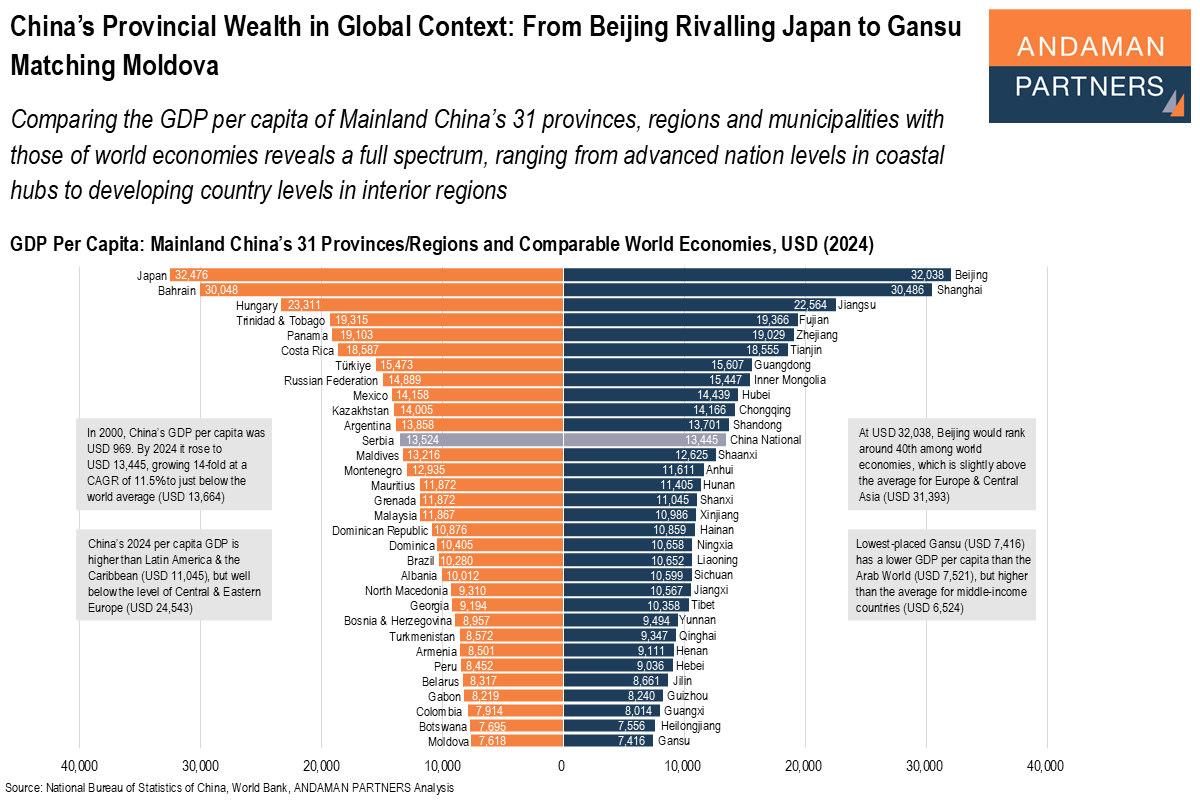

Comparing the GDP per capita of Mainland China’s 31 provinces, regions and municipalities with those of world economies reveals a full spectrum, ranging from advanced nation levels in coastal hubs to developing country levels in interior regions.

China’s current level of development underscores a dual reality: the country is both developed and developing, depending on provincial and regional lines.

In 2024, Beijing’s GDP per capita, the highest among China’s provinces, regions and municipalities, reached

USD 32,038, roughly the same as Japan’s, while Shanghai followed closely at USD 30,486, comparable to Bahrain. If compared to world economies, Beijing and Shanghai would rank around 40th worldwide, similar to the average for Europe & Central Asia.

Jiangsu, at USD 22,564, is slightly below the level of Hungary, while Fujian (USD 19,366) matches Trinidad & Tobago, and Zhejiang (USD 19,029) is comparable to Panama.

At the other end of the spectrum, Gansu’s GDP per capita of USD 7,416 aligns with Moldova, and Heilongjiang’s USD 7,556 matches Botswana, underlining the large spread between China’s most affluent and poorest regions.

