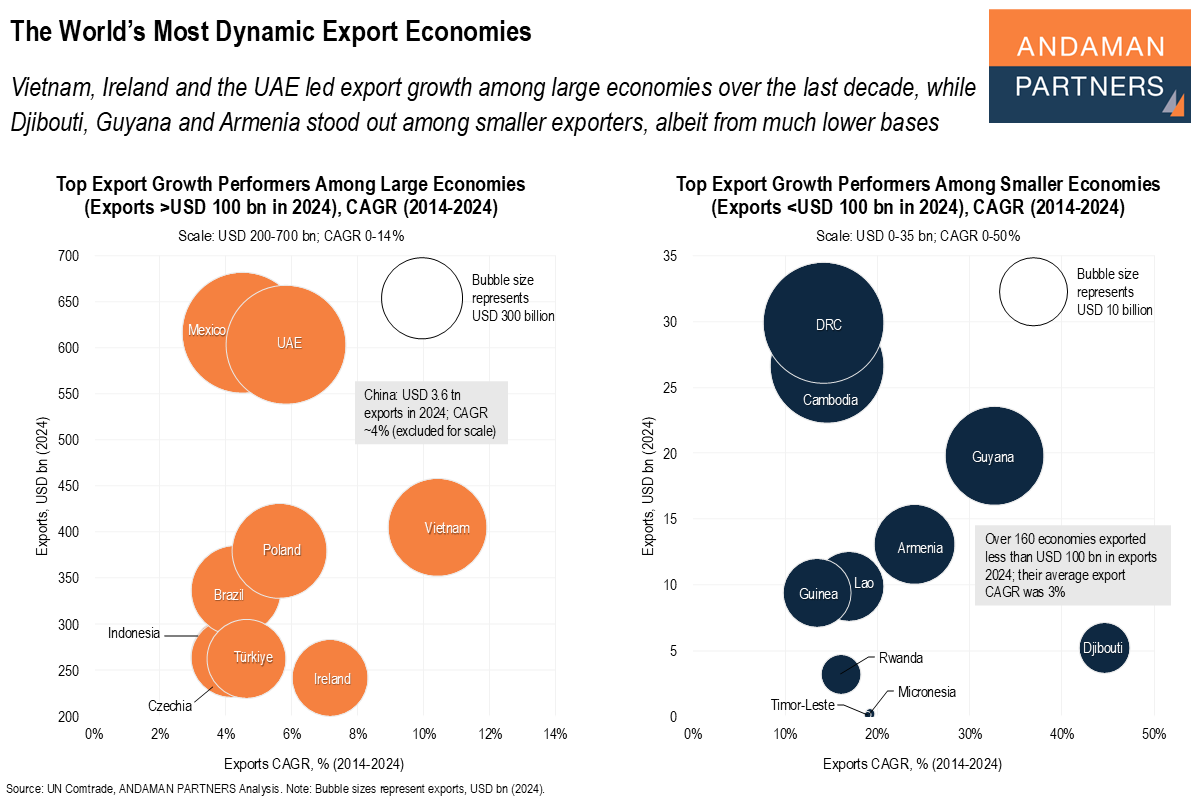

Vietnam, Ireland and the UAE led export growth among large economies over the last decade, while Djibouti, Guyana and Armenia stood out among smaller exporters, albeit from much lower bases.

Understanding global exports requires examining performance across two tiers of economies: those already operating at scale, and those climbing from a smaller base. Reviewing the largest exporters reveals the engines driving global trade in absolute terms, while including fast-growing smaller economies highlights where the next wave of export growth may emerge.

Together, these two tiers reveal both absolute bulk and outright speed, scaling today and accelerating for tomorrow, thus offering a fuller strategic picture of how global trade leadership is evolving.

Over the past decade, a new cohort of export economies has emerged, reshaping global trade dynamics beyond traditional manufacturing hubs. Vietnam and Ireland led all major economies in export growth from 2014 to 2024, posting double-digit and high-single-digit CAGRs while scaling exports to USD 405 billion and USD 242 billion, respectively.

The UAE and Mexico also accelerated meaningfully, combining rising competitiveness, trade facilitation reform and integration into shifting supply chains. China remains the world’s largest exporter by a wide margin, but its growth rate expanded at a steadier 4% CAGR as its export engine transitions from hyper-growth to high-scale maturity.

At the next tier, Poland, Türkiye, Brazil, the Czech Republic and Indonesia posted solid mid-single-digit export growth while strengthening their position in global value chains. These economies benefited from industrial upgrading, near-shoring and friend-shoring trends, as well as greater participation in diversified trade corridors.

The performances of these major exporting economies underscore a broader structural trend: export leadership is no longer concentrated in one region, but is increasingly distributed across competitive mid-sized economies with improving manufacturing ecosystems, logistics infrastructure, and trade agreements.

Alongside these large and mid-sized performers, a group of frontier economies is experiencing rapid export growth, albeit from a significantly lower base. Djibouti, Guyana, Armenia and several small Asian and African economies achieved double-digit to high double-digit export CAGRs over the last decade, supported by resource developments, port and logistics investment, and niche industrial capabilities.

While the absolute export values of these smaller economies remain modest, their trajectories indicate emerging export hubs in various sectors, ranging from energy to tourism and services.

Also by ANDAMAN PARTNERS:

ANDAMAN PARTNERS supports international business ventures and growth. We help launch global initiatives and accelerate successful expansion across borders. If your business, operations or project requires cross-border support, contact connect@andamanpartners.com.

