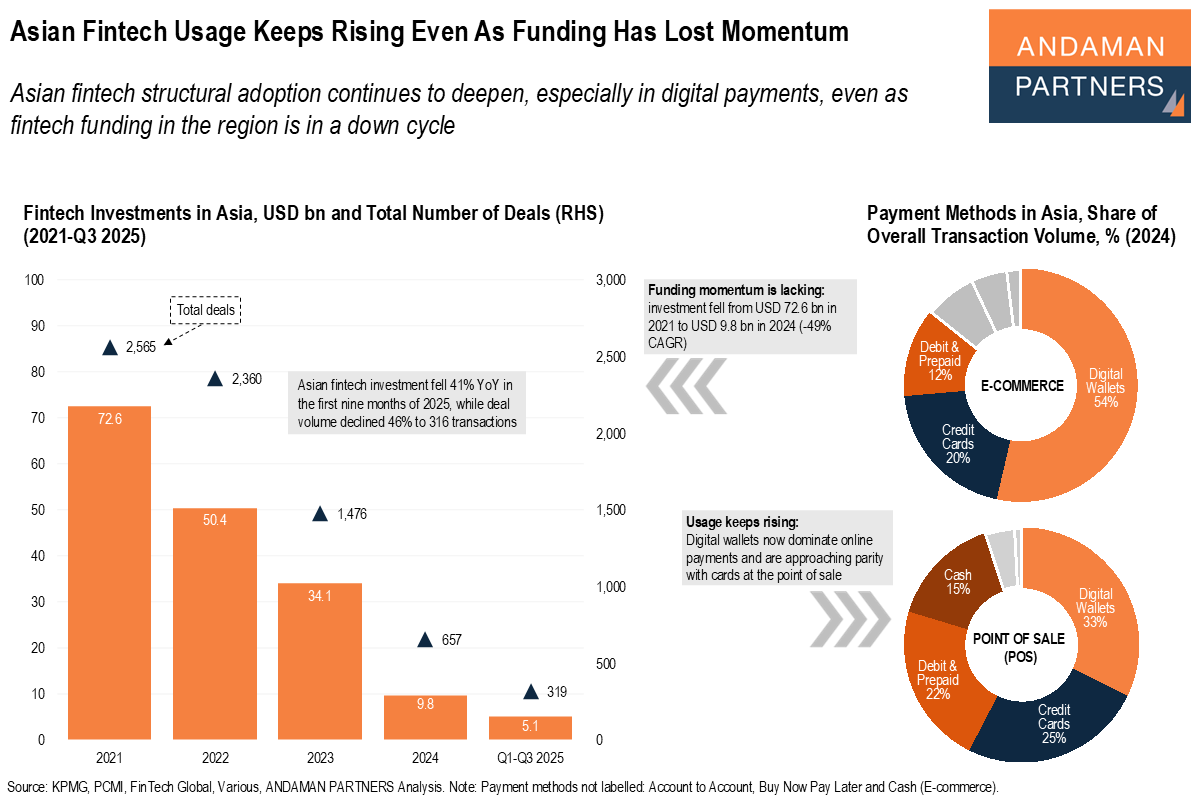

Asian fintech structural adoption continues to deepen, especially in digital payments, even as fintech funding in the region is in a down cycle.

Digital wallets now dominate e-commerce transactions in Asia. They are rapidly closing the gap with credit and debit cards at the point of sale, underscoring how deeply fintech tools are embedded in everyday economic activity. In other words, while the investment cycle has turned, fintech’s role in Asia’s payments infrastructure continues to expand, highlighting a growing disconnect between capital flows and real-world usage.

Asian fintech funding, however, has entered a clear down-cycle, with investment falling sharply from its 2021 peak and deal activity contracting just as decisively. Capital has become more selective, large transactions have dried up and overall momentum has weakened as investors reset expectations for growth, profitability and regulation across the region.

Despite the funding slowdown, fintech adoption in the region underlines a more durable shift in how payments are actually made in Asia.

Also by ANDAMAN PARTNERS:

ANDAMAN PARTNERS supports international business ventures and growth. We help launch global initiatives and accelerate successful expansion across borders. If your business, operations or project requires cross-border support, contact connect@andamanpartners.com.

ANDAMAN PARTNERS to Attend Investing in African Mining Indaba 2026 in Cape Town

ANDAMAN PARTNERS Co-Founders Kobus van der Wath and Rachel Wu will attend Investing in African Mining Indaba 2026 in Cape Town, South Africa.

Join ANDAMAN PARTNERS at Networking Event in Cape Town Ahead of Mining Indaba 2026

ANDAMAN PARTNERS is pleased to support and sponsor this popular Pre-Indaba event in Cape Town.

AAMEG Event in Cape Town Ahead of Mining Indaba 2026

ANDAMAN PARTNERS is pleased to sponsor and support the AAMEG pre-Mining Indaba Cocktails & Canapes event.

