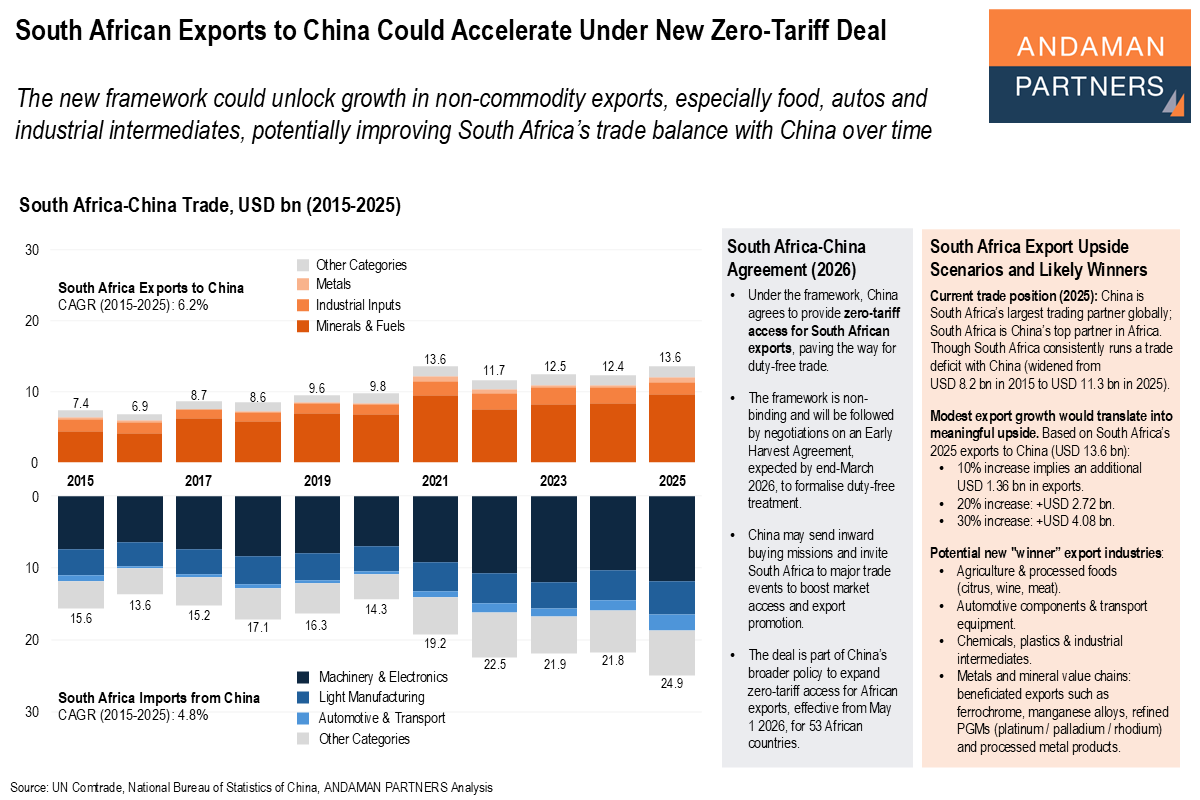

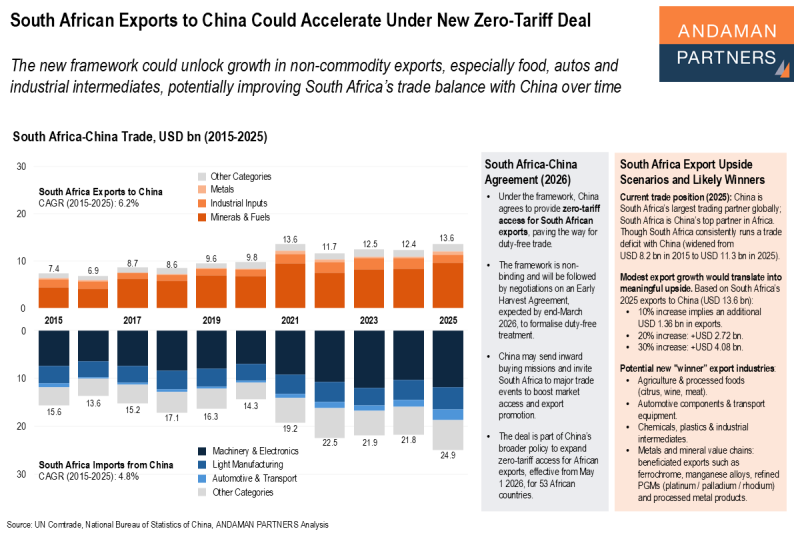

The new framework could unlock growth in non-commodity exports, especially food, autos and industrial intermediates, potentially improving South Africa’s trade balance with China over time.

South Africa-China trade has expanded steadily over the past decade, reinforcing China’s position as South Africa’s largest trading partner globally and South Africa’s role as China’s leading partner in Africa. South Africa’s exports to China rose from USD 7.4 billion in 2015 to USD 13.6 billion in 2025, representing a 6.2% CAGR, supported by strong demand for minerals, metals and industrial inputs. Over the same period, imports from China increased from USD 15.6 billion to USD 24.9 billion (4.8% CAGR), driven by machinery and electronics, light manufacturing, and transport equipment, underscoring China’s importance as a supplier of capital goods and industrial products to South Africa’s economy.

This deepening trade relationship may now enter a new phase. On 6 February 2026, South Africa and China signed a framework agreement to strengthen economic cooperation and expand trade flows. Under the framework, China has agreed to provide zero-tariff access for South African exports, potentially across a wide range of tariff lines. While the agreement is non-binding, negotiations are expected to progress through an Early Harvest Agreement, with a formalised duty-free framework expected by the end of March 2026.

