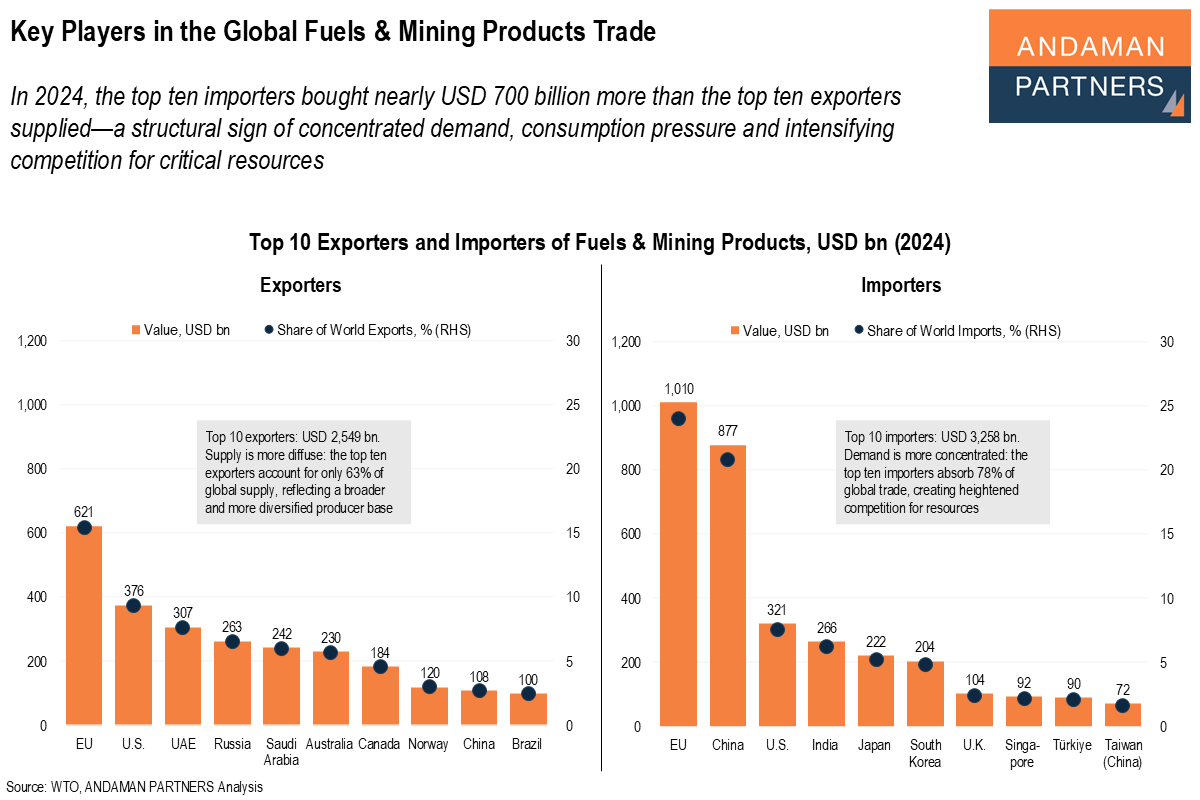

In 2024, the top ten importers bought nearly USD 700 billion more than the top ten exporters supplied—a structural sign of concentrated demand, consumption pressure and intensifying competition for critical resources.

Global trade in Fuels & Mining Products is defined by a sharp imbalance between a broad, diffuse base of suppliers and a highly concentrated set of major buyers, creating structural consumption pressure and intensifying competition for critical resources.

In 2024, the top ten exporters accounted for USD 2.55 trillion, or just 63% of global supply, spread across a diverse group led by the EU, the U.S., the UAE, Russia, Saudi Arabia, Australia and Canada, with China, Norway and Brazil rounding out the mid-sized producers.

On the demand side, the top ten importers absorbed a far larger USD 3.26 trillion, representing nearly 78% of global imports and underscoring how a small cluster of economies, led overwhelmingly by the EU and China, followed by the U.S., India, Japan and South Korea, now anchor global commodity demand.

This concentration of import dependence, combined with a more fragmented supplier base, indicates a market where competition for resources is tightening and procurement risk is rising. Countries that can secure stable, long-term access to energy and minerals will have greater geopolitical leverage.

Also by ANDAMAN PARTNERS:

ANDAMAN PARTNERS supports international business ventures and growth. We help launch global initiatives and accelerate successful expansion across borders. If your business, operations or project requires cross-border support, contact connect@andamanpartners.com.

ANDAMAN PARTNERS Wishes You a Happy and Prosperous Year of the Horse!

Compliments of the Chinese Lunar New Year to all our clients, customers, suppliers and partners.

ANDAMAN PARTNERS to Attend Investing in African Mining Indaba 2026 in Cape Town

ANDAMAN PARTNERS Co-Founders Kobus van der Wath and Rachel Wu will attend Investing in African Mining Indaba 2026 in Cape Town, South Africa.

Join ANDAMAN PARTNERS at Networking Event in Cape Town Ahead of Mining Indaba 2026

ANDAMAN PARTNERS is pleased to support and sponsor this popular Pre-Indaba event in Cape Town.

