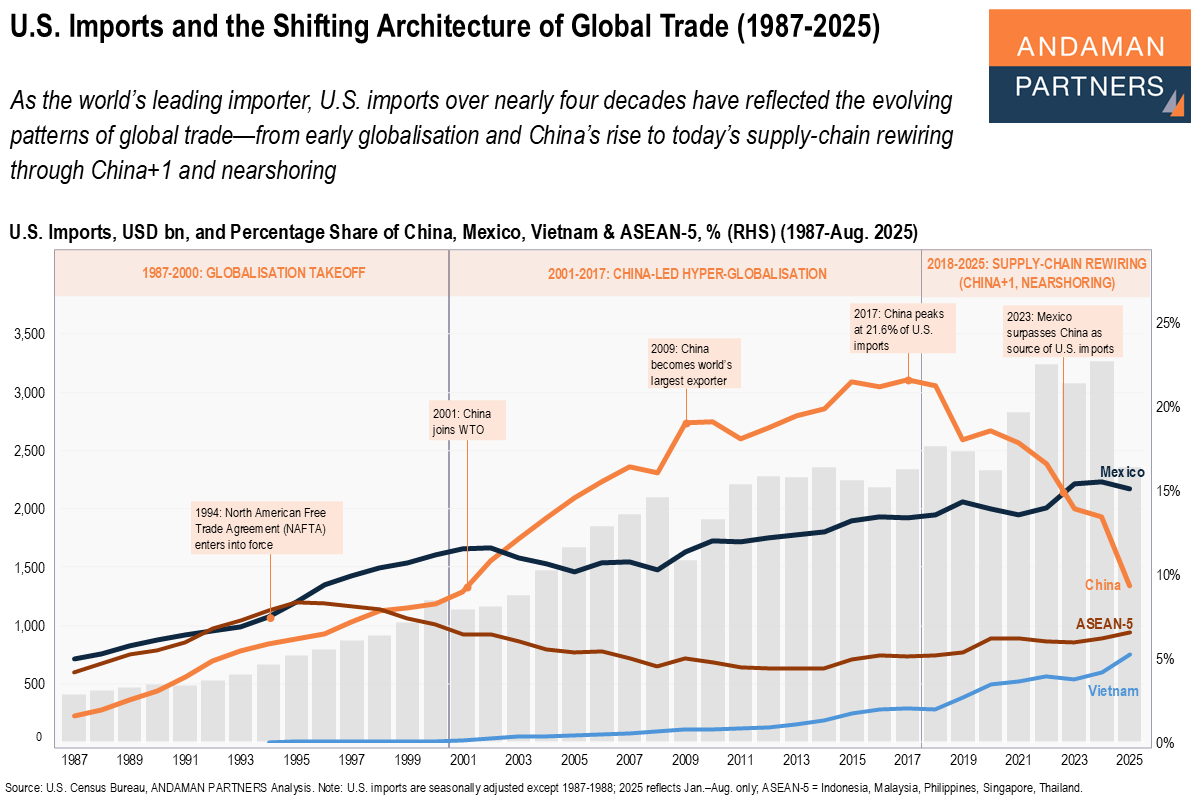

As the world’s leading importer, U.S. imports over nearly four decades have reflected the evolving patterns of global trade—from early globalisation and China’s rise to today’s supply-chain rewiring through China+1 and nearshoring.

Over nearly four decades, U.S. imports have provided the most unambiguous indication of significant shifts in the global trading system. From the late 1980s through 2000, the U.S. absorbed rising volumes of goods as globalisation took off, supply chains lengthened and manufacturers dispersed production across North America and Asia.

This period was the foundational era of modern trade integration, defined by tariff liberalisation, the commencement of the North American Free Trade Agreement (NAFTA) in 1994 and the early stages of offshore manufacturing in Mexico and the Association of Southeast Asian Nations (ASEAN) economies.

From 2001 to 2017, globalisation entered its China-led phase. China’s WTO accession triggered the fastest and most extensive supply-chain integration in modern economic history. China became the world’s largest exporter in 2009 and reached a peak share of 21.6% of all U.S. imports in 2017, reflecting its central role in global electronics, machinery, consumer goods and intermediate components.

U.S. import patterns during this period capture the consolidation of China-centric supply chains and the deep interdependence that characterised the hyper-globalisation era.

Since 2018, the structure of U.S. imports has shifted sharply as global trade entered a new phase of diversification and resilience. China’s share of U.S. imports has fallen rapidly. At the same time, Mexico has risen to become the U.S.’s largest import source, and Vietnam and the ASEAN-5 economies (Indonesia, Malaysia, the Philippines, Singapore and Thailand) have steadily gained ground as China+1 sourcing options.

This supply-chain rewiring period reflects a long-term, organic rebalancing of global production, driven by geopolitics, cost dynamics, industrial policy and corporate strategies to build multi-node, regionally anchored supply networks. The result is a more distributed global trade architecture, with China still central but no longer singular.

Also by ANDAMAN PARTNERS:

ANDAMAN PARTNERS supports international business ventures and growth. We help launch global initiatives and accelerate successful expansion across borders. If your business, operations or project requires cross-border support, contact connect@andamanpartners.com.

ANDAMAN PARTNERS Wishes You a Happy and Prosperous Year of the Horse!

Compliments of the Chinese Lunar New Year to all our clients, customers, suppliers and partners.

