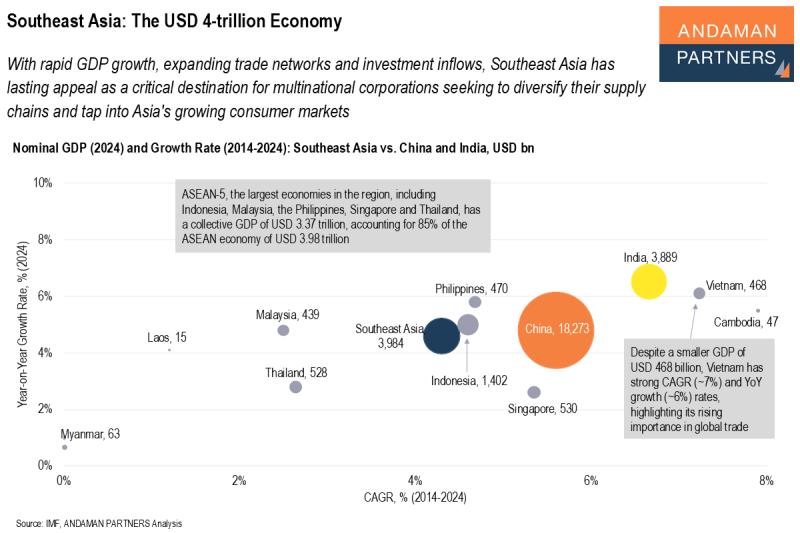

With rapid GDP growth, expanding trade networks and investment inflows, Southeast Asia has lasting appeal as a critical destination for multinational corporations seeking to diversify their supply chains and tap into Asia’s growing consumer markets.

Highlights:

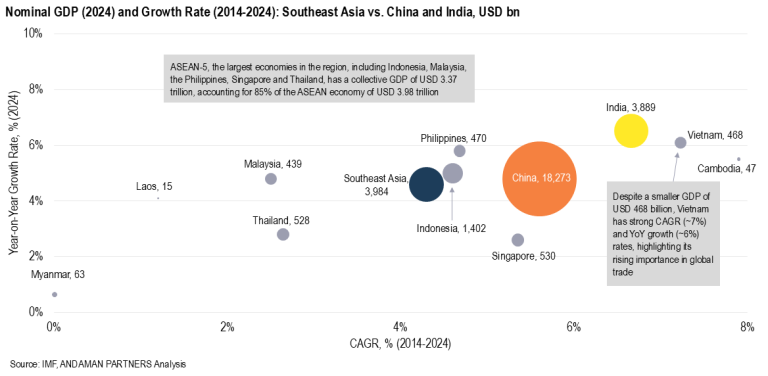

- In 2024, Southeast Asia’s eleven economies had a combined GDP of almost USD 4 trillion.

- The region had an aggregate GDP growth rate of 4.6% in 2024, which is forecast to reach 4.7% in 2025.

