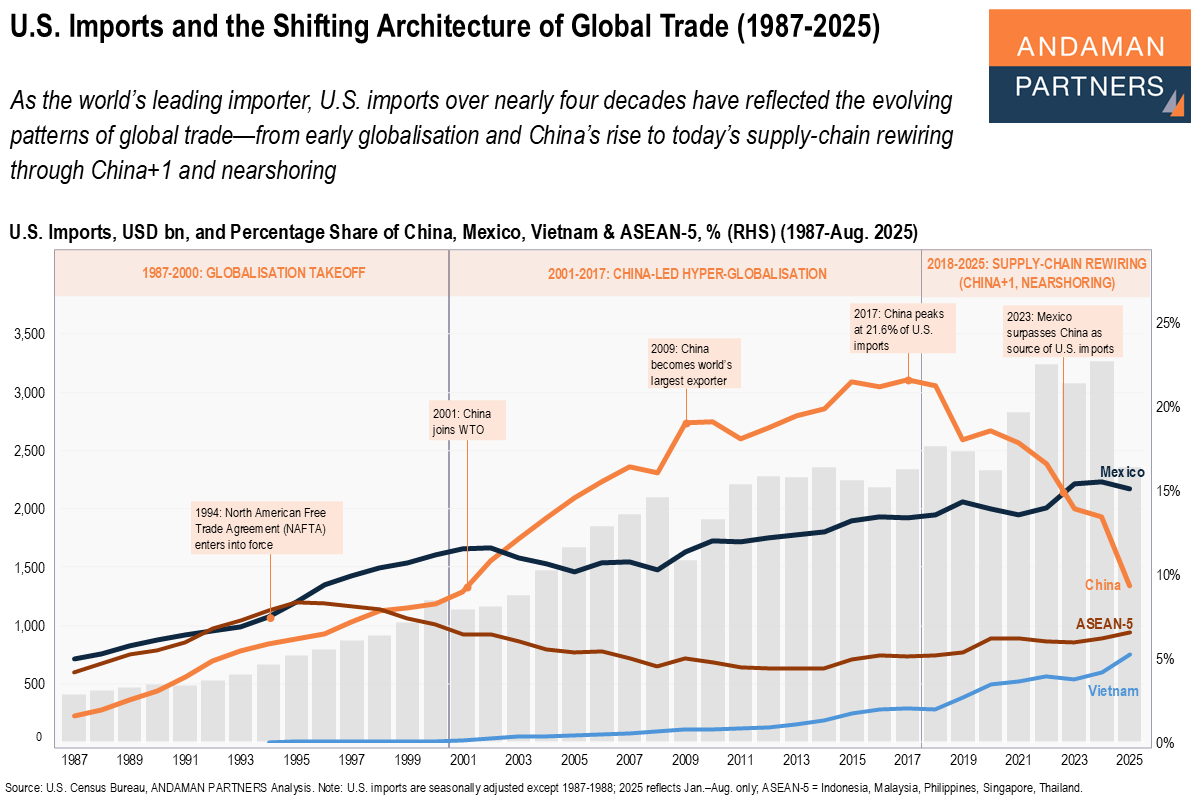

As the world’s leading importer, U.S. imports over nearly four decades have reflected the evolving patterns of global trade—from early globalisation and China’s rise to today’s supply-chain rewiring through China+1 and nearshoring.

Over nearly four decades, U.S. imports have provided the most unambiguous indication of significant shifts in the global trading system. From the late 1980s through 2000, the U.S. absorbed rising volumes of goods as globalisation took off, supply chains lengthened and manufacturers dispersed production across North America and Asia.

This period was the foundational era of modern trade integration, defined by tariff liberalisation, the commencement of the North American Free Trade Agreement (NAFTA) in 1994 and the early stages of offshore manufacturing in Mexico and the Association of Southeast Asian Nations (ASEAN) economies.

From 2001 to 2017, globalisation entered its China-led phase. China’s WTO accession triggered the fastest and most extensive supply-chain integration in modern economic history. China became the world’s largest exporter in 2009 and reached a peak share of 21.6% of all U.S. imports in 2017, reflecting its central role in global electronics, machinery, consumer goods and intermediate components.

U.S. import patterns during this period capture the consolidation of China-centric supply chains and the deep interdependence that characterised the hyper-globalisation era.

Since 2018, the structure of U.S. imports has shifted sharply as global trade entered a new phase of diversification and resilience. China’s share of U.S. imports has fallen rapidly. At the same time, Mexico has risen to become the U.S.’s largest import source, and Vietnam and the ASEAN-5 economies (Indonesia, Malaysia, the Philippines, Singapore and Thailand) have steadily gained ground as China+1 sourcing options.

This supply-chain rewiring period reflects a long-term, organic rebalancing of global production, driven by geopolitics, cost dynamics, industrial policy and corporate strategies to build multi-node, regionally anchored supply networks. The result is a more distributed global trade architecture, with China still central but no longer singular.

Also by ANDAMAN PARTNERS:

ANDAMAN PARTNERS supports international business ventures and growth. We help launch global initiatives and accelerate successful expansion across borders. If your business, operations or project requires cross-border support, contact connect@andamanpartners.com.

Join ANDAMAN PARTNERS at Networking Event in Cape Town Ahead of Mining Indaba 2026

ANDAMAN PARTNERS is pleased to support and sponsor this popular Pre-Indaba event in Cape Town.

