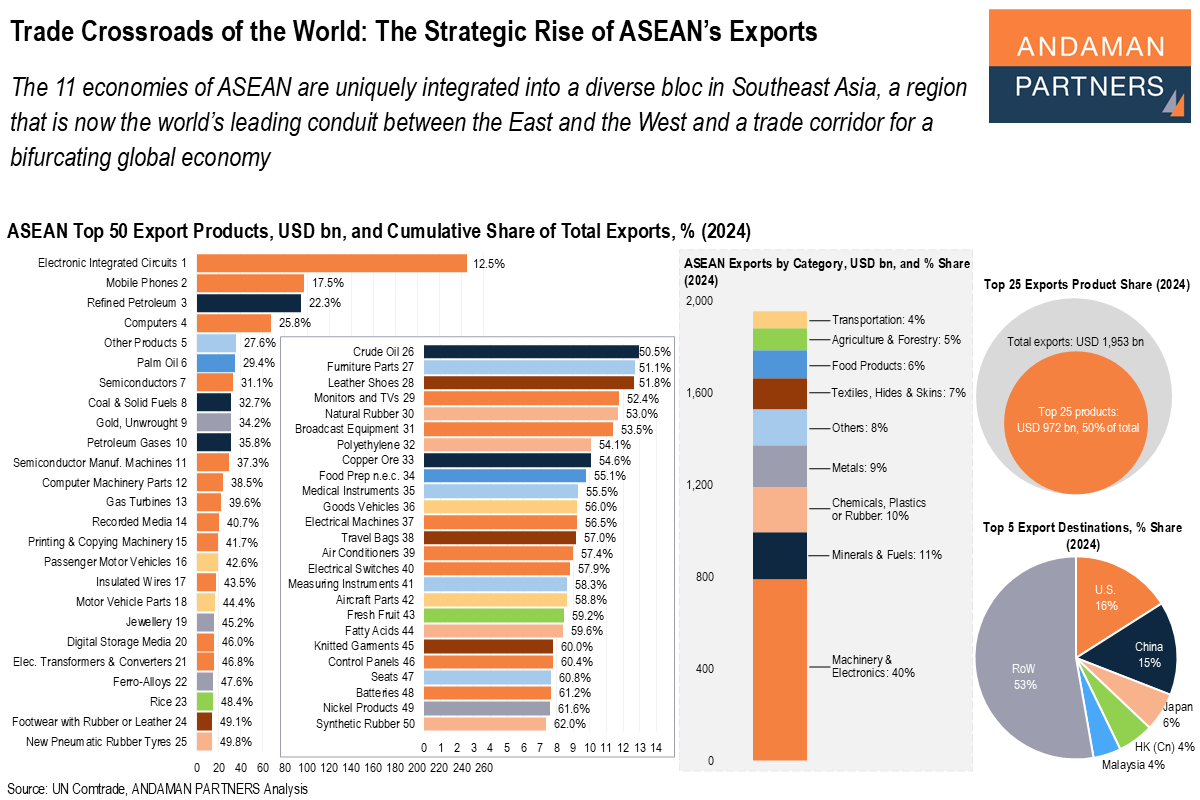

The 11 economies of ASEAN are uniquely integrated into a diverse bloc in Southeast Asia, a region that is now the world’s leading conduit between the East and the West and a trade corridor for a bifurcating global economy.

Highlights:

- ASEAN has a USD4-trillion economy and a projected aggregate GDP growth rate of 4.7% in 2025.

- ASEAN’s export engine amplifies global recovery cycles: when demand rebounds after global shocks, the region’s exports recover rapidly.

- In 2024, ASEAN’s exports amounted to almost USD 2 trillion, led by Machinery & Electronics with a share of 40%.

- Machinery & Electronics was the slowest growing export category from 2000 to 2024, with a CAGR of 5%, while Metals and Transportation recorded the fastest growth, both at 10%.

- ASEAN’s largest export destinations are almost equally divided between the U.S. (16%) and China (15%), indicating that the region sits at the geopolitical hinge of the world economy.

- ASEAN is a uniquely diversified economic bloc, spanning advanced manufacturing hubs, resource-rich economies and fast-growing industrial bases.

The Association of Southeast Asian Nations (ASEAN) is one of the world’s most dynamic economic regions, boasting a USD 4-trillion economy and an aggregate GDP growth rate of 4.6% in 2024, projected to increase to 4.7% in 2025.

