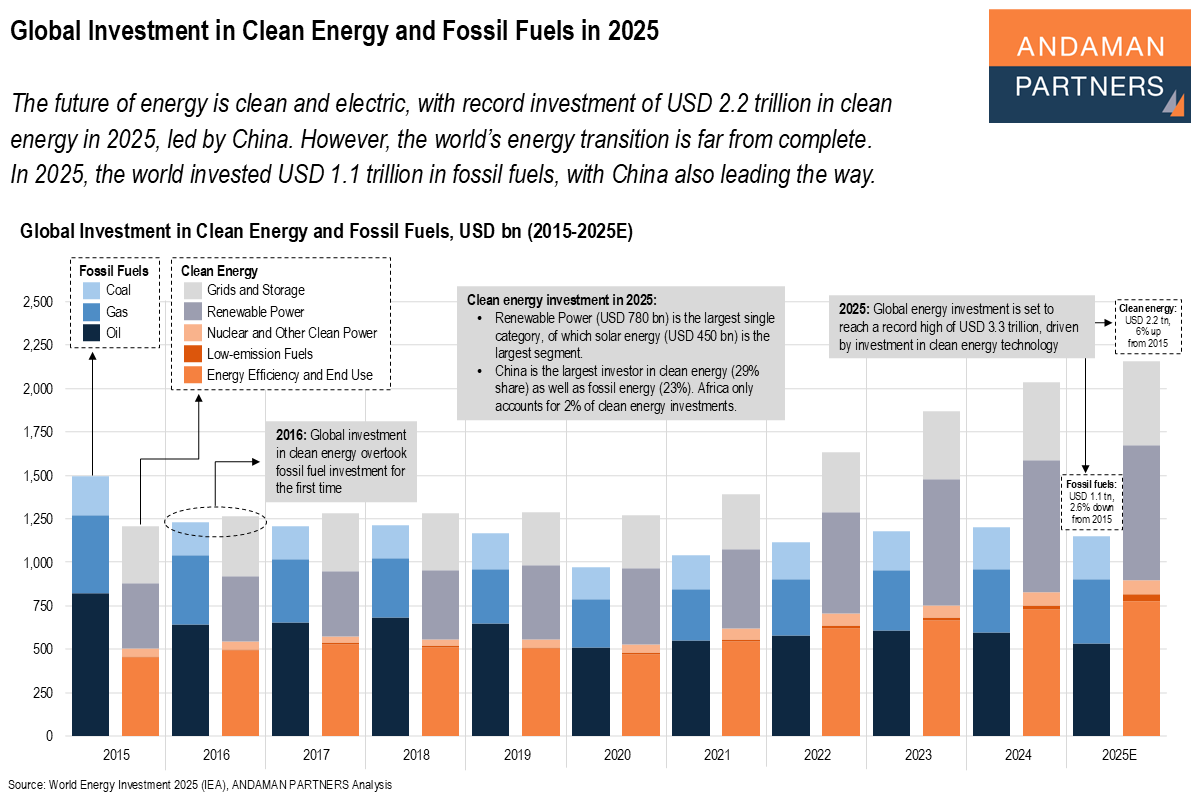

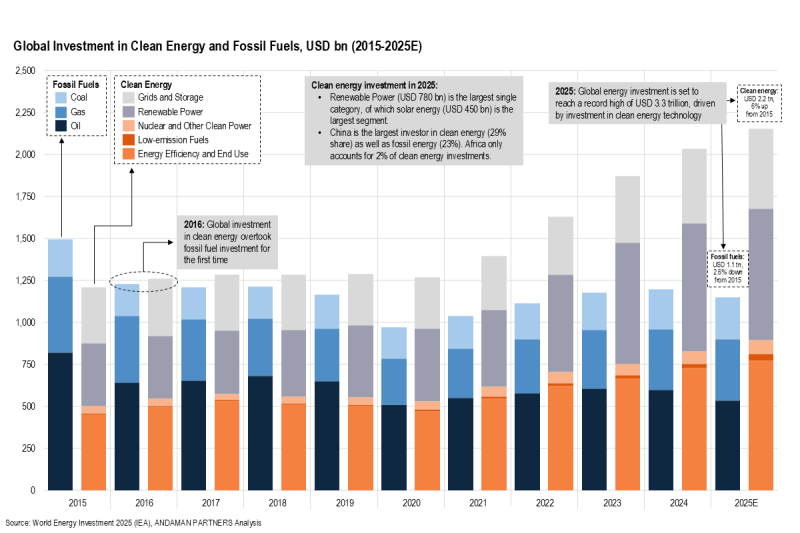

The future of energy is clean and electric, with record investment of USD 2.2 trillion in clean energy in 2025, led by China. However, the world’s energy transition is far from complete. In 2025, the world invested USD 1.1 trillion in fossil fuels, with China also leading the way.

