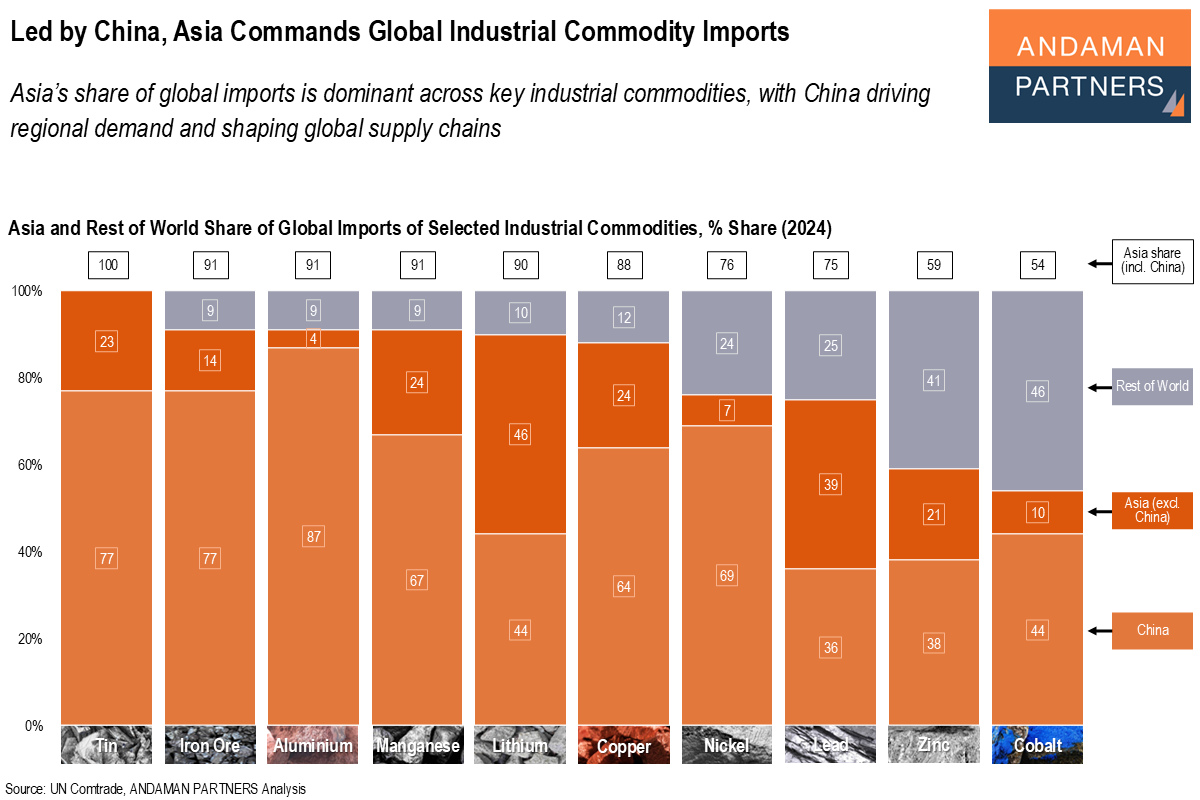

Asia’s share of global imports is dominant across key industrial commodities, with China driving regional demand and shaping global supply chains.

Asia is the world’s largest destination for industrial commodities, accounting for the vast majority of global imports across key industrial metals. China is the region’s dominant importer, reflecting its scale as the world’s leading manufacturing hub and its central role in energy transition supply chains.

While the rest of the world remains a significant buyer for certain commodities, Asia’s concentration of demand defines global trade flows and shapes upstream investment, pricing and strategic supply security.

Tin (Asia Share of World Imports: 100%)

Driven almost entirely by China’s electronics and soldering industries, tin imports are wholly concentrated in Asia, reflecting its position at the heart of global electronics manufacturing.

Iron Ore (Asia Share of World Imports: 91%)

Asia’s massive steel industry, led by China, accounts for nearly all global iron ore demand, feeding construction, shipbuilding and infrastructure development.

Aluminium (Asia Share of World Imports: 91%)

China’s role as the top producer of aluminium products drives high import volumes of raw aluminium and intermediate forms for the manufacturing and construction sectors.

Manganese (Asia Share of World Imports: 91%)

Used primarily in steelmaking, manganese imports are concentrated in Asia because of the region’s dominant steel production base, led by China, with additional substantial output in India, Japan and South Korea.

Lithium (Asia Share of World Imports: 90%)

Asia, particularly China and South Korea, leads the global battery manufacturing industry, making it the main destination for lithium imports.

Copper (Asia Share of World Imports: 88%)

Asia is the world’s manufacturing hub for electronics, machinery and wiring, making it the key consumer of refined copper and related products.

Nickel (Asia Share of World Imports: 76%)

Asia is the primary importer of nickel due to the region’s strong demand from the stainless steel sector and expanding battery production, with China and Indonesia central in processing and use.

Lead (Asia Share of World Imports: 75%)

Used in batteries and industrial applications, lead demand is concentrated in Asia’s automotive and energy storage industries.

Zinc (Asia Share of World Imports: 59%)

Asia’s large construction and galvanisation industries underpin high zinc imports, particularly in China and India.

Cobalt (Asia Share of World Imports: 54%)

Demand is driven by China’s dominant position in battery precursor and cathode manufacturing, making it the largest single importer.

The concentration of demand across these industrial metals underscores how Asia, and especially China, serves as the world’s industrial engine. Global supply chains for metals and minerals are oriented toward meeting Asia’s manufacturing needs.

Also by ANDAMAN PARTNERS:

ANDAMAN PARTNERS supports international business ventures and growth. We help launch global initiatives and accelerate successful expansion across borders. If your business, operations or project requires cross-border support, contact connect@andamanpartners.com.