The 11 South East Asian economies that constitute ASEAN—Brunei, Cambodia, Indonesia, Laos, Malaysia, Myanmar, the Philippines, Singapore, Timor-Leste, Thailand and Vietnam—have collectively become a key engine of global manufacturing and trade. The region now exports everything from microchips and machinery to palm oil and petroleum, with a key focus on Machinery & Electronics.

ASEAN’s dynamism is not just based on the economic heft of its constituent member states, but is founded on the intersection of strategic geography, demographic strength and accelerating economic integration, making the region a rising centre of global trade and production.

With a combined population of around 680 million, a relatively young workforce and a growing middle class, ASEAN’s growth is underpinned by demographic tailwinds. Operating at the crossroads of global trade between China, India and vital sea lanes (notably the Strait of Malacca), Southeast Asia is a natural hub for supply chains, logistics and investment flows. Free-trade agreements, such as the ASEAN Free Trade Area and the Regional Comprehensive Economic Partnership (RCEP), have strengthened intra-regional commerce, making ASEAN a unified trade area rather than a set of isolated markets.

From Singapore’s financial sophistication to Vietnam’s electronics factories and Indonesia’s resource base, ASEAN encompasses manufacturing, services and commodities, drawing in investment from multinationals as supply chains diversify beyond China.

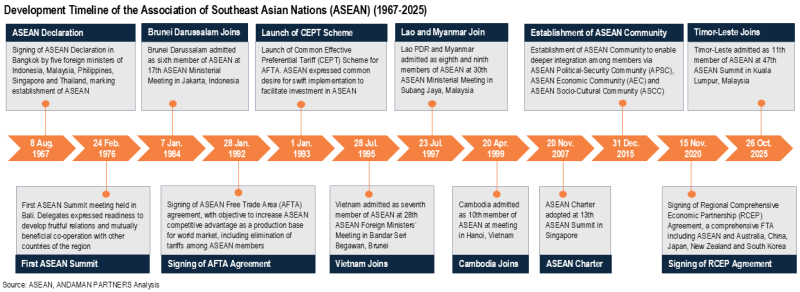

Integration and Growth: The Rise of ASEAN (1967-2025)

The Association of Southeast Asian Nations (ASEAN) was founded as a regional intergovernmental organisation on 8 August 1967 in Bangkok, Thailand, with the signing of the ASEAN Declaration by five founding members: Indonesia, Malaysia, the Philippines, Singapore and Thailand. The first ASEAN Summit in 1976 set the tone for deeper cooperation, and by the early 1990s, the bloc had shifted decisively toward trade integration.

The launch of the ASEAN Free Trade Area (AFTA) in 1992, followed by the Common Effective Preferential Tariff scheme in 1993, marked ASEAN’s entry into the global trade arena with a clear ambition to lower barriers, attract investment and build a competitive regional production base. ASEAN membership expanded from five to ten countries by 1999, creating a single Southeast Asian market that spans more than 600 million people.

With the adoption of the ASEAN Charter in 2007, ASEAN was transformed from a loose diplomatic forum into a rules-based, legally recognised regional organisation. The Charter strengthened governance, clarified dispute-settlement mechanisms and formalised the role of the Secretariat, providing ASEAN with an institutional structure to pursue deeper economic and political integration.

The 2007 ASEAN Economic Community Blueprint provided the first concrete roadmap for a unified market and production base. The Blueprint accelerated trade liberalisation, investment and services; improved logistics and customs integration; and laid the foundation for more unrestricted movement of skilled labour within ASEAN.

The Blueprint culminated in the creation of the ASEAN Community in 2015, which established a unified regional architecture anchored on three pillars (political-security, economic and socio-cultural) to enable deeper integration, shared prosperity and resilience across member states. The ASEAN Community included the launch of the ASEAN Economic Community (AEC) to create a single market and production base, allowing goods, services, investment capital and skilled labour to move more freely across member states.

Between 2002 and 2010, ASEAN concluded several ASEAN+1 free-trade agreements with China, Japan, South Korea, India, Australia and New Zealand, creating one of the most extensive regional trade architectures in the world. These agreements linked Southeast Asia to every major Asian economy, deepening supply chain connectivity. In 2020, ASEAN signed the Regional Comprehensive Economic Partnership (RCEP), the world’s largest free-trade agreement, which links ASEAN with China, Japan, South Korea, Australia and New Zealand.

