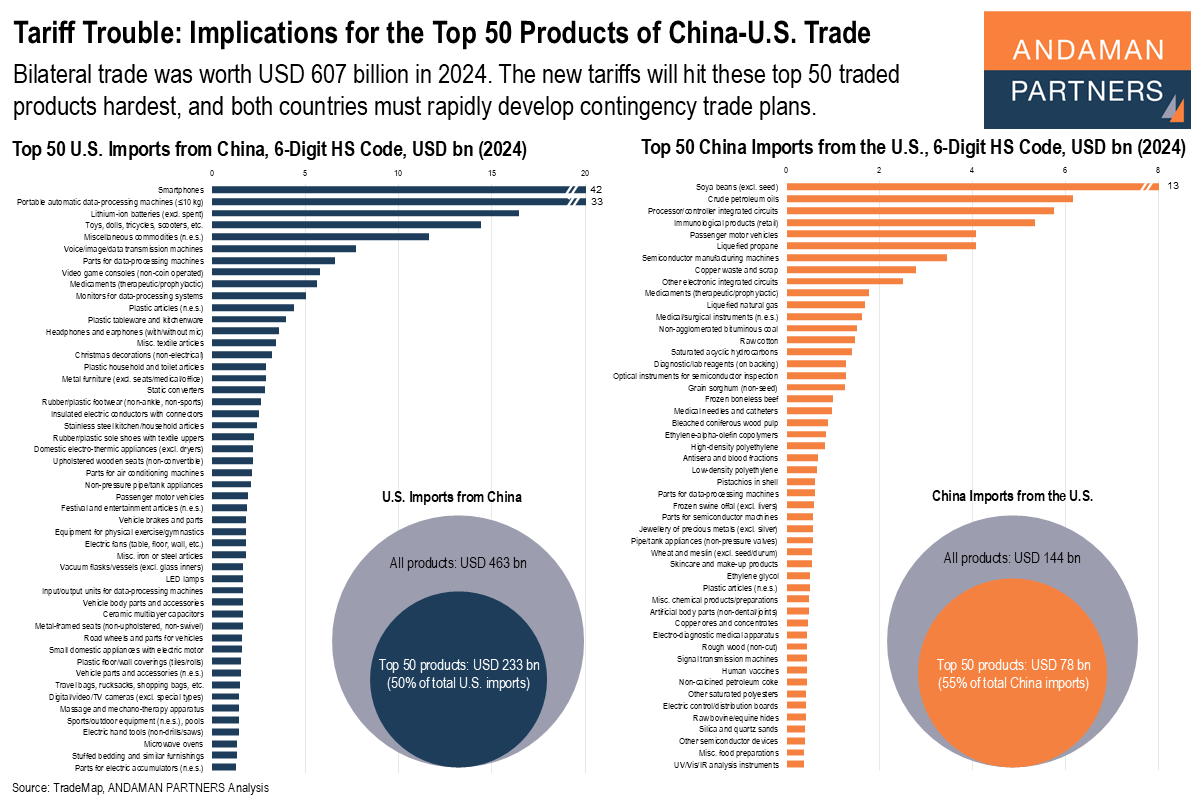

Bilateral trade was worth USD 607 billion in 2024. The new tariffs will hit these top 50 traded products hardest, and both countries must rapidly develop contingency trade plans.

Following a spate of tit-for-tat tariff impositions by the U.S. and China last week, Chinese imports to the U.S. are now subject to a cumulative tariff of 145%. China responded with its own cumulative tariff of 125% on U.S. imports.

U.S. President Donald Trump announced a 90-day pause on tariffs for dozens of countries—but not China. He subsequently announced the exclusion of smartphones, laptops and other electronic products from tariffs on China. Senior U.S. officials, however, stated that these concessions are only temporary and that new tariffs would soon be placed on imports of Chinese semiconductors and the “whole electronics supply chain.”

Thus, the outlook for U.S.-China trade in 2025 is highly regressive, and the steep tariffs will hit the top 50 products in bilateral trade hardest. The bilateral trade relationship will likely undergo significant alterations in 2025, with implications not only for the two countries but also for boardrooms worldwide amid discussions on contingency trade planning.

