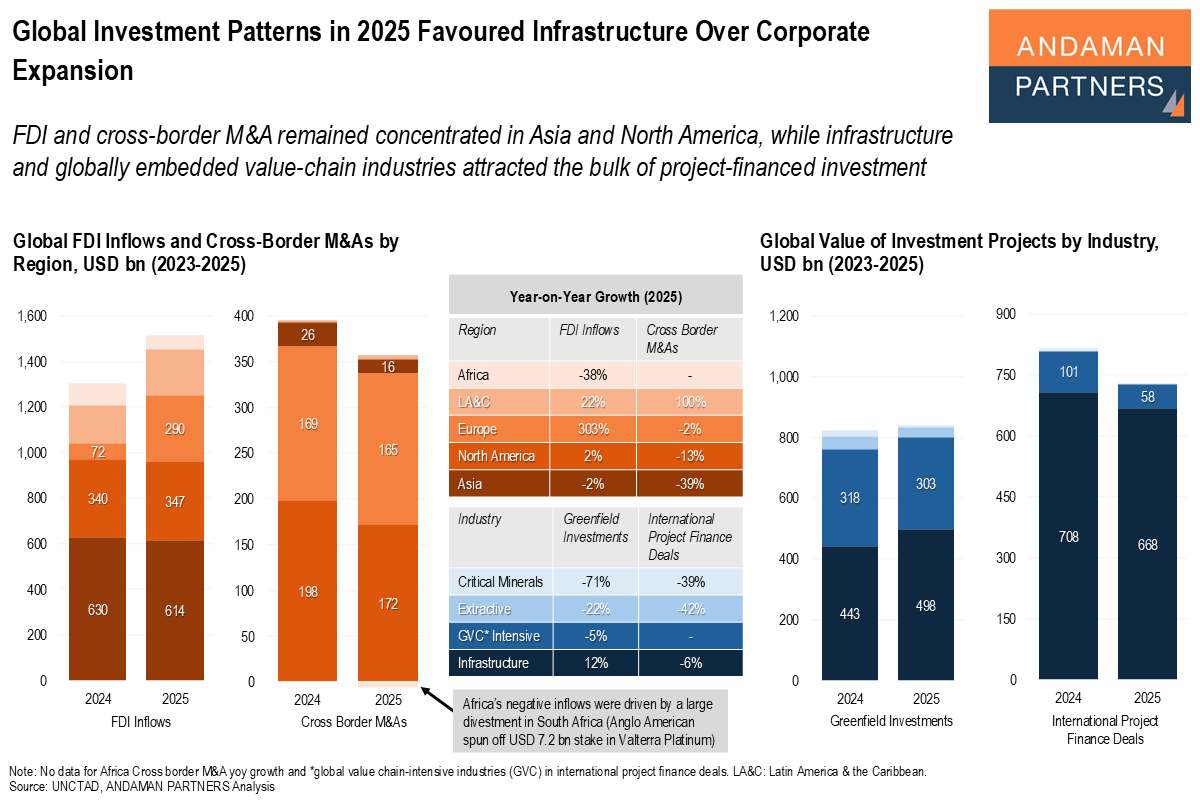

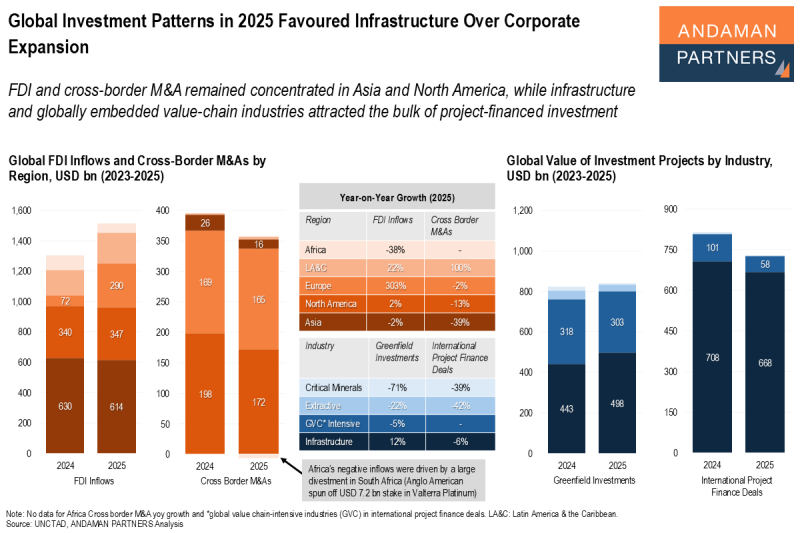

FDI and cross-border M&A remained concentrated in Asia and North America, while infrastructure and globally embedded value-chain industries attracted the bulk of project-financed investment.

Global investment patterns in 2025 reflected a clear divergence between corporate expansion and project-financed investment. On the corporate side, global FDI inflows and cross-border M&A remained sizable in absolute terms but were uneven across regions and softer in momentum. Asia and North America continued to account for the largest share of FDI, while Europe recorded a sharp year-on-year rebound from a low base. Cross-border M&A activity weakened across several major regions in 2025, most notably in Asia and North America, underscoring continued caution around large discretionary corporate transactions.

By contrast, project-financed investment displayed greater stability, particularly in infrastructure and globally embedded value-chain industries. While overall greenfield investment levels were broadly stable between 2024 and 2025, infrastructure was the only major category to show positive year-on-year growth.