With Timor-Leste joining as the 11th member state in 2025, ASEAN stands as a unified economic ecosystem, not just a regional bloc, anchoring supply chains across energy, manufacturing and services, and positioning Southeast Asia as Asia’s second growth pole alongside China.

Export Surge and Diversification (2000-2024)

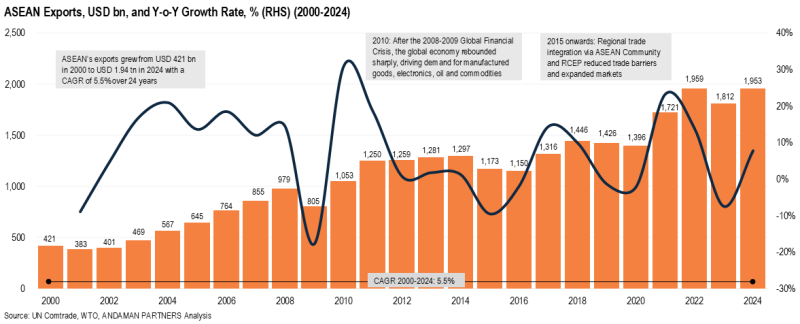

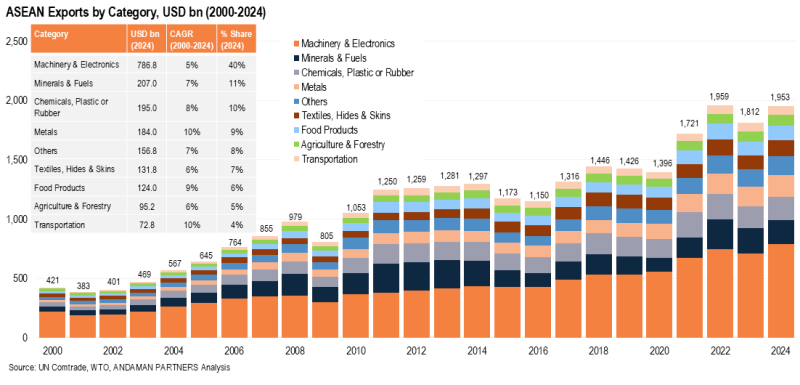

From USD 421 billion in 2000 (after membership reached ten member states) to USD 1.95 trillion in 2024, ASEAN’s exports grew more than fourfold, at a CAGR of 5.5%.

Over this period, ASEAN’s export surge was driven by structural transformation, not a temporary boom. The region shifted from primarily exporting commodities and low-cost labour to operating as a globally integrated manufacturing hub, leveraging its young workforce, strategic location, and sustained trade liberalisation.

Through a series of free-trade agreements, the streamlining of customs and logistics and increased multinational investment in electronics, automotive and battery material supply chains, ASEAN not only expanded volumes but also moved up the value chain and embedded itself in global production systems, enabling diversified and sustained export growth.

ASEAN’s export growth was most pronounced during years of recovery following global crises and slowdowns, i.e., 30.9% year-over-year (y-o-y) growth in 2010 following the Global Financial Crisis in 2008-2009, 14.4% in 2017 following the global trade slowdown in 2016 and 23.3% in 2021 following the COVID-19 shutdowns in 2020.

