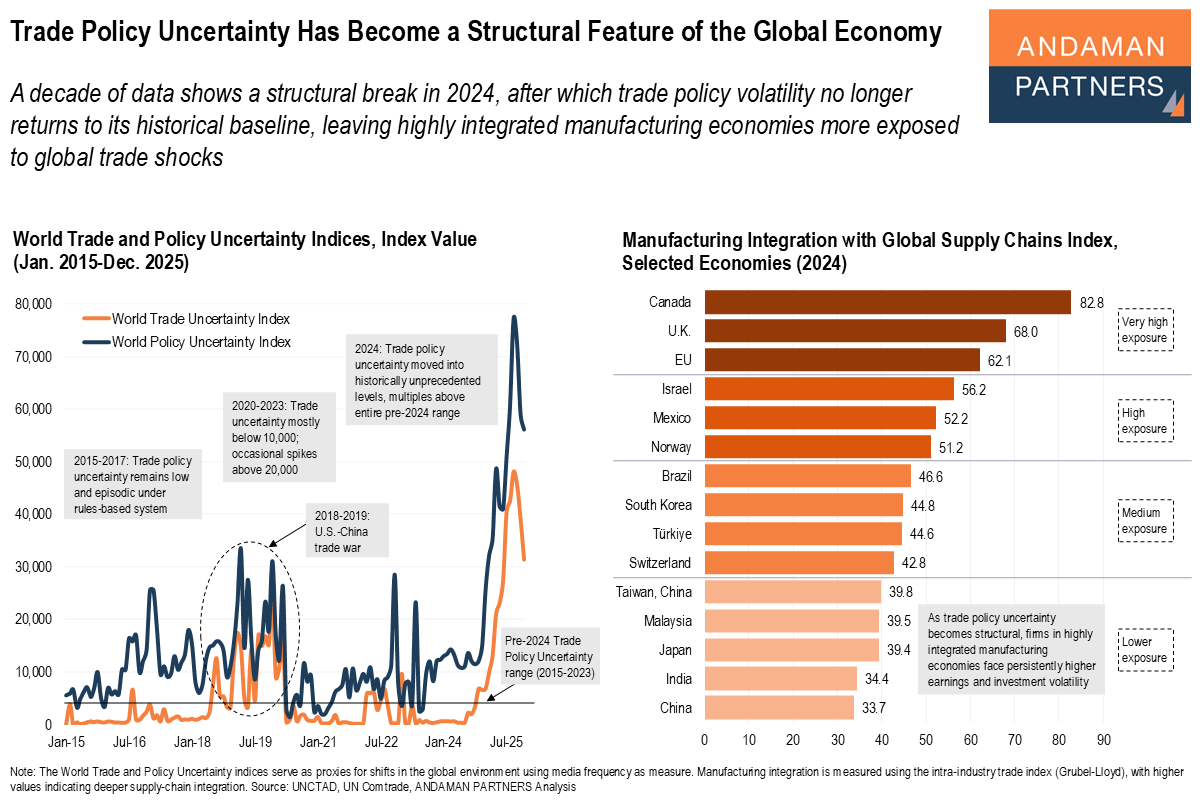

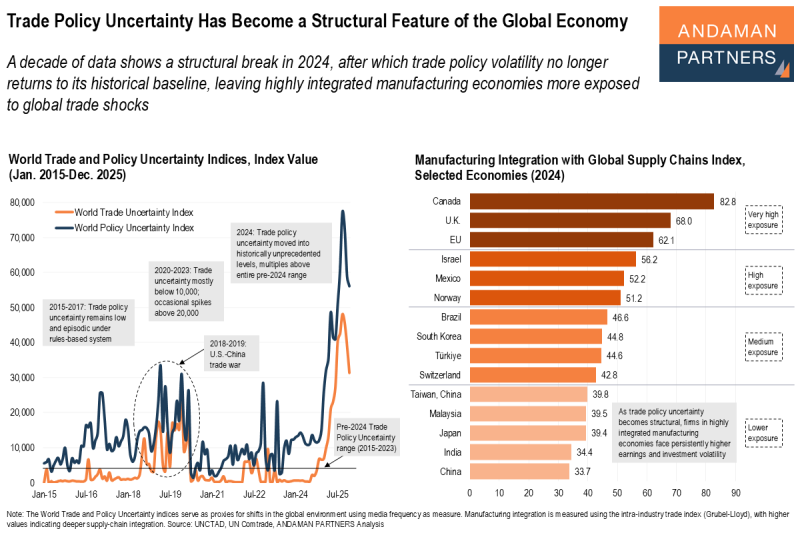

A decade of data shows a structural break in 2024, after which trade policy volatility no longer returns to its historical baseline, leaving highly integrated manufacturing economies more exposed to global trade shocks.

The Economic Policy Uncertainty Index and the Trade Policy Uncertainty Index are widely used measures that track the global policy environment. Both indices are constructed from the frequency of policy- and trade-related uncertainty terms in leading global newspapers. The indices are proxy measures of the intensity and persistence of uncertainty in the policy framework facing firms, investors and global supply chains.

For most of the past decade, trade policy uncertainty remained episodic. Even during major shocks such as the U.S.–China trade war in 2018–2019 and the COVID period, volatility spiked and then returned toward its historical baseline. That pattern shifted decisively in 2024. Since then, trade policy uncertainty has moved into a historically unprecedented regime, several multiples above its entire pre-2024 range, and shows no sign of normalising.