Capital flows to the energy sector in 2025 are set to reach a new high of USD 3.3 trillion, a 2% increase on 2024. Two-thirds of this capital, USD 2.2 trillion, is going to clean energy, including renewables, nuclear, grids, storage, low-emission fuels and electrification:

- The largest single category of clean energy investment in 2025 is renewable power at USD 780 billion, of which solar power, both utility-scale and rooftop, will account for USD 450 billion.

- Investment in end-use investments in electrification and efficiency is expected to reach USD 773 billion, driven by growing electric vehicle (EV) sales.

- Investment in grids and storage is expected to reach USD 479 billion in 2025, and investment in nuclear energy should amount to USD 82 billion.

China is the largest investor in clean energy by a wide margin, accounting for almost a third (29%) of total investments in 2025, followed by the U.S. (19%) and the EU (18%). Africa accounts for only 2% of clean energy investment.

A third of energy investment in 2025, at USD 1.1 trillion, will be devoted to fossil fuels, including USD 900 billion in oil and gas and USD 248 billion in coal. This is underpinned by almost 100 GW of new coal-fired plants that were opened in China in 2024 and a further 15 GW in India. As with renewable energy, China is also the largest investor in fossil fuel energy, accounting for 23%, followed by the U.S. (17%).

Nevertheless, the world’s energy transition is ongoing. Despite over a trillion dollars in fossil energy investment in 2025, from 2016 (when annual renewable energy investment first surpassed fossil energy investment) to 2025, fossil energy investment decreased, albeit slightly by USD 80 billion, while renewable energy investment increased by almost USD 900 billion.

ANDAMAN PARTNERS supports international business ventures and growth. We help launch global initiatives and accelerate successful expansion across borders. If your business, operations or project requires cross-border support, contact connect@andamanpartners.com.

ANDAMAN PARTNERS to Attend Investing in African Mining Indaba 2026 in Cape Town

ANDAMAN PARTNERS Co-Founders Kobus van der Wath and Rachel Wu will attend Investing in African Mining Indaba 2026 in Cape Town, South Africa.

Join ANDAMAN PARTNERS at Networking Event in Cape Town Ahead of Mining Indaba 2026

ANDAMAN PARTNERS is pleased to support and sponsor this popular Pre-Indaba event in Cape Town.

AAMEG Event in Cape Town Ahead of Mining Indaba 2026

ANDAMAN PARTNERS is pleased to sponsor and support the AAMEG pre-Mining Indaba Cocktails & Canapes event.

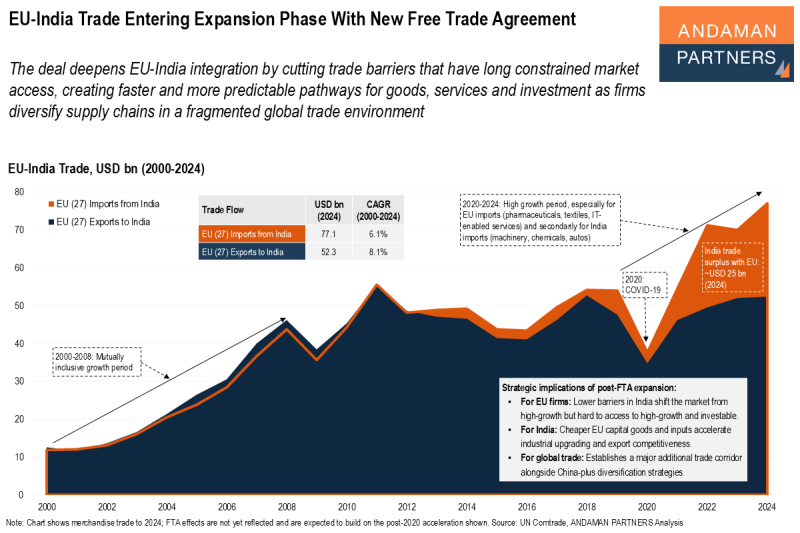

EU-India Trade Entering Expansion Phase With New Free Trade Agreement

The deal deepens EU-India integration by cutting trade barriers that have long constrained market access.