Even modest export growth would translate into meaningful upside. Based on South Africa’s USD 13.6 billion export base in 2025, a 10% increase would imply an additional USD 1.36 billion in exports, while a 20% increase would add USD 2.72 billion and a 30% increase would equate to roughly USD 4.08 billion.

At the same time, South Africa continues to run a trade deficit with China, which widened from USD 8.2 billion in 2015 to USD 11.3 billion in 2025, underscoring the need to expand exports beyond commodities. The strongest upside from tariff-free access is likely to come from non-commodity sectors where market access matters most, including agriculture and processed foods (citrus, wine, meat), automotive components and transport equipment, and chemicals, plastics and industrial intermediates.

South Africa could also benefit from higher-value exports in the processed metals and mineral value chains, such as ferrochrome, manganese alloys and refined Platinum Group Metals (PGMs). While raw mineral exports already underpin much of South Africa’s trade with China, tariff-free access could improve the competitiveness of downstream, beneficiated products that sit further along the value chain and generate higher domestic value added. This is particularly relevant given China’s continued demand for steelmaking inputs, specialty alloys and industrial catalysts, where South Africa’s mineral endowment gives it a natural advantage.

Over time, the most meaningful upside may come not from exporting more raw ore, but from using preferential access to expand exports of processed metal products and industrial intermediates, supporting both export growth and gradual industrial upgrading.

Also by ANDAMAN PARTNERS:

ANDAMAN PARTNERS supports international business ventures and growth. We help launch global initiatives and accelerate successful expansion across borders. If your business, operations or project requires cross-border support, contact connect@andamanpartners.com.

ANDAMAN PARTNERS Wishes You a Happy and Prosperous Year of the Horse!

Compliments of the Chinese Lunar New Year to all our clients, customers, suppliers and partners.

ANDAMAN PARTNERS to Attend Investing in African Mining Indaba 2026 in Cape Town

ANDAMAN PARTNERS Co-Founders Kobus van der Wath and Rachel Wu will attend Investing in African Mining Indaba 2026 in Cape Town, South Africa.

Join ANDAMAN PARTNERS at Networking Event in Cape Town Ahead of Mining Indaba 2026

ANDAMAN PARTNERS is pleased to support and sponsor this popular Pre-Indaba event in Cape Town.

South African Exports to China Could Accelerate Under New Zero-Tariff Deal

The new framework could unlock growth in non-commodity exports, especially food, autos and industrial intermediates.

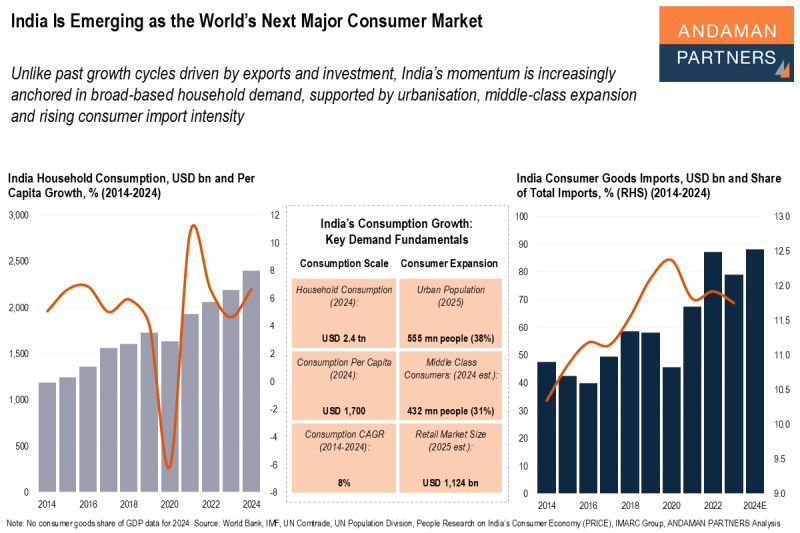

India Is Emerging as the World’s Next Major Consumer Market

India’s momentum is anchored in broad-based household demand, supported by urbanisation, middle-class expansion and consumer import intensity.

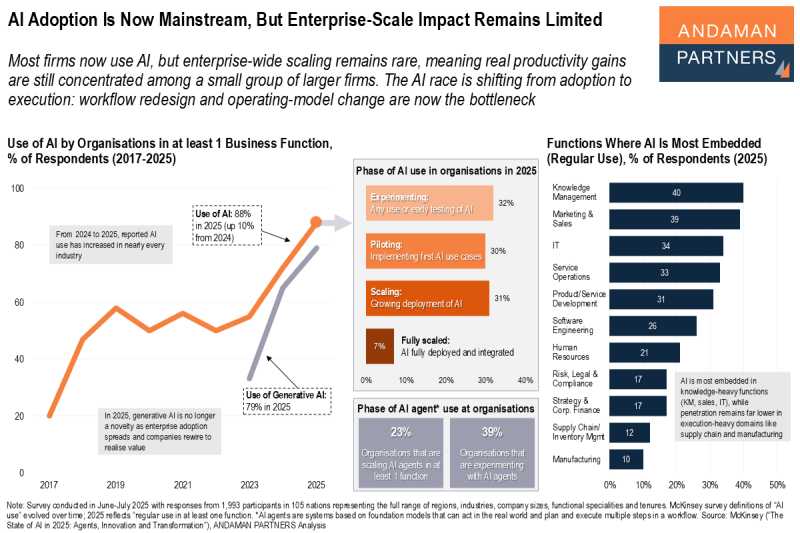

AI Adoption Is Now Mainstream, But Enterprise-Scale Impact Remains Limited

Most firms now use AI, but enterprise-wide scaling remains rare, meaning productivity gains are concentrated in a small group of larger firms.