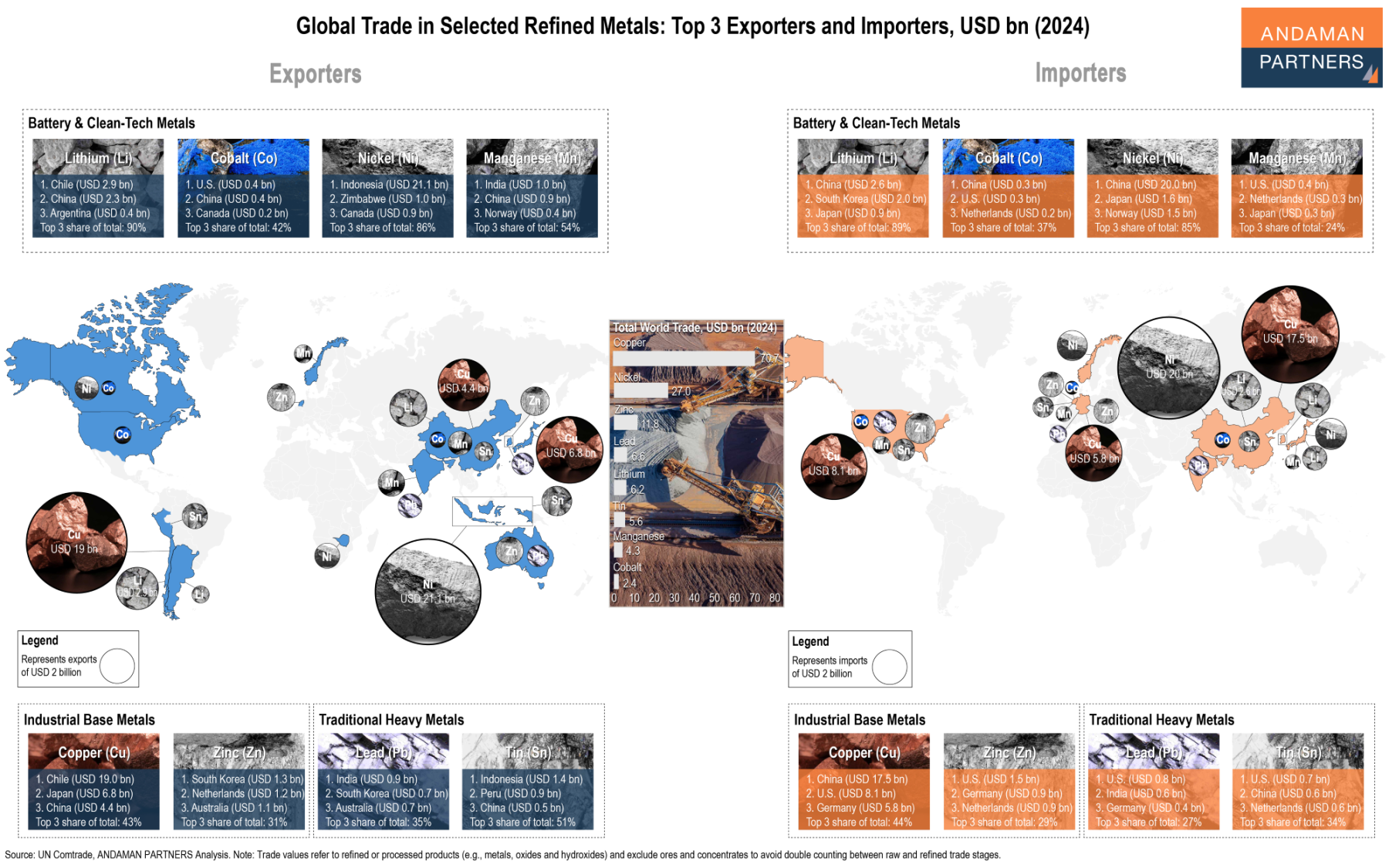

ANDAMAN PARTNERS Maps the Global Trade of Selected Refined Metals

The global metals trade is highly concentrated. A handful of countries dominate the export and import of refined metals, and China appears among the top three importers and exporters for most metals, a dual role no other economy plays.

