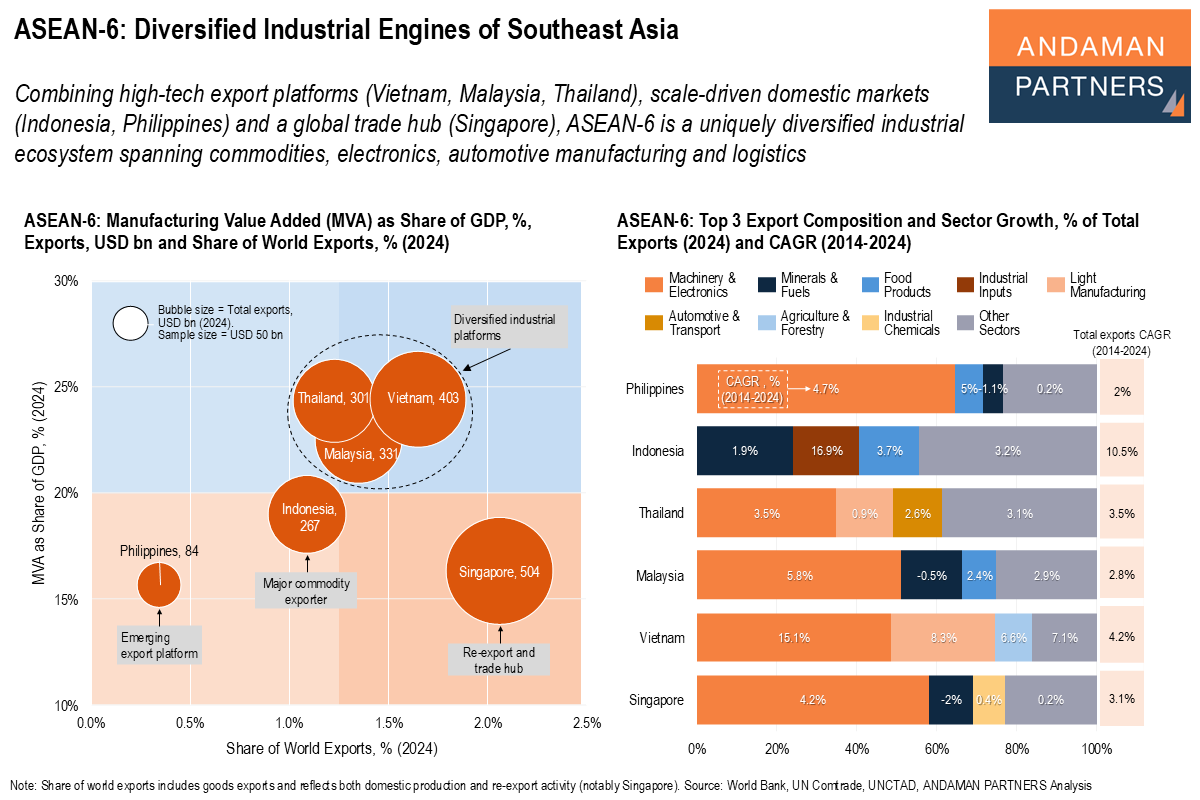

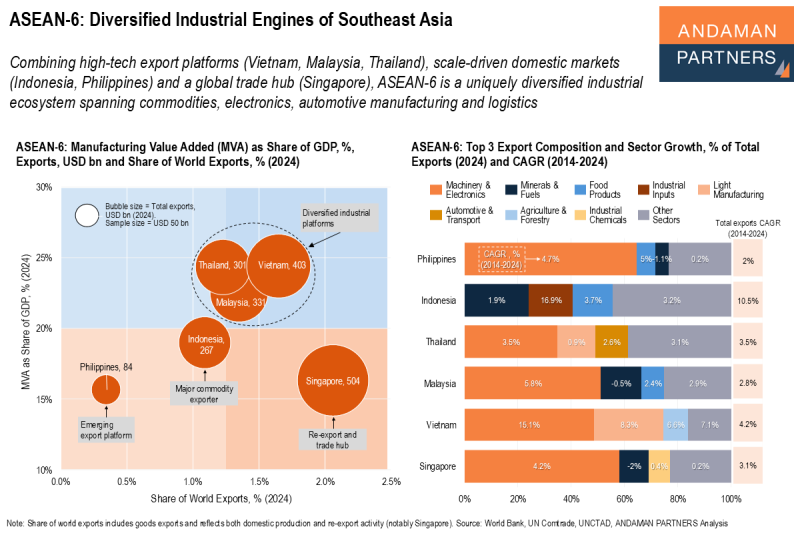

Combining high-tech export platforms (Vietnam, Malaysia, Thailand), scale-driven domestic markets (Indonesia, Philippines) and a global trade hub (Singapore), ASEAN-6 is a uniquely diversified industrial ecosystem spanning commodities, electronics, automotive manufacturing and logistics.

ASEAN-6 stands out as one of the world’s most strategically complementary industrial groupings, combining high-tech export manufacturing, commodity-linked production bases and a globally connected logistics hub. Together, Indonesia, Malaysia, the Philippines, Singapore, Thailand and Vietnam form a diversified ecosystem spanning machinery and electronics, automotive supply chains, resource-based industries and trade intermediation.

The region’s manufacturing intensity varies widely, from highly industrialised export platforms such as Vietnam (MVA 24% of GDP) and Thailand (24%) to more domestically anchored economies such as the Philippines (16%) and Indonesia (19%). Export scale is substantial across the bloc, led by Singapore (USD 504 billion), Vietnam (USD 403 billion), Malaysia (USD 331 billion) and Thailand (USD 301 billion).

