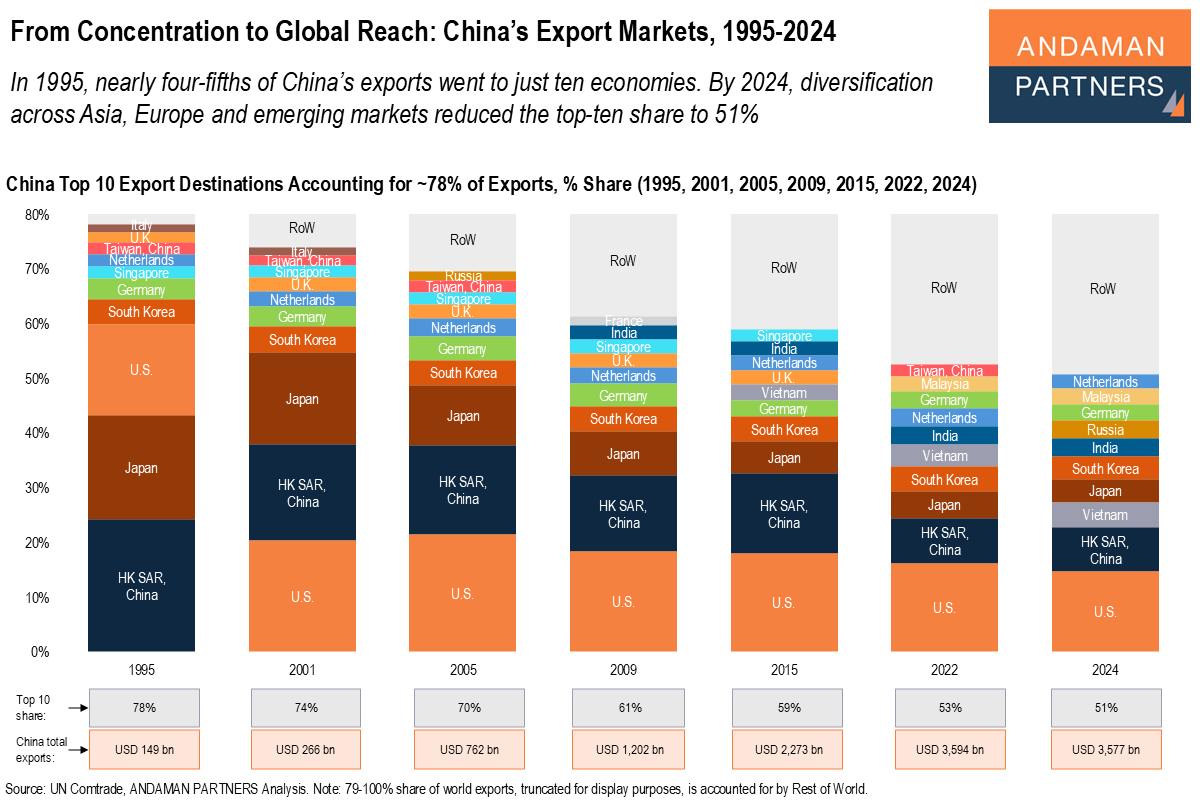

In 1995, nearly four-fifths of China’s exports went to just ten economies. By 2024, diversification across Asia, Europe and emerging markets reduced the top-ten share to 51%.

China’s export footprint has widened dramatically over the past three decades, reducing its dependence on a handful of major buyers.

In the mid-1990s, China’s external demand was heavily concentrated: the U.S., Hong Kong SAR and Japan alone accounted for more than half of its exports. By 2024, that concentration had eroded as China expanded into a broader mix of regional markets.

In 2024, the top ten destinations accounted for just over half of total exports, reflecting a structural diversification of demand that mirrors China’s rise as a multidimensional trading economy.

This diversification was driven by two reinforcing trends: the deepening of intra-Asian supply chains and the emergence of new mid-sized markets across Europe, Southeast Asia, South Asia and the Middle East. As China moved up the value chain, from labour-intensive goods to electronics, machinery and vehicles, it unlocked demand in countries with rising industrial capacity and household consumption.

At the same time, China’s export relationships became less dependent on a small set of advanced economies, with incremental growth in dozens of markets rather than a select few.

The implications are significant for global trade. A more distributed demand base makes China’s export engine more resilient to cyclical shocks and geopolitical friction, while increasing the complexity of global supply networks connected to China.

For policymakers and multinational firms, this means China is now deeply embedded across a wider arc of the world economy. Even as some economies pursue diversification away from China, China has simultaneously broadened its own external reach, reinforcing its central role in global trade flows.

Also by ANDAMAN PARTNERS:

ANDAMAN PARTNERS supports international business ventures and growth. We help launch global initiatives and accelerate successful expansion across borders. If your business, operations or project requires cross-border support, contact connect@andamanpartners.com.

ANDAMAN PARTNERS Wishes You a Happy and Prosperous Year of the Horse!

Compliments of the Chinese Lunar New Year to all our clients, customers, suppliers and partners.

ANDAMAN PARTNERS to Attend Investing in African Mining Indaba 2026 in Cape Town

ANDAMAN PARTNERS Co-Founders Kobus van der Wath and Rachel Wu will attend Investing in African Mining Indaba 2026 in Cape Town, South Africa.

