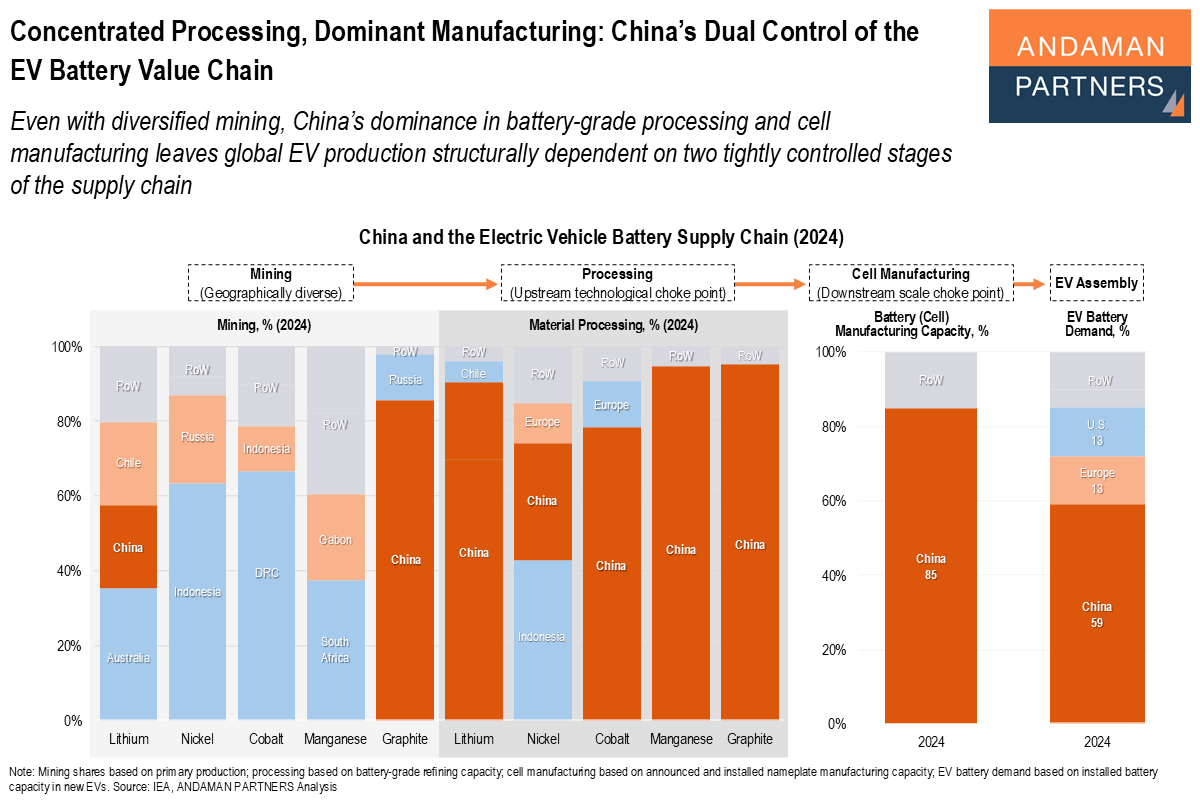

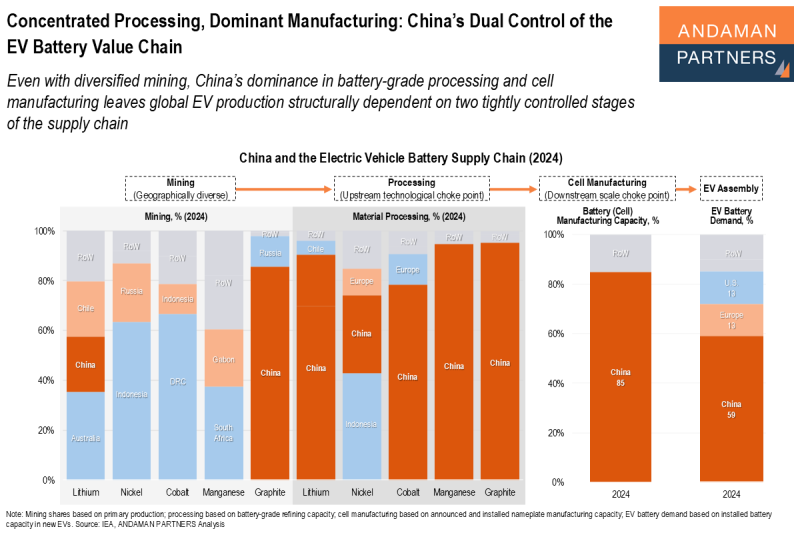

Even with diversified mining, China’s dominance in battery-grade processing and cell manufacturing leaves global EV production structurally dependent on two tightly controlled stages of the supply chain.

Even as critical mineral supply becomes more geographically diversified, the global electric vehicle (EV) battery value chain remains structurally anchored in China because control is exercised not at the mine but at two decisive stages: processing and cell manufacturing.

Upstream, mining is distributed across Australia, Indonesia, the DRC, Chile and a range of other producers, with no single country dominating primary extraction across the major battery materials. This diversification has led many policymakers to believe that upstream dependence can be gradually reduced through new projects and investment partnerships. But this view overlooks where actual bottlenecks now exist. The binding constraint is no longer access to raw ore, but the ability to convert those materials into battery-grade inputs at scale.