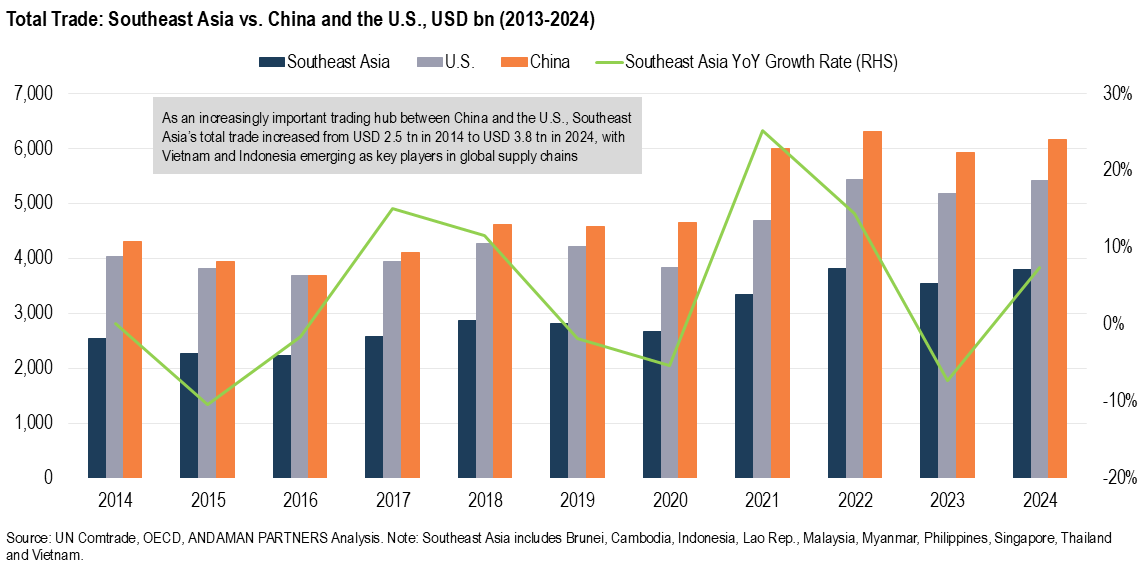

- Total trade in the region reached USD 3.8 trillion in 2024. Vietnam is one of the world’s fastest-growing exporters, with export values that increased by 400% from 2010 to 2023.

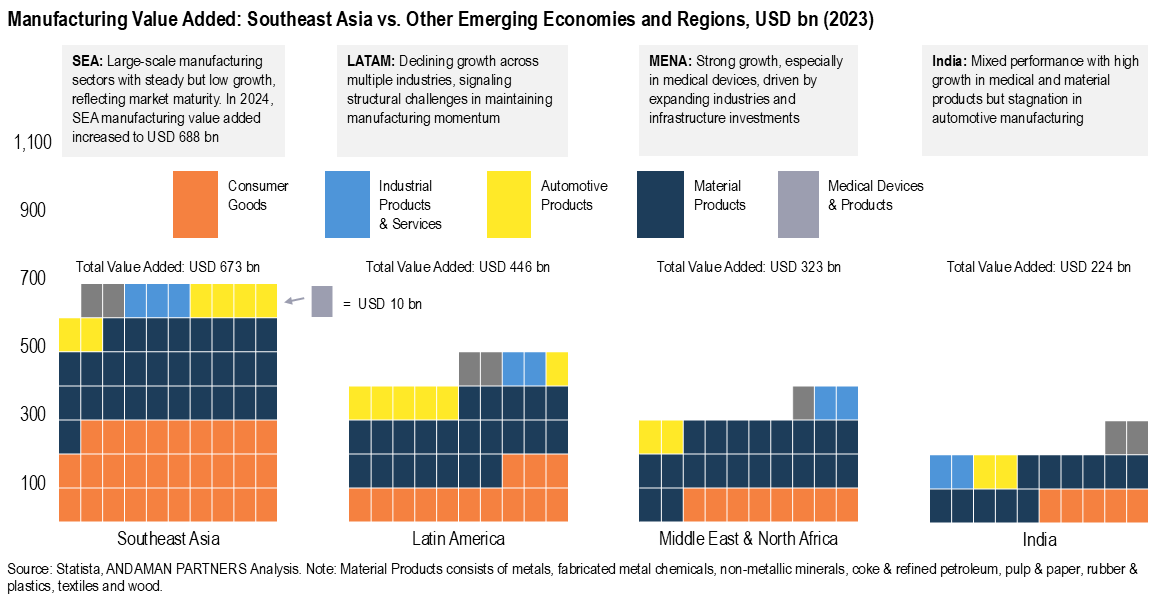

- The region’s manufacturing sector added USD 673 billion to GDP in 2023, dominated by Consumer Goods and Material Products.