The data shows a clear geographic divide: the GDP per capita of coastal and urbanised regions such as Jiangsu, Fujian and Zhejiang cluster near upper-middle-income global peers like Hungary and Panama, while most western provinces, including Gansu, Guizhou and Qinghai, are near the income levels of lower-middle-income economies such as Armenia or Georgia. This divide reflects decades of export-led industrialisation concentrated along China’s eastern seaboard.

Despite these internal variations, China’s overall GDP per capita reached USD 13,445 in 2024, almost 14 times its 2000 level of USD 969, growing at a CAGR of 11.5%. That places China slightly below the world average

(USD 13,664) but above Latin America & the Caribbean (USD 11,045). Few countries have achieved such a rapid rise from low-income to near-global-average levels within a single generation.

Also by ANDAMAN PARTNERS:

ANDAMAN PARTNERS supports international business ventures and growth. We help launch global initiatives and accelerate successful expansion across borders. If your business, operations or project requires cross-border support, contact connect@andamanpartners.com.

ANDAMAN PARTNERS Wishes You a Happy and Prosperous Year of the Horse!

Compliments of the Chinese Lunar New Year to all our clients, customers, suppliers and partners.

ANDAMAN PARTNERS to Attend Investing in African Mining Indaba 2026 in Cape Town

ANDAMAN PARTNERS Co-Founders Kobus van der Wath and Rachel Wu will attend Investing in African Mining Indaba 2026 in Cape Town, South Africa.

Join ANDAMAN PARTNERS at Networking Event in Cape Town Ahead of Mining Indaba 2026

ANDAMAN PARTNERS is pleased to support and sponsor this popular Pre-Indaba event in Cape Town.

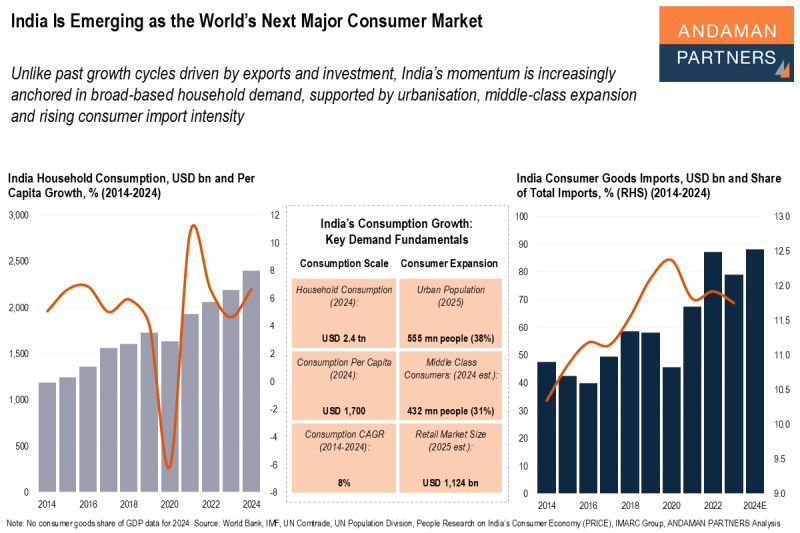

India Is Emerging as the World’s Next Major Consumer Market

India’s momentum is anchored in broad-based household demand, supported by urbanisation, middle-class expansion and consumer import intensity.

