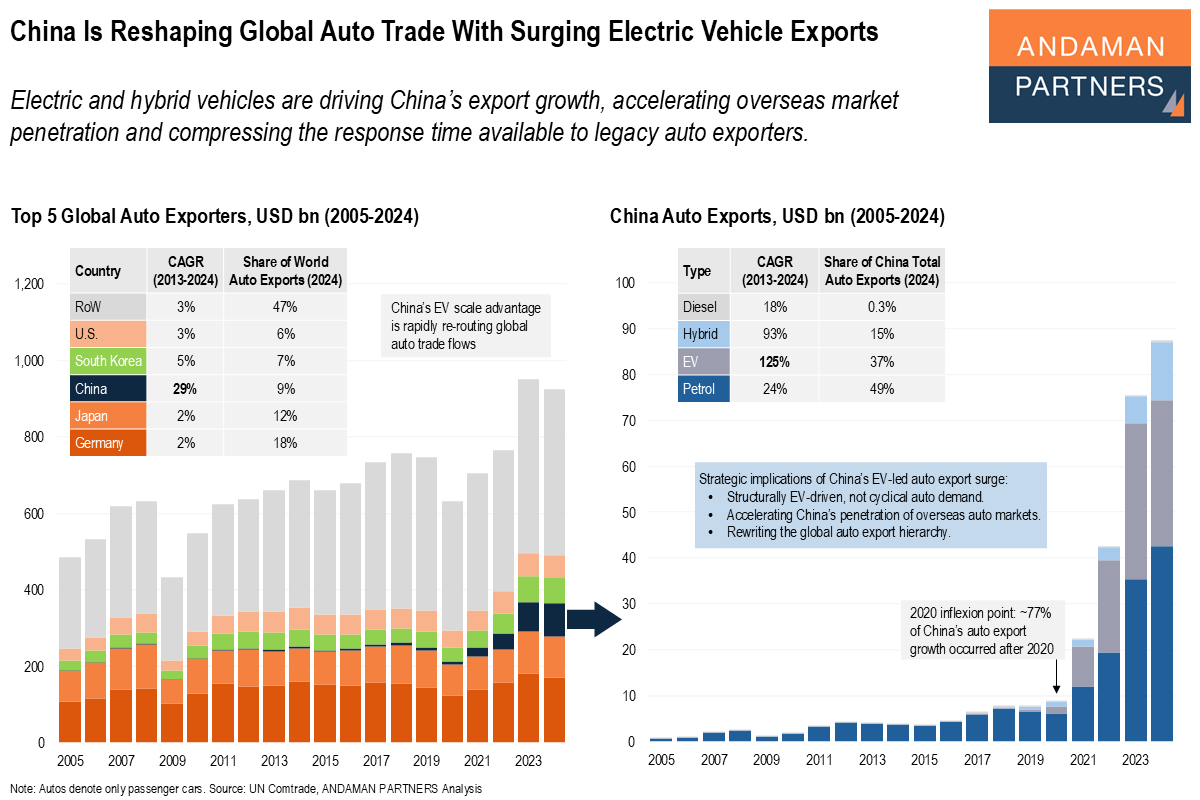

Electric and hybrid vehicles are driving China’s export growth, accelerating overseas market penetration and compressing the response time available to legacy auto exporters.

China’s rise as a global auto exporter has accelerated sharply over the past decade, but the recent surge marks a structural break rather than a cyclical upswing. Between 2013 and 2024, China’s passenger-car exports expanded at a CAGR of roughly 29%, far outpacing every other major exporting economy. By 2024, China accounted for 9% of global auto exports by value, narrowing the gap with long-established exporters such as Germany (18%) and Japan (12%), whose export growth over the same period remained in the low single digits.

What distinguishes China’s export expansion is not scale alone, but composition. Electric Vehicles (EVs) have emerged as the dominant growth engine within China’s auto exports. EV exports expanded at an extraordinary triple-digit 125% CAGR between 2013 and 2024 and now represent more than a third of China’s total auto export value. Hybrid vehicles have followed a similar trajectory, growing at close to 100% annually and accounting for roughly 15% of exports. By contrast, internal-combustion vehicles have grown far more slowly, with petrol cars still representing the largest share of exports by value but no longer driving incremental growth. Diesel vehicles have become almost irrelevant in China’s export mix.

The timing of this shift is equally important. The majority of China’s export expansion has occurred since 2020, marking a clear inflexion point. From 2020 to 2024, China’s total auto exports increased from USD 9 billion to over USD 87 billion, a CAGR of 77%, coinciding with rapid EV model proliferation, battery cost compression and the scaling of dedicated export platforms. This acceleration underscores that China’s auto export growth is not a recovery from past weakness, but a rapid deployment of new-generation vehicles into global markets.

At the global level, this has begun to reshape the competitive landscape. While traditional exporters such as Germany, Japan, South Korea and the U.S. remain significant players, their export growth over the past decade has been modest. China, by contrast, has combined speed, scale and technology transition in a way that is re-ordering relative positions in global auto trade. The centre of gravity is shifting away from legacy production dominance toward EV capability, supply-chain integration and cost competitiveness.

The strategic implications of these changes in global auto trade are clear. First, China’s auto export growth is structurally EV-driven, not a cyclical rebound in conventional vehicle demand. Second, EV scale is enabling faster and deeper penetration of overseas markets than internal-combustion vehicles ever achieved. Third, the global auto export hierarchy is being reordered around EV adoption rather than historical incumbency. For governments, manufacturers and suppliers alike, this shift raises the stakes around trade policy, market access and supply-chain positioning, as EVs move from niche exports to the central battleground of global automotive competition.

