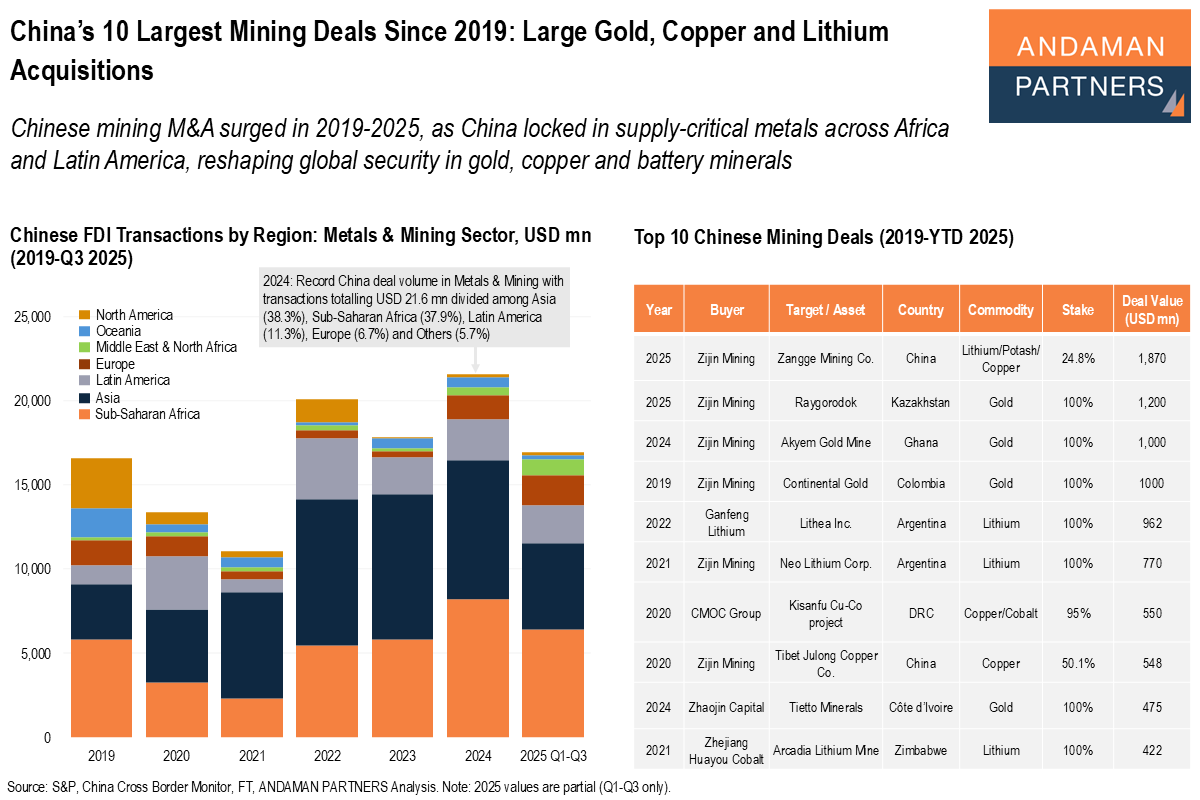

Chinese mining M&A surged in 2019-2025, as China locked in supply-critical metals across Africa and Latin America, reshaping global security in gold, copper and battery minerals.

The ten largest Chinese M&A transactions since 2019 illustrate the strategic focus, geographic priorities and commodity logic of China’s overseas mining expansion. The list is overwhelmingly dominated by Zijin Mining, which accounts for six of the ten deals, underscoring the firm’s central role as China’s flagship international miner.

These ten transactions collectively focus on gold, copper, lithium and associated battery minerals, spanning Africa, Latin America, Central Asia and China itself, confirming the global breadth of China’s resource acquisition strategy.

The two largest deals of the period occurred in 2025, with Zijin Mining acquiring Zangge Mining Co. (China) for USD 1.87 billion and the Raygorodok gold project in Kazakhstan for USD 1.2 billion. The first deal’s combination of lithium, potash and copper shows how Chinese firms increasingly target multi-resource portfolios. In contrast, the second confirms Zijin’s continued appetite for significant, high-grade gold assets.

In 2024, Zijin completed a USD 1 billion acquisition of the Akyem Gold Mine in Ghana, adding another significant African gold deposit to its expanding footprint on the continent. This follows its earlier USD 1 billion purchase of Continental Gold in Colombia (2019), a foundational transaction that marked the beginning of China’s rapid build-up of overseas gold capacity during this period.

Beyond gold, the list shows China’s strategic priority for lithium, the core input for EV batteries. Two major lithium deals stand out:

- Ganfeng Lithium’s acquisition of Lithea Inc. in Argentina for USD 962 million (2022)

- Zijin’s USD 770 million purchase of Neo Lithium Corp., also in Argentina (2021)

Both assets are located in the South American Lithium Triangle, reinforcing China’s commitment to locking in long-term battery supply chains.

Copper and cobalt, essential for electric grids and energy transition infrastructure, appear on the list via CMOC Group’s USD 550 million acquisition of the Kisanfu Cu-Co project in the DRC (2020), and Zijin’s USD 548 million acquisition of Tibet Julong Copper Co. (2020). Together, these assets strengthen China’s already dominant global position in copper and cobalt production.

Finally, Zhaojin Capital’s USD 475 million acquisition of Côte d’Ivoire’s Tietto Minerals (2024) and Zhejiang Huayou Cobalt’s USD 422 million purchase of Zimbabwe’s Arcadia Lithium Mine (2021) round out the list, confirming that Africa remains central to China’s supply-security strategy.

Also by ANDAMAN PARTNERS:

ANDAMAN PARTNERS supports international business ventures and growth. We help launch global initiatives and accelerate successful expansion across borders. If your business, operations or project requires cross-border support, contact connect@andamanpartners.com.

