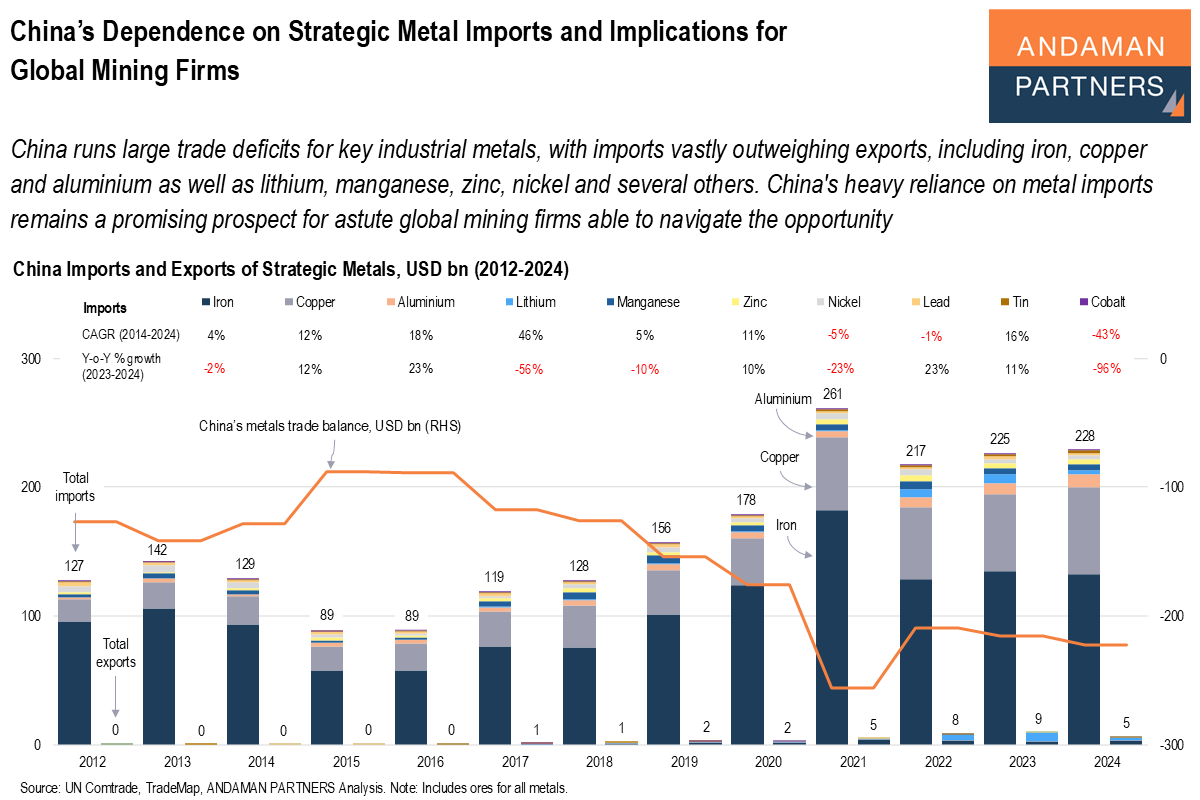

China runs large trade deficits for key industrial metals, with imports vastly outweighing exports, including iron, copper and aluminium as well as lithium, manganese, zinc, nickel and several others. China’s heavy reliance on metal imports remains a promising prospect for astute global mining firms able to navigate the opportunity.

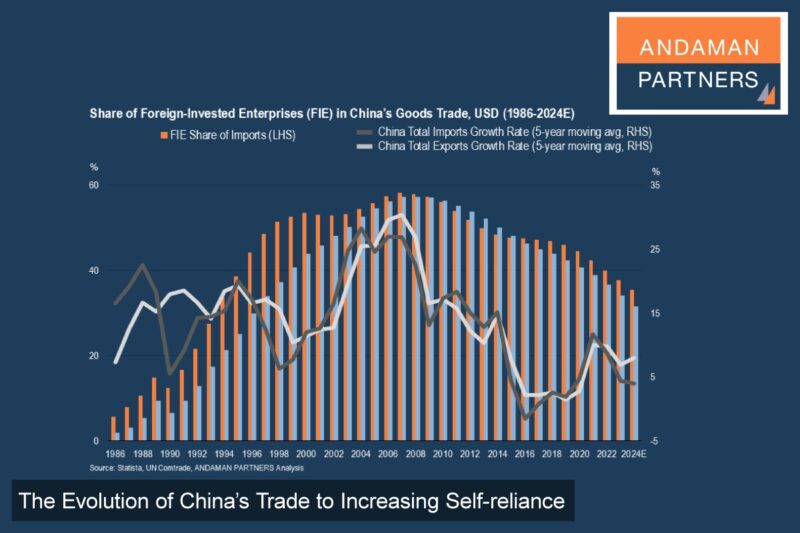

Despite its industrial dominance, China remains heavily reliant on imported raw materials, leaving its vast industrial engine exposed to supply risks.