Tariff Trouble: Implications for China

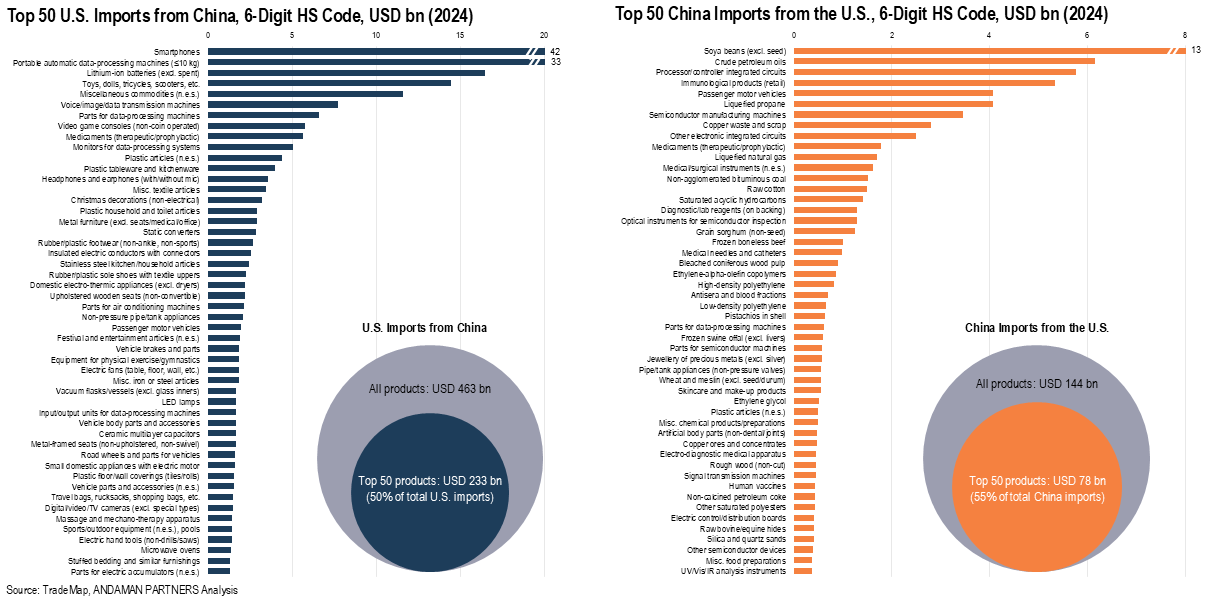

- The top 50 U.S. imports from China in 2024 amounted to USD 233 billion, accounting for 50% of the total imports of USD 463 billion.

- The largest U.S. imports were smartphones (USD 42 billion), portable data-processing machines, or laptop computers (USD 33 billion), lithium-ion batteries (USD 16 billion) and toys, dolls, tricycles and scooters (USD 14 billion).

Implications:

- Chinese exports of lower-cost goods like toys, dolls, tricycles and scooters could be shifted to emerging markets. However, for premium smartphones and laptops, China will have to pivot fast as the U.S. is the most lucrative market.

- Emerging markets like India and Southeast Asia could offer volume over margin and offset some U.S. losses. In markets like Europe, the Middle East and Latin America, Chinese manufacturers must invest significantly in branding and innovation to be more competitive.

- For lithium-ion batteries, losing the U.S. market would likewise force a significant pivot for China. The most likely candidate is Europe: Chinese manufacturers are already deeply embedded in the electric vehicle (EV) supply chains in the European Union (EU). However, U.S. pressure on EU countries could limit China’s expansion in some markets.

- Manufacturing locally could be an option to sidestep U.S. tariffs. Chinese manufacturers are building and expanding plants in several countries, including Hungary, Thailand, Indonesia and Germany. China could also redirect some exports to regions like India, Southeast Asia, Latin America and Africa, which are at the earlier stages of EV adoption

Tariff Trouble: Implications for the U.S.

- The top 50 Chinese imports from the U.S. in 2024 amounted to USD 78 billion, accounting for 55% of the total of USD 144 billion.

- The largest Chinese imports were soya beans (USD 13 billion), crude petroleum oils (USD 13 billion), integrated circuits (USD 6 billion) and immunological products, including vaccines and antibodies (USD 5 billion).