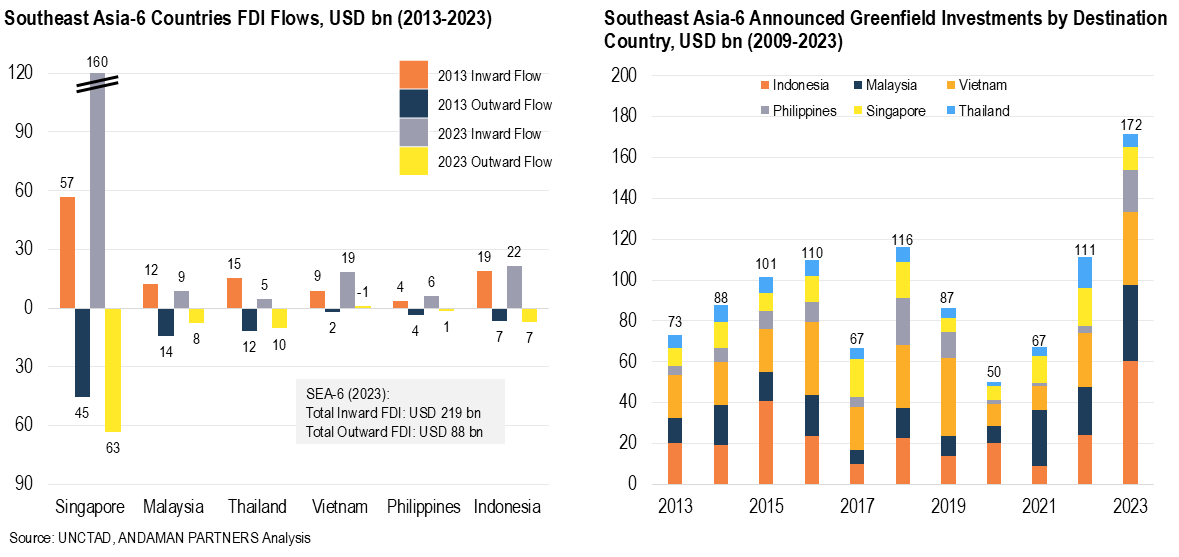

- In 2023, six Southeast Asian economies attracted USD 219 billion in foreign investment, almost two-thirds of which went to Singapore.

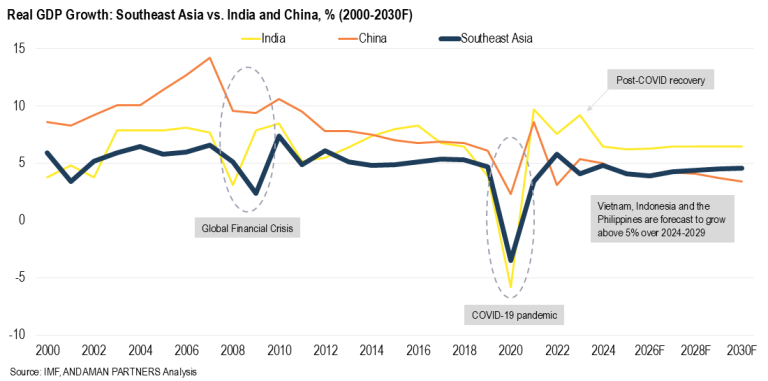

Southeast Asia’s economy is supported by robust export markets, resilient domestic demand and government initiatives to attract foreign investment. The region’s economic trajectory reflects a blend of resilience and variety, with distinct GDP growth and investment patterns among regional economies.

South East Asia includes 11 economies: Brunei, Cambodia, Indonesia, Laos, Malaysia, Myanmar, the Philippines, Singapore, Timor-Leste, Thailand and Vietnam. All these countries except Timor-Leste are members of the Association of Southeast Asian Nations (ASEAN); Timor-Leste will likely join ASEAN in 2025.

The region’s economy is dominated by the six largest economies (Southeast Asia-6): Indonesia, Malaysia, the Philippines, Singapore, Thailand and Vietnam.

In 2024, Southeast Asia’s combined real GDP was USD 3.98 trillion, with varying growth rates across the region. This compares to 2024 real GDP of USD 6.73 trillion for the 33 countries in Latin America & the Caribbean and USD 1.89 trillion for the 45 countries of Sub-Saharan Africa.

According to an IMF estimate, Southeast Asia’s GDP will increase to USD 4.25 trillion in 2025 and USD 5.55 trillion in 2029.

