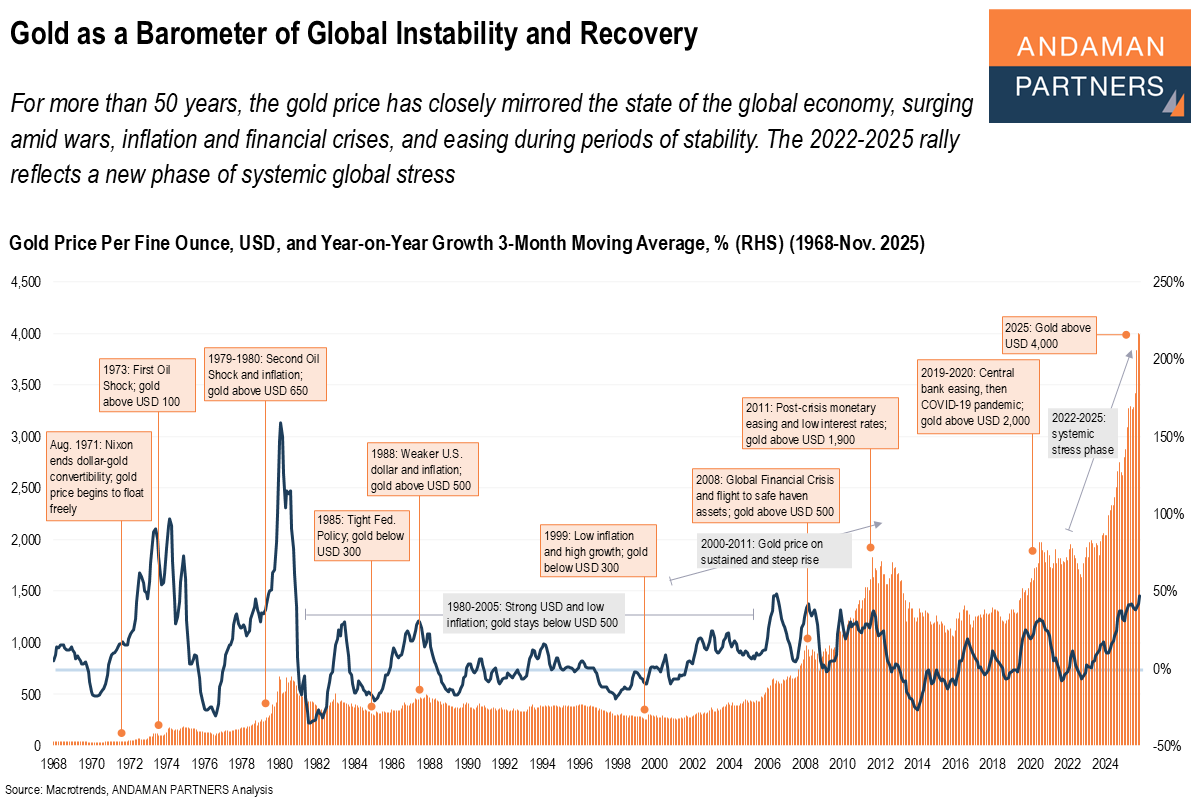

For more than 50 years, the gold price has closely mirrored the state of the global economy, surging amid wars, inflation and financial crises, and easing during periods of stability. The 2022-2025 rally reflects a new phase of systemic global stress.

Since the late 1960s, the international price of gold has reflected the changing tides of the global economy. The modern era of gold pricing began in 1971, when U.S. President Richard Nixon ended the dollar’s convertibility to gold, allowing prices to float freely. Within two years, the first oil crisis of 1973 and a wave of global inflation pushed gold above USD 100 for the first time.

A second oil crisis and spiralling inflation in 1979-1980 sent prices soaring beyond USD 650, marking the peak of the post-Bretton Woods inflation era. As the U.S. Federal Reserve sharply raised interest rates in the early 1980s, inflation decreased and gold fell below USD 300, entering a long period of stability. The strong-dollar, low-inflation environment of 1980-2005 kept prices under USD 500.

By 1999, amid robust global growth and low inflation, gold had reached a two-decade low of under USD 300, its weakest level since the early 1970s. The new century reversed the trend: between 2000 and 2011, gold rose steadily as monetary easing, the 2008 Global Financial Crisis and the post-crisis low-interest-rate era drove prices past USD 1,900.

Following a correction in the mid-2010s, new turbulence arrived. Central-bank stimulus, the COVID-19 pandemic and geopolitical tensions from 2019 onward reignited demand for safe-haven assets, pushing gold above

USD 2,000.

The escalation of war, inflation and fiscal strain from 2022 to 2025 lifted gold beyond USD 4,000, marking one of the steepest and most prolonged surges in its modern history, a clear reflection of renewed systemic global stress.

Also by ANDAMAN PARTNERS:

ANDAMAN PARTNERS supports international business ventures and growth. We help launch global initiatives and accelerate successful expansion across borders. If your business, operations or project requires cross-border support, contact connect@andamanpartners.com.

ANDAMAN PARTNERS Wishes You a Happy and Prosperous Year of the Horse!

Compliments of the Chinese Lunar New Year to all our clients, customers, suppliers and partners.

ANDAMAN PARTNERS to Attend Investing in African Mining Indaba 2026 in Cape Town

ANDAMAN PARTNERS Co-Founders Kobus van der Wath and Rachel Wu will attend Investing in African Mining Indaba 2026 in Cape Town, South Africa.