Also by ANDAMAN PARTNERS:

ANDAMAN PARTNERS supports international business ventures and growth. We help launch global initiatives and accelerate successful expansion across borders. If your business, operations or project requires cross-border support, contact connect@andamanpartners.com.

ANDAMAN PARTNERS Wishes You a Happy and Prosperous Year of the Horse!

Compliments of the Chinese Lunar New Year to all our clients, customers, suppliers and partners.

ANDAMAN PARTNERS to Attend Investing in African Mining Indaba 2026 in Cape Town

ANDAMAN PARTNERS Co-Founders Kobus van der Wath and Rachel Wu will attend Investing in African Mining Indaba 2026 in Cape Town, South Africa.

Join ANDAMAN PARTNERS at Networking Event in Cape Town Ahead of Mining Indaba 2026

ANDAMAN PARTNERS is pleased to support and sponsor this popular Pre-Indaba event in Cape Town.

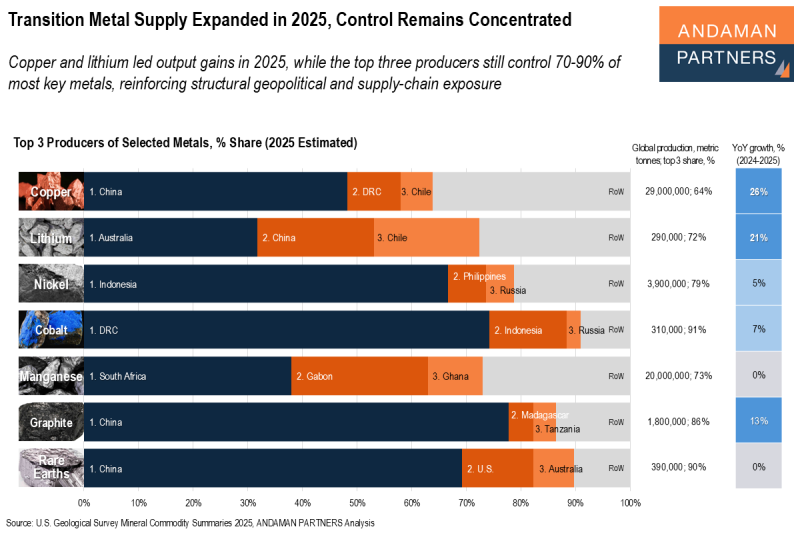

Transition Metal Supply Expanded in 2025, Control Remains Concentrated

Copper and lithium led output gains in 2025, while the top three producers still control 70-90% of most key metals.

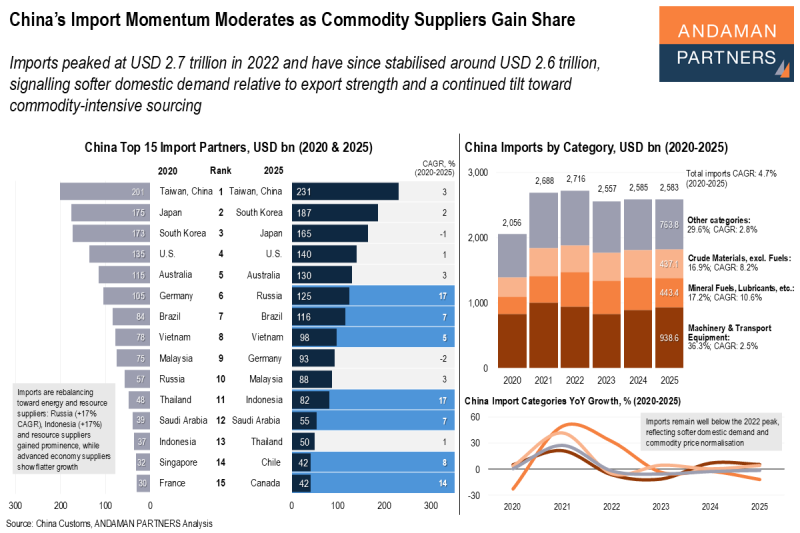

China’s Import Momentum Moderates as Commodity Suppliers Gain Share

Imports have stabilised around USD 2.6 trillion, signalling softer domestic demand and a continued tilt toward commodity-intensive sourcing.

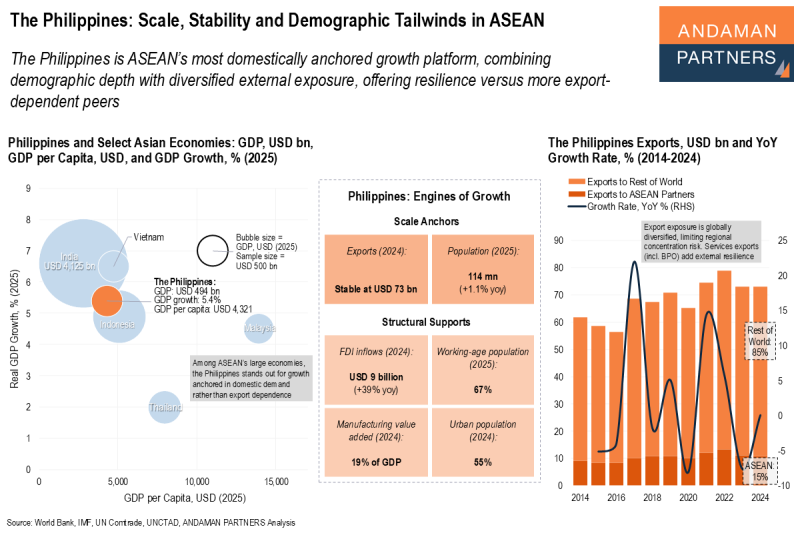

The Philippines: Scale, Stability and Demographic Tailwinds in ASEAN

The Philippines is ASEAN’s most domestically anchored growth platform, combining demographic depth with diversified external exposure.