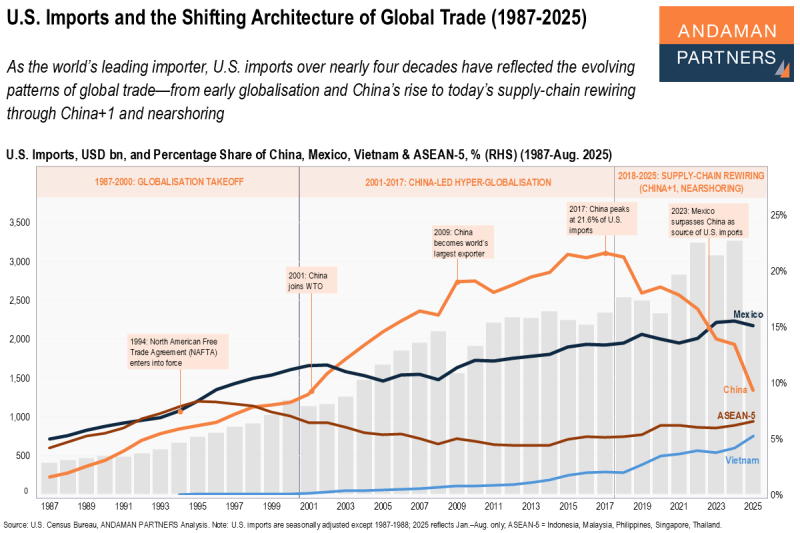

In other words, ASEAN’s export engine amplifies global recovery cycles: when global demand rebounds after a shock, ASEAN’s exports don’t just recover, they surge. This suggests that ASEAN is deeply integrated into global value chains, and when the global economy rebounds, ASEAN becomes one of the world’s strongest export accelerators. ASEAN thrives in the upswing because it sits at the intersection of shifting global supply chains, particularly via China+1 supply chain diversification.

Machinery & Electronics, Fuels and Chemicals: ASEAN’s Exports (2024)

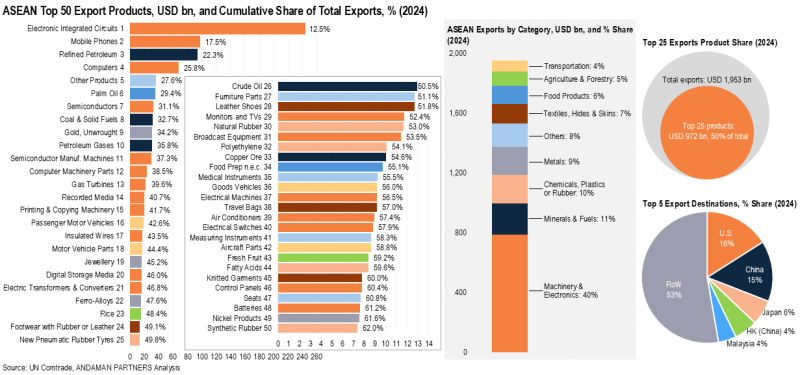

In 2024, ASEAN’s collective exports amounted to USD 1.95 trillion, an increase of 7.8% from the previous year. Machinery & Electronics accounted for USD 787 billion of the region’s exports, a share of 40%. The region’s largest single export product was Electronic Integrated Circuits, at USD 245 billion, accounting for a 12.5% share of total exports. Most of these exports were accounted for by Malaysia’s strong semiconductor export base, although other ASEAN economies also contributed smaller shares, notably Vietnam, Thailand, the Philippines and Singapore.

Other prominent Machinery & Electronics products among ASEAN’s ten largest exports in 2024 included Mobile Phones (USD 97 billion), Computers (USD 67 billion) and Semiconductors (USD 33 billion).

Minerals & Fuels (USD 207 billion) accounted for 11% of ASEAN’s total exports, with the leading products being refined petroleum (USD 94 billion), coal & solid fuels (USD 31 billion) and petroleum gas (USD 31 billion). Singapore is the region’s leading exporter of refined petroleum, while Indonesia is the leading coal exporter and Malaysia accounts for the majority of petroleum gas exports.

Chemicals (USD 195 billion) accounted for 10% of total exports, with the largest export product being rubber tyres (USD 14 billion). Metals (USD 184 billion) accounted for 9%, led by unwrought gold (USD 31 billion). Textiles

(USD 132 billion) accounted for 7%, Food Products (USD 124 billion) accounted for 6% (led by palm oil with

USD 35 billion), Agriculture & Forestry (USD 95 billion) accounted for 5% and Transportation (USD 74 billion) accounted for 4%.

While by far the largest export category, Machinery & Electronics had the slowest growth from 2000 to 2024, with a CAGR of 5%. Metals and Transportation recorded the fastest growth over this period, both at 10%, suggesting ASEAN’s industrial upgrading, increasing resource leverage and supply-chain integration. The growth in Metal exports was driven by ASEAN’s increased leverage of natural resources, combined with foreign investment, especially in nickel and downstream nickel product exports from Indonesia, as well as aluminium and copper exports from Malaysia and Vietnam.

While still only accounting for 4% of total ASEAN exports in 2024, the growth in Transportation exports was driven by the region’s emerging electric vehicle (EV) supply chains, facilitated by Indonesia’s minerals and Thailand’s auto ecosystem, including the manufacturing of passenger vehicles and pickup trucks (along with motorcycle and scooter manufacturing in Indonesia and Vietnam).

All ASEAN export categories recorded favourable growth rates from 2000 to 2024, including Food Products (9%), Chemicals (8%), Minerals & Fuels (7%), Textiles (6%) and Agriculture & Forestry (6%).