ANDAMAN PARTNERS Wishes You a Happy and Prosperous Year of the Horse!

Compliments of the Chinese Lunar New Year to all our clients, customers, suppliers and partners.

ANDAMAN PARTNERS to Attend Investing in African Mining Indaba 2026 in Cape Town

ANDAMAN PARTNERS Co-Founders Kobus van der Wath and Rachel Wu will attend Investing in African Mining Indaba 2026 in Cape Town, South Africa.

Join ANDAMAN PARTNERS at Networking Event in Cape Town Ahead of Mining Indaba 2026

ANDAMAN PARTNERS is pleased to support and sponsor this popular Pre-Indaba event in Cape Town.

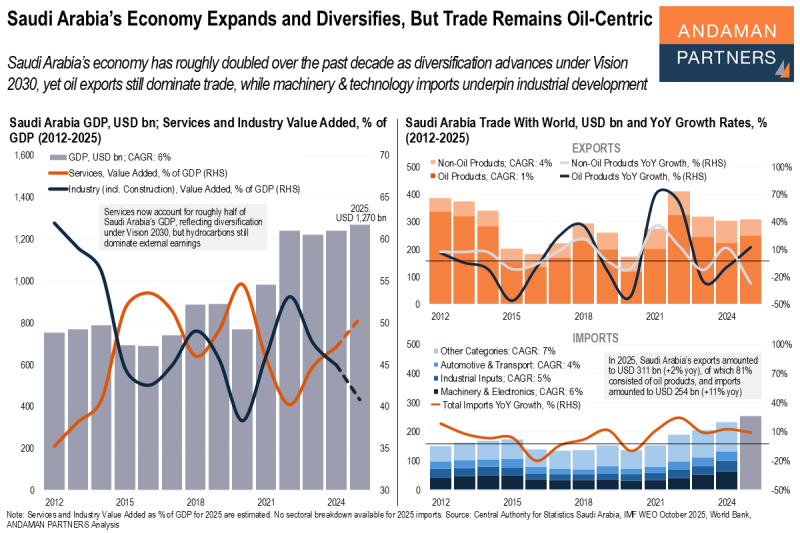

Saudi Arabia’s Economy Expands and Diversifies, But Trade Remains Oil-Centric

Saudi Arabia’s economy has roughly doubled over the past decade, yet oil exports still dominate trade.

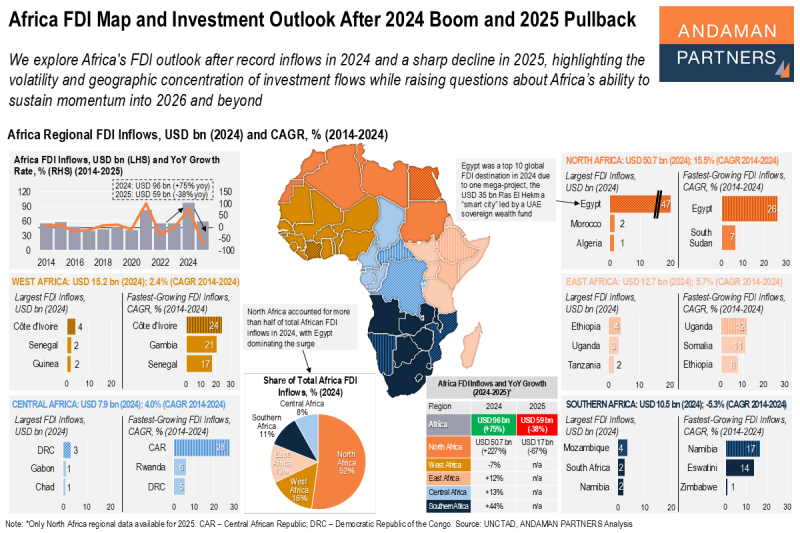

Africa FDI Map and Investment Outlook After 2024 Boom and 2025 Pullback

The volatility and geographic concentration of investment flows raises questions about Africa’s ability to sustain momentum into 2026 and beyond.

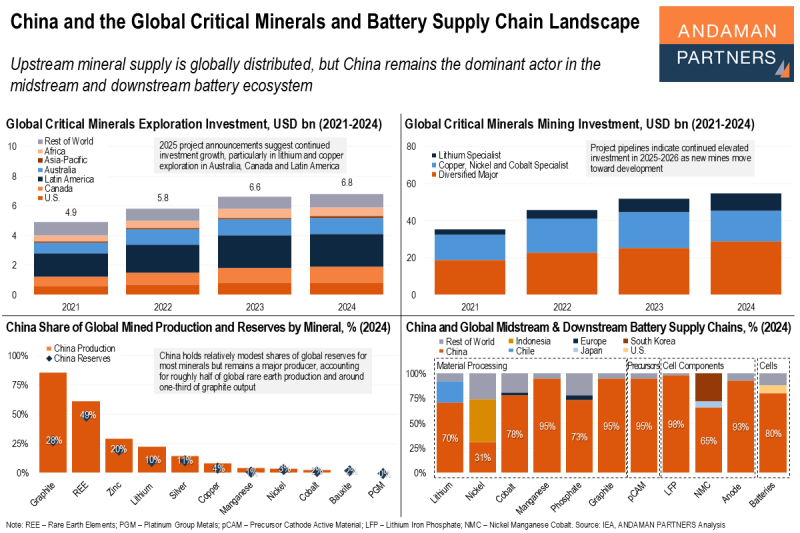

China and the Global Critical Minerals and Battery Supply Chain Landscape

Upstream mineral supply is globally distributed, but China remains the dominant actor in the midstream and downstream battery ecosystem.