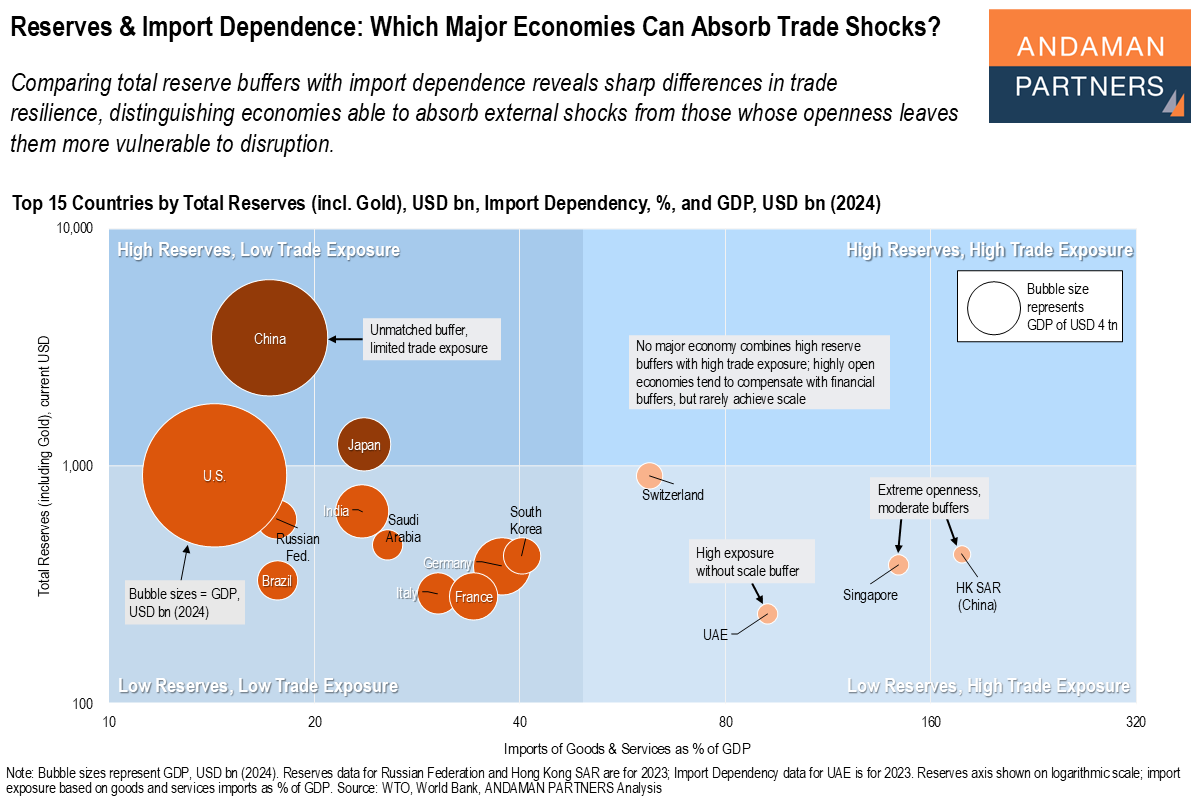

Comparing total reserve buffers with import dependence reveals sharp differences in trade resilience, distinguishing economies able to absorb external shocks from those whose openness leaves them more vulnerable to disruption.

Total reserve buffers and import dependence offer a powerful lens through which to assess which major economies are structurally positioned to absorb external trade shocks, and which remain vulnerable if global trade conditions deteriorate.

Economies combining large financial buffers with limited trade exposure are best placed to withstand disruption. China stands apart, with unmatched reserves and relatively low import dependence, giving it exceptional capacity to absorb external shocks without excessive adjustment. Japan also sits in this resilient category, pairing substantial buffers with moderate exposure and strong policy flexibility. Switzerland combines very high trade exposure with strong reserve buffers, placing it closer to true resilience than most open economies.

A second group includes economies with lower trade exposure but more limited reserve buffers, notably the U.S., India, Brazil, Saudi Arabia and Russia. Their relative insulation from trade shocks reduces immediate exposure, but their ability to absorb stress relies more on policy responses, domestic demand and institutional strength than on reserve firepower alone.

Several economies combine higher trade exposure with comparatively limited buffers, increasing vulnerability to external shocks. Germany, France, Italy and South Korea all rely heavily on global trade while holding smaller reserve cushions, leaving them more exposed if disruptions persist.

A third group consists of economies that maintain buffers of comparative size to the second group but are highly trade-exposed. The UAE stands out for its high exposure, with more limited reserve buffers, making it particularly sensitive to shifts in global trade conditions. Ultra-open hubs such as Singapore and Hong Kong SAR exhibit extreme openness combined with moderate reserve protection. These economies are resilient to routine volatility but remain sensitive to prolonged or systemic trade disruptions.

Overall, actual shock-absorbing capacity remains rare. While many open economies attempt to offset vulnerability through financial buffers, only a small number combine sufficient scale, structure and insulation to withstand a major global trade shock without significant adjustment.

Also by ANDAMAN PARTNERS:

ANDAMAN PARTNERS supports international business ventures and growth. We help launch global initiatives and accelerate successful expansion across borders. If your business, operations or project requires cross-border support, contact connect@andamanpartners.com.

ANDAMAN PARTNERS Wishes You a Happy and Prosperous Year of the Horse!

Compliments of the Chinese Lunar New Year to all our clients, customers, suppliers and partners.

