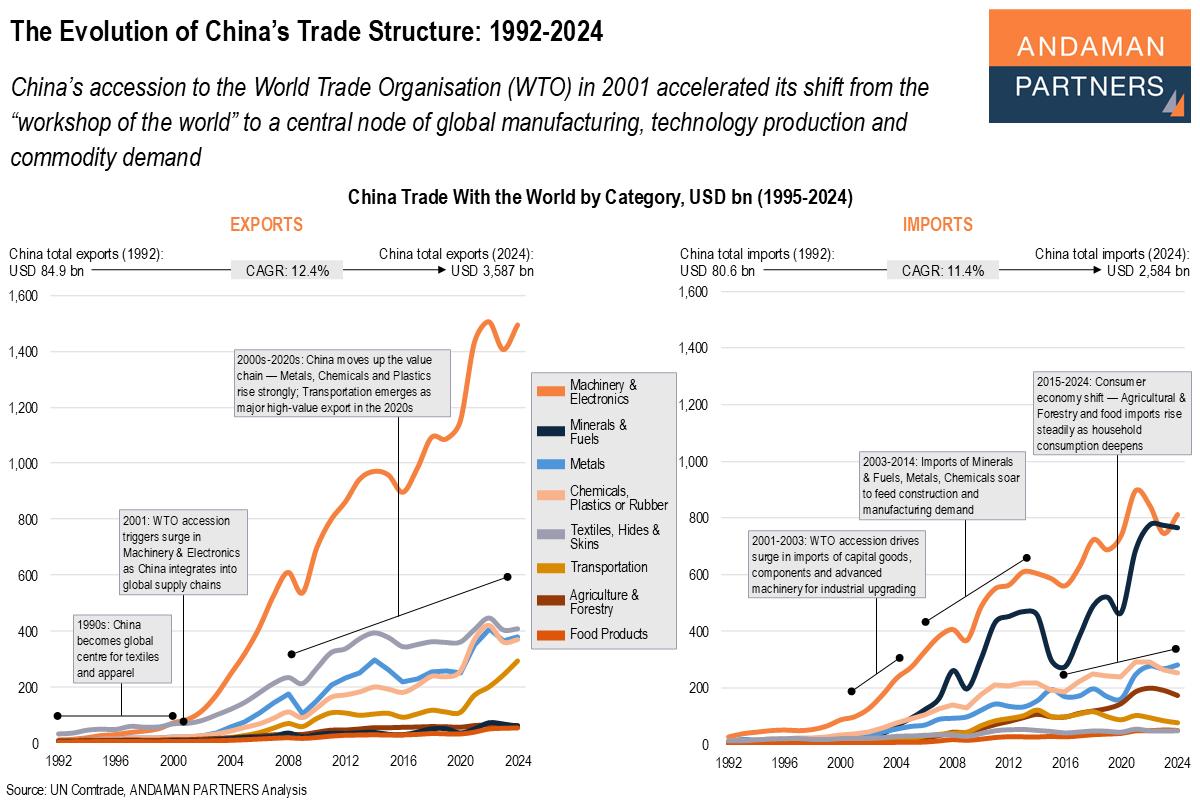

China’s accession to the World Trade Organisation (WTO) in 2001 accelerated its shift from the “workshop of the world” to a central node of global manufacturing, technology production and commodity demand.

China’s trade structure has undergone a profound transformation since the 1990s, reshaping both its domestic economy and global supply chains.

In the 1980s and 1990s, China’s exports were dominated by low-value, labour-intensive goods—most notably textiles, apparel and simple manufactured products. WTO accession in 2001 marked a decisive turning point. As foreign investment surged and multinational supply chains integrated China at scale, Machinery & Electronics began an exponential rise (CAGR of 16.4% in 1992-2024), generating the most crucial export transition of the past three decades and positioning China as the world’s central manufacturing hub.

