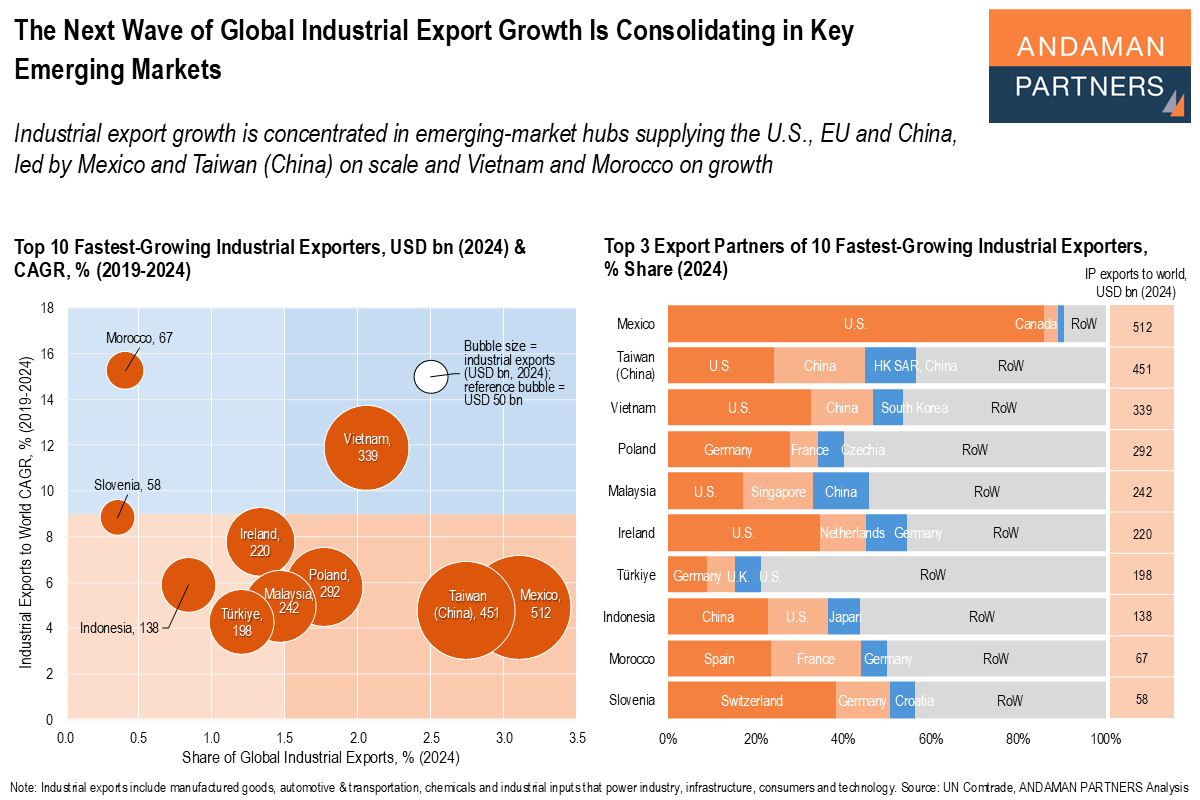

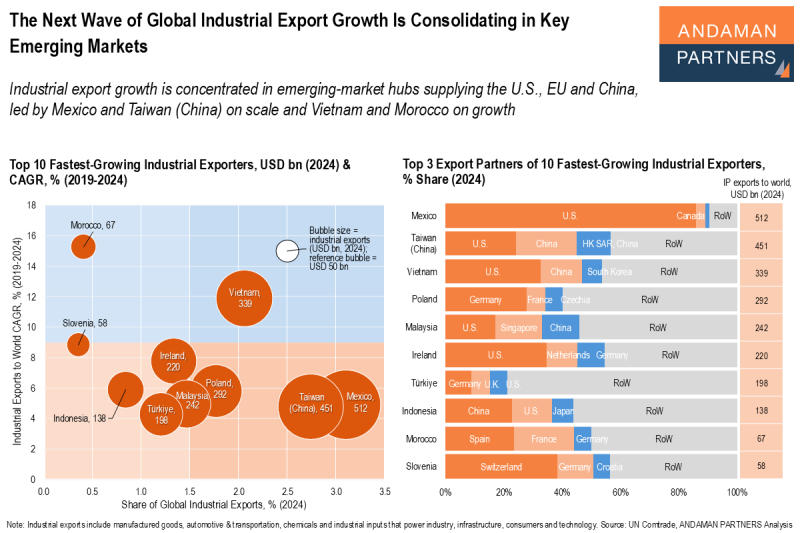

Industrial export growth is concentrated in emerging-market hubs supplying the U.S., EU and China, led by Mexico and Taiwan (China) on scale and Vietnam and Morocco on growth.

Global industrial export growth is consolidating in a small group of highly competitive emerging-market export hubs that are scaling rapidly while remaining tightly integrated into demand from the U.S., the EU and China.

Industrial product exports include manufactured goods such as machinery and electronics, vehicles and other transport equipment and chemicals and intermediate industrial inputs that underpin global manufacturing, infrastructure and consumer industries.

The ten fastest-growing industrial exporters globally by export scale in 2024 and export growth momentum (CAGR, 2019-2024) are a set of high-performing emerging-market hubs that now serve as core industrial suppliers to the U.S., the EU and China. The ten exporters are led by Mexico and Taiwan (China) in scale and by Vietnam and Morocco in growth, along with a cluster of six exporters from Europe and Asia.

- Mexico is the largest exporter in the group, with industrial exports of USD 512 billion in 2024, driven largely by U.S. demand and specialising in autos, electronics and machinery.