Join ANDAMAN PARTNERS at Networking Event in Cape Town Ahead of Mining Indaba 2026

ANDAMAN PARTNERS is pleased to support and sponsor this popular Pre-Indaba event in Cape Town.

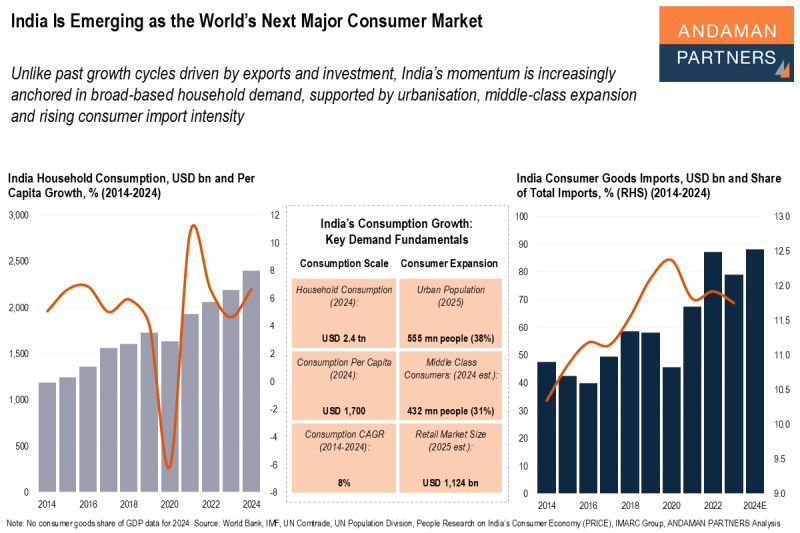

India Is Emerging as the World’s Next Major Consumer Market

India’s momentum is anchored in broad-based household demand, supported by urbanisation, middle-class expansion and consumer import intensity.

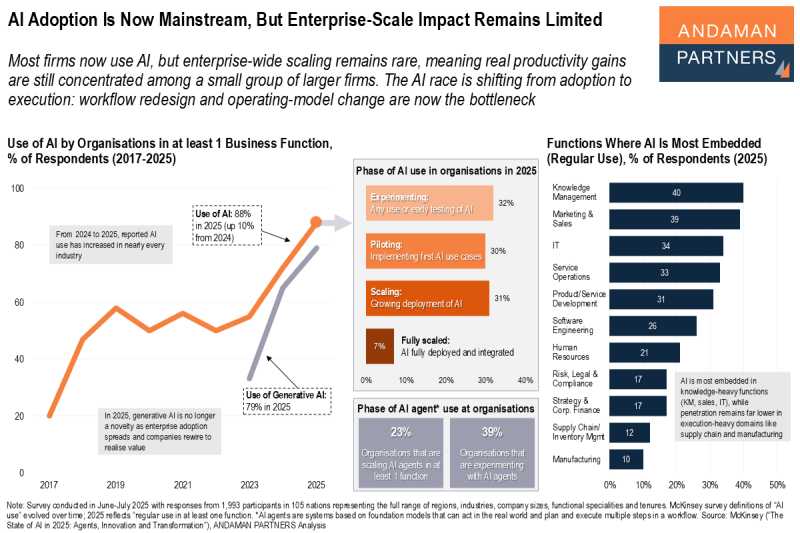

AI Adoption Is Now Mainstream, But Enterprise-Scale Impact Remains Limited

Most firms now use AI, but enterprise-wide scaling remains rare, meaning productivity gains are concentrated in a small group of larger firms.

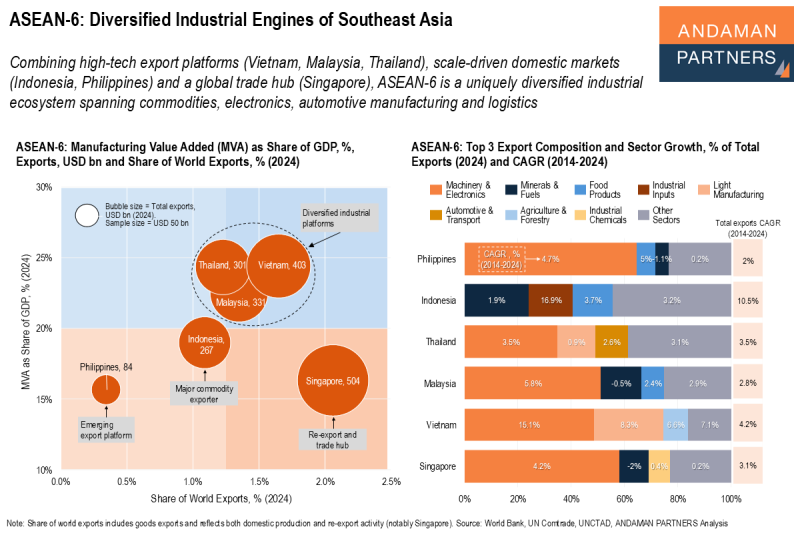

ASEAN-6: Diversified Industrial Engines of Southeast Asia

Combining high-tech export platforms, scale-driven domestic markets and a global trade hub, ASEAN-6 is a uniquely diversified industrial ecosystem.