For a group of ten strategic industrial metals, namely iron, copper, aluminium, lithium, manganese, zinc, nickel, lead, tin and cobalt, China has consistently had a large trade deficit. The deficit for these ten metals expanded from –USD 126.8 billion in 2012 to –USD 222.4 billion in 2024. The most significant annual deficit of –USD 255.9 billion occurred in 2021, when China imported USD 261 billion of these metals, and exported only USD 5 billion.

China’s imports of strategic metals increased significantly in 2021 as post-COVID-19 global demand picked up. China also accelerated production lines for electric vehicles (EVs), batteries and renewables, creating structural demand for lithium, cobalt, nickel, manganese and aluminium.

In 2022-2024, China’s imports fell back slightly, but remained well above USD 200 billion annually.

Over the period 2012-2024, the growth of China’s imports of these strategic metals was remarkable, for example:

- Iron: Increased by 38% from USD 95.62 billion to USD 132.43 billion.

- Copper: More than tripled from USD 16.93 billion to USD 67.33 billion.

- Aluminium: Increased more than fivefold from USD 1.89 billion to USD 10.53 billion.

- Lithium: Increased more than tenfold from USD 66 million to USD 2.85 billion. (In 2024, lithium exports of USD 2.2 billion nearly matched imports, making it the only metal approaching import-export parity.)

- Manganese: Doubled from USD 2.19 billion to USD 4.41 billion.

For a few strategic metals, China’s imports decreased from 2012 to 2024, notably nickel (–5%) and cobalt (–43%).

Risk and Reward for Global Mining Firms

China’s dependence on imports of strategic metals means that global commodity price cycles directly affect Chinese industrial costs. But as China is the largest buyer of these metals, its fluctuating levels of imports create global price shocks that affect industrial supply chains worldwide.

To mitigate risk, China stockpiles resources, purchases equity stakes and long-term contracts abroad and invests in overseas mining rights and infrastructure to secure supply chains. China still relies on only a few countries for supplies of key metals, such as iron ore (Australia), copper (Chile, Peru) and cobalt (D.R.C.), and this concentration of supply can create geopolitical complications.

Overall, China is locked in intensified resource competition with the U.S., EU, Japan and India for critical metals and minerals. China’s import dependency remains a massive opportunity for global mining firms, with China ensuring reliable long-term demand, regardless of global cycles.

This opportunity is not without challenges, however, as China’s demand is still subject to demand cycles, policy swings and geopolitics. To navigate these challenges, global mining firms must be strategic, leverage the right information and partners, diversify their customer base and develop flexible operating models. Agile end-to-end supply chain management is also crucial.

ANDAMAN PARTNERS supports international business ventures and growth. We help launch global initiatives and accelerate successful expansion across borders. If your business, operations or project requires cross-border support, contact connect@andamanpartners.com.

ANDAMAN PARTNERS Wishes You a Happy and Prosperous Year of the Horse!

Compliments of the Chinese Lunar New Year to all our clients, customers, suppliers and partners.

ANDAMAN PARTNERS to Attend Investing in African Mining Indaba 2026 in Cape Town

ANDAMAN PARTNERS Co-Founders Kobus van der Wath and Rachel Wu will attend Investing in African Mining Indaba 2026 in Cape Town, South Africa.

Join ANDAMAN PARTNERS at Networking Event in Cape Town Ahead of Mining Indaba 2026

ANDAMAN PARTNERS is pleased to support and sponsor this popular Pre-Indaba event in Cape Town.

