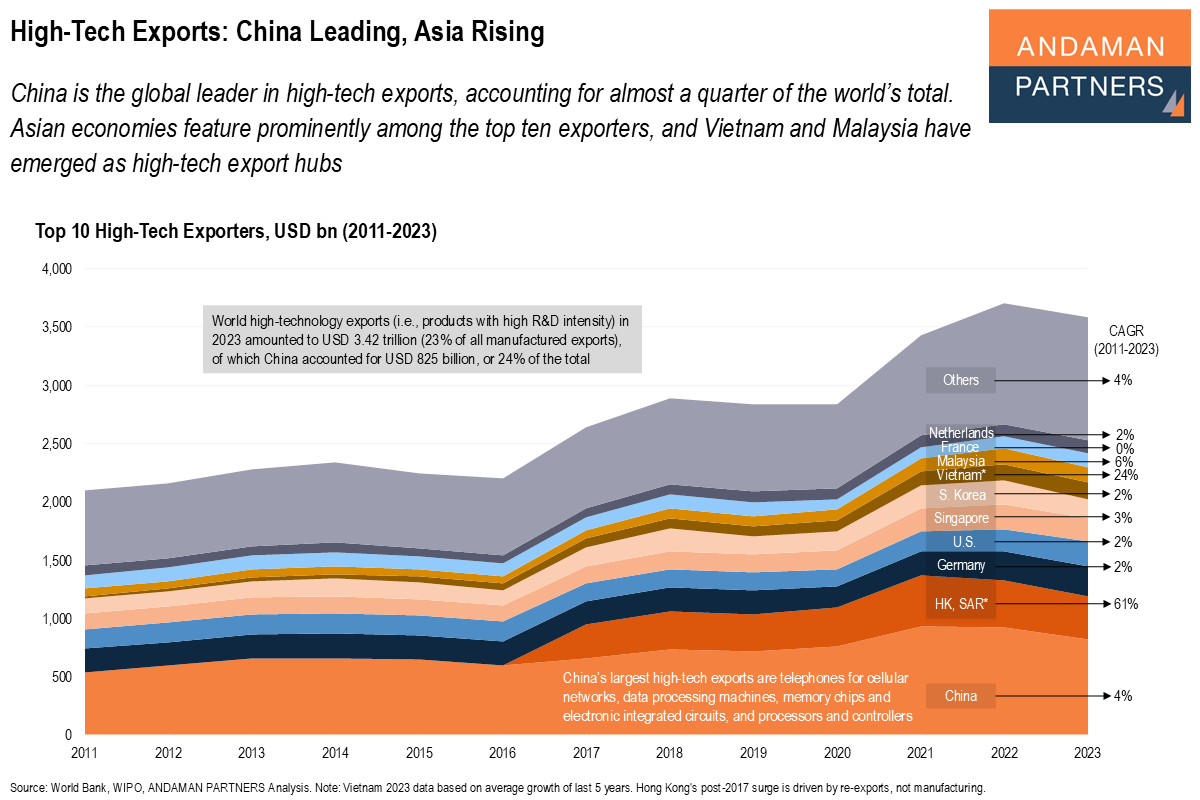

China is the global leader in high-tech exports, accounting for almost a quarter of the world’s total. Asian economies feature prominently among the top ten exporters, and Vietnam and Malaysia have emerged as high-tech export hubs.

High-technology exports include products with high R&D intensity, such as those used in artificial intelligence (AI), biotechnology, aerospace, vehicles, microchips, computers, scientific instruments and electrical machinery. As such, they are a key indicator of global competitiveness and the effectiveness of industrial policy, reflecting a country’s competency in advanced manufacturing, R&D and innovation.

China, the world’s largest exporter overall, is also the clear leader in high-tech exports. Following a peak of USD 936 billion in 2021, China’s high-tech exports in 2023 (complete datasets for 2024 are not yet available) stood at USD 825 billion, accounting for 24% of the world total of USD 3.42 trillion, which was a slight decrease from the all-time high of USD 3.72 trillion in 2022.

