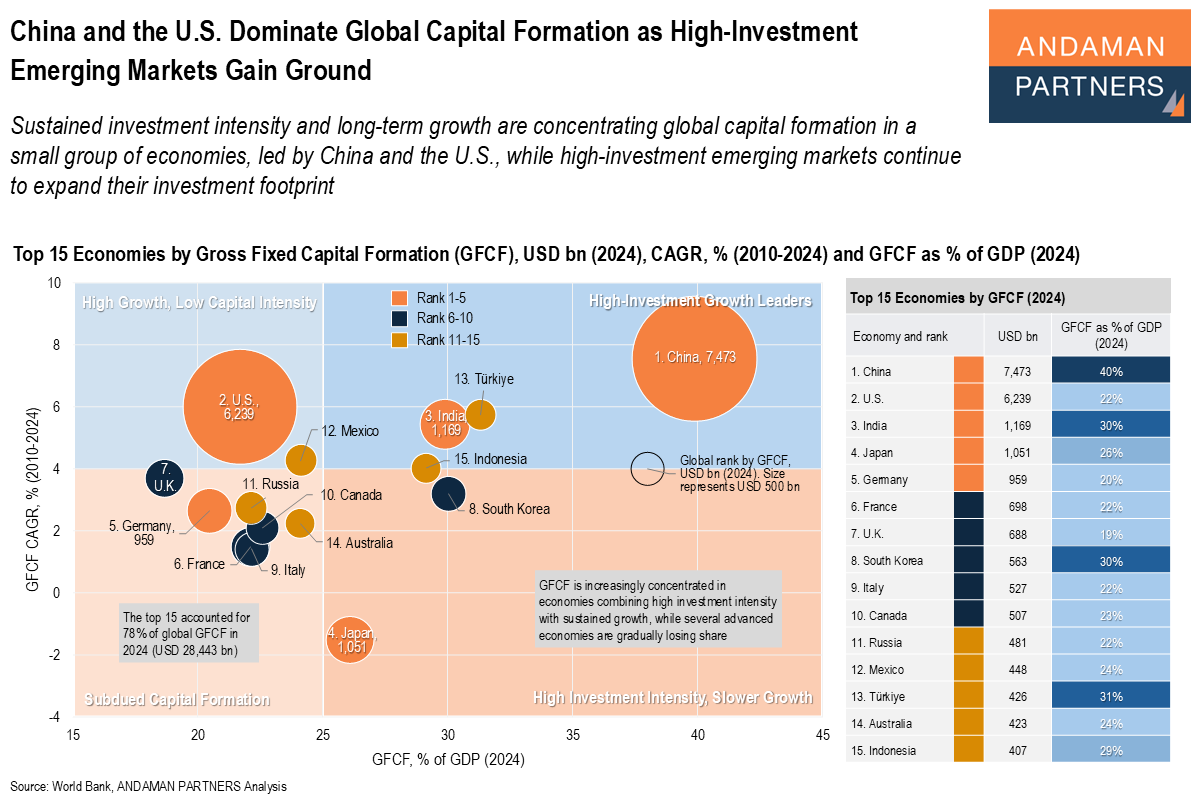

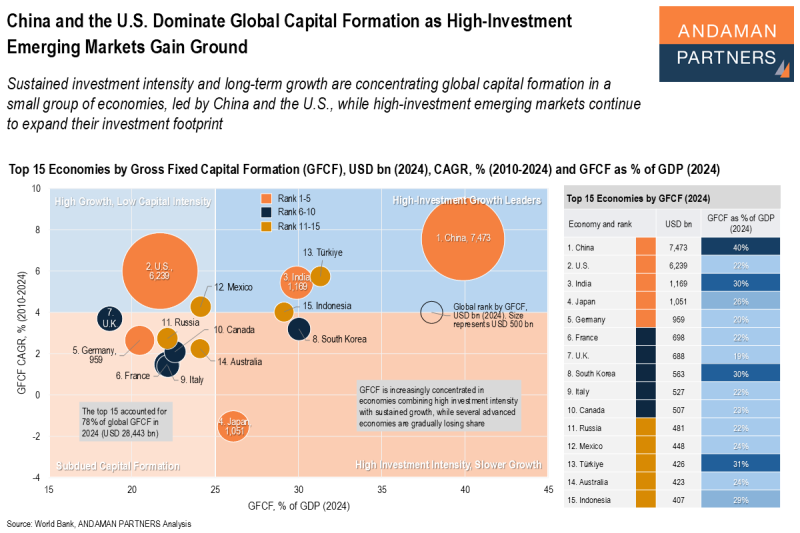

Sustained investment intensity and long-term growth are concentrating global capital formation in a small group of economies, led by China and the U.S., while high-investment emerging markets continue to expand their investment footprint.

Gross Fixed Capital Formation (GFCF) captures real-economy investment in long-lived assets such as infrastructure, machinery, industrial facilities and construction. As such, it is one of the clearest indicators of where future productive capacity is being built, and where future demand for capital goods, commodities, energy and logistics capacity will concentrate. Comparing both the scale of GFCF and its intensity (GFCF as a share of GDP) provides a powerful lens into which economies are structurally expanding their capital base versus those growing through consumption or services.

The data shows that global capital formation remains overwhelmingly concentrated in two economies: China and the U.S. China stands out not only for its unmatched absolute scale of investment, but also for its exceptionally high investment intensity (40%), highlighting a growth model still anchored in capital deepening, infrastructure build-out and industrial expansion.

The U.S., by contrast, combines large investment volumes with strong long-term growth in GFCF, but at a lower investment-to-GDP ratio (22%), reflecting a more consumption- and productivity-driven structure.