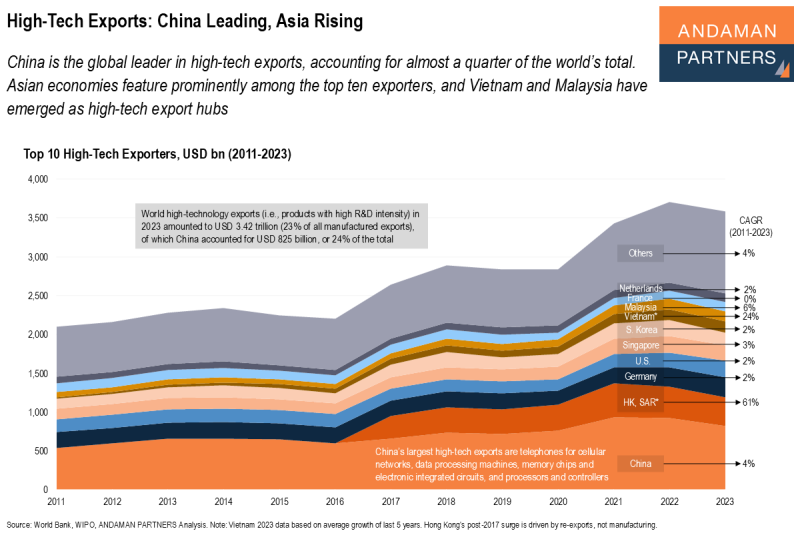

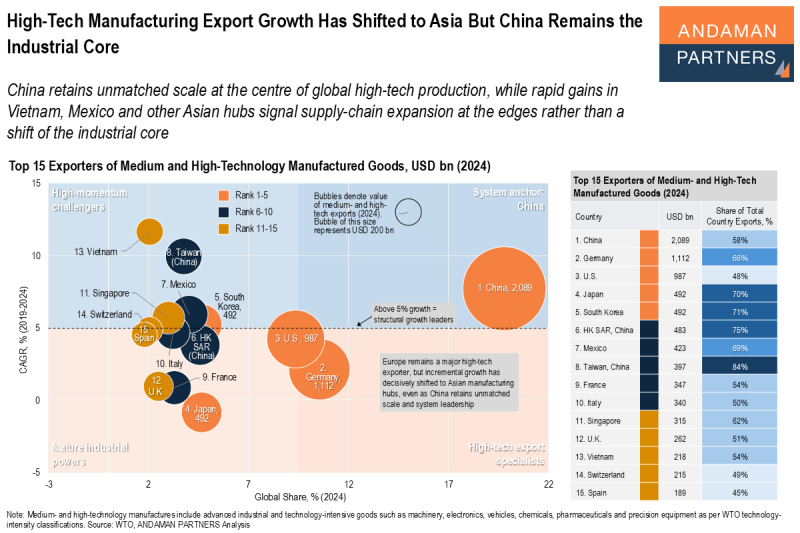

High-Tech Manufacturing Export Growth Has Shifted to Asia, But China Remains the Industrial Core

China retains unmatched scale at the centre of global high-tech production, while rapid gains in Vietnam, Mexico and other Asian hubs.

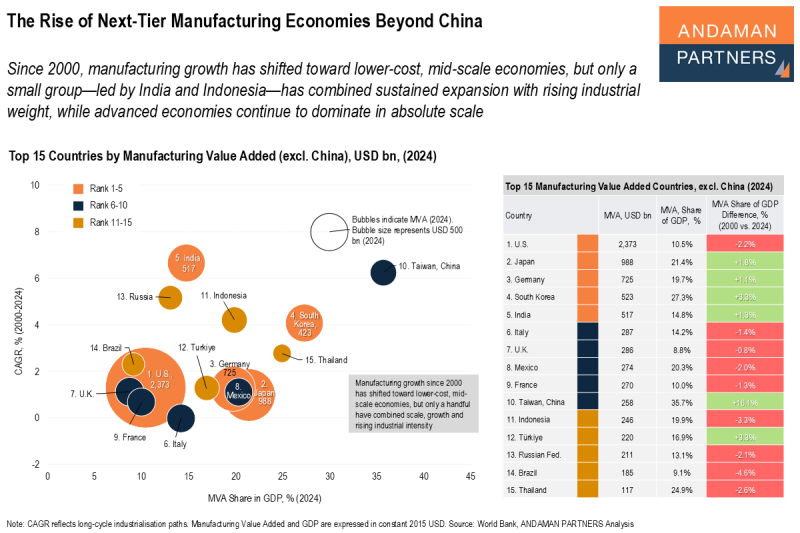

The Rise of Next-Tier Manufacturing Economies Beyond China

Manufacturing growth shifted toward lower-cost, mid-scale economies, but only a small group has combined sustained expansion with rising industrial weight.