In 2023, China’s most significant high-tech exports were telephones for cellular networks (USD 139 billion), data processing machines (USD 99 billion), memory chips and electronic integrated circuits (USD 56 billion), and processors and controllers (USD 50 billion).

In 2024, world high-tech exports grew at an estimated annual growth rate of 8.6%, driven by booming trade in microchips, electric vehicles (EVs), aeroplanes, spacecraft, energy equipment and equipment for nuclear reactors.

Asia Rising

China’s high-tech exports in 2023 were more than three times larger than those of Germany (USD 255 billion) and the U.S. (USD 208 billion). The value for the EU in 2023 was USD 523 billion.

Six of the top ten largest high-tech exporters in 2023 were Asian economies. Following a post-2017 surge in high-tech re-exports, Hong Kong was in second place with USD 369 billion, followed by Germany and the U.S., whose high-tech exports both increased significantly from 2020. In 2024, U.S. exports (led by processors, controllers and electronic integrated circuits) reached USD 233 billion, an increase of USD 92 billion from 2020.

The high-tech exports of Singapore, in fifth place, and South Korea, in sixth, both declined year-on-year in 2023, but are estimated to have recovered well in 2024.

In 2023, Vietnam had the seventh-largest high-tech exports at an estimated USD 153 billion, and Malaysia had the eighth-largest at USD 127 billion. These two Southeast Asian economies represent a rapidly rising force in global high-tech exports. From 2011 to 2023, Malaysia’s high-tech exports increased by 6% and those of Vietnam by an incredible 24%.

Both these Asian economies have become critical nodes in electronics and semiconductor value chains. Vietnam is now a centre for consumer electronics and smartphone assembly, and Malaysia has consolidated its role in high-value exports of semiconductors and electrical and electronic products.

Driven by investment inflows, supply-chain diversification from China and strong global demand for microchips and electronics, Vietnam and Malaysia are now long-term pillars of the global high-tech supply chain, not just short-term beneficiaries.

ANDAMAN PARTNERS supports international business ventures and growth. We help launch global initiatives and accelerate successful expansion across borders. If your business, operations or project requires cross-border support, contact connect@andamanpartners.com.

ANDAMAN PARTNERS Wishes You a Happy and Prosperous Year of the Horse!

Compliments of the Chinese Lunar New Year to all our clients, customers, suppliers and partners.

ANDAMAN PARTNERS to Attend Investing in African Mining Indaba 2026 in Cape Town

ANDAMAN PARTNERS Co-Founders Kobus van der Wath and Rachel Wu will attend Investing in African Mining Indaba 2026 in Cape Town, South Africa.

Join ANDAMAN PARTNERS at Networking Event in Cape Town Ahead of Mining Indaba 2026

ANDAMAN PARTNERS is pleased to support and sponsor this popular Pre-Indaba event in Cape Town.

