase of 468%.

- One sector accounted for the most significant growth: Minerals, Fuels & Chemicals. In 2002, this sector accounted for 34% of Australian exports; in 2023, the share increased to a staggering 69.1%.

- Minerals, Fuels & Chemicals mostly comprises coal, iron ore and petroleum gas, which are predominantly exported to China, Japan, South Korea and India.

- In 2022, Australia was the world’s largest exporter of coal, iron ore, wheat and aluminium oxide.

Australia’s highly specialized export profile can be a source of risk and opportunity in a changing global trade context. China is Australia’s largest customer of minerals and fuels, taking a share of 40% in 2023. However, China’s economic growth and appetite for minerals and fuels are gradually slowing. It is doubtful whether other countries will fully be able to make up for China’s slowing demand for Australian exports.

This is a risky scenario for Australia and its highly specialized export profile. But it also presents an opportunity: Firstly, to leverage its proximity to Asia and ‘be the best at marketing and sales of resources’ to these markets’ customers; and secondly, to develop other export sectors, such as metals, tools & machinery and agricultural goods. In addition, this also presents favorable investment opportunities for foreign investors in Australia’s other export sectors.

From an Australian point of view, it will be essential to also market its other exports in China, India, and other large foreign markets better than other competitors. This suggests that the Australian economy will be tied even more closely to Asia’s rising economies. Supportive policy, capacity and skills development, and exemplary boardroom leadership have never been more important.

ANDAMAN PARTNERS supports international business ventures and growth. We help launch global initiatives and accelerate successful expansion across borders. If your business, operations or project requires cross-border support, contact connect@andamanpartners.com.

ANDAMAN PARTNERS Was a Co-Sponsor of the South African National Day Reception in Shanghai on 30 May 2025

ANDAMAN PARTNERS was a cosponsor of the South African National Day Reception in Shanghai on 30 May 2025.

Asia’s Shifting Role in Global Supply Chains — Perspectives by ANDAMAN PARTNERS Co-Founder Rachel Wu

Analysis by ANDAMAN PARTNERS Co-Founder Rachel Wu on changing patterns in global supply chains.

ANDAMAN PARTNERS Co-sponsored the West Australian Mining Club Luncheon in Perth on 27 February 2025

WA Mining Club luncheons are valuable ways to network with colleagues and clients and learn about the latest industry insights.

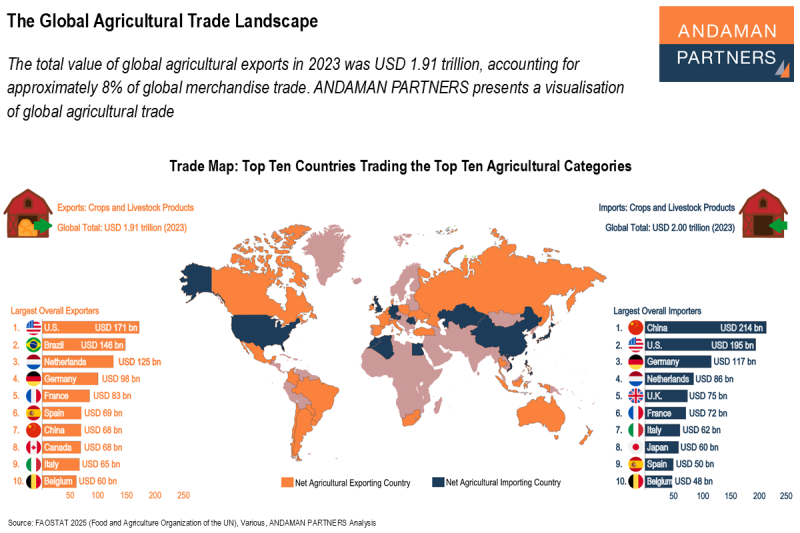

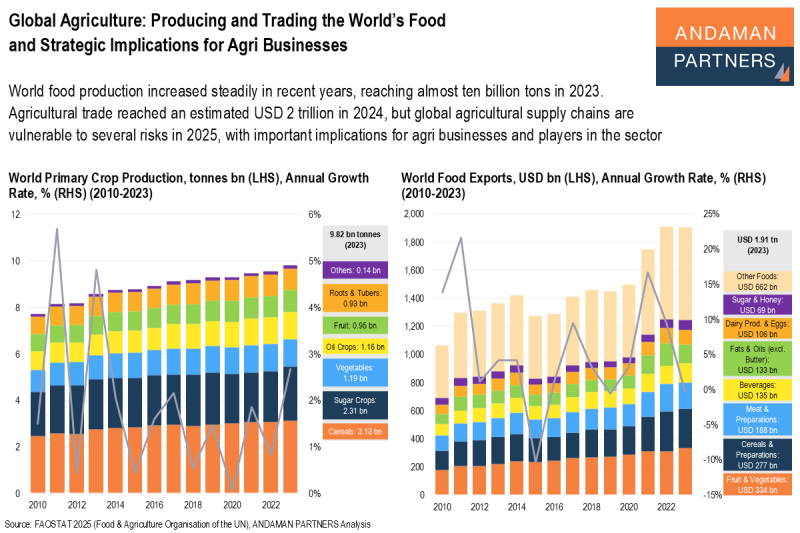

Global Agriculture: Producing and Trading the World’s Food and Strategic Implications for Agri Businesses

Global agricultural supply chains are vulnerable to several risks in 2025, with important implications for agri businesses and players in the sector.

Southeast Asia: The USD 4-trillion Economy

With rapid GDP growth, expanding trade networks and investment inflows, Southeast Asia retains its enduring appeal as a vital destination for multinational corporations seeking to diversify their supply chains and tap into Asia’s growing consumer markets.

Indonesia’s Dynamic Economic Growth Story Offering Opportunities for Global Businesses

Indonesia’s dynamic, services-led and consumption-driven economy is poised to become one of the world’s largest by mid-century, presenting many opportunities for businesses and investors.