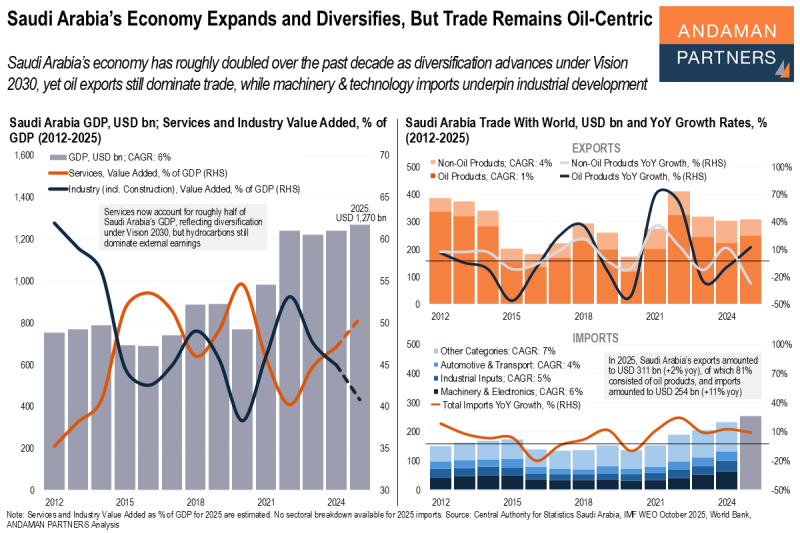

Saudi Arabia’s Economy Expands and Diversifies, But Trade Remains Oil-Centric

Saudi Arabia’s economy has roughly doubled over the past decade, yet oil exports still dominate trade.

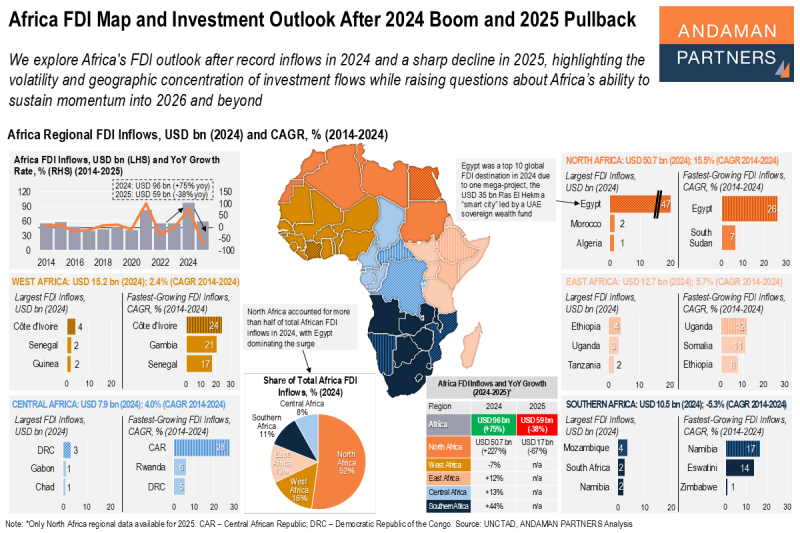

Africa FDI Map and Investment Outlook After 2024 Boom and 2025 Pullback

The volatility and geographic concentration of investment flows raises questions about Africa’s ability to sustain momentum into 2026 and beyond.

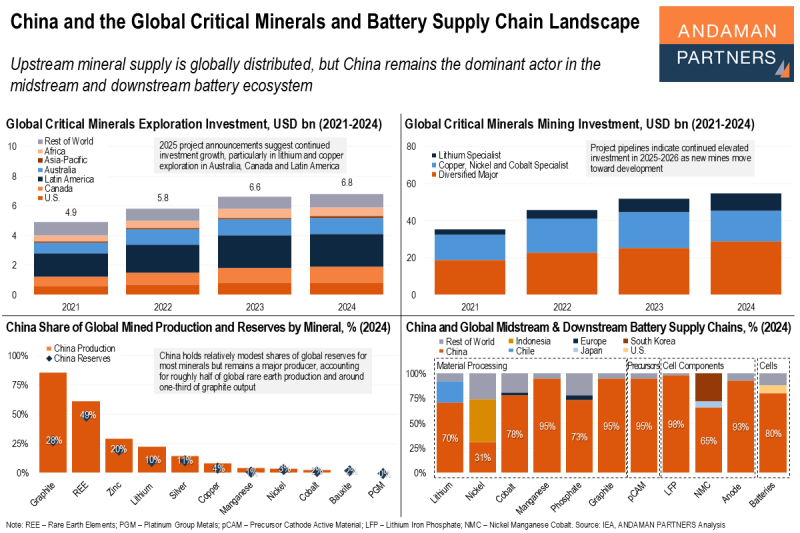

China and the Global Critical Minerals and Battery Supply Chain Landscape

Upstream mineral supply is globally distributed, but China remains the dominant actor in the midstream and downstream battery ecosystem.