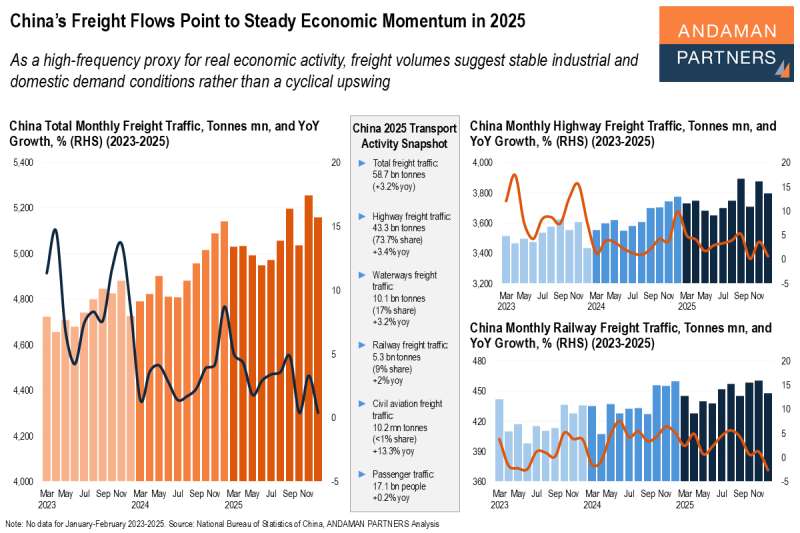

China’s Freight Flows Point to Steady Economic Momentum in 2025

Freight volumes suggest stable conditions in industrial and domestic demand rather than a cyclical upswing.

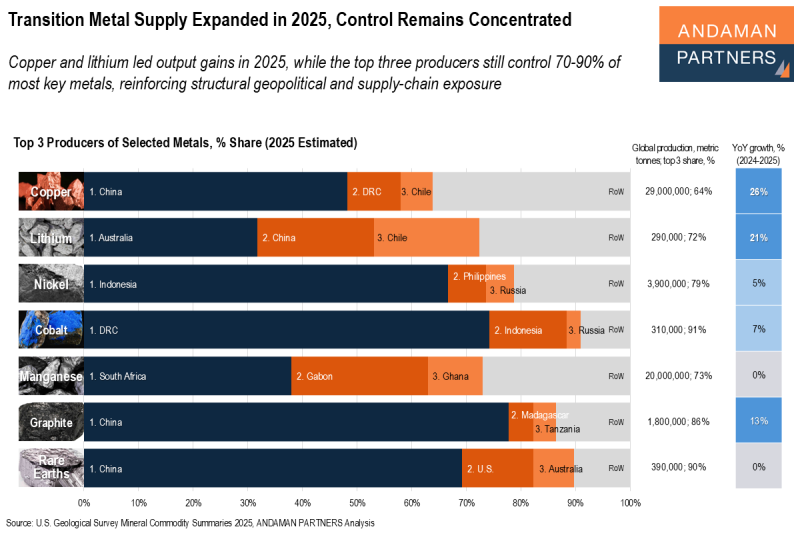

Transition Metal Supply Expanded in 2025, Control Remains Concentrated

Copper and lithium led output gains in 2025, while the top three producers still control 70-90% of most key metals.

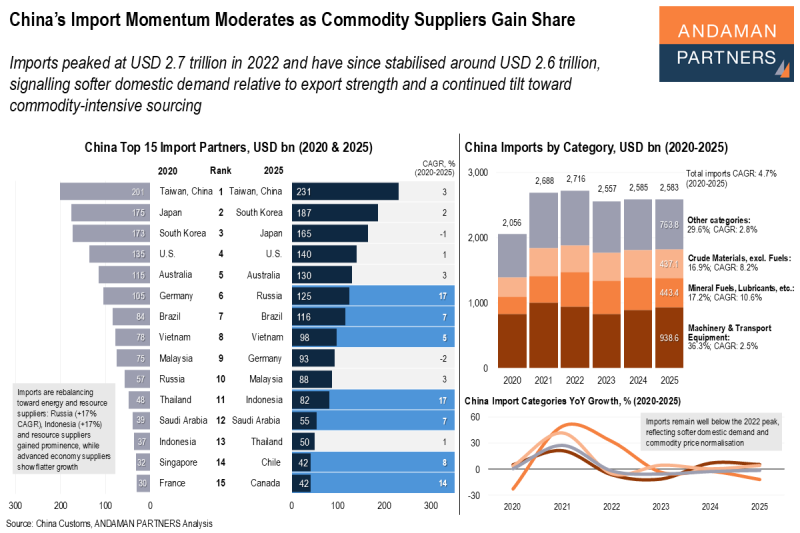

China’s Import Momentum Moderates as Commodity Suppliers Gain Share

Imports have stabilised around USD 2.6 trillion, signalling softer domestic demand and a continued tilt toward commodity-intensive sourcing.