Growth has varied among the region’s economies in recent years. In 2024, Indonesia (5%), Cambodia (5%), the Philippines (5.8%) and Vietnam (6.1%) attained real GDP growth rates above 5%, followed by Malaysia (4.8%) and Laos (4.1%) above 4%. Growth was more moderate in Thailand (2.8%), Singapore (2.6%), Brunei (2.4%) and Myanmar (1%).

Vietnam, Indonesia and the Philippines are regional growth engines, with projected GDP growth rates above 6% through 2029. Vietnam has sustained high growth rates over decades, including more than 7% annualised GDP growth from 2014 to 2024. As a whole, Southeast Asia’s economic growth has now surpassed that of China and is closely tracking India’s rapid growth.

Indonesia, the largest economy in the region with a GDP of USD 1.40 trillion, continues to expand, and the Philippines has shown solid growth momentum, reaching a GDP of USD 470 billion in 2024.

Malaysia, Singapore and Thailand recently experienced relatively slower growth, although all three economies remain essential players in the region. Despite a modest year-on-year increase of 2.6% in 2024, Singapore retains strategic importance as a stable, high-income hub. Thailand and Singapore are both forecast to grow at 2-3% up to 2029.

Trade

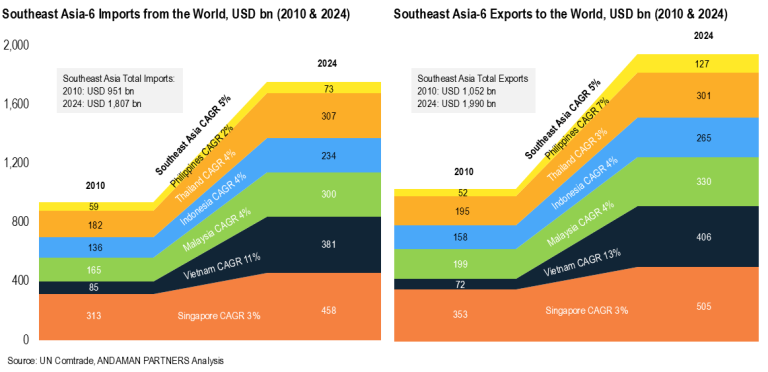

Southeast Asia’s prominence in global trade continues to grow, with the region’s total trade reaching USD 3.8 trillion in 2024, nearly doubling from USD 2 trillion in 2010. Total imports in 2024 reached USD 1.80 trillion, and exports reached USD 2.0 trillion.

With its strategic location and robust trade agreements, Vietnam achieved the most substantial increase over this period, with export values jumping from USD 72 billion in 2010 to USD 406 billion in 2024, an increase of nearly 400%. Vietnam is a critical player in the export of technology and consumer goods, particularly textiles and electronics. Trade links between China and Vietnam are expanding via new infrastructure projects, notably railways, which are extending logistics and transportation networks.

Singapore leads the region with USD 963 billion in total trade in 2024, while Vietnam posted USD 787 billion. The increase in trade is supported by Southeast Asia’s favourable location and expansive logistics and transportation infrastructure, which facilitates smooth access to key markets like China, India, the U.S. and Europe.

Southeast Asia’s trade networks have benefited from the Regional Comprehensive Economic Partnership (RCEP), a trade agreement signed in 2020 between ASEAN and the largest economies in Asia, including China, Indonesia, Japan and South Korea. RCEP provides a framework for lowering trade barriers and increasing regional market access.

ASEAN continues to strengthen trade and investment links with China and the U.S. ASEAN economies have found ways to capture export opportunities brought about by Chinese and U.S. tariffs, a recurring geopolitical issue in 2025.

Manufacturing

Southeast Asia’s manufacturing sector is a crucial driver of economic growth. In 2024, total manufacturing value added by all industries amounted to USD 688 billion (an increase of USD 15 billion from 2023), driven by the region’s increasing high-tech manufacturing capacity for consumer and industrial goods.

In 2023, Consumer Goods (USD 291 billion) and Material Products (USD 280 billion) accounted for nearly 85% of the region’s total manufacturing value added. Automotive Products bounced back from the disruptions caused by the COVID pandemic, contributing USD 55.3 billion.