ANDAMAN PARTNERS to Attend Investing in African Mining Indaba 2026 in Cape Town

ANDAMAN PARTNERS Co-Founders Kobus van der Wath and Rachel Wu will attend Investing in African Mining Indaba 2026 in Cape Town, South Africa.

Join ANDAMAN PARTNERS at Networking Event in Cape Town Ahead of Mining Indaba 2026

ANDAMAN PARTNERS is pleased to support and sponsor this popular Pre-Indaba event in Cape Town.

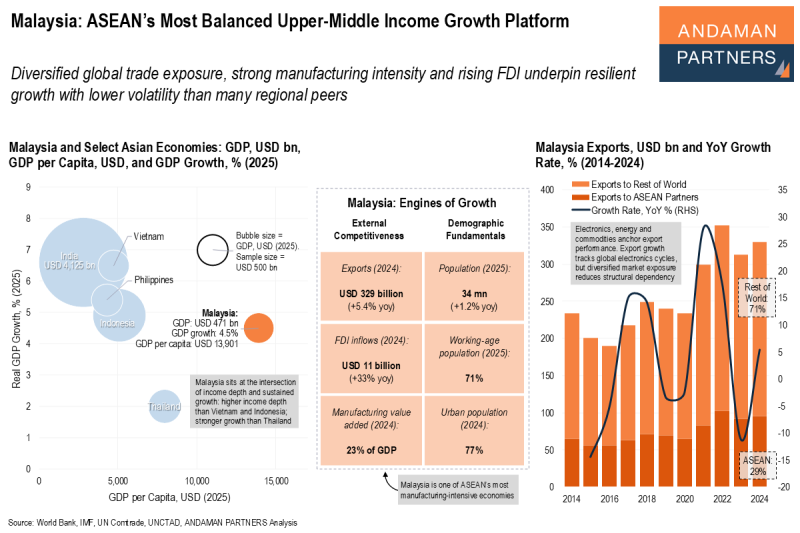

Malaysia: ASEAN’s Most Balanced Upper-Middle Income Growth Platform

Diversified global trade exposure, strong manufacturing intensity and rising FDI underpin resilient growth with lower volatility than many regional peers.

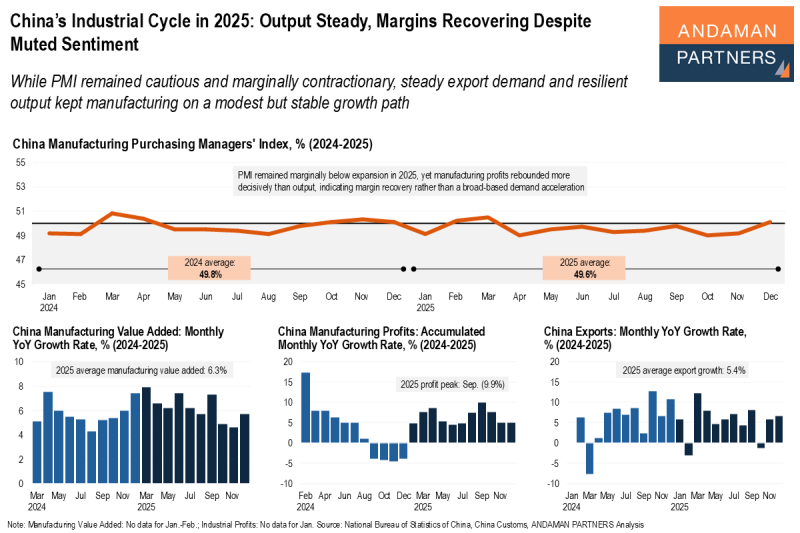

China’s Industrial Cycle in 2025: Output Steady, Margins Recovering Despite Muted Sentiment

While PMI remained cautious and marginally contractionary, steady export demand and resilient output kept manufacturing on a modest but stable growth path.

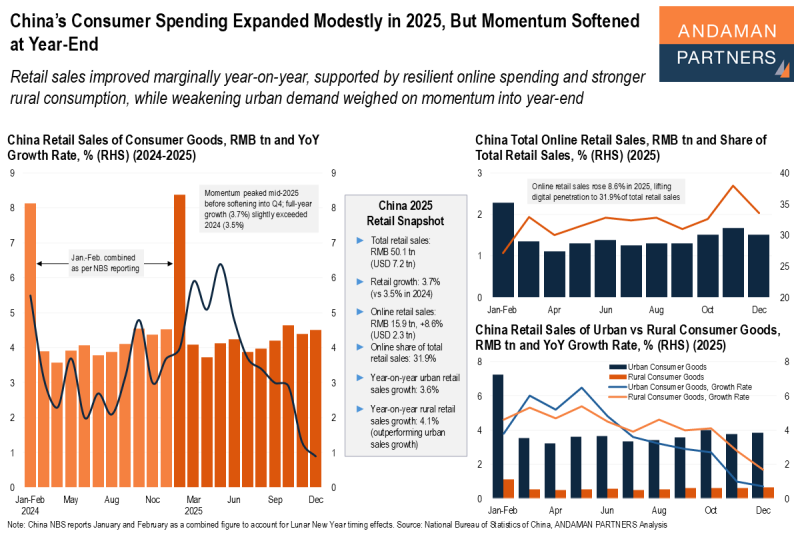

China’s Consumer Spending Expanded Modestly in 2025, But Momentum Softened at Year-End

Retail sales improved marginally year-on-year, supported by resilient online spending and stronger rural consumption.