From the mid-2000s, China’s export base widened and the country moved sharply up the value chain. Heavy-industry-linked categories—Metals (CAGR 8.2%), Chemicals & Plastics (13.4%) and especially Transportation (16.7%, the fastest-growing category)—expanded rapidly as China built world-leading capacity in materials, components, petrochemicals and eventually autos and electric vehicles.

The 2010s and early 2020s saw this transition accelerate: advanced manufacturing replaced assembly, high-value industrial inputs became central export pillars and China emerged not only as the world’s workshop but increasingly as a global technology and production nexus across a range of high-complexity sectors.

On the imports side, the data reflects the other half of China’s development story. Industrial expansion and urbanisation drove a long-running supercycle in resource demand: Minerals & Fuels (CAGR 17.2%), Metals (11.5%) and Chemicals (9.9%) became dominant import categories as China built steel, construction and manufacturing capacity at an unprecedented scale. At the same time, WTO accession also triggered a sharp rise in Machinery & Electronics imports (11.6%), reflecting China’s need for components, equipment and production machinery during the industrial upgrade of the 2000s. More recently, the 2020s have brought a steady increase in Agriculture & Forestry and Food Products imports (CAGR 12.5% and 11.3%), mirroring the rise of a more consumption-driven domestic economy.

Together, these shifts reveal China’s evolution from a low-cost exporter to a central node of global manufacturing, technology production and commodity demand. The world’s supply chains depend on China not only for finished electronics and machinery but also for the industrial inputs, chemicals, electric vehicles and materials underpinning global production systems.

At the same time, China’s deepening reliance on imported commodities, food and critical resources is reshaping global trade flows, driving investment in energy, mining and agriculture across Asia, Latin America and Africa. China’s changing trade structure is no longer simply a story of export scale—it is a story of structural interdependence, with implications for global industrial policy, resource security and economic resilience.

Also by ANDAMAN PARTNERS:

ANDAMAN PARTNERS supports international business ventures and growth. We help launch global initiatives and accelerate successful expansion across borders. If your business, operations or project requires cross-border support, contact connect@andamanpartners.com.

ANDAMAN PARTNERS Wishes You a Happy and Prosperous Year of the Horse!

Compliments of the Chinese Lunar New Year to all our clients, customers, suppliers and partners.

ANDAMAN PARTNERS to Attend Investing in African Mining Indaba 2026 in Cape Town

ANDAMAN PARTNERS Co-Founders Kobus van der Wath and Rachel Wu will attend Investing in African Mining Indaba 2026 in Cape Town, South Africa.

Join ANDAMAN PARTNERS at Networking Event in Cape Town Ahead of Mining Indaba 2026

ANDAMAN PARTNERS is pleased to support and sponsor this popular Pre-Indaba event in Cape Town.

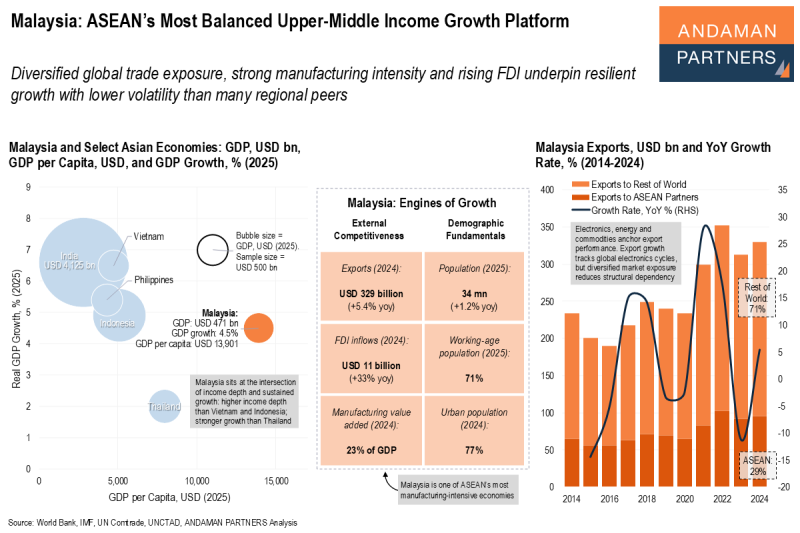

Malaysia: ASEAN’s Most Balanced Upper-Middle Income Growth Platform

Diversified global trade exposure, strong manufacturing intensity and rising FDI underpin resilient growth with lower volatility than many regional peers.