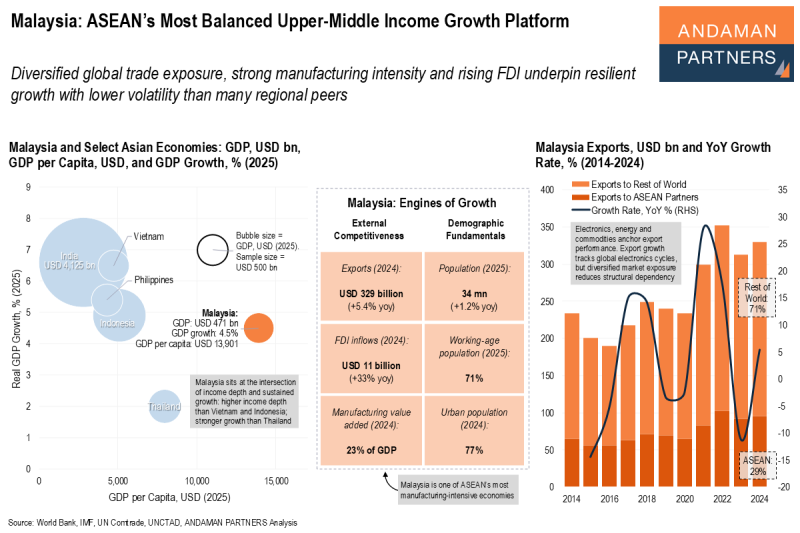

Malaysia: ASEAN’s Most Balanced Upper-Middle Income Growth Platform

Diversified global trade exposure, strong manufacturing intensity and rising FDI underpin resilient growth with lower volatility than many regional peers.

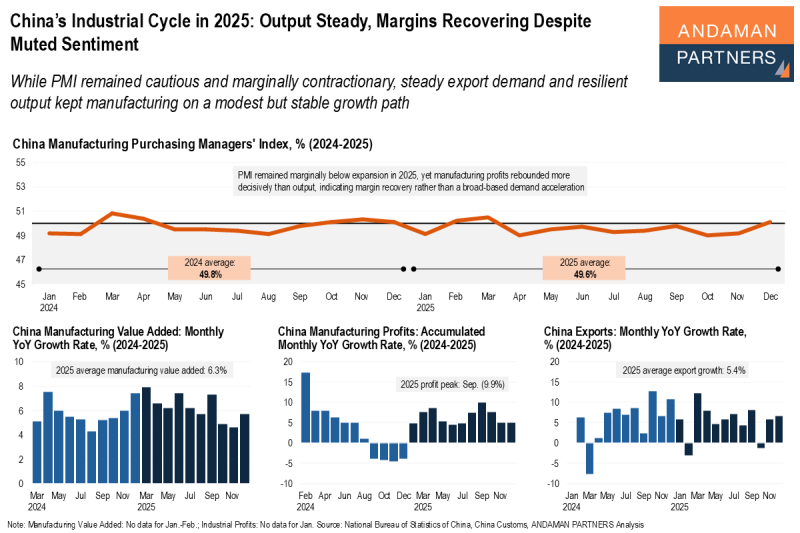

China’s Industrial Cycle in 2025: Output Steady, Margins Recovering Despite Muted Sentiment

While PMI remained cautious and marginally contractionary, steady export demand and resilient output kept manufacturing on a modest but stable growth path.

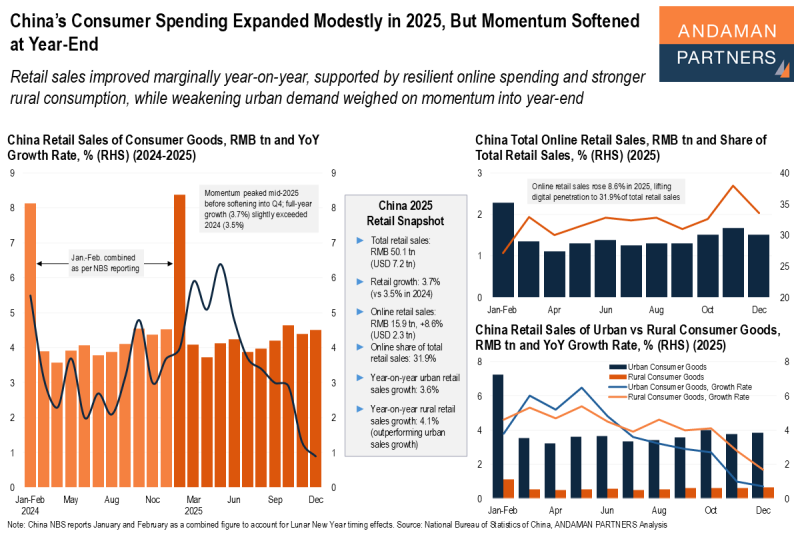

China’s Consumer Spending Expanded Modestly in 2025, But Momentum Softened at Year-End

Retail sales improved marginally year-on-year, supported by resilient online spending and stronger rural consumption.