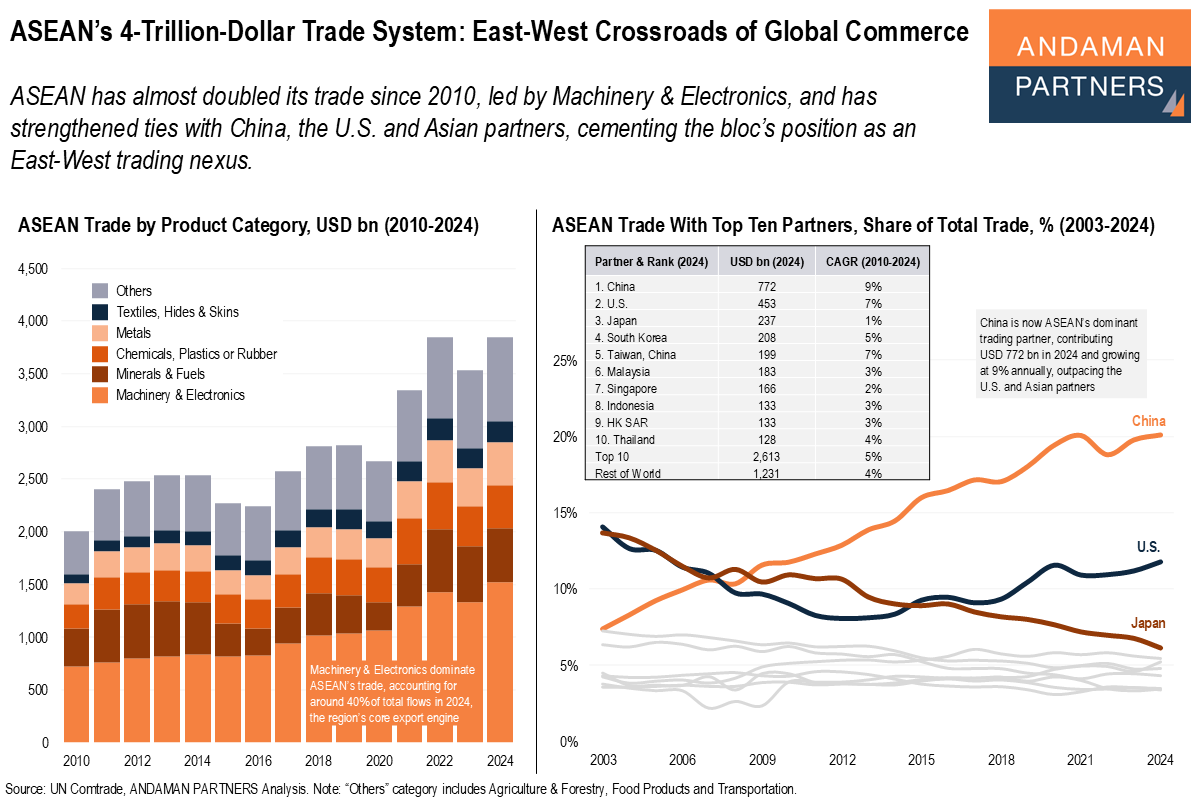

ASEAN has almost doubled its trade since 2010, led by Machinery & Electronics, and has strengthened ties with China, the U.S. and Asian partners, cementing the bloc’s position as an East-West trading nexus.

ASEAN’s trade profile reveals a structural transformation that is reshaping how global companies must think about supply chains, market access and long-term commercial positioning in Asia.

From 2010 to 2024, ASEAN has almost doubled its total trade to nearly USD 4 trillion, placing it in the same tier as the EU and far larger than most emerging-market blocs. But the true strategic significance lies not only in the scale of ASEAN’s trade, but in the composition of what it trades and the partners with which it is increasingly integrated.

Machinery & Electronics have become the mainstay of ASEAN’s trade expansion, now accounting for roughly 40% of all flows. This shift reflects the region’s ascent as a central node in global manufacturing value chains, spanning semiconductors, consumer electronics, automotive components and industrial machinery.

This development is not accidental; it stems from two reinforcing trends highlighted in recent analysis: rising investment in advanced manufacturing in Vietnam, Malaysia, Singapore and Thailand, and strategic diversification by global producers seeking resilient, multi-country production footprints beyond China. As multinational firms rebalance their global operations, ASEAN offers scale, labour depth, geographic proximity to China and a rapidly improving logistics and digital infrastructure base.

Equally important is the evolution of ASEAN’s trade partnerships. China has become the region’s dominant trading counterpart, contributing more than USD 770 billion in 2024 and growing at nearly 9% annually since 2010, outpacing the U.S. (7%) and prominent Asian partners such as South Korea (5%), Thailand (4%), Malaysia (3%) and Japan (1%). ASEAN’s trade with China is driven not only by goods flows but also by China’s deep role in supplying intermediate products, capital goods and industrial inputs that feed ASEAN’s expanding manufacturing base.

Aside from China, trade with the U.S., Japan, South Korea and Taiwan (China) remains substantial and strategically vital, giving ASEAN a uniquely balanced partner architecture that few other regions can match. This balance, a strong China foundation combined with diversified ties to advanced economies, underpins ASEAN’s role as an East–West trade nexus.

ASEAN is no longer simply a destination for market expansion or low-cost production; it is a platform where global and regional value chains converge, and where future growth in electronics, machinery and industrial processing will increasingly originate. Companies that do not embed ASEAN into their long-term supply-chain strategy risk missing one of the most durable shifts in global trade architecture of the coming decade.

Also by ANDAMAN PARTNERS:

ANDAMAN PARTNERS supports international business ventures and growth. We help launch global initiatives and accelerate successful expansion across borders. If your business, operations or project requires cross-border support, contact connect@andamanpartners.com.

