In China-Africa Trade Overview: H1 2025, ANDAMAN PARTNERS examines the rapid increase in China’s exports to Africa in the first half of 2025.

Global trade in 2024–2025 is marked by slower growth and rising fragmentation, as geopolitical tensions and industrial policy reshape flows.

With the U.S. and EU tightening tariffs, China is re-routing more exports toward Africa, Latin America, the Middle East and Southeast Asia.

As China’s exports to the U.S. and EU fall due to tariffs, Africa has become a key growth market. Preliminary 2025 data show strong China export growth to Africa (+21.6% YoY) and steady flows to Latin America, while exports to Europe, North America and Oceania have contracted sharply.

Chinese exports to Africa surged in H1 2025, especially in a few leading importing markets (e.g., Nigeria, Côte d’Ivoire, Guinea, Angola).

South Africa, Nigeria and Egypt have consistently been the largest African importers from China. Despite a decline of 5% from 2000, South Africa still remains the largest African importer from China, accounting for 13% of total African imports from China in 2024.

In H1 2025, Cote d’Ivoire (50%), Nigeria (33%) and Tanzania (24%) have growth rates for China imports vastly outperforming the African 5-month YoY growth rate (18%), indicating that China’s exports to the continent are finding new avenues for growth. Smaller, less developed economies

(e.g., Eritrea, Sudan, Malawi, Mali, Angola, Guinea) have China import growth rates in excess of 60%.

Please see the option below to view or download the presentation in full (2.7 mb).

ANDAMAN PARTNERS supports international business ventures and growth. We help launch global initiatives and accelerate successful expansion across borders. If your business, operations or project requires cross-border support, contact connect@andamanpartners.com.

Media

ANDAMAN PARTNERS Wishes You a Happy and Prosperous Year of the Horse!

Compliments of the Chinese Lunar New Year to all our clients, customers, suppliers and partners.

ANDAMAN PARTNERS to Attend Investing in African Mining Indaba 2026 in Cape Town

ANDAMAN PARTNERS Co-Founders Kobus van der Wath and Rachel Wu will attend Investing in African Mining Indaba 2026 in Cape Town, South Africa.

Join ANDAMAN PARTNERS at Networking Event in Cape Town Ahead of Mining Indaba 2026

ANDAMAN PARTNERS is pleased to support and sponsor this popular Pre-Indaba event in Cape Town.

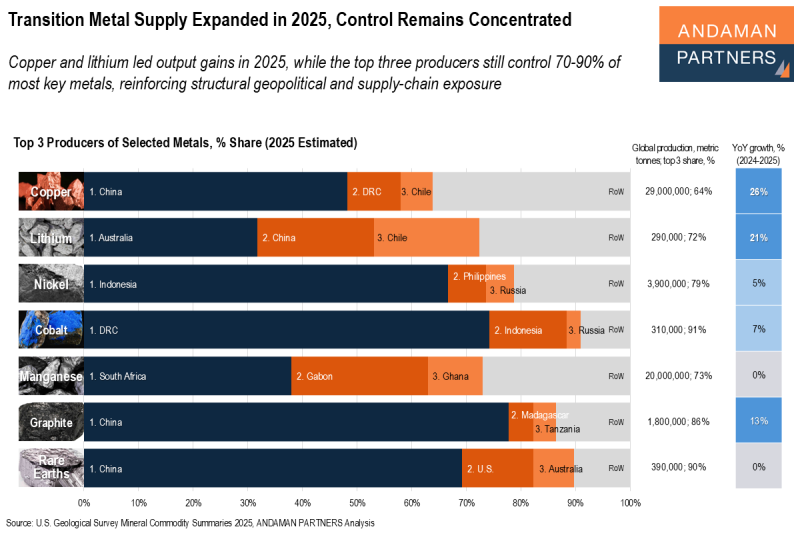

Transition Metal Supply Expanded in 2025, Control Remains Concentrated

Copper and lithium led output gains in 2025, while the top three producers still control 70-90% of most key metals.

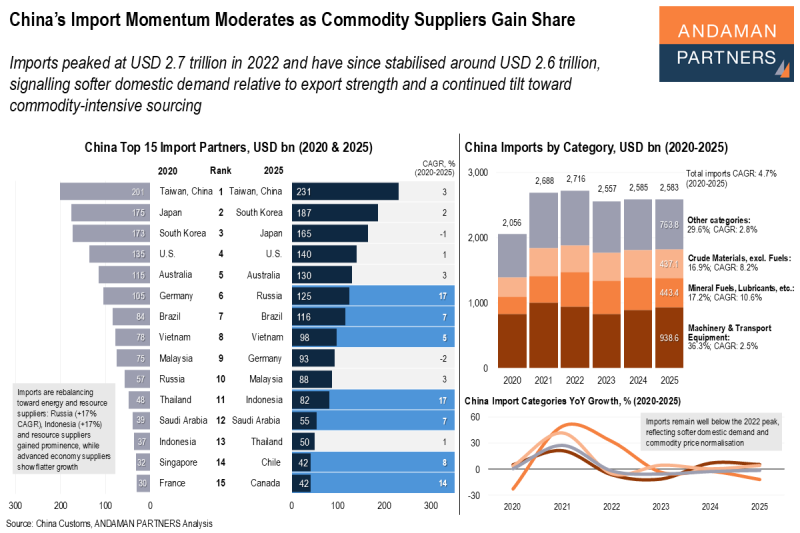

China’s Import Momentum Moderates as Commodity Suppliers Gain Share

Imports have stabilised around USD 2.6 trillion, signalling softer domestic demand and a continued tilt toward commodity-intensive sourcing.

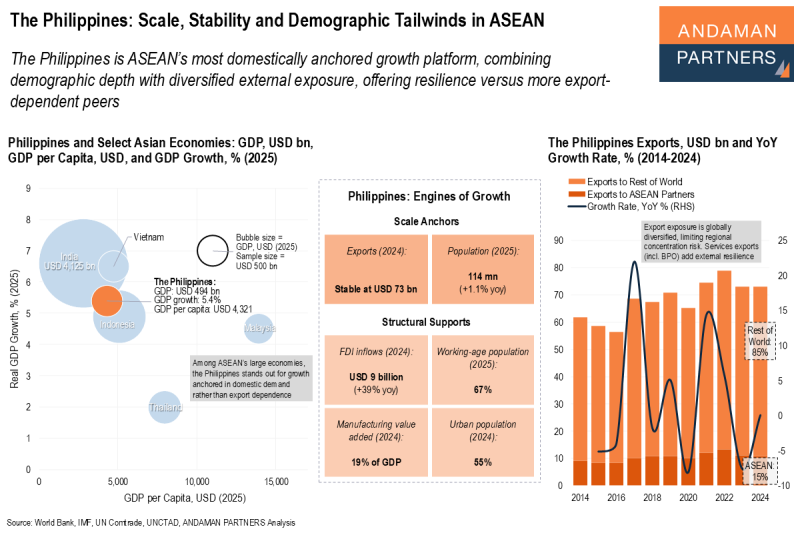

The Philippines: Scale, Stability and Demographic Tailwinds in ASEAN

The Philippines is ASEAN’s most domestically anchored growth platform, combining demographic depth with diversified external exposure.