Beyond these two anchors, a second tier of high-investment emerging markets is gaining ground. Economies such as India, Indonesia, Türkiye, Brazil, Mexico and Russia combine meaningful scale with relatively high investment intensity, pointing to continued infrastructure build-out and expanding industrial capacity. Several mature economies, including Japan, Germany, France, South Korea, the U.K., and Italy, show weaker GFCF growth, reinforcing a broader divergence in global investment momentum.

The top 15 economies shown here effectively define the global capex map: together they account for the bulk of worldwide fixed investment and therefore set the direction of demand for construction, machinery, transport infrastructure and industrial inputs.

Within this group, China and the U.S. form the system’s core, while India and several large emerging markets represent the most important sources of incremental investment growth. Weaker momentum across major European economies and Japan highlights a widening gap between regions expanding productive capacity and those investing more cautiously.

These 15 economies accounted for 78% of the world’s GFCF in 2024; this concentration means that future supply-chain build-out, competitive capacity expansion and market scale will increasingly be shaped by a relatively small set of investment-heavy economies.

Also by ANDAMAN PARTNERS:

ANDAMAN PARTNERS supports international business ventures and growth. We help launch global initiatives and accelerate successful expansion across borders. If your business, operations or project requires cross-border support, contact connect@andamanpartners.com.

ANDAMAN PARTNERS to Attend Investing in African Mining Indaba 2026 in Cape Town

ANDAMAN PARTNERS Co-Founders Kobus van der Wath and Rachel Wu will attend Investing in African Mining Indaba 2026 in Cape Town, South Africa.

Join ANDAMAN PARTNERS at Networking Event in Cape Town Ahead of Mining Indaba 2026

ANDAMAN PARTNERS is pleased to support and sponsor this popular Pre-Indaba event in Cape Town.

AAMEG Event in Cape Town Ahead of Mining Indaba 2026

ANDAMAN PARTNERS is pleased to sponsor and support the AAMEG pre-Mining Indaba Cocktails & Canapes event.

China and the U.S. Dominate Global Capital Formation as High-Investment Emerging Markets Gain Ground

Sustained investment intensity and long-term growth are concentrating global capital formation in a small group of economies, led by China and the U.S.

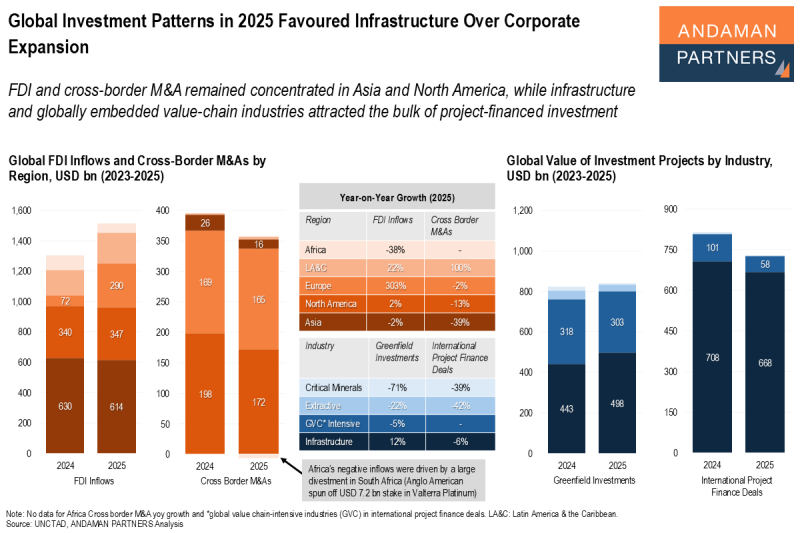

Global Investment Patterns in 2025 Favoured Infrastructure Over Corporate Expansion

FDI and M&A remained concentrated in Asia and North America, while infrastructure attracted the bulk of project-financed investment.

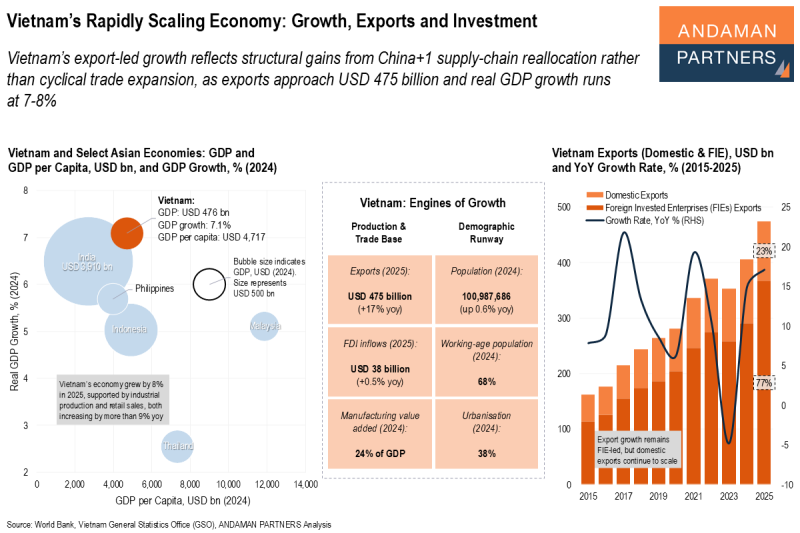

Vietnam’s Rapidly Scaling Economy: Growth, Exports and Investment

Vietnam’s export-led growth reflects structural gains from China+1 supply-chain reallocation rather than cyclical trade expansion.