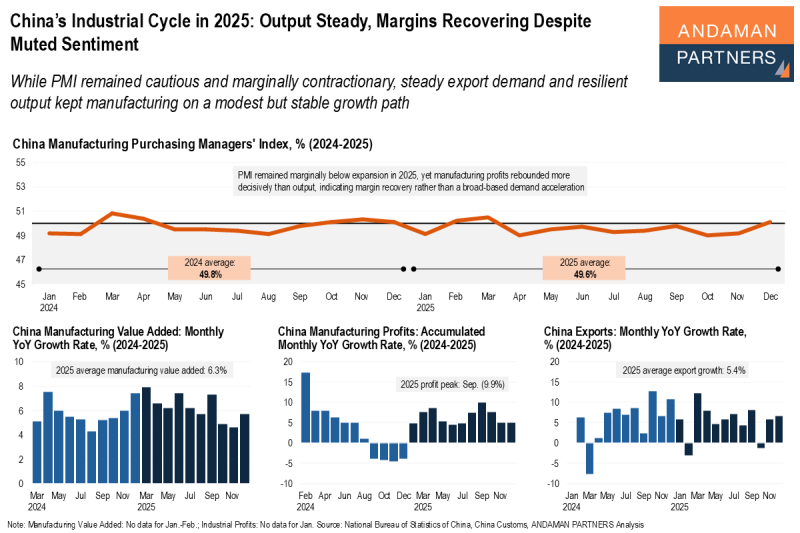

China’s Industrial Cycle in 2025: Output Steady, Margins Recovering Despite Muted Sentiment

While PMI remained cautious and marginally contractionary, steady export demand and resilient output kept manufacturing on a modest but stable growth path.

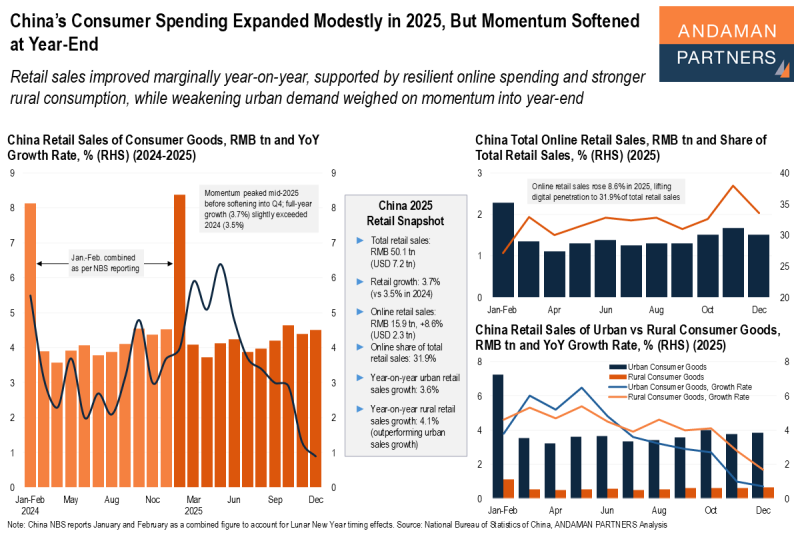

China’s Consumer Spending Expanded Modestly in 2025, But Momentum Softened at Year-End

Retail sales improved marginally year-on-year, supported by resilient online spending and stronger rural consumption.