Between the East and the West: ASEAN Export Regions

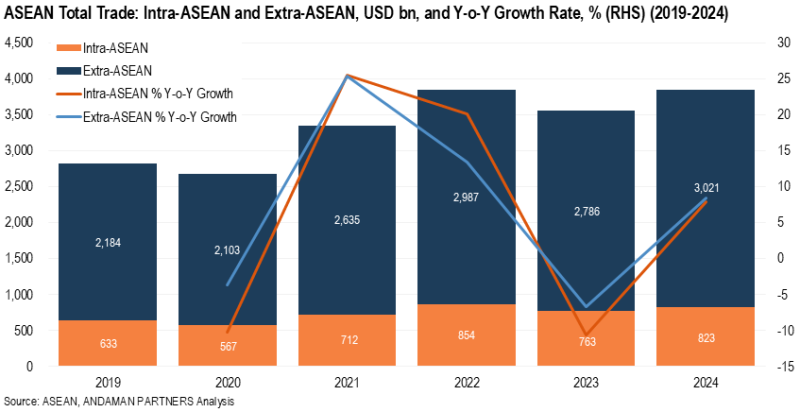

ASEAN is a region with a pronounced outward-looking trade stance, as trade with external partners regularly exceeds intra-ASEAN trade by more than three-to-one. In 2024, in terms of ASEAN total trade, extra-ASEAN trade accounted for USD 3.0 trillion, and intra-ASEAN trade for USD 823 billion, resulting in a factor of 3.6 in favour of external trade.

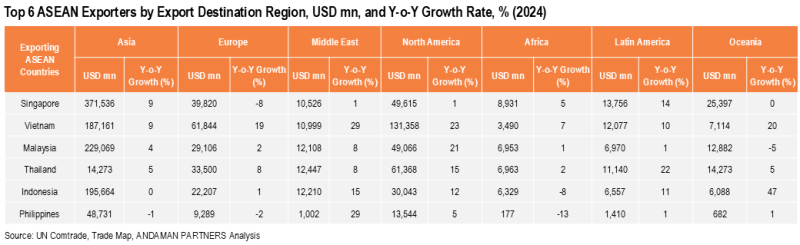

ASEAN’s largest export destinations in 2024 were divided between the U.S. (16%) and China (15%), followed by Japan (6%) and Hong Kong, China (4%). With its export markets roughly equally divided between the U.S. and China, ASEAN serves as the geopolitical hinge of global trade, being commercially integrated with China, geopolitically connected to the West and structurally central to supply-chain realignment. In a world of economic bifurcation, ASEAN operates in the middle ground.

The exports of Singapore, Malaysia and Indonesia remain primarily Asia-anchored, while Vietnam, Thailand (and to a lesser extent the Philippines) are increasingly West-facing, posting strong 2024 growth to North America and Europe. Singapore is ASEAN’s largest exporter to Asia (USD 372 billion), with flat growth to the U.S. and EU, reflecting its role as a global refining, re-export, and logistics hub rather than a pure manufacturing base. Malaysia and Indonesia continue to supply energy, components and resource-linked products broadly across Asia, although Malaysia’s electronics sector is gaining momentum in Western markets.

Vietnam is the standout growth engine for advanced economies, recording double-digit export gains to Europe, North America and Oceania, driven by electronics, computers, smartphones and apparel. Thailand and Malaysia are also benefiting from supply-chain realignment, with notable growth in exports of auto parts, electronics and semiconductors to Western demand centres. In short, the data shows a clear shift: ASEAN’s manufacturing economies are increasingly plugged into Western supply chains as China+1 sourcing strategies mature.

This overlapping East-West orientation highlights a critical reality: Southeast Asia is the world’s bridge for diversification between the East and the West, as well as a trade corridor for a bifurcating global economy.