ANDAMAN PARTNERS to Attend Investing in African Mining Indaba 2026 in Cape Town

ANDAMAN PARTNERS Co-Founders Kobus van der Wath and Rachel Wu will attend Investing in African Mining Indaba 2026 in Cape Town, South Africa.

Join ANDAMAN PARTNERS at Networking Event in Cape Town Ahead of Mining Indaba 2026

ANDAMAN PARTNERS is pleased to support and sponsor this popular Pre-Indaba event in Cape Town.

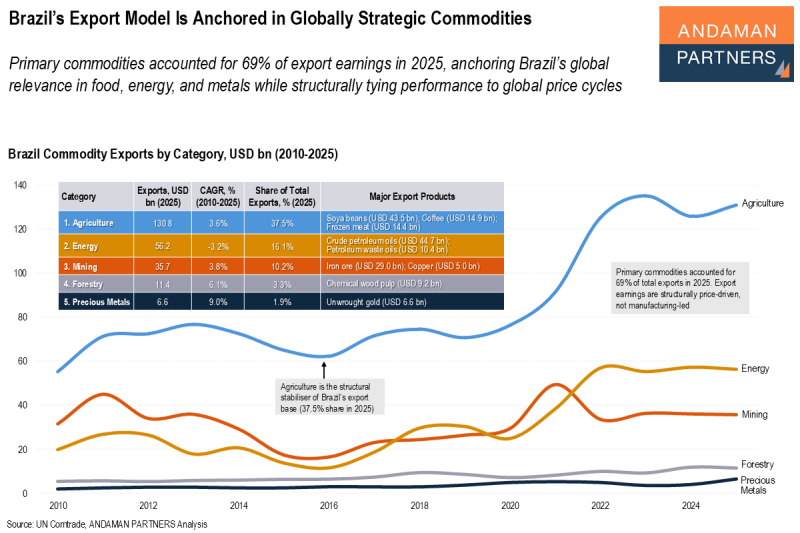

Brazil’s Export Model Is Anchored in Globally Strategic Commodities

Primary commodities accounted for 69% of export earnings in 2025, anchoring Brazil’s global relevance in food, energy, and metals.

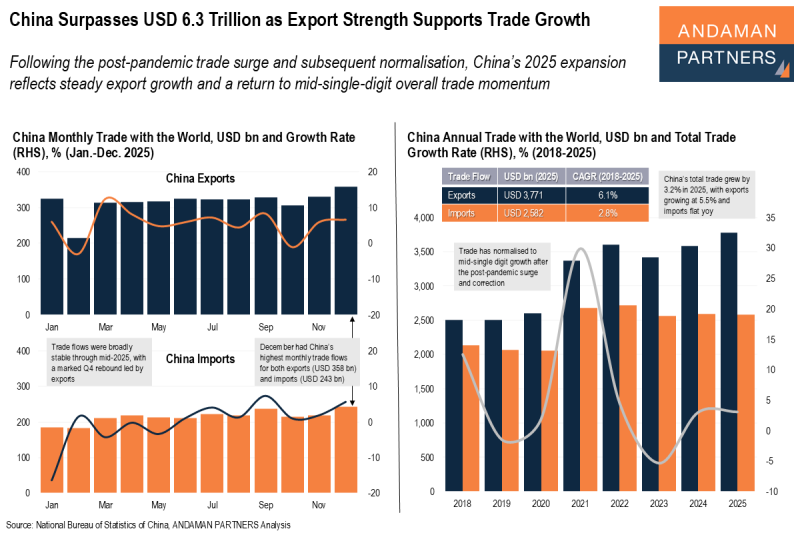

China Surpasses USD 6.3 Trillion as Export Strength Supports Trade Growth

China’s 2025 expansion reflects steady export growth and a return to mid-single-digit overall trade momentum.

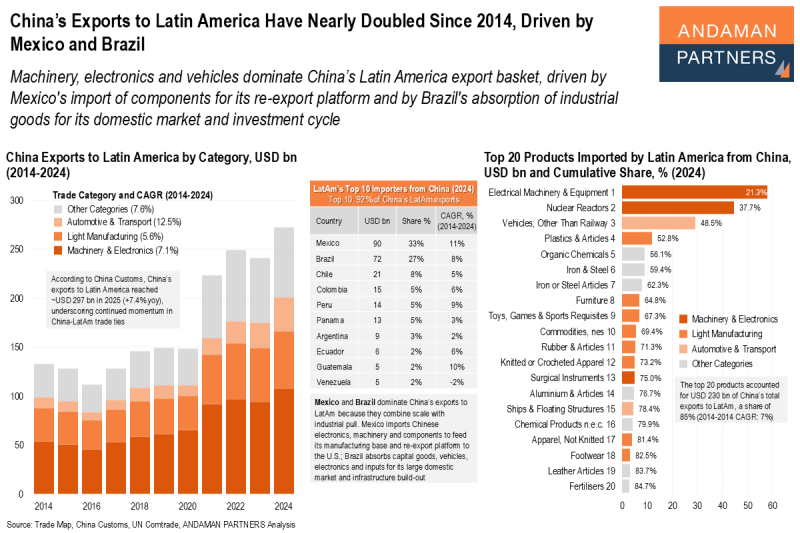

China’s Exports to Latin America Have Nearly Doubled Since 2014, Driven by Mexico and Brazil

Machinery, electronics and vehicles dominate China’s Latin America export basket, driven by Mexico and Brazil.