Join ANDAMAN PARTNERS at Networking Event in Cape Town Ahead of Mining Indaba 2026

ANDAMAN PARTNERS is pleased to support and sponsor this popular Pre-Indaba event in Cape Town.

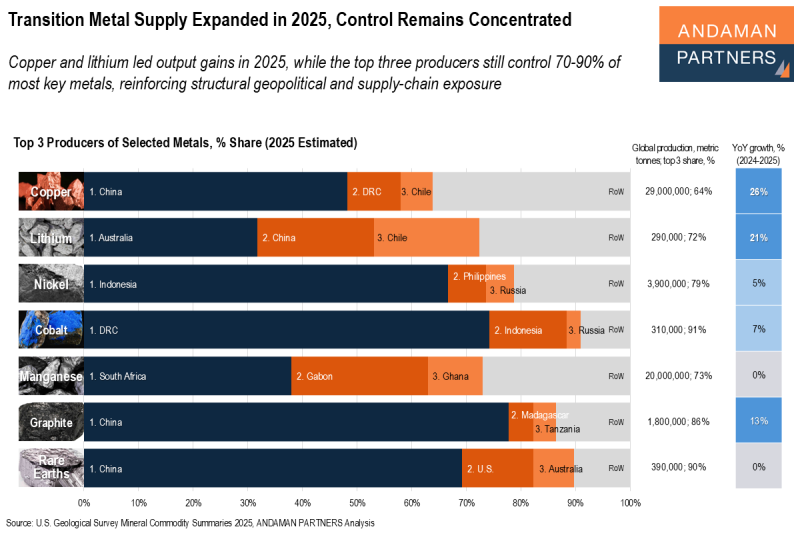

Transition Metal Supply Expanded in 2025, Control Remains Concentrated

Copper and lithium led output gains in 2025, while the top three producers still control 70-90% of most key metals.

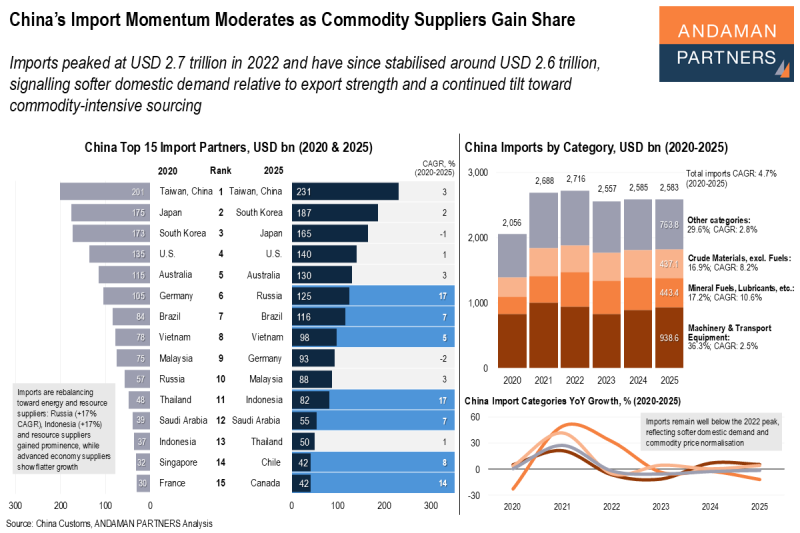

China’s Import Momentum Moderates as Commodity Suppliers Gain Share

Imports have stabilised around USD 2.6 trillion, signalling softer domestic demand and a continued tilt toward commodity-intensive sourcing.

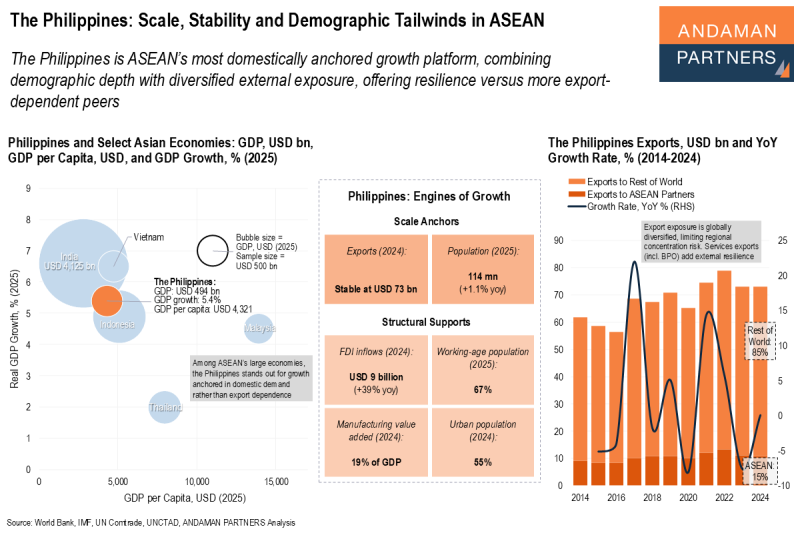

The Philippines: Scale, Stability and Demographic Tailwinds in ASEAN

The Philippines is ASEAN’s most domestically anchored growth platform, combining demographic depth with diversified external exposure.