Greater Than the Sum of Its Parts: ASEAN’s Constituent Member Economies

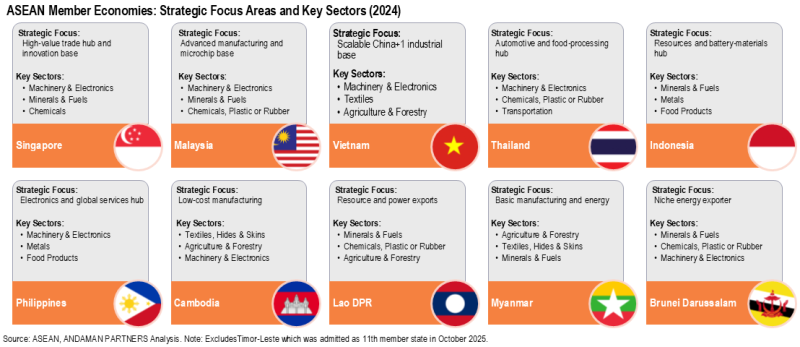

ASEAN is a uniquely diversified economic bloc, spanning advanced manufacturing hubs, resource-rich economies and fast-growing industrial bases. Singapore orchestrates capital, logistics and high-tech flows; Malaysia and the Philippines power semiconductor and service value chains; Vietnam and Thailand scale mass manufacturing from smartphones to autos; and Indonesia anchors energy and critical minerals for the EV era. Cambodia, Laos and Myanmar provide low-cost manufacturing and resource capacity, while Brunei supplies hydrocarbons.

The bloc’s strength lies in complementary advantages: petrochemicals and refined fuels in Singapore, microchips in Malaysia, services in the Philippines, assembly in Vietnam, autos in Thailand, minerals in Indonesia and cost-competitive supply in frontier markets, together forming Asia’s most diversified economic platform.

Conclusions: The Strategic Rise of ASEAN’s Exports

Southeast Asia has moved from a peripheral market to a central pillar of global trade. ASEAN is now a critical link between the East and the West, powering supply chains for electronics, autos, energy and fast-growing consumer markets.

- ASEAN is Now a Core Node in Global Supply Chains:

ASEAN has evolved from an assembly hub to a supply ecosystem that anchors not just low-cost manufacturing but also semiconductors, EV batteries and petrochemicals. - ASEAN Export Growth Is Structural, Not Cyclical:

ASEAN’s export surge reflects industrial upgrading and deep investment flows. Electronics, autos and resource processing industries now complement commodities and textiles. - ASEAN Thrives in Global Recoveries and Amplifies Them:

When the world resets, ASEAN accelerates. Post-crisis export rebounds of +31% (2010), +14% (2017) and +23% (2021) make ASEAN one of the world’s most responsive demand engines. - ASEAN Is the Economic Crossroads of the East and the West:

ASEAN’s exports are almost equally split between the U.S. and China. This balance positions ASEAN as the natural hub for diversification in a world of supply-chain realignment and geopolitical tension. - Diversity is ASEAN’s Strategic Strength:

No single industry or economy defines the region; rather, it is complementarity that does.

The strategic rise of ASEAN’s exports is more than just a trade story; it represents a structural shift in the global commerce landscape. As supply chains rewire and economic blocs form, Southeast Asia is emerging as the region where capital, production and demand converge. For businesses and policymakers alike, ASEAN is not merely a growth market; it is a strategic platform that is shaping the next era of global trade.

Also by ANDAMAN PARTNERS:

ANDAMAN PARTNERS supports international business ventures and growth. We help launch global initiatives and accelerate successful expansion across borders. If your business, operations or project requires cross-border support, contact connect@andamanpartners.com.

ANDAMAN PARTNERS to Attend Investing in African Mining Indaba 2026 in Cape Town

ANDAMAN PARTNERS Co-Founders Kobus van der Wath and Rachel Wu will attend Investing in African Mining Indaba 2026 in Cape Town, South Africa.

Join ANDAMAN PARTNERS at Networking Event in Cape Town Ahead of Mining Indaba 2026

ANDAMAN PARTNERS is pleased to support and sponsor this popular Pre-Indaba event in Cape Town.

AAMEG Event in Cape Town Ahead of Mining Indaba 2026

ANDAMAN PARTNERS is pleased to sponsor and support the AAMEG pre-Mining Indaba Cocktails & Canapes event.