ANDAMAN PARTNERS to Attend Investing in African Mining Indaba 2026 in Cape Town

ANDAMAN PARTNERS Co-Founders Kobus van der Wath and Rachel Wu will attend Investing in African Mining Indaba 2026 in Cape Town, South Africa.

Join ANDAMAN PARTNERS at Networking Event in Cape Town Ahead of Mining Indaba 2026

ANDAMAN PARTNERS is pleased to support and sponsor this popular Pre-Indaba event in Cape Town.

AAMEG Event in Cape Town Ahead of Mining Indaba 2026

ANDAMAN PARTNERS is pleased to sponsor and support the AAMEG pre-Mining Indaba Cocktails & Canapes event.

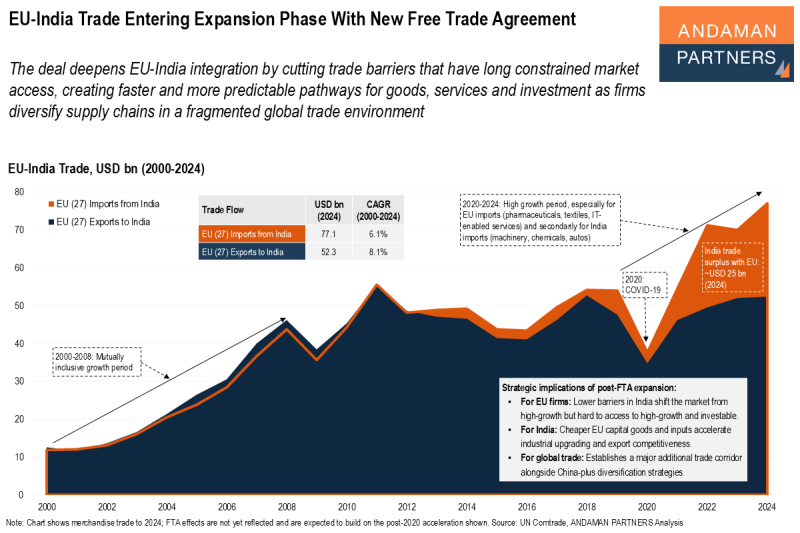

EU-India Trade Entering Expansion Phase With New Free Trade Agreement

The deal deepens EU-India integration by cutting trade barriers that have long constrained market access.

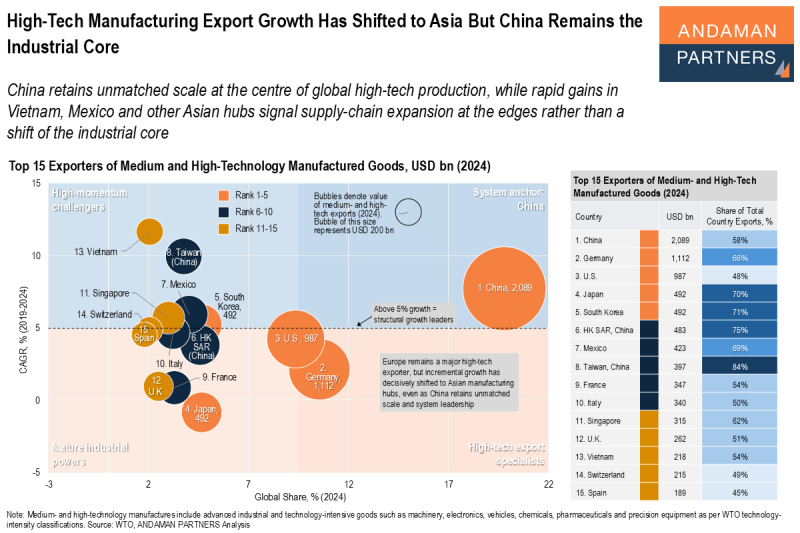

High-Tech Manufacturing Export Growth Has Shifted to Asia, But China Remains the Industrial Core

China retains unmatched scale at the centre of global high-tech production, while rapid gains in Vietnam, Mexico and other Asian hubs.

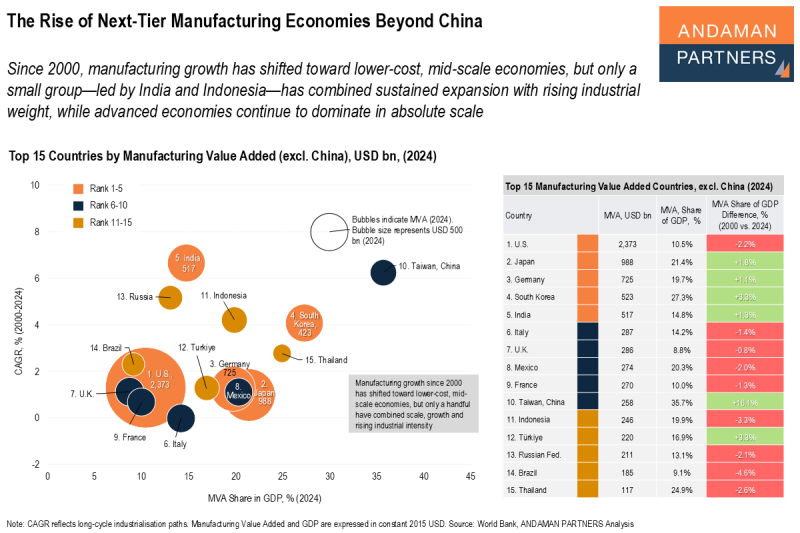

The Rise of Next-Tier Manufacturing Economies Beyond China

Manufacturing growth shifted toward lower-cost, mid-scale economies, but only a small group has combined sustained expansion with rising industrial weight.