The eight minerals and metals portrayed in this map are at the core of global industrial and energy transition supply chains. Lithium, cobalt, nickel and manganese are critical inputs for batteries and clean technologies; copper and zinc are essential for infrastructure, electrification and manufacturing; and lead and tin are vital in traditional heavy industries and electronics.

Together, the eight metals represent a cross-section of both emerging and established industrial value chains and provide a panoramic lens for understanding the global mineral trade.

To ensure analytical clarity and avoid double-counting, the map shows refined or processed mineral products rather than raw ores and concentrates, reflecting the actual geography of high-value mineral trade rather than upstream extraction alone.

Few Players, High Flows

Across the eight metals, the top three exporters typically control between 40% and 90% of global trade value. This reflects a narrow, strategic network of players at both ends of the market.

Exporters are often resource-rich countries (Chile, Indonesia, China, Australia), while importers are large industrialised economies (China, the U.S., Japan, Germany, South Korea) that transform these materials into manufactured goods.

Battery and clean-tech metals, in particular, stand out for their extreme concentration, especially lithium and nickel, with the top three exporters and importers accounting for more than 80% of global trade. These flows are heavily centred on South America (lithium) and Asia (nickel) on the export side, and East Asia (especially China) on the import side.

Traditional industrial metals have broader trade networks but are still concentrated. The top three exporters and importers of copper, zinc, lead and tin, for example, control a 30-50% share of global trade.

China at the Core

China is at the centre of the global trade in metals. It is both the world’s largest demand centre for critical and industrial metals and a primary refining and re-export hub.

China is the world’s second-largest exporter of lithium, cobalt and manganese, and the third-largest exporter of copper and tin. On the import side, China is the largest importer of lithium, cobalt, nickel and copper, and the second-largest importer of tin.

China’s centrality in the global metals trade has significant implications for supply chain resilience, industrial strategy and geopolitical risk. As a key hub for both imports and exports, China effectively anchors the flow of critical materials, shaping the cost, availability and security of supply for industries worldwide.

Also by ANDAMAN PARTNERS:

- China’s Entrenched Role as the World’s Leading Supplier of Mining Equipment and Consumables

- Nexus of the Mining World: China’s Share of Global Reserves and Production of Strategic Minerals and Metals

- Nexus of the Mining World: China’s Share of Global Processing and Exports of Strategic Minerals and Metals

ANDAMAN PARTNERS supports international business ventures and growth. We help launch global initiatives and accelerate successful expansion across borders. If your business, operations or project requires cross-border support, contact connect@andamanpartners.com.

Media

Join ANDAMAN PARTNERS at Networking Event in Cape Town Ahead of Mining Indaba 2026

ANDAMAN PARTNERS is pleased to support and sponsor this popular Pre-Indaba event in Cape Town.

AAMEG Event in Cape Town Ahead of Mining Indaba 2026

ANDAMAN PARTNERS is pleased to sponsor and support the AAMEG pre-Mining Indaba Cocktails & Canapes event.

AAMEG & ACBSA Event in Johannesburg Ahead of Mining Indaba 2026

ANDAMAN PARTNERS is pleased to sponsor and support the AAMEG & ABCSA pre-Mining Indaba Connections & Canapes event.