This marks a structural shift rather than a cyclical shock. Trade policy uncertainty is no longer a transient disturbance that firms can wait out; it has become a persistent feature of the operating environment.

Manufacturing integration, measured by the intra-industry trade index, captures the extent to which countries participate in cross-border production within the same industries. Economies such as Canada, the U.K. and the EU rank at the top of this distribution, reflecting heavy exposure to complex, multi-country supply chains.

In a world of structurally high trade policy uncertainty, highly integrated manufacturing economies face persistently higher earnings volatility and greater investment risk. As uncertainty becomes a permanent feature of the operating environment, supply chain resilience and geographic diversification move from tactical risk management to permanent strategic priorities. For CEOs, trade volatility is no longer a cyclical risk to manage; it is now a structural planning constraint that shapes sourcing, production and capital allocation decisions.

Also by ANDAMAN PARTNERS:

ANDAMAN PARTNERS supports international business ventures and growth. We help launch global initiatives and accelerate successful expansion across borders. If your business, operations or project requires cross-border support, contact connect@andamanpartners.com.

ANDAMAN PARTNERS to Attend Investing in African Mining Indaba 2026 in Cape Town

ANDAMAN PARTNERS Co-Founders Kobus van der Wath and Rachel Wu will attend Investing in African Mining Indaba 2026 in Cape Town, South Africa.

Join ANDAMAN PARTNERS at Networking Event in Cape Town Ahead of Mining Indaba 2026

ANDAMAN PARTNERS is pleased to support and sponsor this popular Pre-Indaba event in Cape Town.

AAMEG Event in Cape Town Ahead of Mining Indaba 2026

ANDAMAN PARTNERS is pleased to sponsor and support the AAMEG pre-Mining Indaba Cocktails & Canapes event.

Trade Policy Uncertainty Has Become a Structural Feature of the Global Economy

A decade of data shows a structural break in 2024, after which trade policy volatility no longer returns to its historical baseline.

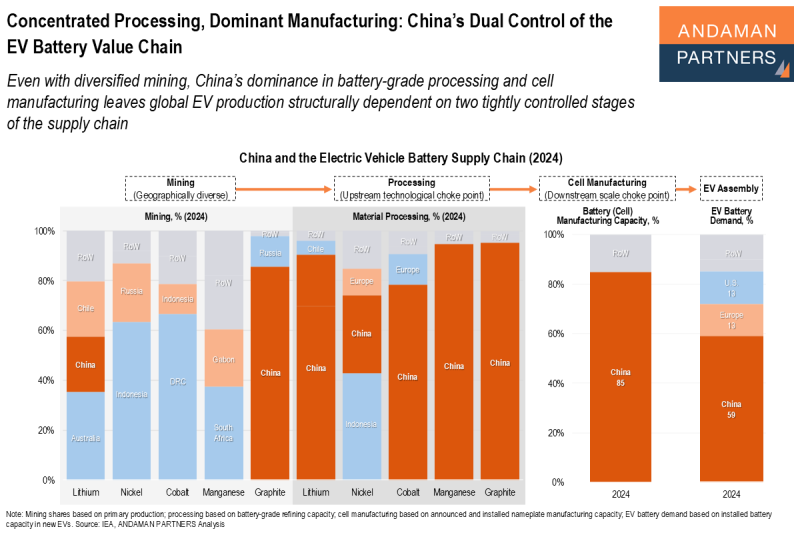

Concentrated Processing, Dominant Manufacturing: China’s Dual Control of the EV Battery Value Chain

China’s dominance in battery-grade processing and cell manufacturing leaves global EV production dependent on two stages of the supply chain.

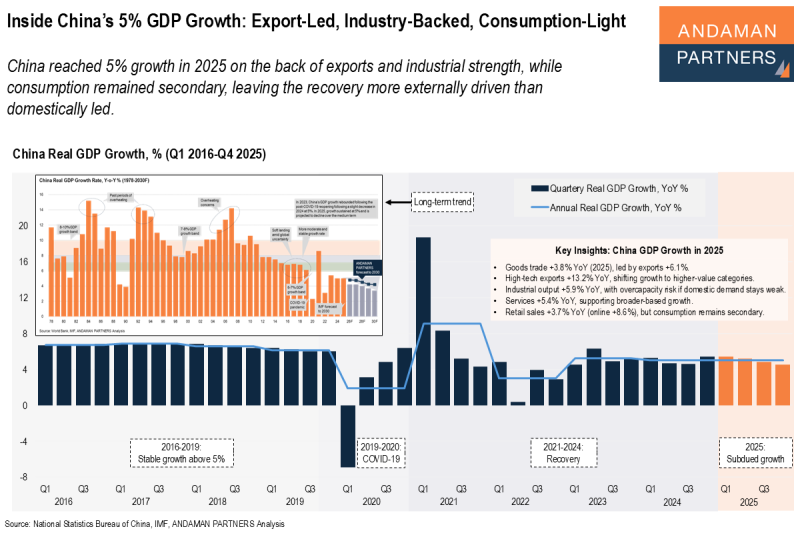

Inside China’s 5% GDP Growth: Export-Led, Industry-Backed, Consumption-Light

China reached 5% growth in 2025 on the back of exports and industrial strength, while consumption remained secondary.