ANDAMAN PARTNERS Wishes You a Happy and Prosperous Year of the Horse!

Compliments of the Chinese Lunar New Year to all our clients, customers, suppliers and partners.

ANDAMAN PARTNERS to Attend Investing in African Mining Indaba 2026 in Cape Town

ANDAMAN PARTNERS Co-Founders Kobus van der Wath and Rachel Wu will attend Investing in African Mining Indaba 2026 in Cape Town, South Africa.

Join ANDAMAN PARTNERS at Networking Event in Cape Town Ahead of Mining Indaba 2026

ANDAMAN PARTNERS is pleased to support and sponsor this popular Pre-Indaba event in Cape Town.

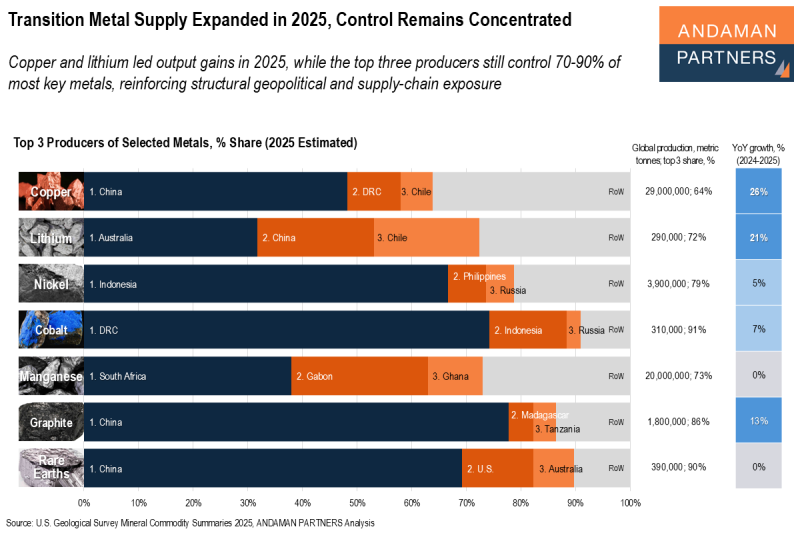

Transition Metal Supply Expanded in 2025, Control Remains Concentrated

Copper and lithium led output gains in 2025, while the top three producers still control 70-90% of most key metals.

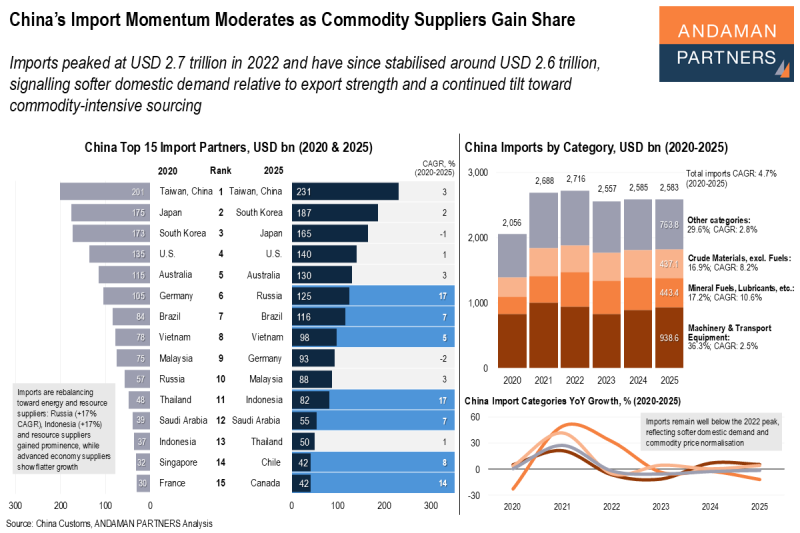

China’s Import Momentum Moderates as Commodity Suppliers Gain Share

Imports have stabilised around USD 2.6 trillion, signalling softer domestic demand and a continued tilt toward commodity-intensive sourcing.

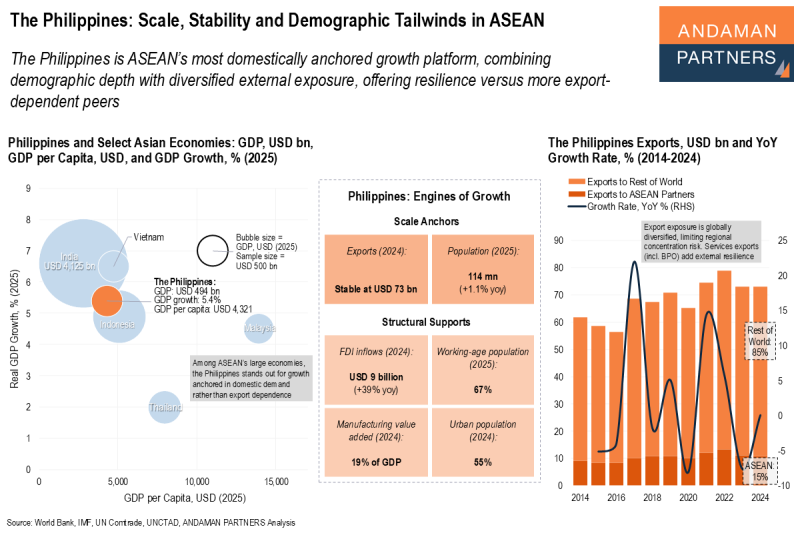

The Philippines: Scale, Stability and Demographic Tailwinds in ASEAN

The Philippines is ASEAN’s most domestically anchored growth platform, combining demographic depth with diversified external exposure.