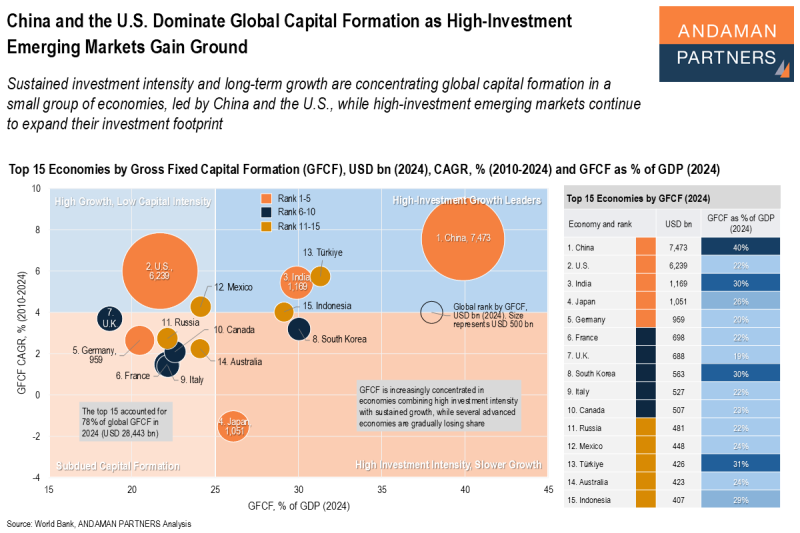

China and the U.S. Dominate Global Capital Formation as High-Investment Emerging Markets Gain Ground

Sustained investment intensity and long-term growth are concentrating global capital formation in a small group of economies, led by China and the U.S.

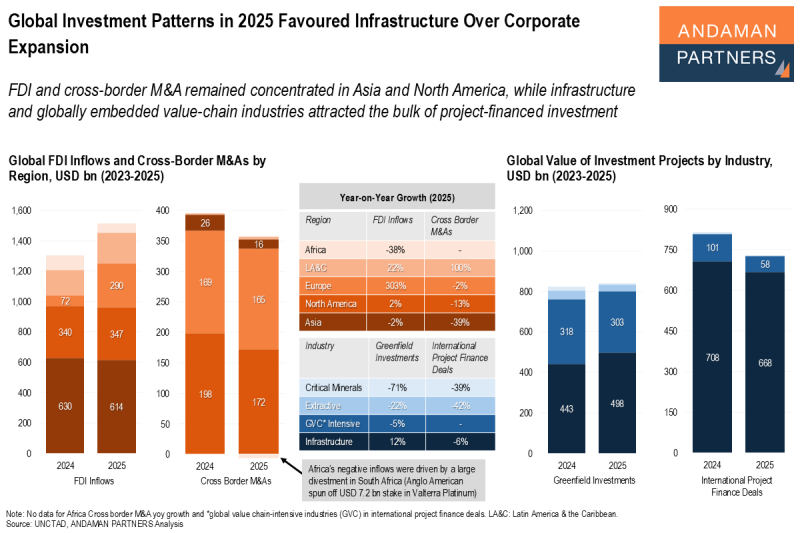

Global Investment Patterns in 2025 Favoured Infrastructure Over Corporate Expansion

FDI and M&A remained concentrated in Asia and North America, while infrastructure attracted the bulk of project-financed investment.

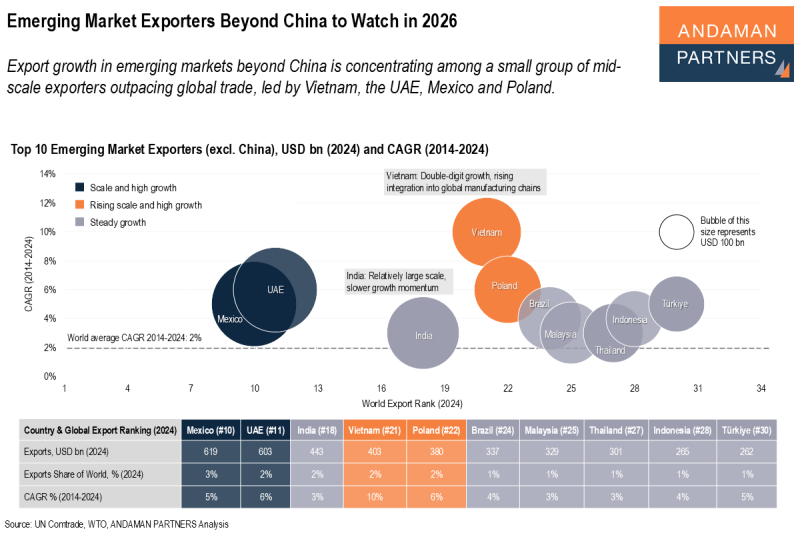

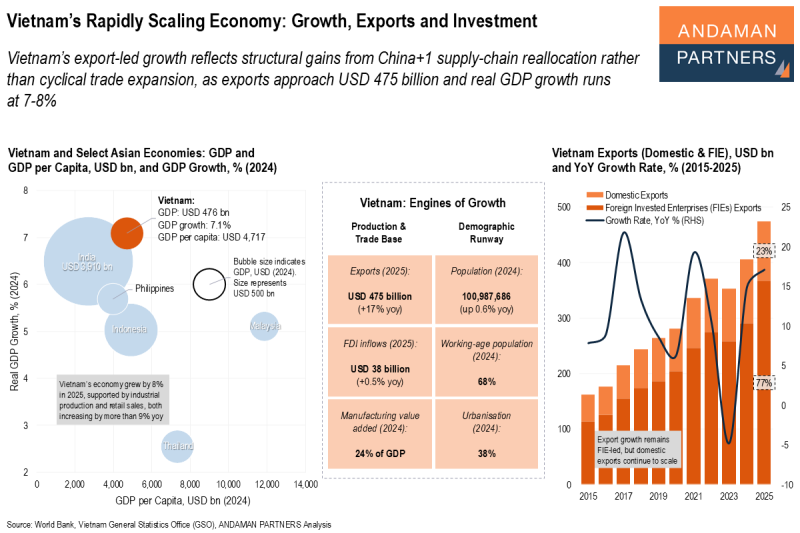

Vietnam’s Rapidly Scaling Economy: Growth, Exports and Investment

Vietnam’s export-led growth reflects structural gains from China+1 supply-chain reallocation rather than cyclical trade expansion.