African manufacturing value added dropped overall in 2024, including significant currency-related decreases in Egypt, Ghana and Nigeria, which masked flat or marginal growth in output in these countries. Several economies made genuine gains in production, including South Africa and Morocco.

Africa’s manufacturing sector experienced a notable decline last year, dropping from USD 324.5 billion in 2023 to USD 296.2 billion in 2024, a decrease of 8.7% year-on-year. The 2024 data is distorted, however, by the sharp depreciation against the U.S. dollar of several African currencies.

Mostly Currency-Related Losses

Egypt, South Africa and Nigeria remain firmly at the top of the 20 leading African countries by manufacturing value added in 2024. Both Egypt and Nigeria have significantly lower USD values in 2024: Egypt’s manufacturing value added decreased by 9% and that of Nigeria by 55%. Yet in both cases, these significant declines can mainly be attributed to depreciating currencies.

In March 2024, the Central Bank of Egypt floated the Egyptian pound as part of an agreement with the International Monetary Fund (IMF), which resulted in a depreciation of the currency by nearly 40% against the U.S. dollar. This devaluation automatically translates into a drop in USD‑denominated manufacturing output. Egyptian manufacturing conditions were somewhat strained in 2024, with weak demand and cost pressures. However, Egypt’s Ministry of Planning reported a 16.3% increase in manufacturing activity in the third quarter of 2024, indicating that Egyptian manufacturing was growing and/or recovering in real terms.

Similarly, in Nigeria, the sharp drop of 55% in manufacturing value added in 2024 is primarily attributable to the depreciating naira, which slumped by ~130% against the U.S. dollar in 2024 due to several factors, including dwindling foreign reserves and persistent inflation. According to Nigeria’s National Bureau of Statistics, however, manufacturing output in 2024 was flat or grew marginally, including +1.3% year-on-year in the second quarter and +1.8% in the fourth quarter of 2024. Nigeria’s manufacturing sector did face several challenges in 2024, including high energy costs and a scarcity of imports, but the sector was likely able to eke out modest gains in output last year.

Manufacturing value added in Ghana declined by 7%, and this was again primarily attributable to a depreciating currency. Amid high inflation and a tight fiscal and monetary policy, the cedi depreciated by ~20% against the U.S. dollar in 2024. According to official data from the Index of Industrial Production (IIP), the Ghanaian manufacturing sector actually grew by 5.1% year-on-year in the fourth quarter of 2024, pointing to flat or marginal growth in the sector.

Real Gains

South Africa’s manufacturing value added expanded by 4% in 2024 to USD 51.2 billion. The rand depreciated by only ~3.2% against the U.S. dollar in 2024, and the increase in manufacturing value added is primarily attributable to improved electricity supply and stronger chemical and automotive exports. Volkswagen’s African unit, based in South Africa, for example, achieved record exports of 131,485 Polo vehicles to Europe and Asia in 2024, beating the previous record of 108,422 units set in 2019.

Morocco achieved a 5% increase in manufacturing value added in 2024 due to substantial output gains in chemicals, electronics, automotive and food processing. According to official data, the country’s automotive industry exports rose by 6.3% to a record USD 17 billion in 2024.

Other notable gains occurred in the Democratic Republic of Congo (+6%), driven by strong growth in industrial metals exports; and Cote d’Ivoire (+5%), propelled by a notable rise in gold production and high GDP growth.

Zimbabwe achieved a manufacturing value-added increase of 42% in 2024, supported by better electricity supply. Although this significant increase was inflated by the country’s widespread use of USD pricing in the economy, the Zimbabwe National Statistics Agency reported a 10% increase year-on-year in manufacturing activity in the fourth quarter of 2024.

Other notable gains in manufacturing value added in 2024 among the top 20 included Uganda (+7%), Cameroon (+7%), Burkina Faso (+7%) and Gabon (+5%). Notable gains among the top 30 included Sierra Leone (+23%), Benin (+10%), Mali (+10%) and Mozambique (+9%).

ANDAMAN PARTNERS supports international business ventures and growth. We help launch global initiatives and accelerate successful expansion across borders. If your business, operations or project requires cross-border support, contact connect@andamanpartners.com.

ANDAMAN PARTNERS Wishes You a Happy and Prosperous Year of the Horse!

Compliments of the Chinese Lunar New Year to all our clients, customers, suppliers and partners.

ANDAMAN PARTNERS to Attend Investing in African Mining Indaba 2026 in Cape Town

ANDAMAN PARTNERS Co-Founders Kobus van der Wath and Rachel Wu will attend Investing in African Mining Indaba 2026 in Cape Town, South Africa.

Join ANDAMAN PARTNERS at Networking Event in Cape Town Ahead of Mining Indaba 2026

ANDAMAN PARTNERS is pleased to support and sponsor this popular Pre-Indaba event in Cape Town.