The region’s manufacturing sector has seen significant growth in high-tech industries in recent years. Vietnam and Indonesia, for example, attracted substantial investments in semiconductors, consumer electronics and electric vehicles (EVs).The region’s transition to more advanced manufacturing sectors, including medical devices and sustainable energy products, positions Southeast Asia as a key player in global manufacturing.

Southeast Asia’s manufacturing sector compares favorably to other emerging economies and regions, especially regarding Consumer Goods and Material Products. The region’s manufacturing value added in 2023 vastly outstripped that of Latin America, the Middle East & North Africa and India.

Investment

In 2023, the SEA-6 economies received over USD 219 billion in Foreign Direct Investment (FDI), with Singapore alone accounting for USD 160 billion, almost 73% of the total. Indonesia, Vietnam and Malaysia have also attracted substantial inflows.

In 2023, Indonesia received FDI of USD 22 billion, primarily driven by investments in energy, manufacturing and digital sectors. Vietnam and Malaysia attracted around USD 19 billion and USD 9 billion, respectively, focused on high-tech manufacturing and electronics.

Announced greenfield investments in SEA-6 countries increased from USD 73 billion in 2013 to USD 172 billion in 2023. Indonesia (USD 60 billion), Malaysia (USD 37 billion) and Vietnam (USD 36 billion) were the top beneficiaries, attracting significant investments in energy, manufacturing and technology projects.

Indonesia has emerged as a significant EV battery supply chain player, attracting substantial investments in nickel smelting. Singapore continues to lead smart manufacturing, offering incentives to attract investment in advanced technologies, particularly biotechnology and electronics.

These inflows underscore the region’s lasting appeal as a critical destination for multinational corporations seeking to diversify their supply chains and tap into Asia’s growing consumer markets.

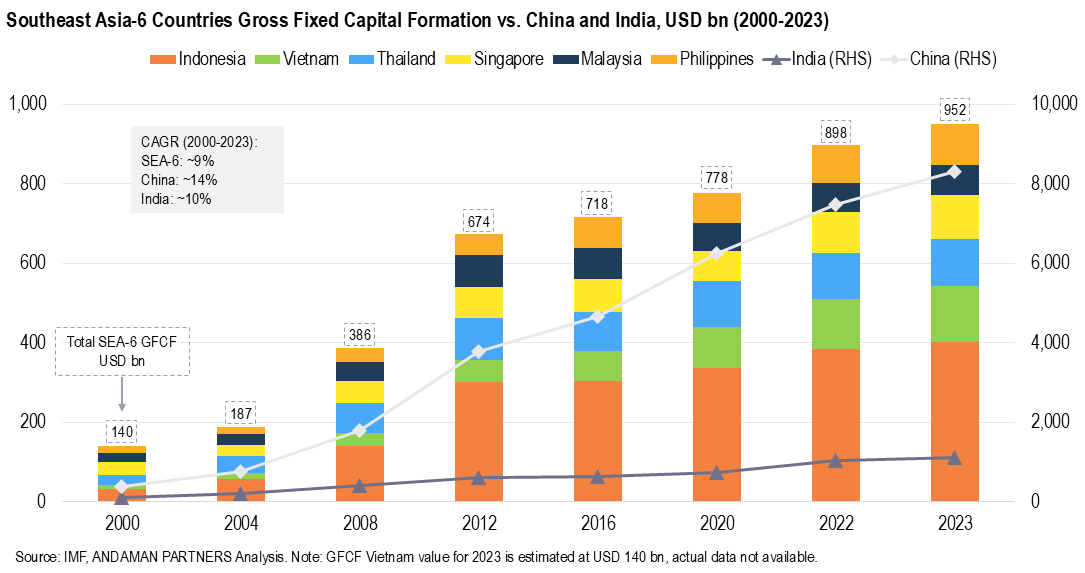

Gross Fixed Capital Formation (GFCF), i.e., net investments in fixed assets, in SEA-6 countries increased from USD 140 billion in 2000 to USD 952 billion in 2023. With a CAGR of 8.7%, the surge in GFCF underscores the region’s growing role as a hub for capital-intensive projects.

