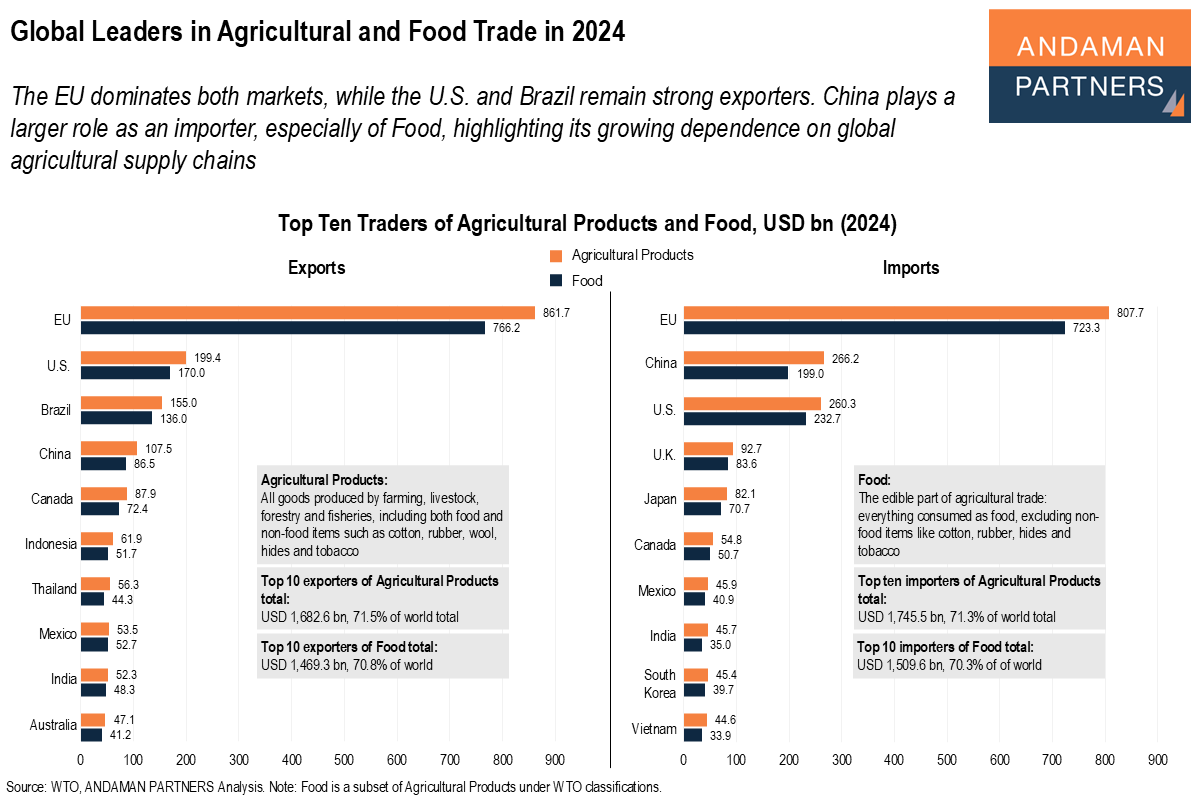

The EU dominates both markets, while the U.S. and Brazil remain strong exporters. China plays a larger role as an importer, especially of Food, highlighting its growing dependence on global agricultural supply chains.

The global trade landscape for agricultural products and food is highly concentrated, with the top ten traders accounting for more than 70% of world flows. The European Union (EU) overwhelmingly anchors both markets: it is by far the largest exporter and importer of agricultural goods and food, reflecting the depth of its integrated value chains, its strong production base and its heavy intra-EU trade.

For a detailed study on global agricultural trade in the years before 2024, please see Global Agriculture: Producing and Trading the World’s Food and Strategic Implications for Agri Businesses.

The U.S. and Brazil follow as the next major exporters, but neither comes close to the EU’s scale, underscoring the bloc’s central role in shaping global agricultural supply and demand. The U.S. and Brazil remain structurally strong agricultural suppliers, while China’s export role is more limited.

The picture flips on the import side: China is the second-largest importer of agricultural products after the EU and a significant overall food importer. This divergence highlights a fundamental structural pattern: the U.S. and Brazil are net providers of global agricultural commodities and food, whereas China is increasingly a primary destination market.

Other advanced economies, such as the U.K., Japan and Canada, also appear prominently as importers, reflecting their heavy dependence on external suppliers of food and agricultural raw materials.

The side-by-side comparison reveals that food is consistently slightly smaller than total agricultural trade for every major country, confirming that a meaningful portion of global agricultural commerce lies in non-food items such as cotton, rubber, hides and wool.

For countries like Brazil, Indonesia, and India, the gap between agricultural and food exports is especially visible, suggesting a strong role in supplying raw agricultural materials and edible goods. Conversely, on the import side, China and the U.S. show large food import volumes relative to total agricultural imports, indicating the scale of their domestic consumption needs.

Also by ANDAMAN PARTNERS:

ANDAMAN PARTNERS supports international business ventures and growth. We help launch global initiatives and accelerate successful expansion across borders. If your business, operations or project requires cross-border support, contact connect@andamanpartners.com.

ANDAMAN PARTNERS Wishes You a Happy and Prosperous Year of the Horse!

Compliments of the Chinese Lunar New Year to all our clients, customers, suppliers and partners.