International project finance volumes declined modestly in 2025 but remained concentrated in long-lived assets with relatively predictable cash flows. This contrasts with a sharp pullback in critical minerals and extractive projects, highlighting a selective rather than broad-based preference within asset-linked investment.

The year-on-year growth breakdown reinforces this picture. Corporate investment flows showed significant regional dispersion, with weak outcomes in Africa and Asia offset by strong growth in Europe and Latin America. Within project finance, infrastructure proved comparatively resilient, while commodity-exposed sectors experienced pronounced retrenchment.

Taken together, the data suggest that in 2025, global capital allocation was shaped less by a generalised expansionary cycle and more by caution and selectivity. Corporate investment remained concentrated in established regions, while project finance favoured infrastructure and essential value-chain assets over more cyclical or price-sensitive opportunities. This pattern highlights how risk considerations and cash-flow visibility continued to play a crucial role in shaping global investment decisions during the year.

Also by ANDAMAN PARTNERS:

ANDAMAN PARTNERS supports international business ventures and growth. We help launch global initiatives and accelerate successful expansion across borders. If your business, operations or project requires cross-border support, contact connect@andamanpartners.com.

ANDAMAN PARTNERS to Attend Investing in African Mining Indaba 2026 in Cape Town

ANDAMAN PARTNERS Co-Founders Kobus van der Wath and Rachel Wu will attend Investing in African Mining Indaba 2026 in Cape Town, South Africa.

Join ANDAMAN PARTNERS at Networking Event in Cape Town Ahead of Mining Indaba 2026

ANDAMAN PARTNERS is pleased to support and sponsor this popular Pre-Indaba event in Cape Town.

AAMEG Event in Cape Town Ahead of Mining Indaba 2026

ANDAMAN PARTNERS is pleased to sponsor and support the AAMEG pre-Mining Indaba Cocktails & Canapes event.

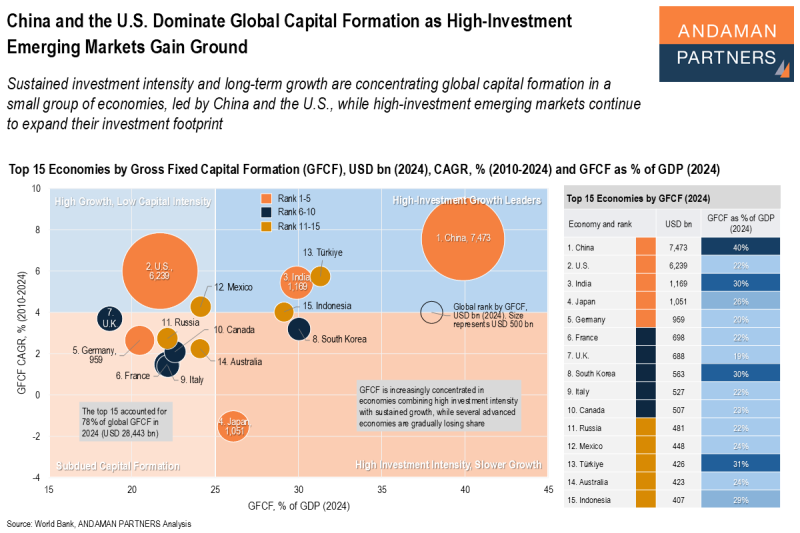

China and the U.S. Dominate Global Capital Formation as High-Investment Emerging Markets Gain Ground

Sustained investment intensity and long-term growth are concentrating global capital formation in a small group of economies, led by China and the U.S.

Global Investment Patterns in 2025 Favoured Infrastructure Over Corporate Expansion

FDI and M&A remained concentrated in Asia and North America, while infrastructure attracted the bulk of project-financed investment.

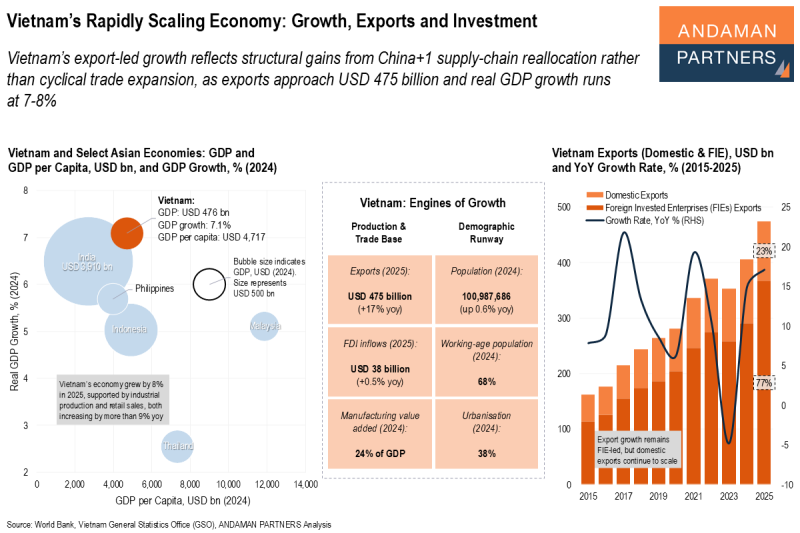

Vietnam’s Rapidly Scaling Economy: Growth, Exports and Investment

Vietnam’s export-led growth reflects structural gains from China+1 supply-chain reallocation rather than cyclical trade expansion.