In 2023, Indonesia alone accounted for USD 402 of the region’s GFCF due to a surge in public sector infrastructure investments, including several projects related to the new capital city, Nusantara, located on the island of Borneo.

Southeast Asia’s Economic Prospects

Southeast Asia is on a transformative journey, transitioning from a low-cost production base to a major global trade and high-tech manufacturing hub. With sustained GDP growth, expanding manufacturing sectors and increasing trade and investment, the region is poised to become a formidable global economic force. Another key factor in Southeast Asia’s economic rise is that the region benefits from ongoing trade friction and rivalry between the U.S. and China, a geopolitical issue that will not soon dissipate.

The alignment of sustained economic growth and increasing investment signals a new phase for the region, with countries like Vietnam and Indonesia positioning to lead the region’s long-term economic expansion. Southeast Asia’s ability to balance rapid industrialisation with sustainable development will determine its long-term success.

ANDAMAN PARTNERS supports international business ventures and growth. We help launch global initiatives and accelerate successful expansion across borders. If your business, operations or project requires cross-border support, contact connect@andamanpartners.com

ANDAMAN PARTNERS Was a Co-Sponsor of the South African National Day Reception in Shanghai on 30 May 2025

ANDAMAN PARTNERS was a cosponsor of the South African National Day Reception in Shanghai on 30 May 2025.

Asia’s Shifting Role in Global Supply Chains — Perspectives by ANDAMAN PARTNERS Co-Founder Rachel Wu

Analysis by ANDAMAN PARTNERS Co-Founder Rachel Wu on changing patterns in global supply chains.

ANDAMAN PARTNERS Co-sponsored the West Australian Mining Club Luncheon in Perth on 27 February 2025

WA Mining Club luncheons are valuable ways to network with colleagues and clients and learn about the latest industry insights.

Africa’s Unfulfilled Manufacturing Revolution and New Opportunities of Industrialisation

Africa previously failed to develop a broad manufacturing base despite industrial foundations laid early in the post-colonial period. But Africa’s potential for industrial takeoff remains.

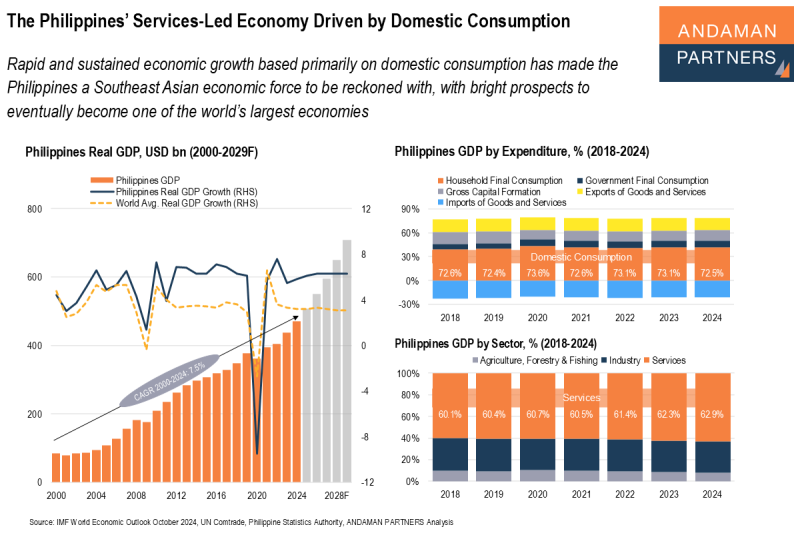

The Philippines’ Services-Led Economy Driven by Domestic Consumption

Rapid and sustained economic growth has made the Philippines a Southeast Asian economic force to be reckoned with, with bright prospects.

Southeast Asia: The USD 4-trillion Economy

With rapid GDP growth, expanding trade networks and investment inflows, Southeast Asia has lasting appeal as a destination for corporations seeking to diversify supply chains.