AAMEG Event in Cape Town Ahead of Mining Indaba 2026

ANDAMAN PARTNERS is pleased to sponsor and support the AAMEG pre-Mining Indaba Cocktails & Canapes event.

AAMEG & ACBSA Event in Johannesburg Ahead of Mining Indaba 2026

ANDAMAN PARTNERS is pleased to sponsor and support the AAMEG & ABCSA pre-Mining Indaba Connections & Canapes event.

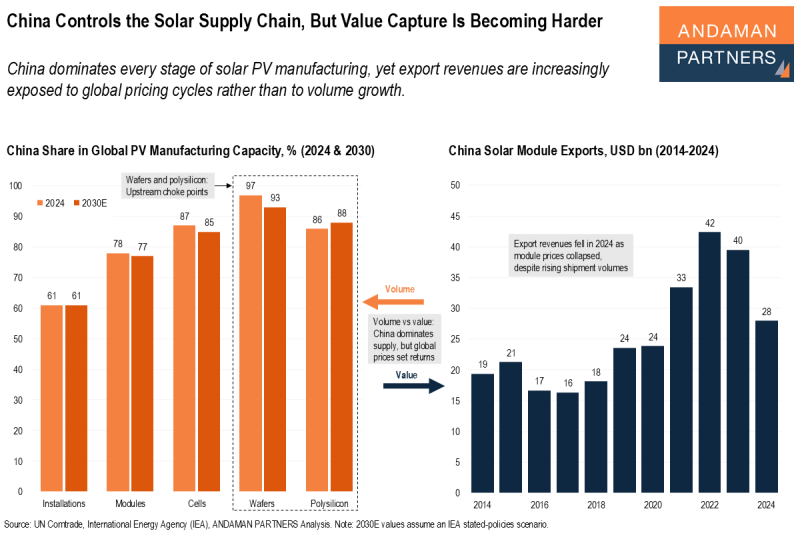

China Controls the Solar Supply Chain, But Value Capture Is Becoming Harder

China dominates every stage of solar PV manufacturing, yet export revenues are increasingly exposed to global pricing cycles rather than to volume growth.

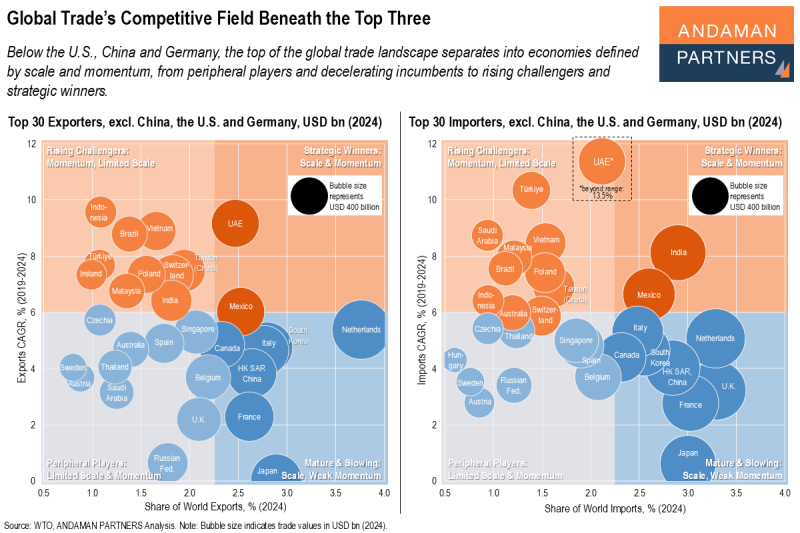

Global Trade’s Competitive Field Beneath the Top Three

The top of the global trade landscape separates into economies defined by scale and momentum.

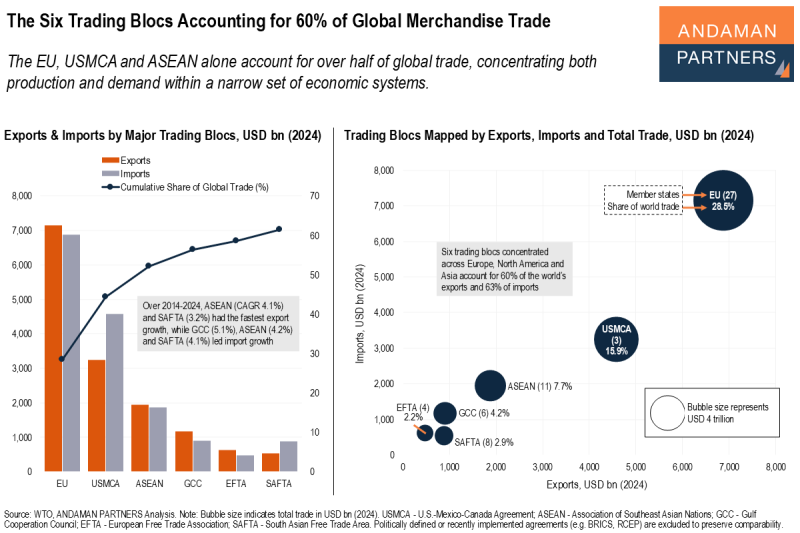

The Six Trading Blocs Accounting for 60% of Global Merchandise Trade

The EU, USMCA and ASEAN alone account for over half of global trade, concentrating both production and demand within a narrow set of economic systems.