Implications:

- China has historically been the largest buyer of U.S. soya beans, and the loss of the Chinese market will be a significant setback for farmers in the U.S. Midwest. There are several other growing markets for U.S. soya beans, including the EU, Mexico, Indonesia, Egypt, and Japan. However, none of these countries purchased anywhere near the same level as China in 2024 (the largest buyer was the EU with more than USD 2 billion).

- Considering China’s large petroleum-refining capacity, offsetting the loss of exports to China will be challenging. Shipping and refining bottlenecks will be a challenge, but the U.S. can potentially shift exports to the Asia-Pacific region, especially South Korea, Japan, India and Singapore, and increase exports to Europe, which is seeking to reduce its dependency on Russian oil.

- China is actively pursuing a strategy to decouple from U.S. microchips, so the U.S. must rapidly pivot to markets like Taiwan (China), South Korea, Japan, Germany and India, where demand is high.

- China is the third-largest buyer of U.S. immunological products, including vaccines, antibodies, toxins and antitoxins, behind Germany and the Netherlands. The U.S. will likely seek to expand exports to markets in developed economies, notably the EU, Japan, Canada, Singapore and Malaysia.

ANDAMAN PARTNERS supports international business ventures and growth. We help launch global initiatives and accelerate successful expansion across borders. If your business, operations or project requires cross-border support, contact connect@andamanpartners.com.

ANDAMAN PARTNERS Was a Co-Sponsor of the South African National Day Reception in Shanghai on 30 May 2025

ANDAMAN PARTNERS was a cosponsor of the South African National Day Reception in Shanghai on 30 May 2025.

Asia’s Shifting Role in Global Supply Chains — Perspectives by ANDAMAN PARTNERS Co-Founder Rachel Wu

Analysis by ANDAMAN PARTNERS Co-Founder Rachel Wu on changing patterns in global supply chains.

ANDAMAN PARTNERS Co-sponsored the West Australian Mining Club Luncheon in Perth on 27 February 2025

WA Mining Club luncheons are valuable ways to network with colleagues and clients and learn about the latest industry insights.

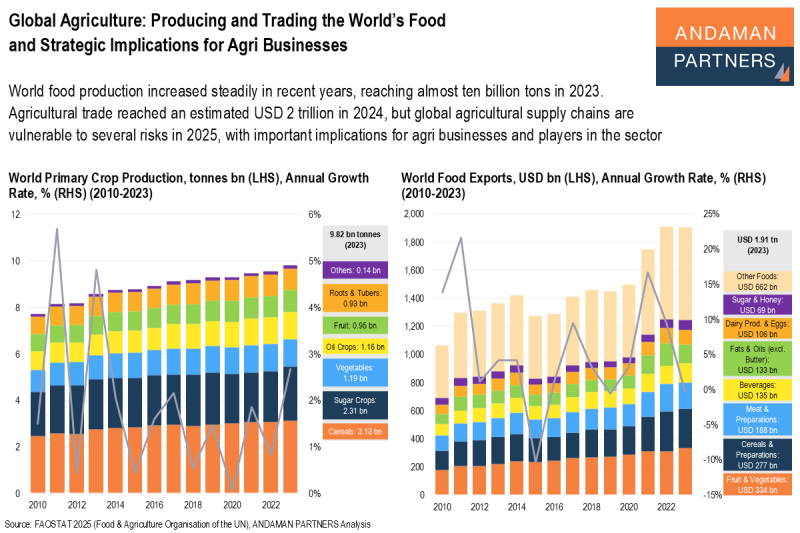

Global Agriculture: Producing and Trading the World’s Food and Strategic Implications for Agri Businesses

Global agricultural supply chains are vulnerable to several risks in 2025, with important implications for agri businesses and players in the sector.

Southeast Asia: The USD 4-trillion Economy

With rapid GDP growth, expanding trade networks and investment inflows, Southeast Asia retains its enduring appeal as a vital destination for multinational corporations seeking to diversify their supply chains and tap into Asia’s growing consumer markets.

Indonesia’s Dynamic Economic Growth Story Offering Opportunities for Global Businesses

Indonesia’s dynamic, services-led and consumption-driven economy is poised to become one of the world’s largest by mid-century, presenting many opportunities for businesses and investors.