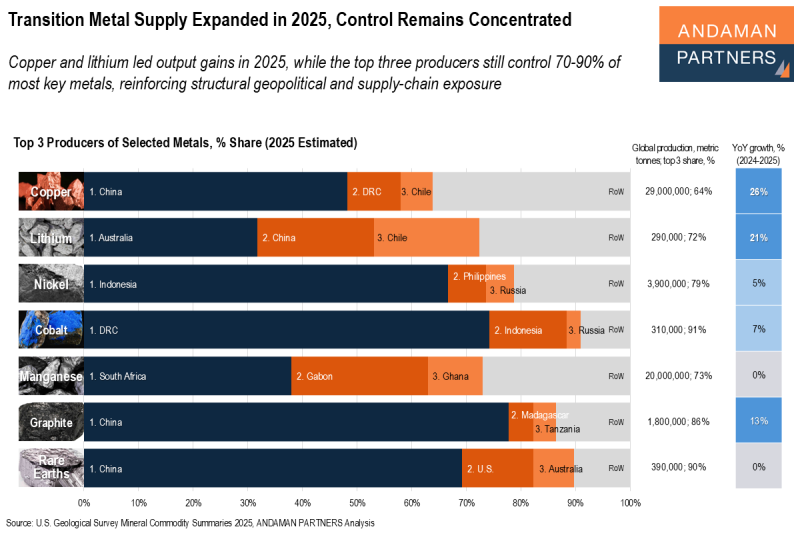

Transition Metal Supply Expanded in 2025, Control Remains Concentrated

Copper and lithium led output gains in 2025, while the top three producers still control 70-90% of most key metals.

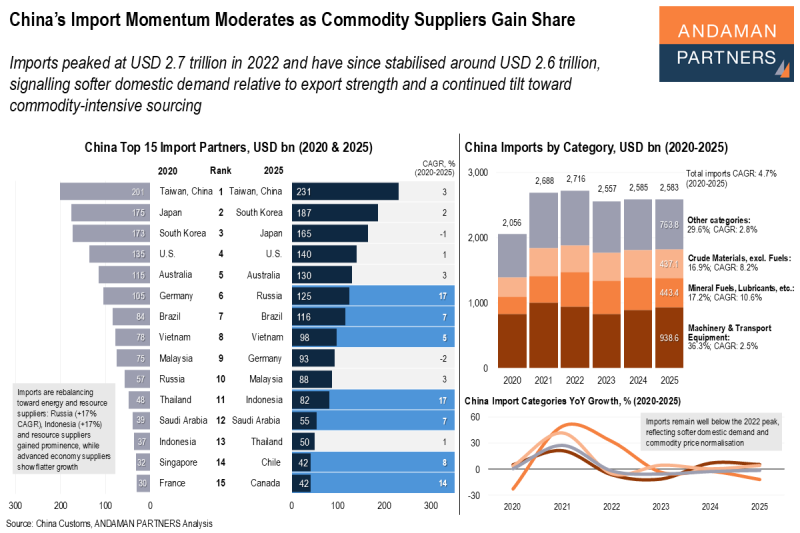

China’s Import Momentum Moderates as Commodity Suppliers Gain Share

Imports have stabilised around USD 2.6 trillion, signalling softer domestic demand and a continued tilt toward commodity-intensive sourcing.

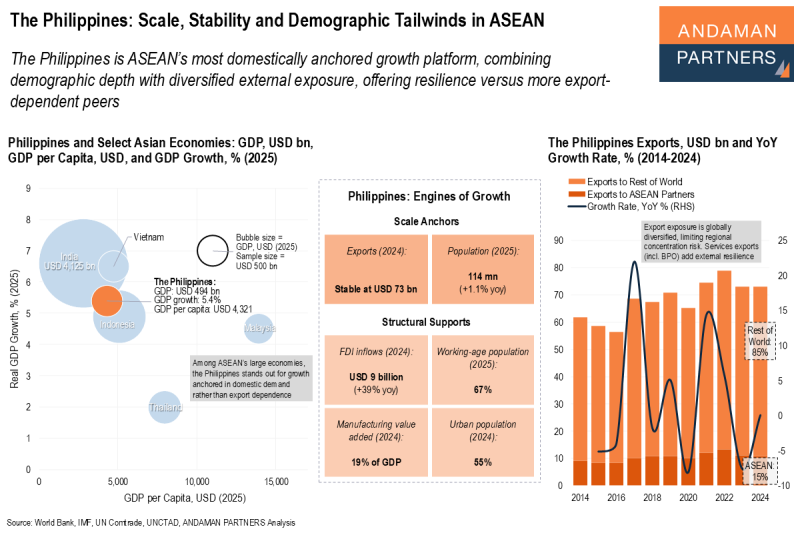

The Philippines: Scale, Stability and Demographic Tailwinds in ASEAN

The Philippines is ASEAN’s most domestically anchored growth platform, combining demographic depth with diversified external exposure.