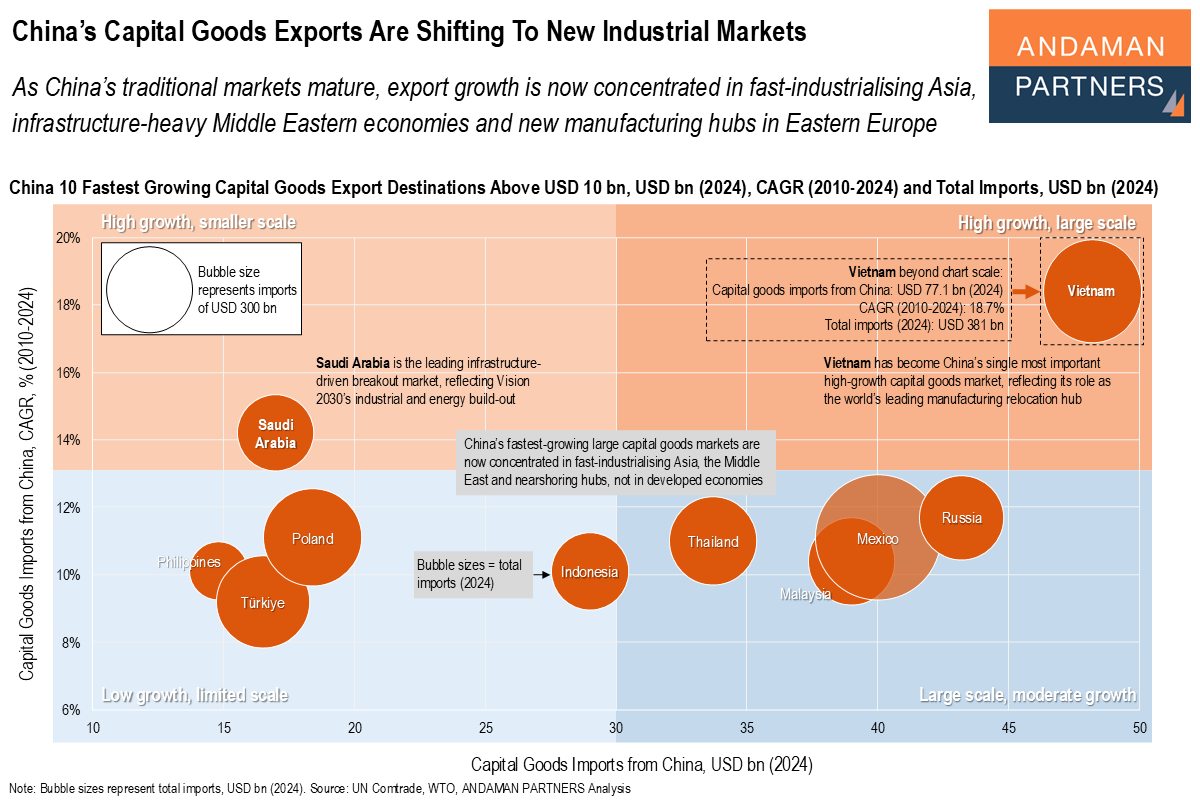

As China’s traditional markets mature, export growth is now concentrated in fast-industrialising Asia, infrastructure-heavy Middle Eastern economies and new manufacturing hubs in Eastern Europe.

China’s capital goods export growth is undergoing an unmistakable and structurally significant geographic reorientation. As China’s traditional developed markets mature, the fastest expansion is no longer coming from developed economies, but from a small group of fast-industrialising markets that are building the next wave of global manufacturing and infrastructure capacity.

Scale and momentum now coincide most strongly in emerging industrial economies. Vietnam stands out as the dominant case. With imports exceeding USD 77 billion in 2024 and a CAGR of nearly 19% over 2010-2024, China has become its single most crucial high-growth capital goods destination. This reflects Vietnam’s role as the world’s leading manufacturing relocation hub, absorbing large volumes of machinery, equipment and production systems as global supply chains continue to diversify.

Across Southeast Asia, Indonesia, Thailand and Malaysia form a tight cluster combining meaningful scale with sustained growth. This concentration reflects the rapid build-out of manufacturing capacity across ASEAN, as multinational firms expand regional production networks in electronics, machinery, automotive and intermediate goods. Mexico plays a similar role from the nearshoring side, linking China’s capital goods exports directly to the reconfiguration of North American manufacturing.

In the Middle East, Saudi Arabia emerges as the leading infrastructure-driven breakout market. Its position reflects the scale of industrial, energy and construction investment under Vision 2030, which is generating sustained demand for heavy equipment, process machinery and industrial systems.

Equally important is what is no longer driving growth. Developed economies are mainly absent from the group of fastest-growing large markets. Export momentum is now structurally concentrated in fast-industrialising Asia, infrastructure-heavy Middle Eastern economies and new manufacturing hubs in Eastern Europe.

This matters because capital goods flows are a forward indicator of where future industrial capacity, supply chains and competitive ecosystems are being built. The centre of gravity of global industrial investment is shifting toward a new set of emerging markets, and China’s capital goods export engine is now firmly aligned with that new industrial geography.

Also by ANDAMAN PARTNERS:

ANDAMAN PARTNERS supports international business ventures and growth. We help launch global initiatives and accelerate successful expansion across borders. If your business, operations or project requires cross-border support, contact connect@andamanpartners.com.

ANDAMAN PARTNERS Wishes You a Happy and Prosperous Year of the Horse!