- Taiwan (China) follows at USD 451 billion, driven by advanced electronics and semiconductor-linked exports spanning the U.S. and China.

- Vietnam (USD 339 billion) stands out for its strong combination of scale and growth, powered by electronics, consumer goods and diversified assembly supply chains serving the U.S., China and South Korea.

- Poland (USD 292 billion) reflects Europe’s manufacturing depth, supplying Germany and France with machinery, autos and industrial components.

- Malaysia (USD 242 billion) is a key exporter of electronics and semiconductors, embedded in U.S. and China-facing production networks.

- Ireland (USD 220 billion) is distinctive for high-value pharmaceutical and chemicals exports to the U.S. and Europe.

- Türkiye (USD 198 billion) combines industrial breadth (autos, appliances and textiles) with strong European integration.

- Indonesia (USD 138 billion) is scaling exports in resource-linked industrial inputs, metals and basic manufacturing, with China as the leading buyer, followed by the U.S. and Japan.

- Morocco (USD 67 billion) is emerging as a fast-growing nearshore platform for Europe, led by automotive electrical systems and parts supply chains.

- Slovenia (USD 58 billion), though smaller in scale, is a fast-growing EU-integrated exporter specialising in high-value industrial components.

Also by ANDAMAN PARTNERS:

ANDAMAN PARTNERS supports international business ventures and growth. We help launch global initiatives and accelerate successful expansion across borders. If your business, operations or project requires cross-border support, contact connect@andamanpartners.com.

ANDAMAN PARTNERS Wishes You a Happy and Prosperous Year of the Horse!

Compliments of the Chinese Lunar New Year to all our clients, customers, suppliers and partners.

ANDAMAN PARTNERS to Attend Investing in African Mining Indaba 2026 in Cape Town

ANDAMAN PARTNERS Co-Founders Kobus van der Wath and Rachel Wu will attend Investing in African Mining Indaba 2026 in Cape Town, South Africa.

Join ANDAMAN PARTNERS at Networking Event in Cape Town Ahead of Mining Indaba 2026

ANDAMAN PARTNERS is pleased to support and sponsor this popular Pre-Indaba event in Cape Town.

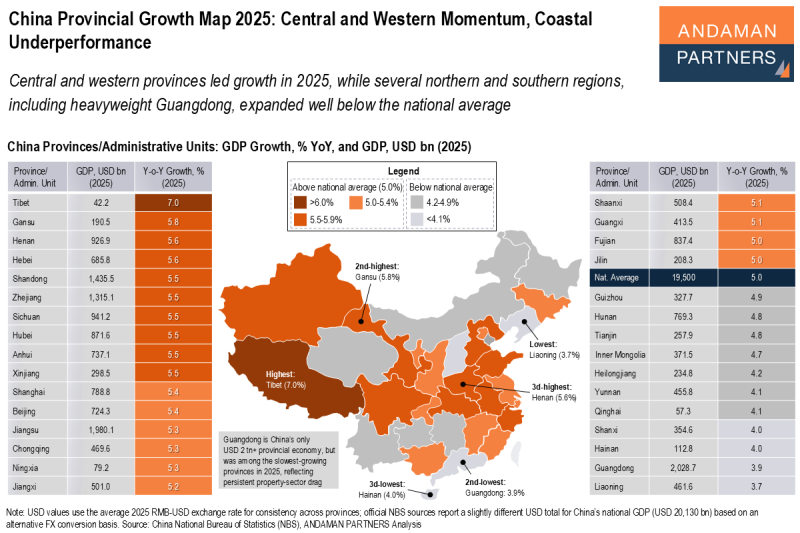

China Provincial Growth Map 2025: Central and Western Momentum, Coastal Underperformance

Central and western provinces led growth in 2025, while several northern and southern regions expanded well below the national average.

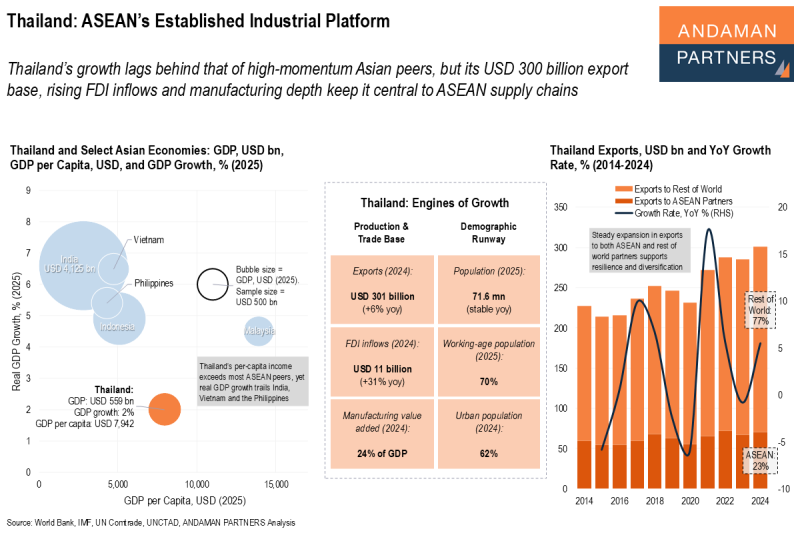

Thailand: ASEAN’s Established Industrial Platform

Thailand’s USD 300 billion export base, rising FDI inflows and manufacturing depth keep it central to ASEAN supply chains.

The Next Wave of Global Industrial Export Growth Is Consolidating in Key Emerging Markets

Industrial export growth is concentrated in emerging-market hubs supplying the U.S., EU and China, led by Mexico and Taiwan (China).