Vietnam is the standout high-tech engine, with machinery and electronics dominating exports and driving a 4.2% CAGR in total export growth (2014-2024). Malaysia and Thailand have similarly diversified industrial platforms, combining machinery and electronics with automotive and industrial supply-chain exports, though growth rates are slower (2.8% and 3.5%). Indonesia remains ASEAN’s commodity anchor, with minerals and fuels contributing heavily to exports and the bloc’s fastest export growth (10.5% CAGR 2014-2024).

The Philippines is smaller in scale (USD 84 billion in exports) but shows steady momentum, led by machinery and electronics with a 4.7% CAGR. Singapore remains the region’s trade hub, combining large export value with a lower manufacturing share of GDP (17%), reflecting its re-export and logistics role.

For global procurement managers, ASEAN-6’s key advantage is its optionality: diversified supplier bases, deepening industrial clusters and the ability to combine cost-competitive manufacturing with reliable trade connectivity. The bloc is increasingly positioned as a core sourcing region for machinery and electronics, industrial components and automotive supply chains, while Indonesia strengthens upstream resilience in energy and materials.

Also by ANDAMAN PARTNERS:

ANDAMAN PARTNERS supports international business ventures and growth. We help launch global initiatives and accelerate successful expansion across borders. If your business, operations or project requires cross-border support, contact connect@andamanpartners.com.

ANDAMAN PARTNERS Wishes You a Happy and Prosperous Year of the Horse!

Compliments of the Chinese Lunar New Year to all our clients, customers, suppliers and partners.

ANDAMAN PARTNERS to Attend Investing in African Mining Indaba 2026 in Cape Town

ANDAMAN PARTNERS Co-Founders Kobus van der Wath and Rachel Wu will attend Investing in African Mining Indaba 2026 in Cape Town, South Africa.

Join ANDAMAN PARTNERS at Networking Event in Cape Town Ahead of Mining Indaba 2026

ANDAMAN PARTNERS is pleased to support and sponsor this popular Pre-Indaba event in Cape Town.

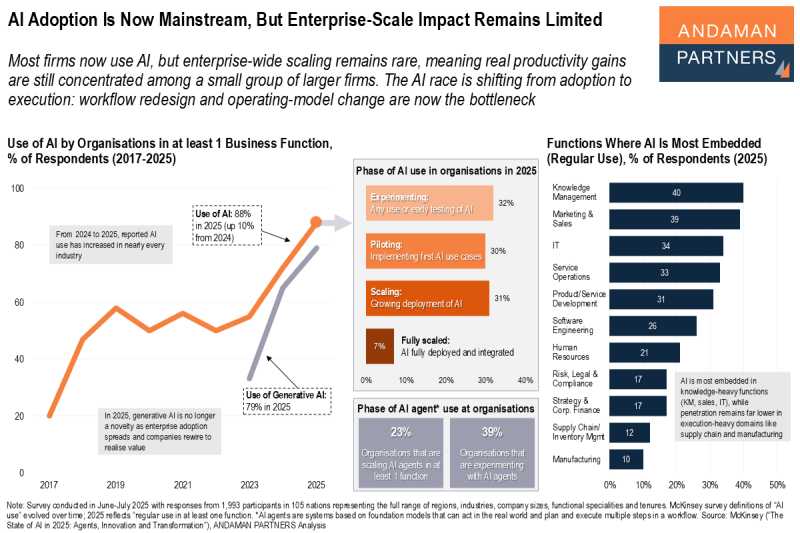

AI Adoption Is Now Mainstream, But Enterprise-Scale Impact Remains Limited

Most firms now use AI, but enterprise-wide scaling remains rare, meaning productivity gains are concentrated in a small group of larger firms.

ASEAN-6: Diversified Industrial Engines of Southeast Asia

Combining high-tech export platforms, scale-driven domestic markets and a global trade hub, ASEAN-6 is a uniquely diversified industrial ecosystem.

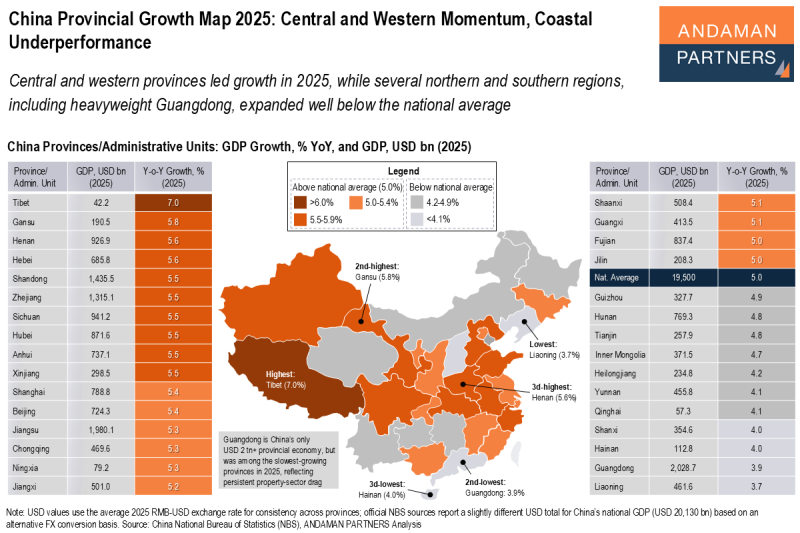

China Provincial Growth Map 2025: Central and Western Momentum, Coastal Underperformance

Central and western provinces led growth in 2025, while several northern and southern regions expanded well below the national average.