ANDAMAN PARTNERS to Attend Investing in African Mining Indaba 2026 in Cape Town

ANDAMAN PARTNERS Co-Founders Kobus van der Wath and Rachel Wu will attend Investing in African Mining Indaba 2026 in Cape Town, South Africa.

Join ANDAMAN PARTNERS at Networking Event in Cape Town Ahead of Mining Indaba 2026

ANDAMAN PARTNERS is pleased to support and sponsor this popular Pre-Indaba event in Cape Town.

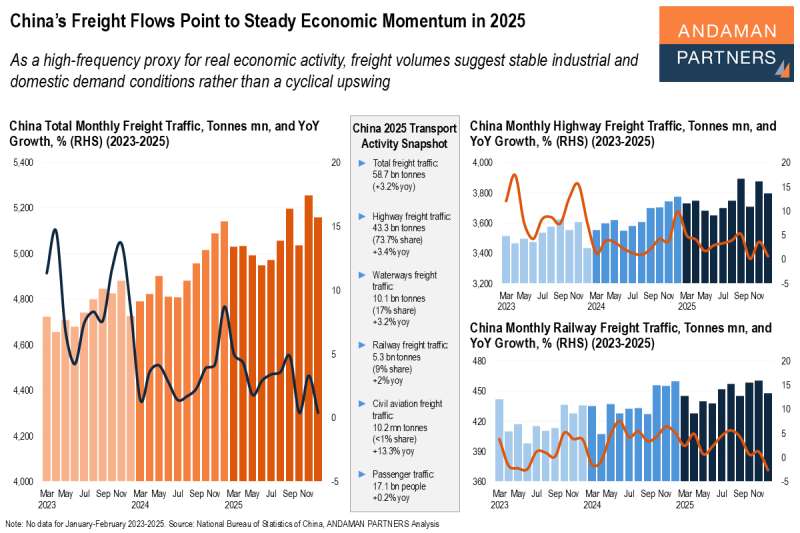

China’s Freight Flows Point to Steady Economic Momentum in 2025

Freight volumes suggest stable conditions in industrial and domestic demand rather than a cyclical upswing.

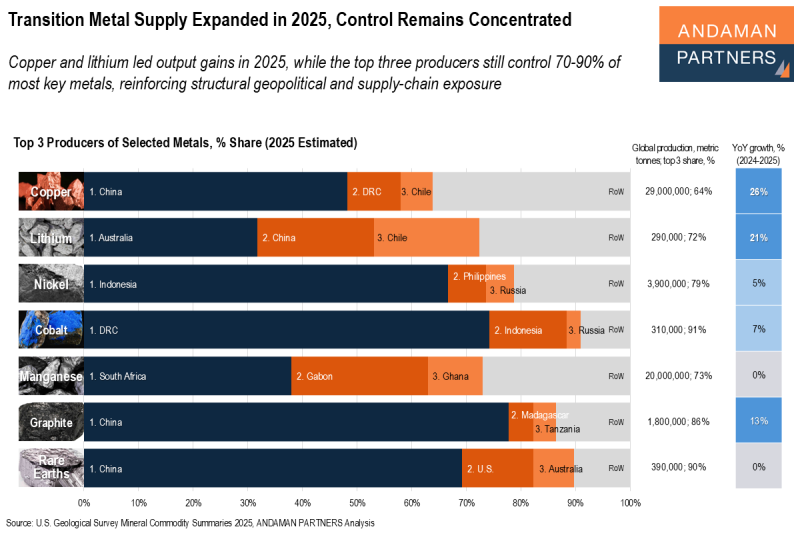

Transition Metal Supply Expanded in 2025, Control Remains Concentrated

Copper and lithium led output gains in 2025, while the top three producers still control 70-90% of most key metals.

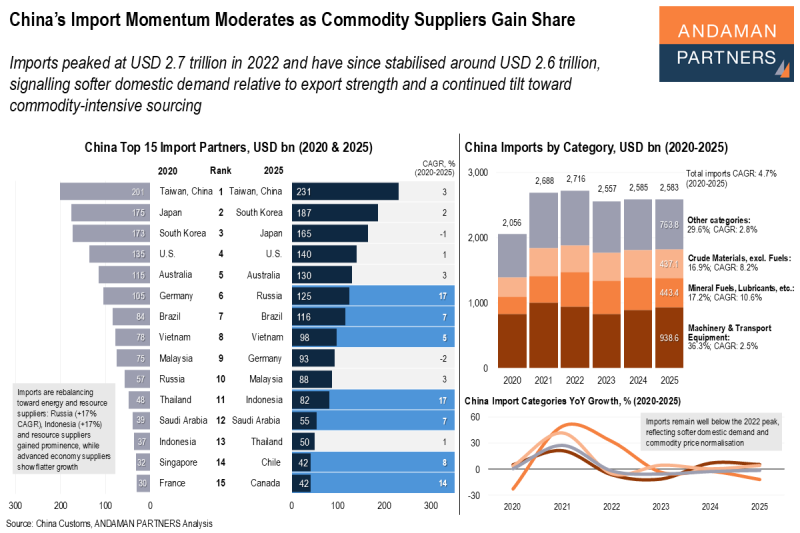

China’s Import Momentum Moderates as Commodity Suppliers Gain Share

Imports have stabilised around USD 2.6 trillion, signalling softer domestic demand and a continued tilt toward commodity-intensive sourcing.