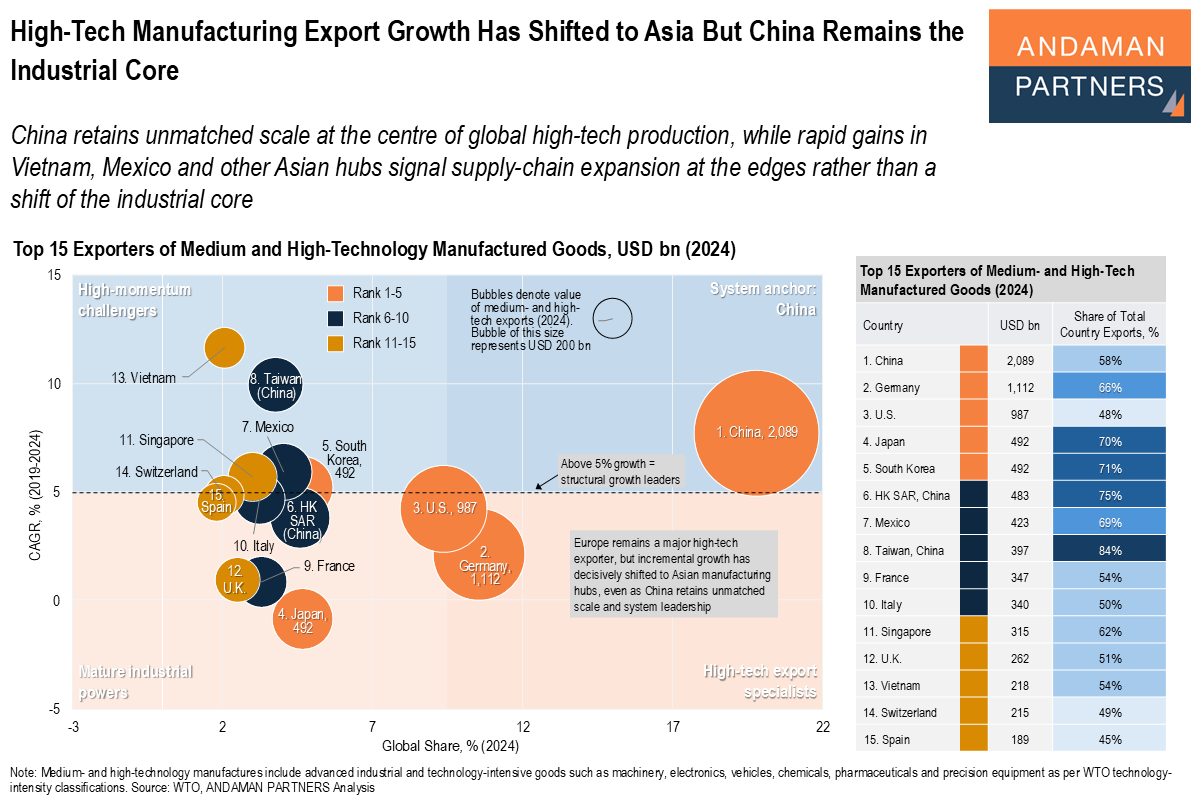

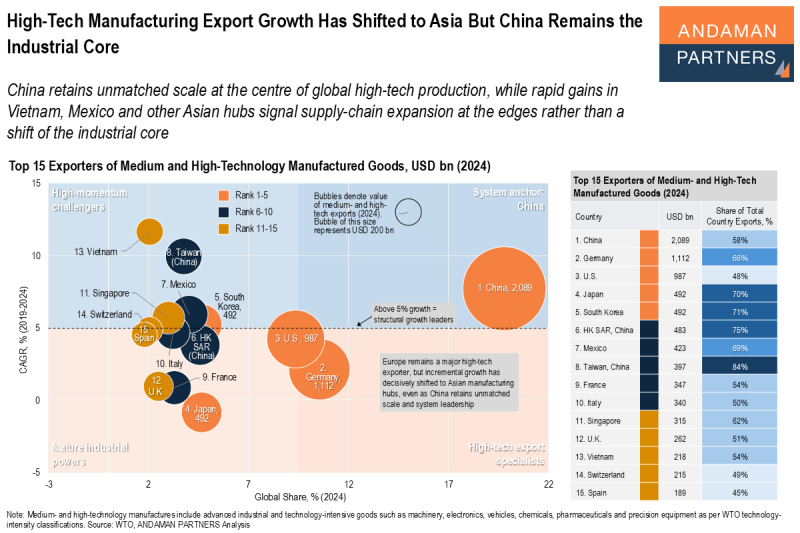

China retains unmatched scale at the centre of global high-tech production, while rapid gains in Vietnam, Mexico and other Asian hubs signal supply-chain expansion at the edges rather than a shift of the industrial core.

Global high-tech manufacturing is expanding geographically, but its centre of gravity has not moved. China stands apart on sheer scale, exporting more medium- and high-technology manufactures than any other country by a wide margin. Its recent growth is steady rather than spectacular, yet its size means it continues to anchor the global production network. This signals that the deepest supplier ecosystems, the broadest industrial capabilities and the highest capacity for rapid scale-up remain concentrated in China.

At the same time, momentum is clearly building elsewhere in Asia. Vietnam recorded the fastest sustained growth among major exporters (2019-2024 CAGR of 12%), while Taiwan (China) and South Korea pair strong growth with meaningful scale. Taiwan (China) is particularly striking: a large exporter whose national export basket is overwhelmingly high-tech (84% share), reflecting its pivotal role in advanced electronics and semiconductor value chains. Singapore and Mexico (both with a 6% CAGR) also show above-average expansion, pointing to Asian regionalisation and North American near-shoring dynamics.