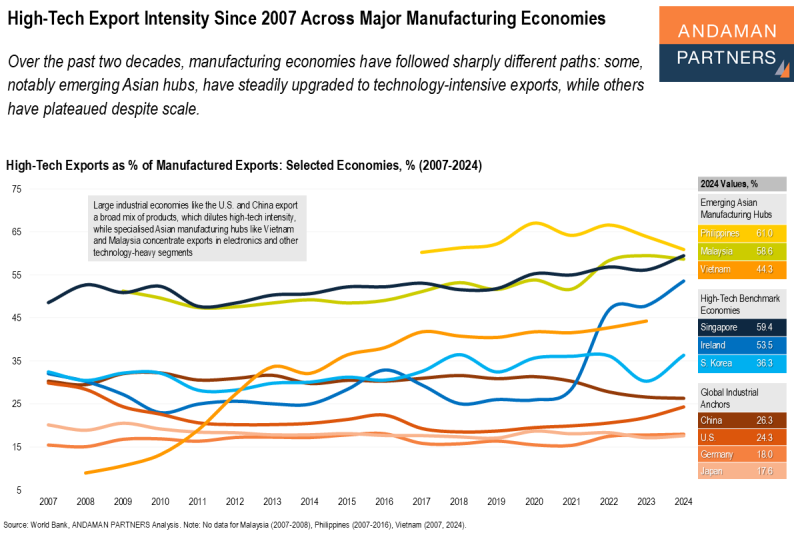

High-Tech Export Intensity Since 2007 Across Major Manufacturing Economies

Some manufacturing economies have upgraded to tech-intensive exports while others have plateaued despite scale.

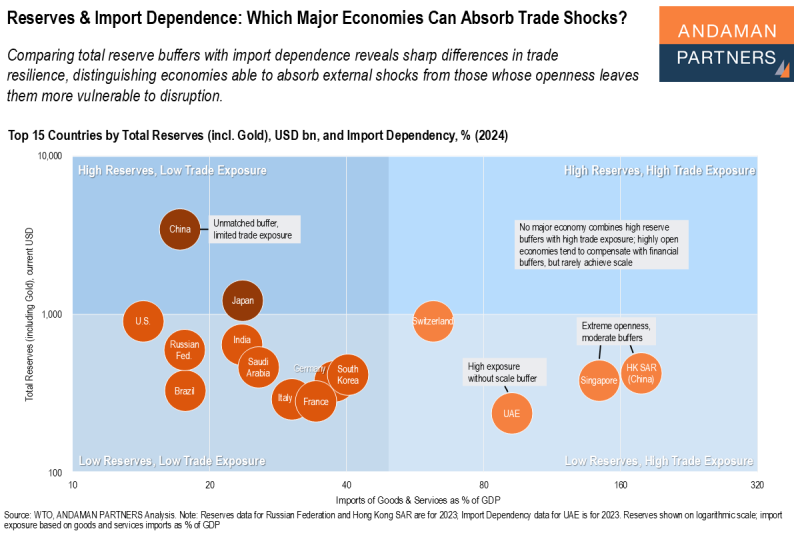

Reserves & Import Dependence: Which Major Economies Can Absorb Trade Shocks?

Comparing total reserve buffers with import dependence reveals sharp differences in trade resilience among major economies.

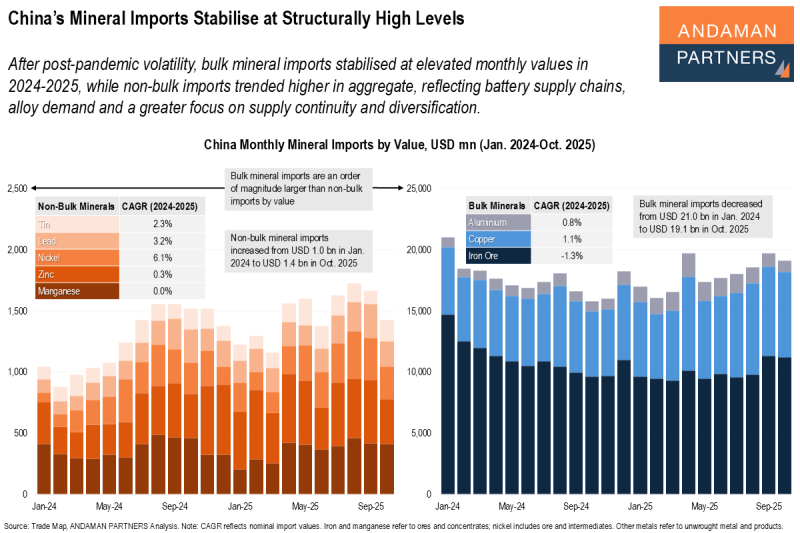

China’s Mineral Imports Stabilise at Structurally High Levels

Bulk mineral imports stabilised at elevated monthly values in 2024-2025, while non-bulk imports trended higher in aggregate.