Compliments of the Chinese Lunar New Year to all our clients, customers, suppliers and partners.

ANDAMAN PARTNERS to Attend Investing in African Mining Indaba 2026 in Cape Town

ANDAMAN PARTNERS Co-Founders Kobus van der Wath and Rachel Wu will attend Investing in African Mining Indaba 2026 in Cape Town, South Africa.

Join ANDAMAN PARTNERS at Networking Event in Cape Town Ahead of Mining Indaba 2026

ANDAMAN PARTNERS is pleased to support and sponsor this popular Pre-Indaba event in Cape Town.

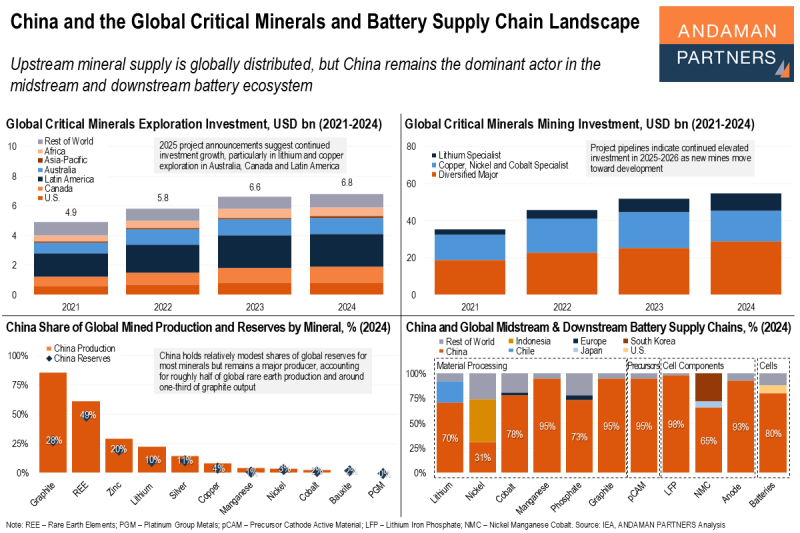

China and the Global Critical Minerals and Battery Supply Chain Landscape

Upstream mineral supply is globally distributed, but China remains the dominant actor in the midstream and downstream battery ecosystem.

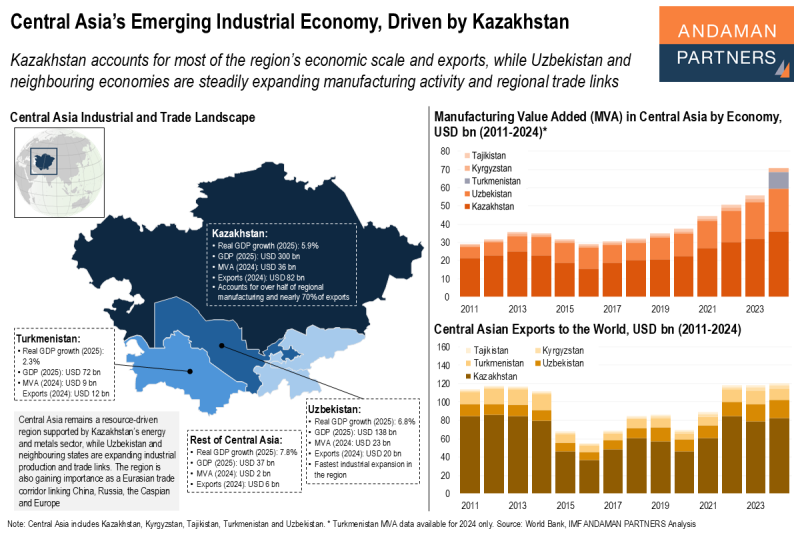

Central Asia’s Emerging Industrial Economy, Driven by Kazakhstan

Kazakhstan accounts for the region’s economic scale, while Uzbekistan and neighbouring economies are expanding manufacturing and trade.

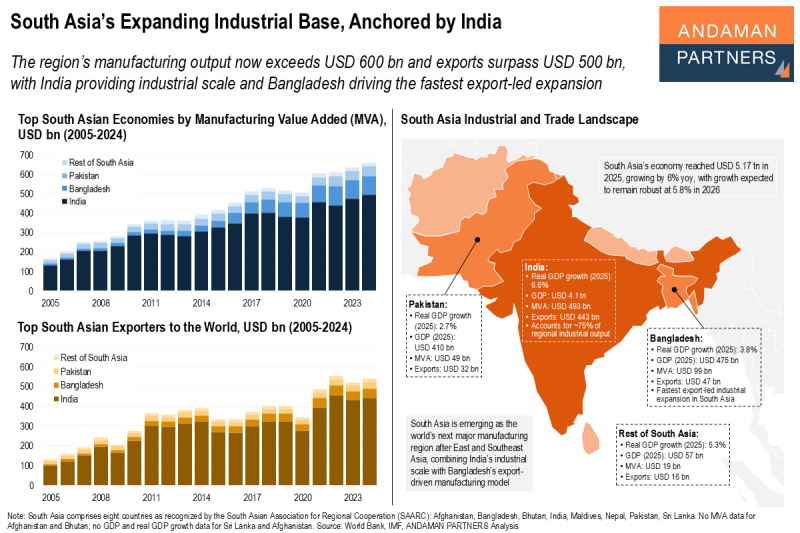

South Asia’s Expanding Industrial Base, Anchored by India

India provides the region’s industrial scale and Bangladesh is driving the fastest export-led expansion.