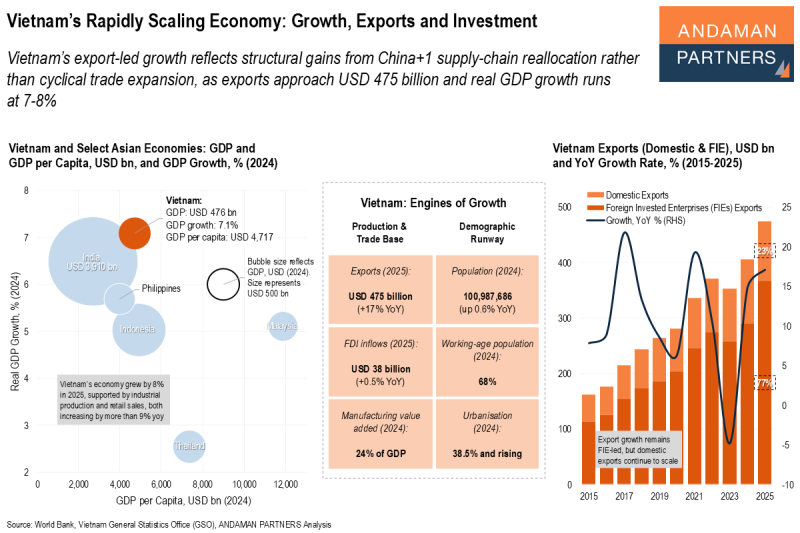

Vietnam’s Rapidly Scaling Economy: Growth, Exports and Investment

Vietnam’s export-led growth reflects structural gains from China+1 supply-chain reallocation rather than cyclical trade expansion.

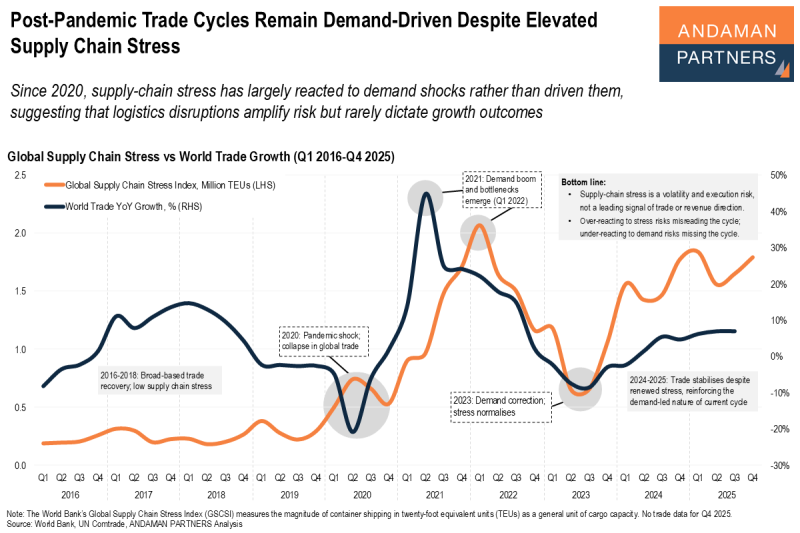

Post-Pandemic Trade Cycles Remain Demand-Driven Despite Elevated Supply Chain Stress

Supply-chain stress has largely reacted to demand shocks rather than driven them, suggesting that logistics disruptions rarely dictate growth.

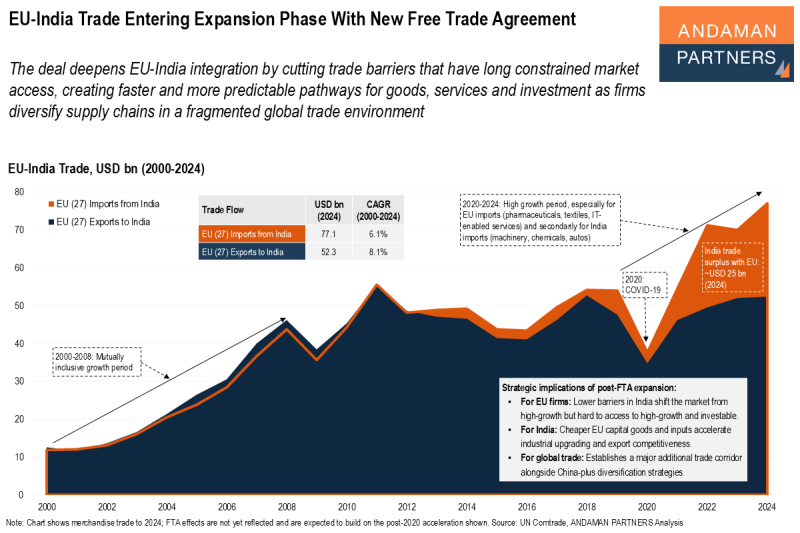

EU-India Trade Entering Expansion Phase With New Free Trade Agreement

The deal deepens EU-India integration by cutting trade barriers that have long constrained market access.