Europe’s leading exporters, including Germany, France and Italy, remain large and technologically sophisticated, but are in the slower-growth tier along with Japan. These economies continue to matter enormously for quality, engineering depth and specialised equipment, but the fastest-compounding additions to global high-tech capacity are now occurring in Asian hubs rather than in Europe.

The emerging pattern for medium- and high-tech exports is a China-centred core surrounded by a widening ring of fast-growing Asian production nodes. Growth at the edges does not displace the core; it reinforces a broader, Asia-weighted manufacturing system.

For corporate strategy, that means diversification opportunities are increasing, but critical dependencies are also becoming more regionally concentrated. Decisions on sourcing, partnerships and investment will increasingly hinge on how effectively companies position themselves within this China-anchored, Asia-driven industrial ecosystem.

Also by ANDAMAN PARTNERS:

ANDAMAN PARTNERS supports international business ventures and growth. We help launch global initiatives and accelerate successful expansion across borders. If your business, operations or project requires cross-border support, contact connect@andamanpartners.com.

ANDAMAN PARTNERS to Attend Investing in African Mining Indaba 2026 in Cape Town

ANDAMAN PARTNERS Co-Founders Kobus van der Wath and Rachel Wu will attend Investing in African Mining Indaba 2026 in Cape Town, South Africa.

Join ANDAMAN PARTNERS at Networking Event in Cape Town Ahead of Mining Indaba 2026

ANDAMAN PARTNERS is pleased to support and sponsor this popular Pre-Indaba event in Cape Town.

AAMEG Event in Cape Town Ahead of Mining Indaba 2026

ANDAMAN PARTNERS is pleased to sponsor and support the AAMEG pre-Mining Indaba Cocktails & Canapes event.

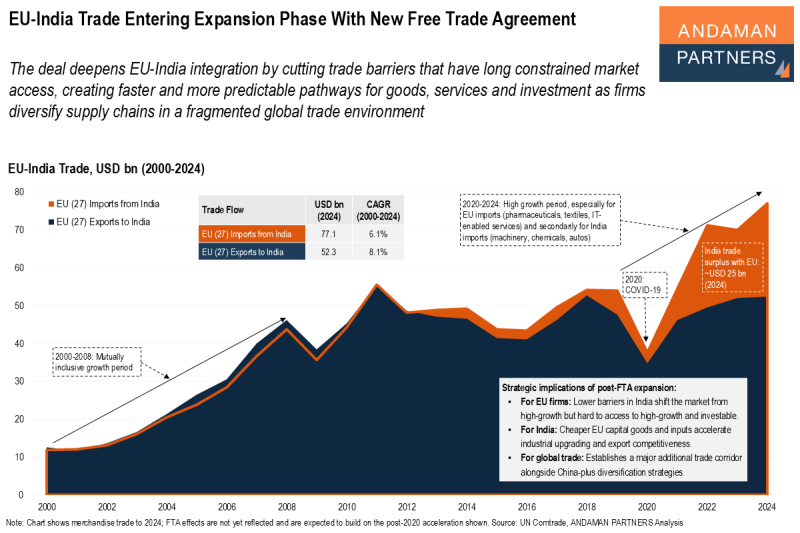

EU-India Trade Entering Expansion Phase With New Free Trade Agreement

The deal deepens EU-India integration by cutting trade barriers that have long constrained market access.

High-Tech Manufacturing Export Growth Has Shifted to Asia, But China Remains the Industrial Core

China retains unmatched scale at the centre of global high-tech production, while rapid gains in Vietnam, Mexico and other Asian hubs.

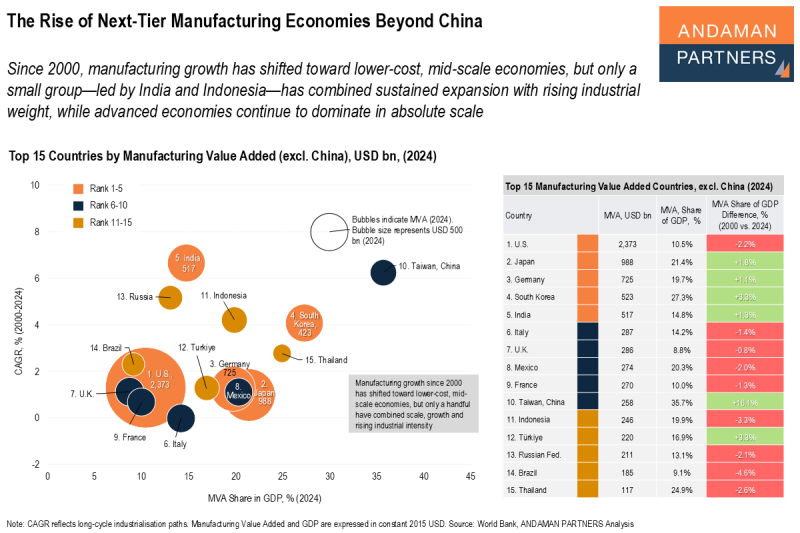

The Rise of Next-Tier Manufacturing Economies Beyond China

Manufacturing growth shifted toward lower-cost, mid-scale economies, but only a small group has combined sustained expansion with rising industrial weight.