ANDAMAN PARTNERS to Attend Investing in African Mining Indaba 2026 in Cape Town

ANDAMAN PARTNERS Co-Founders Kobus van der Wath and Rachel Wu will attend Investing in African Mining Indaba 2026 in Cape Town, South Africa.

Join ANDAMAN PARTNERS at Networking Event in Cape Town Ahead of Mining Indaba 2026

ANDAMAN PARTNERS is pleased to support and sponsor this popular Pre-Indaba event in Cape Town.

AAMEG Event in Cape Town Ahead of Mining Indaba 2026

ANDAMAN PARTNERS is pleased to sponsor and support the AAMEG pre-Mining Indaba Cocktails & Canapes event.

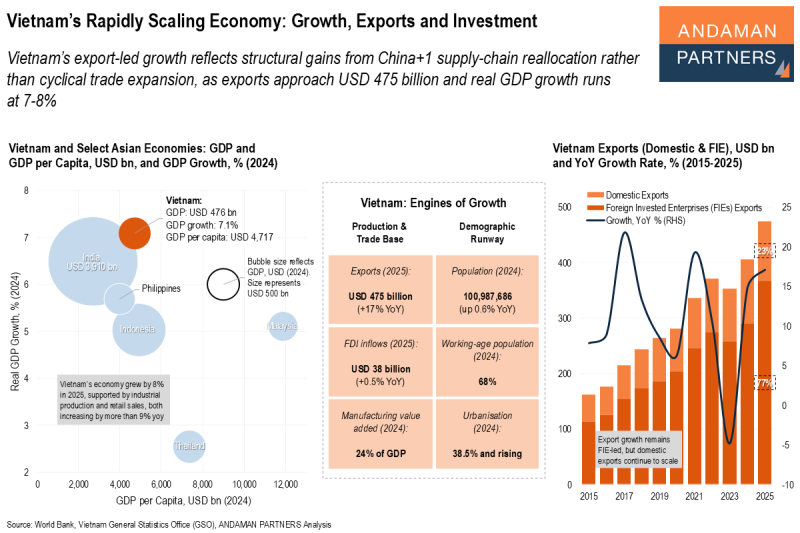

Vietnam’s Rapidly Scaling Economy: Growth, Exports and Investment

Vietnam’s export-led growth reflects structural gains from China+1 supply-chain reallocation rather than cyclical trade expansion.

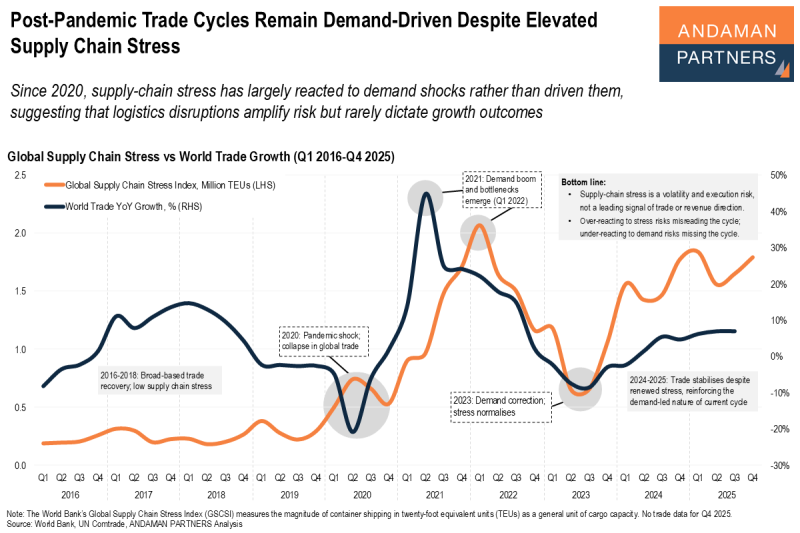

Post-Pandemic Trade Cycles Remain Demand-Driven Despite Elevated Supply Chain Stress

Supply-chain stress has largely reacted to demand shocks rather than driven them, suggesting that logistics disruptions rarely dictate growth.

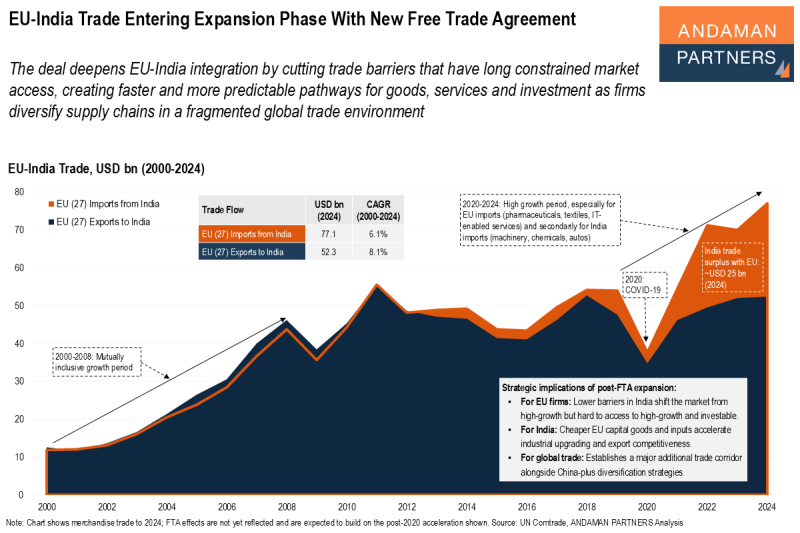

EU-India Trade Entering Expansion Phase With New Free Trade Agreement

The deal deepens EU-India integration by cutting trade barriers that have long constrained market access.