In the materials processing industry, China has built overwhelming dominance across all five critical materials. In graphite, lithium, cobalt, manganese and large parts of nickel refining, China controls the vast majority of global battery-grade processing capacity. This stage focuses on technical know-how, environmental permitting, chemical engineering expertise and supply-chain integration, in a way that is extremely difficult to replicate elsewhere. Even diversified mining flows are therefore still routed back through Chinese processing networks.

Downstream, this concentration is reinforced by the scale of manufacturing. China accounts for around 85% of global cell manufacturing capacity but absorbs only about 59% of global EV battery demand. This surplus capacity positions China as the systemic supplier of last resort for the rest of the world. Western gigafactory build-outs can reduce exposure at the margin, but they remain dependent on Chinese-processed inputs and lag far behind in accumulated manufacturing experience, yields and ramp-up speed.

The result is a two-layer dependency. Mining diversification weakens upstream concentration, but it does not break the system’s core constraint. Control has migrated downstream to processing and scale manufacturing, where substitution is slow, capital-intensive and technologically complex. Until those two stages are meaningfully diversified, global EV production will remain structurally dependent on China, regardless of how widely mineral supply is distributed.

Also by ANDAMAN PARTNERS:

ANDAMAN PARTNERS supports international business ventures and growth. We help launch global initiatives and accelerate successful expansion across borders. If your business, operations or project requires cross-border support, contact connect@andamanpartners.com.

ANDAMAN PARTNERS to Attend Investing in African Mining Indaba 2026 in Cape Town

ANDAMAN PARTNERS Co-Founders Kobus van der Wath and Rachel Wu will attend Investing in African Mining Indaba 2026 in Cape Town, South Africa.

Join ANDAMAN PARTNERS at Networking Event in Cape Town Ahead of Mining Indaba 2026

ANDAMAN PARTNERS is pleased to support and sponsor this popular Pre-Indaba event in Cape Town.

AAMEG Event in Cape Town Ahead of Mining Indaba 2026

ANDAMAN PARTNERS is pleased to sponsor and support the AAMEG pre-Mining Indaba Cocktails & Canapes event.

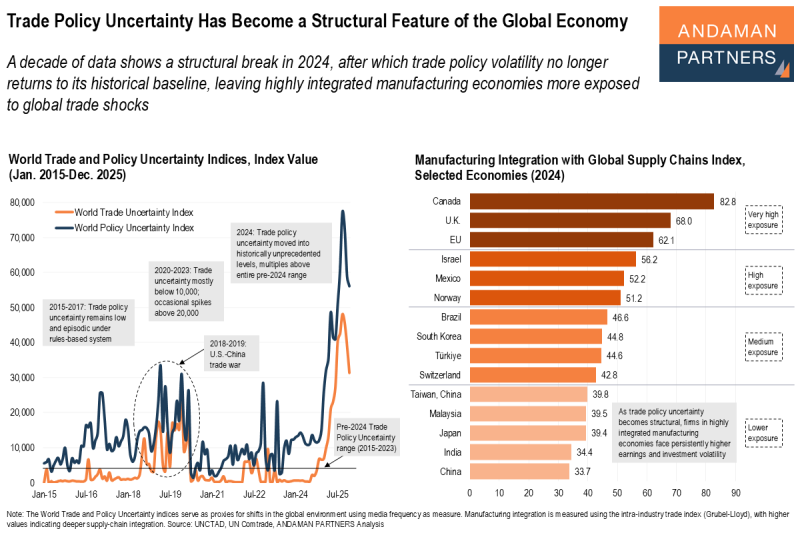

Trade Policy Uncertainty Has Become a Structural Feature of the Global Economy

A decade of data shows a structural break in 2024, after which trade policy volatility no longer returns to its historical baseline.

Concentrated Processing, Dominant Manufacturing: China’s Dual Control of the EV Battery Value Chain

China’s dominance in battery-grade processing and cell manufacturing leaves global EV production dependent on two stages of the supply chain.

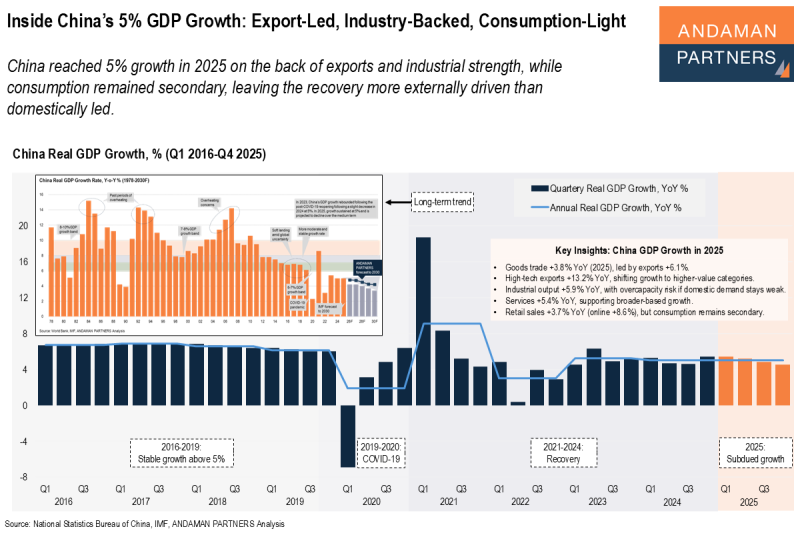

Inside China’s 5% GDP Growth: Export-Led, Industry-Backed, Consumption-Light

China reached 5% growth in 2025 on the back of exports and industrial strength, while consumption remained secondary.