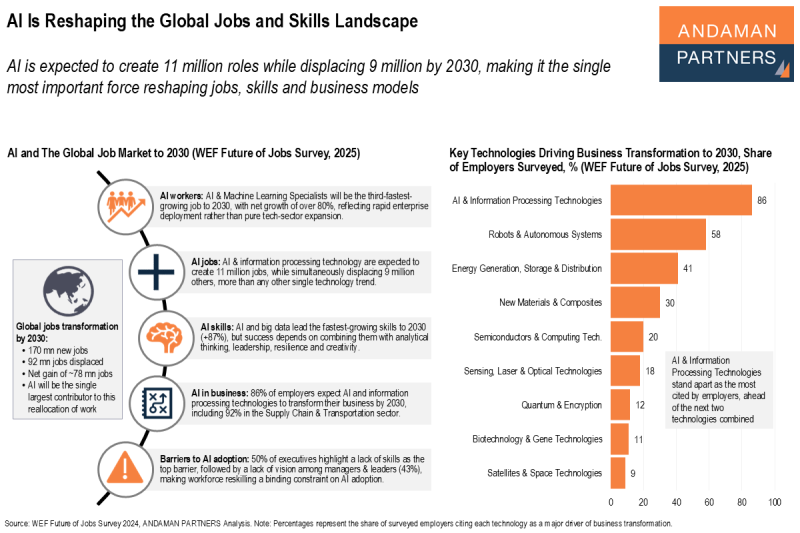

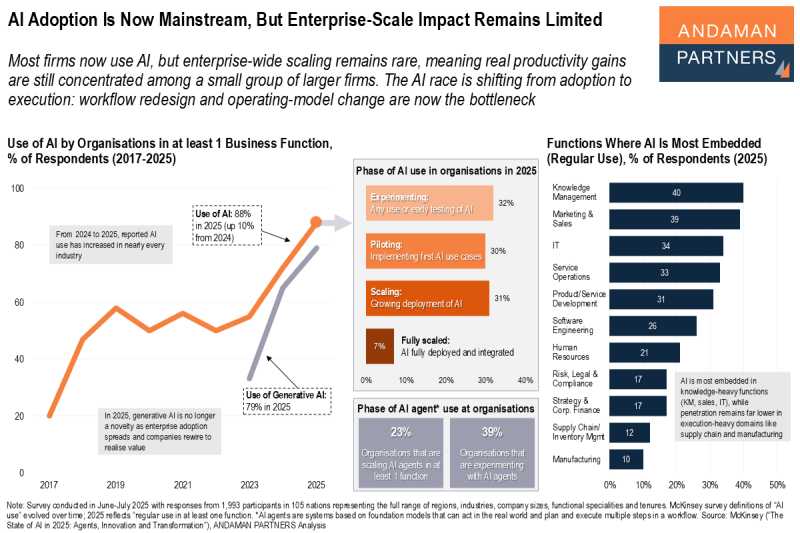

AI Adoption Is Now Mainstream, But Enterprise-Scale Impact Remains Limited

Most firms now use AI, but enterprise-wide scaling remains rare, meaning productivity gains are concentrated in a small group of larger firms.

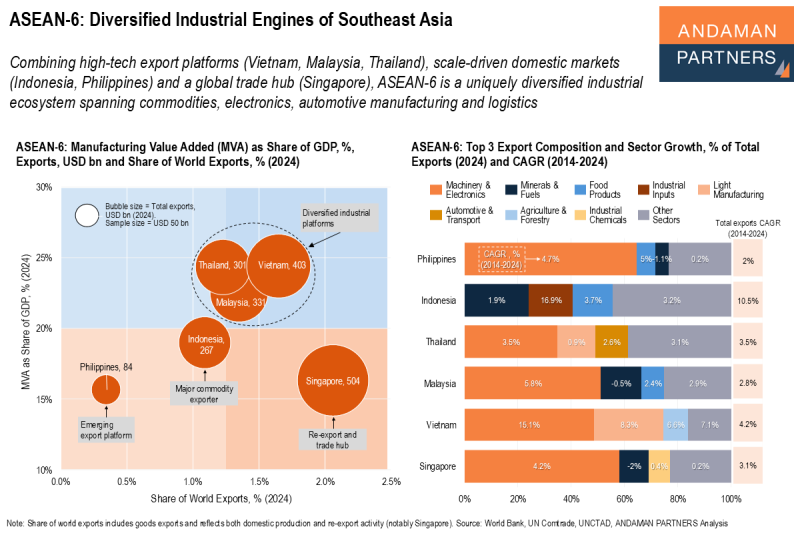

ASEAN-6: Diversified Industrial Engines of Southeast Asia

Combining high-tech export platforms, scale-driven domestic markets and a global trade hub, ASEAN-6 is a uniquely diversified industrial ecosystem.